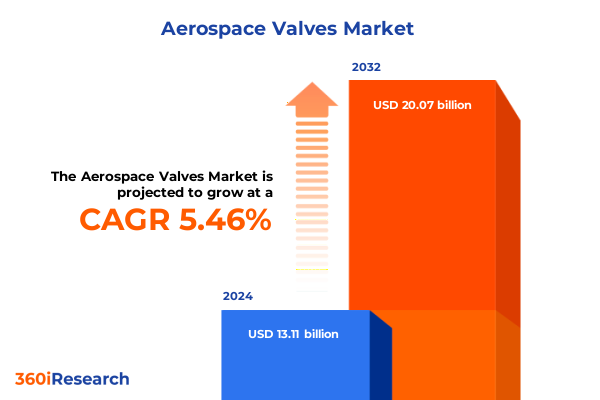

The Aerospace Valves Market size was estimated at USD 13.82 billion in 2025 and expected to reach USD 14.57 billion in 2026, at a CAGR of 5.47% to reach USD 20.07 billion by 2032.

Unlocking the Fundamentals of Aerospace Valve Dynamics to Propel Reliability, Efficiency, and Safety in Advanced Aeronautical Systems

Aerospace valve technology underpins the safe and efficient operation of modern aircraft and spacecraft, yet it often remains an unseen hero behind critical fluid control functions. This executive summary unveils the key forces shaping an industry that must balance extreme performance requirements with stringent regulatory demands and evolving material innovations. As aerospace architectures evolve toward greater electrification, autonomy, and space exploration initiatives, the valves that regulate fluid flows in propulsion, environmental control, hydraulic actuation, and fuel management systems are more vital than ever.

Within this document, we explore the multifaceted dimensions of the aerospace valve market-from the transformative shifts driven by advanced manufacturing and digitalization, to the strategic responses necessitated by recent tariff regimes. Our analysis synthesizes segmentation insights, regional dynamics, and competitive positioning, providing a holistic framework for decision-makers to comprehend current trends and anticipate future inflection points. By emphasizing robust methodology and expert perspectives, this summary ensures you grasp the essential takeaways required to navigate intricate supply chains, innovation pipelines, and regulatory landscapes.

Embracing Technological Disruption in Aerospace Valve Engineering with Artificial Intelligence and Advanced Materials to Navigate Rapid Industry Transformations

The aerospace valve landscape has entered a period of rapid transformation, catalyzed by advancements in additive manufacturing, digital twins, and embedded sensing technologies. Additive techniques are enabling intricate flow-path geometries and weight reductions previously unattainable through traditional machining, thereby offering new avenues to optimize performance and fuel efficiency in next-generation aircraft. Simultaneously, the integration of digital twins allows engineers to simulate valve behavior under dynamic operating conditions, accelerating design validation while mitigating development risk.

In parallel, the rise of predictive maintenance models-driven by high-fidelity sensors and machine learning algorithms-empowers operators to anticipate valve degradation and schedule interventions based on real-time health indicators rather than fixed intervals. This shift not only enhances system reliability but also reduces downtime and maintenance costs. Furthermore, ongoing investments in novel high-temperature alloys and composite materials are extending valve service life in extreme environments, such as supersonic propulsion and deep-space missions. By leveraging data-driven insights and material innovations, industry stakeholders are redefining performance benchmarks and unlocking new growth frontiers across commercial, military, and emerging space sectors.

Assessing the Cumulative Impact of United States Tariff Policies in 2025 on Aerospace Valve Supply Chains and Competitiveness

In 2025, the imposition of revised United States tariffs has significantly altered the cost and availability dynamics of key aerospace valve components. Manufacturers importing raw materials and precision fittings now face elevated duties that are reshaping supply strategies and prompting near-shoring of critical production processes. As a result, several leading firms have begun collaborating more closely with domestic machining partners and forging alliances with specialty alloy suppliers to mitigate exposure to tariff-related price volatility.

The ripple effects extend beyond direct input costs; the increased financial burden on valve integrators has necessitated a reevaluation of contract terms with original equipment manufacturers (OEMs) and tier-one suppliers. Forward-looking companies are renegotiating long-term agreements to distribute risk more equitably, while others are exploring value-engineering opportunities to maintain competitive pricing structures. Moreover, the tariff environment has accelerated the adoption of multi-source procurement models, fostering greater supplier diversification and enhancing resilience against future trade policy fluctuations. Collectively, these strategic responses underscore the industry’s capacity to adapt to external shocks while preserving reliability and performance in critical aerospace applications.

Deciphering Deep Segmentation Insights Across Valve Types, Actuation Methods, Materials, End Users, Pressure Ratings, and Body Constructions

Deep segmentation analysis reveals nuanced performance drivers across a range of valve configurations and application contexts. When examining valve type, the market incorporates ball valves and butterfly valves for high-flow applications, check valves to prevent reverse flow, control valves subdivided into flow control and pressure reducing categories, and gate valves for precise shut-off functions. Each valve category exhibits distinct design priorities, from rapid actuation response in flow control valves to robust sealing characteristics in gate valves.

Actuation modality further differentiates offerings, as electric, hydraulic, manual, and pneumatic mechanisms cater to varied installation requirements and operational constraints. For instance, hydraulic actuation remains predominant in high-force aerospace environments, whereas electric actuation is gaining ground for its precise positioning capabilities and integration with aircraft power systems. Material selection also plays a pivotal role: aluminum components deliver favorable strength-to-weight ratios in low-pressure segments, nickel alloys and stainless steel balance corrosion resistance with durability, and titanium solutions excel under ultra-high pressure demands.

User applications span commercial aircraft, helicopters and unmanned aerial vehicles, military aircraft, and spacecraft. Commercial platforms prioritize lifecycle cost efficiency, while defense customers emphasize rugged performance and mission-critical reliability. Meanwhile, spacecraft programs demand valves that withstand extreme temperatures and vacuum cycles. Pressure rating strata-from low through medium and high to ultra-high-inform seal designs, wall thicknesses, and testing protocols. Finally, body construction options including one-piece, two-piece, and three-piece architectures influence maintainability and customization potential. Together, these segmentation layers provide a granular view of evolving market requirements and innovation hotspots.

This comprehensive research report categorizes the Aerospace Valves market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Valve Type

- Actuation Method

- Material

- Pressure Rating

- Body Construction

- Connection Type

- Application

- End User

- Aircraft Type

- Distribution Channel

Unearthing Regional Nuances and Growth Drivers across the Americas, Europe Middle East Africa, and Asia-Pacific Aerospace Valve Markets

Regional dynamics exhibit distinct growth catalysts and regulatory landscapes that influence aerospace valve adoption and innovation trajectories. In the Americas, established commercial aviation hubs and defense spending remain primary demand generators, with an increasing focus on retrofitting older fleets to improve sustainability metrics and reduce emissions. Meanwhile, North American suppliers are championing digitalized production lines and lean manufacturing to enhance domestic competitiveness.

The Europe, Middle East, and Africa bloc presents a mosaic of aerospace initiatives, ranging from pan-European collaborative research into lightweight alloys to Gulf region investments in next-gen urban air mobility platforms. European regulatory bodies are driving harmonization efforts around valve safety standards, prompting suppliers to accelerate certification pathways. Concurrently, emerging aerospace clusters across North Africa and the Levant are fostering technology transfer initiatives with established OEMs.

Across Asia-Pacific, rapid fleet expansions and burgeoning space programs are fueling robust demand for innovative valve solutions. Key markets such as China and India are elevating domestic manufacturing capabilities while incentivizing technology partnerships with global suppliers. In parallel, Asia-Pacific research consortia are exploring advanced composite and additive manufacturing processes that promise significant weight savings for future rotary and fixed-wing applications. The interplay of regulatory reform, infrastructure investment, and local supply chain maturation underscores the region’s growing prominence in the global aerospace valve landscape.

This comprehensive research report examines key regions that drive the evolution of the Aerospace Valves market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves and Innovation Highlights from Leading Aerospace Valve Manufacturers Shaping Future Market Landscape

Leading aerospace valve manufacturers are leveraging strategic investments and partnerships to solidify their market positions. Some pioneers have established dedicated additive manufacturing centers to accelerate rapid prototyping of complex valve geometries, while others have formed joint ventures with sensor and software firms to embed real-time condition monitoring capabilities within valve assemblies. This convergence of mechanical and digital innovation is elevating value propositions and creating new service-driven revenue models.

Innovation pipelines are further influenced by acquisitions of specialty alloy producers, which grant direct access to high-performance materials and associated technical expertise. By aligning material science roadmaps with valve design roadmaps, these vertically integrated players can optimize trade-offs between weight, durability, and cost. Concurrently, several firms have expanded their aftermarket service networks, enabling rapid field support and refurbishment programs that appeal to maintenance-driven operators. These strategic moves underscore an industry-wide emphasis on end-to-end value chain integration, from raw material sourcing to lifecycle services.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aerospace Valves market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AeroControlex by TransDigm Group Incorporated

- Astrophel Aerospace

- Bellatrix Aerospace

- Boeing Company

- CIRCOR International, Inc.

- Collins Aerospace by RTX Corporation

- Crane Aerospace & Electronics Inc.

- Crissair, Inc. by ESCO Technologies Inc.

- Dynex/Rivett Inc

- Eaton Corporation plc

- Honeywell International Inc.

- ITT Inc.

- KITZ Corporation

- Liebherr-International Deutschland GmbH

- Marotta Controls, Inc.

- Maxon International AG

- Meggitt PLC

- Moog Inc.

- Parker-Hannifin Corporation

- Porvair Filtration Group

- Precision Fluid Controls, Inc.

- Safran S.A.

- SAM GmbH

- The Lee Company

- Triton Valves Ltd.

- Triumph Group, Inc.

- Valcor Engineering Corporation

- Woodward, Inc.

Delivering Actionable Recommendations for Industry Leaders to Strengthen Resilience, Foster Innovation, and Enhance Supply Chain Agility

To capitalize on emerging opportunities and shore up resilience, industry leaders must adopt a multi-pronged strategy. First, deepening collaboration with raw material suppliers and forging dual-sourcing arrangements will hedge against geopolitical disruptions and tariff volatility. Simultaneously, embedding digital twin frameworks into product development cycles will compress time-to-market and enhance design validation processes.

Second, investing in modular valve architectures and scalable manufacturing platforms will enable rapid customization for diverse end-use scenarios, from heavy lift rotorcraft to micro-satellite propulsion systems. Third, fostering cross-industry partnerships-especially with aerospace electrification and space propulsion developers-can unlock adjacent markets and accelerate technology diffusion. In parallel, deploying advanced analytics to monitor field performance data will drive predictive maintenance services and strengthen aftermarket offerings. Finally, cultivating a skilled workforce equipped with additive manufacturing and data science proficiencies will ensure that innovation agendas align with evolving aerospace requirements. By implementing these actionable initiatives, leaders can enhance agility, sustain competitive advantages, and deliver next-generation valve solutions.

Outlining Robust Research Methodology Integrating Multi-Source Data, Expert Interviews, and Advanced Analytical Techniques for Market Insights

Our research methodology integrates a rigorous, multi-dimensional approach designed to ensure analytical integrity and relevance. Primary inputs were gathered through in-depth interviews with aerospace OEM executives, valve design engineers, and supply chain managers, providing firsthand perspectives on technology adoption, procurement challenges, and future requirement roadmaps. This qualitative insight was complemented by systematic analysis of technical publications, regulatory filings, and patent databases to trace innovation trajectories and emerging materials science breakthroughs.

Quantitative data was collated from customs databases, publicly available procurement records, and industry association statistics to map demand patterns and supply chain shifts. Advanced analytical techniques, including scenario modeling and sensitivity analysis, were applied to evaluate the impact of tariff scenarios, material price fluctuations, and adoption rates of additive manufacturing. Furthermore, peer reviews with academic experts and third-party validation of key findings fortified the study’s credibility. Throughout the process, strict data governance and triangulation protocols were maintained to mitigate bias and ensure that conclusions reflect the latest industry realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aerospace Valves market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aerospace Valves Market, by Valve Type

- Aerospace Valves Market, by Actuation Method

- Aerospace Valves Market, by Material

- Aerospace Valves Market, by Pressure Rating

- Aerospace Valves Market, by Body Construction

- Aerospace Valves Market, by Connection Type

- Aerospace Valves Market, by Application

- Aerospace Valves Market, by End User

- Aerospace Valves Market, by Aircraft Type

- Aerospace Valves Market, by Distribution Channel

- Aerospace Valves Market, by Region

- Aerospace Valves Market, by Group

- Aerospace Valves Market, by Country

- United States Aerospace Valves Market

- China Aerospace Valves Market

- Competitive Landscape

- List of Figures [Total: 22]

- List of Tables [Total: 1908 ]

Concluding Critical Takeaways that Synthesize Strategic Trends, Market Challenges, and Forward-Looking Perspectives for Aerospace Valve Stakeholders

In synthesizing the key findings, several overarching themes emerge. Technological convergence between additive manufacturing, digital twins, and embedded sensing is redefining performance expectations and supply chain architectures. Concurrently, regional dynamics-from North American modernization initiatives to Asia-Pacific space program expansions-are reshaping demand geographies and competitive battlegrounds. The 2025 tariff environment has underscored the criticality of supply chain diversification and strategic near-shoring, while deep segmentation analysis reveals targeted opportunities across valve types, actuation modalities, and material applications.

Looking forward, stakeholders who embrace data-driven innovation and collaborative partnerships will be best positioned to address evolving aerospace challenges-whether in reducing environmental footprints, enabling urban air mobility, or supporting deep-space missions. By weaving together technical, economic, and regulatory insights, this report illuminates the pathways through which valve technology will continue to support the next era of aerospace advancement.

Secure Exclusive Access to the Comprehensive Aerospace Valve Market Research Report by Contacting Ketan Rohom, Associate Director, Sales & Marketing

I welcome you to explore the comprehensive aerospace valve market analysis in greater depth, and encourage you to secure your copy of the full report directly from Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. This in-depth study delivers actionable intelligence spanning valve technologies, regional landscapes, tariff impacts, competitive strategies, and innovation trajectories. By partnering with Ketan, you can tailor your research objectives, access exclusive executive briefings, and gain clarity on how these insights align with your strategic goals. Whether you seek to benchmark against leading manufacturers or understand emerging segment opportunities, Ketan’s expertise will ensure you receive the right data configurations and advisory support to drive confident decision-making.

Take the next step toward maximizing your competitive advantage by reaching out to Ketan Rohom. With direct consultation and customizable research packages, you’ll obtain the rigor and granularity needed to navigate complex market dynamics. Empower your leadership team with validated findings and forward-looking scenarios that illuminate future growth pathways. Contact Ketan now to transform in-depth market knowledge into impactful business results and secure your organization’s position at the forefront of aerospace valve innovation.

- How big is the Aerospace Valves Market?

- What is the Aerospace Valves Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?