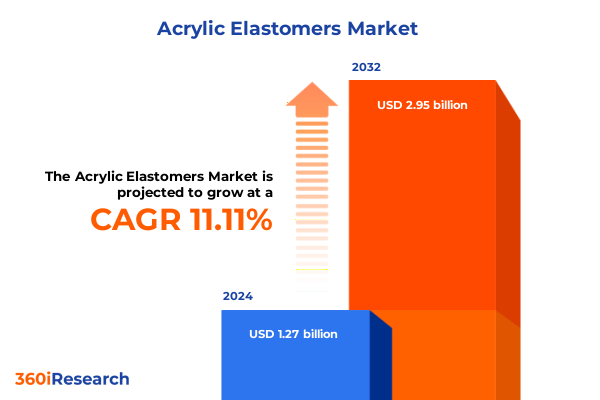

The Acrylic Elastomers Market size was estimated at USD 1.39 billion in 2025 and expected to reach USD 1.53 billion in 2026, at a CAGR of 11.29% to reach USD 2.95 billion by 2032.

Understanding the Fundamentals of Acrylic Elastomers and Their Critical Role in High-Performance Industrial Applications

Acrylic elastomers represent a class of synthetic rubbers primarily formed from alkyl acrylate copolymers, renowned for their superior resistance to heat, oils, and oxidation while maintaining performance at continuous operating temperatures up to 150 °C and intermittent excursions as high as 180 °C. Chemically, these materials are polar, free of unsaturation, and exhibit excellent ozone resistance and low gas permeability. Their molecular architecture, devoid of carbon–carbon double bonds, underpins their stability in aggressive industrial environments.

Exploring How Sustainable Innovations and Regulatory Mandates Are Revolutionizing the Acrylic Elastomers Landscape Worldwide

Recent years have witnessed a paradigm shift in the acrylic elastomers landscape, driven by mounting regulatory pressures and an industry-wide pivot toward sustainability. Bio-based elastomers derived from renewable feedstocks such as soybean oil, sugarcane, and algae are gaining prominence as manufacturers respond to stringent carbon reduction targets and circular economy mandates in North America and the European Union. These bio-based variants not only lower the industry’s reliance on petrochemicals but also offer comparable mechanical and thermal properties to traditional acrylate elastomers.

Simultaneously, the rapid adoption of electric vehicles (EVs) is reshaping material performance requirements. EV battery systems demand high-temperature seals that also facilitate end-of-life disassembly and recycling, spurring innovation in chemically debondable elastomers and thermoplastic vulcanizates. Emerging formulations now integrate up to 40 percent bio-content without compromising seal integrity, aligning with both automotive sustainability goals and lifecycle management frameworks.

Regulatory initiatives such as the EU’s REACH and North America’s evolving VOC emission standards have compelled formulators to replace traditional phthalate-based plasticizers with nonhazardous, bio-derived alternatives. This compliance-driven innovation has accelerated R&D investments in non-toxic additives and circular design principles, ultimately fuelling a shift toward eco-friendly acrylic elastomers that meet exacting performance benchmarks.

Assessing the Far-Reaching Consequences of 2025’s United States Tariff Measures on Acrylic Elastomer Production and Trade Dynamics

On February 1, 2025, the U.S. administration imposed a 25 percent tariff on most goods imported from Mexico and Canada, alongside a 10 percent levy on Chinese chemical imports, marking the most significant reshaping of North American chemical trade in decades. For acrylic elastomers, which often rely on precursors sourced across these regions, the measures have translated into elevated feedstock costs, heightened sourcing complexity, and the urgency to reevaluate cross-border supply chains.

Industry associations such as the Society of Chemical Manufacturers & Affiliates have cautioned that higher tariffs on key monomers will ripple through to finished goods, risking cost-induced erosion of competitiveness in both domestic and export markets. Concurrently, resin analysts project volatility in polymer prices throughout 2025 as market participants adjust inventory strategies to buffer against tariff-driven price fluctuations.

In response, several acrylic elastomer producers are exploring strategic reshoring of production capacity and forging regional supply partnerships to mitigate tariff exposure. At the same time, leading companies are negotiating tariff exclusions and leveraging trade remedy consultations to secure relief for critical chemical streams, underscoring the need for agile supply-chain risk management.

Unveiling Crucial Insights Across Multi-Dimensional Market Segmentation to Navigate Acrylic Elastomer Demand and Application Nuances

A nuanced understanding of the acrylic elastomers market emerges through its multi-dimensional segmentation by product type, application, end-use industry, form, and sales channel. Each product class-ranging from butadiene methyl methacrylate copolymers to ethyl methyl acrylate copolymers and methyl methacrylate copolymers-possesses distinct performance attributes calibrated for specific service conditions in sealing and damping functions.

Application segmentation further refines market dynamics as adhesives and sealants not only encompass pressure sensitive adhesives and structural adhesives but also direct formulation strategies for sealants that adhere to demanding substrate conditions. Automotive components span gaskets, hoses, and seals designed for exposure to transmission oils and elevated temperatures. Construction uses cover flooring, waterproofing membranes, and sealants engineered for UV and weathering resilience, while industrial goods depend on specialized belts, hoses, and O-rings. Paints and coatings differentiate into architectural and industrial variants, each requiring acrylic elastomer additives that optimize film flexibility and impact resistance.

Market demand also varies significantly by end-use industry, where aerospace and medical applications prioritize ultra-low extractables and biocompatibility, contrasting with oil & gas requirements for high chemical resistance and pressure containment. Additionally, product form-granules, latex, or liquid-dictates processing pathways from extrusion molding to emulsion-based coating systems. Sales channels, whether direct sales to OEMs or through distributors targeting aftermarket applications, shape both pricing strategies and technical support networks.

This comprehensive research report categorizes the Acrylic Elastomers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- Application

- End Use Industry

- Sales Channel

Deep-Dive Examination of Regional Dynamics Driving Acrylic Elastomer Adoption in the Americas, Europe Middle East Africa, and the Asia-Pacific

The Americas region commands attention as a hub of innovation and supply-chain integration for acrylic elastomers, bolstered by a concentration of automotive and aerospace manufacturers in the U.S. and Mexico. Ongoing reshoring trends, coupled with government incentives for advanced manufacturing, have spurred localized capacity expansions and collaborative R&D initiatives. Despite the short-term tariff headwinds, North American stakeholders benefit from proximity to strategic feedstock sources and a robust downstream industrial ecosystem.

This comprehensive research report examines key regions that drive the evolution of the Acrylic Elastomers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Competitive Strategies and Growth Trajectories of Leading Global Players in the Evolving Acrylic Elastomers Sector

The competitive landscape of the acrylic elastomers market features established chemical majors and specialty polymer producers driving continuous innovation. Zeon Corporation pioneered its HyTemp AR series to address high-temperature automotive applications, while Dow’s Acrypren X formulation extended low-temperature flexibility in sealing systems. Arkema’s introduction of Kynar® VT-2 targeted extreme chemical and thermal environments in oil & gas, aerospace, and chemical processing sectors, exemplifying the focus on high-performance niche segments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Acrylic Elastomers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Arkema S.A.

- Asahi Kasei Corporation

- Aurora Plastics, LLC

- BASF SE

- Biesterfeld AG

- Celanese Corporation

- Denka Co., Ltd.

- DuPont de Nemours Inc.

- Evonik Industries AG

- Exxon Mobil Corporation

- Kraton Corporation

- Kuraray Co., Ltd.

- Lubrizol Corporation

- LyondellBasell Industries N.V.

- Mitsubishi Chemical Corporation

- NOK CORPORATION

- RTP Company

- Shin-Etsu Polymer Co., Ltd.

- SIBUR International GmbH

- Solvay S.A.

- Teknor Apex Company, Inc.

- The Dow Chemical Company

- Tosoh Corporation

- Zeon Corporation

Actionable Strategies for Industry Leaders to Drive Innovation, Resilience, and Competitive Advantage in the Acrylic Elastomers Market

Industry leaders must prioritize investment in sustainable feedstock innovation, expanding the integration of bio-based monomers to stay ahead of tightening environmental regulations and evolving customer expectations. Collaborative R&D consortia can accelerate the development of circular elastomer platforms that allow efficient end-of-life disassembly and material recovery, supporting longer product lifecycles and lower carbon footprints.

Detailing a Rigorous Multi-Method Research Methodology Grounded in Primary Engagement and Comprehensive Secondary Analysis Approaches

This research employed a rigorous mixed-methods approach combining primary and secondary data sources to ensure comprehensive market coverage and actionable insights. Secondary research encompassed the analysis of governmental trade data, industry association publications, and peer-reviewed studies to establish baseline trends and validate historical developments. Primary research involved structured interviews with polymer scientists, supply-chain executives, and end-user procurement specialists to capture firsthand perspectives on performance requirements, supply-chain challenges, and strategic priorities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Acrylic Elastomers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Acrylic Elastomers Market, by Product Type

- Acrylic Elastomers Market, by Form

- Acrylic Elastomers Market, by Application

- Acrylic Elastomers Market, by End Use Industry

- Acrylic Elastomers Market, by Sales Channel

- Acrylic Elastomers Market, by Region

- Acrylic Elastomers Market, by Group

- Acrylic Elastomers Market, by Country

- United States Acrylic Elastomers Market

- China Acrylic Elastomers Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Summarizing the Strategic Imperatives and Future Outlook for Stakeholders in the Global Acrylic Elastomers Arena

In conclusion, the acrylic elastomers market stands at the intersection of high-performance material demands and an accelerating shift toward sustainability. Technological advances in bio-based and recyclable formulations, coupled with the imperative to navigate evolving trade policies, underscore the need for agile strategies. Regional dynamics and segmentation insights highlight where targeted investments can unlock value, while competitive analyses reveal best practices in product innovation and supply-chain resilience. By integrating these findings, stakeholders can chart a path that balances performance excellence with environmental stewardship, ensuring long-term market leadership.

Contact Ketan Rohom to Secure Your Comprehensive Market Research Report and Gain a Competitive Edge in the Acrylic Elastomers Industry

To explore the comprehensive findings and gain an in-depth understanding of the acrylic elastomers market, please reach out to Ketan Rohom, Associate Director, Sales & Marketing. Ketan brings extensive expertise in polymer market dynamics and is ready to assist you in securing the full market research report. By engaging with him, you can obtain tailored insights and strategic guidance that will empower your organization to navigate emerging challenges and capitalize on new growth opportunities.

- How big is the Acrylic Elastomers Market?

- What is the Acrylic Elastomers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?