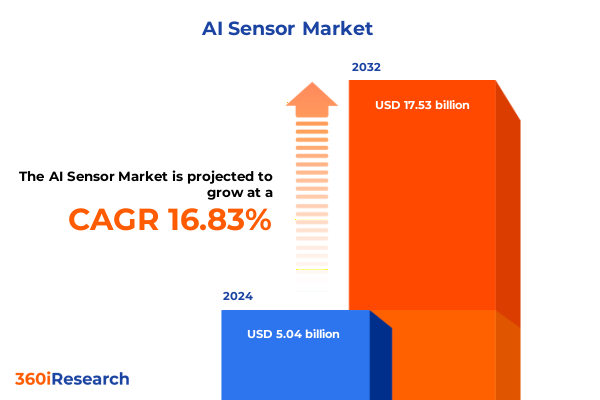

The AI Sensor Market size was estimated at USD 5.83 billion in 2025 and expected to reach USD 6.75 billion in 2026, at a CAGR of 17.03% to reach USD 17.53 billion by 2032.

Discover the transformative potential of AI-driven sensor technologies shaping innovation across industries and redefining digital intelligence frameworks

AI-driven sensors are swiftly becoming the backbone of modern digital ecosystems, enabling unprecedented levels of data collection and analysis across diverse sectors. As devices grow smarter and networks more interconnected, the role of intelligent sensing modules is expanding beyond mere measurement tools to become critical enablers of automation and real-time decision-making. This transformation reflects a broader shift toward embedding artificial intelligence at the edge, where refined algorithms interpret raw signals from advanced sensors to yield actionable intelligence.

Amid this evolution, organizations face the dual challenge of integrating heterogeneous sensor types and ensuring seamless interoperability within complex architectures. Innovations in machine vision, lidar scanning, and ultrasonic detection are converging with rapid advancements in connectivity protocols, driving a wave of next-generation solutions. As enterprises and governments alike invest heavily in smart infrastructure, mobility, and defense initiatives, the demand for robust, AI-enabled sensor platforms that balance precision, power efficiency, and cost-effectiveness has never been higher. This report provides an essential lens into these dynamics, outlining the foundational trends, technological breakthroughs, and strategic imperatives shaping the AI sensor domain.

Uncover the seismic shifts redefining sensor ecosystems driven by advancements in machine intelligence and the drive for ultra-precise data acquisition

The landscape of sensor technologies is undergoing seismic shifts as the convergence of AI and miniaturized hardware redefines performance benchmarks. Breakthroughs in semiconductor fabrication allow for the integration of neural processors directly into sensing units, reducing latency and supporting sophisticated inference at the edge. This evolution diminishes reliance on centralized cloud resources, fortifying data privacy and boosting responsiveness for applications demanding immediate insights.

Simultaneously, open architectures and standardized interfaces are unlocking new opportunities for cross-domain interoperability. Key industry consortia have rallied around unified communication protocols that facilitate seamless integration of image sensors, lidar arrays, and radar modules. As a result, system architects are now empowered to design multi-modal sensor fusion platforms that draw strength from the complementary characteristics of each detection modality. This holistic approach is revolutionizing fields such as autonomous navigation and robotic perception, where the synergy between optical and radio-frequency sensing reliably overcomes environmental challenges like poor visibility and electromagnetic interference.

Explore how evolving US tariff regimes in 2025 are reshaping global sensor supply chains and compelling strategic adjustments in sourcing and manufacturing

The introduction and escalation of United States tariff measures throughout 2025 have injected new complexity into global sensor supply chain strategies. Higher duties on certain semiconductor and sensor imports have prompted OEMs and tier-one suppliers to reexamine procurement pathways and manufacturing footprints. As tariffs render traditional sourcing costlier, many organizations are accelerating efforts to diversify vendor networks and repatriate subprocesses closer to primary markets.

In response, a noticeable trend has emerged: the partial reshoring of sensor assembly and calibration services to North America, accompanied by a notable uptick in partnerships with domestic fabrication facilities. Concurrently, trade policy uncertainty has spurred firms to adopt more agile contract terms and build additional inventory buffers to hedge against potential duty spikes. While these adjustments have mitigated immediate disruptions, they also underscore the strategic imperative of crafting resilient supply ecosystems that can flex in the face of shifting global trade conditions.

Gain deep insights into diverse sensor market segments spanning imaging, lidar, pressure, proximity, radar, temperature, ultrasonic technologies and their unique drivers

Insight into sensor market segmentation illuminates the forces driving technology adoption and informs product roadmaps. Within the spectrum of sensor types, image sensors command a preeminent position due to their versatility in machine vision applications, fueling growth in areas from automated inspection to gesture recognition. Lidar sensors are witnessing surging demand in advanced driver assistance and mapping solutions, propelled by the autonomous mobility agenda, while pressure sensors continue to underpin critical processes across industrial automation.

Proximity and ultrasonic sensors are rapidly gaining traction in consumer electronics and robotics, offering noncontact detection capabilities essential for touchless interfaces and obstacle avoidance. Radar sensors have sustained their role in safety-critical systems, leveraging their robustness under adverse weather conditions. Temperature sensors remain foundational to IoT frameworks in environmental monitoring and healthcare, with innovations aimed at higher accuracy and reduced power draw. These diverse segments reflect a dynamic landscape where technology maturity, application requirements, and cost structures intersect to shape priority areas for investment.

This comprehensive research report categorizes the AI Sensor market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Sensor Type

- Deployment

- Application

Navigate the nuanced regional dynamics across Americas, Europe Middle East Africa, and Asia-Pacific that are influencing AI sensor adoption and innovation landscapes

Regional dynamics are profoundly influencing how AI sensor technologies are developed, deployed, and monetized. In the Americas, leading automotive and aerospace hubs are amplifying demand for advanced vision systems and lidar packages, while environmental monitoring initiatives are driving higher adoption of temperature and pressure sensors across municipal infrastructures. Government investments in smart city deployments and defense modernization programs further consolidate North America’s position as a pivotal innovation nucleus.

Across Europe, Middle East, and Africa, established industrial powerhouses in Germany and the United Kingdom are accelerating integration of sensor-driven automation in manufacturing, while defense applications are benefiting from the region’s historic strengths in radar and infrared systems. Meanwhile, rapid urbanization in the Gulf states has stimulated demand for intelligent building management solutions. In the Asia-Pacific, China’s vast electronics manufacturing ecosystem continues to scale production of image and proximity sensors, whereas Japan and South Korea lead in semiconductor and precision optical sensor technologies. Emerging markets such as India are increasingly investing in wireless connectivity standards, spurring uptake of smart agriculture and healthcare monitoring platforms.

This comprehensive research report examines key regions that drive the evolution of the AI Sensor market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examine the competitive landscape and strategic maneuvers of leading sensor technology firms and their pivotal roles in driving industry evolution forward

The competitive landscape for AI sensor solutions is characterized by a blend of diversified technology providers and specialized innovators. Established semiconductor firms leverage their fabrication expertise to introduce high-volume image and pressure sensors that balance performance with cost effectiveness, while specialist lidar companies differentiate through cutting-edge scanning architectures and solid-state designs tailored for autonomous mobility.

Simultaneously, analog and mixed-signal component vendors have expanded portfolios to include integrated sensor front ends, simplifying system integration for OEMs. Collaborations between connectivity chipset providers and sensor developers have given rise to modules combining wireless interfaces with AI-capable sensing, catering to rapid IoT deployments. Amid these developments, strategic mergers and alliances are reshaping market contours, as larger players acquire niche startups to bolster sensor fusion capabilities and expedite time to market for next-generation product offerings.

This comprehensive research report delivers an in-depth overview of the principal market players in the AI Sensor market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Advantech Co., Ltd

- ams-OSRAM AG

- Analog Devices, Inc.

- Emerson Electric Co.

- Fujitsu Limited

- Honeywell International Inc.

- Infineon Technologies AG

- KaylaTek

- Microchip Technology Incorporated

- Movella Inc.

- NXP Semiconductors N.V.

- OMRON Corporation

- Panasonic Corporation

- Qualcomm Technologies, Inc.

- Robert Bosch GmbH

- Samsung Electronics Co., Ltd.

- Sensata Technologies, Inc.

- Sensirion AG

- Sick AG

- Siemens AG

- Sony Corporation

- STMicroelectronics N.V.

- TE Connectivity, Inc.

- Texas Instruments Incorporated

- Yokogawa Electric Corporation

Implement targeted strategies to capitalize on emerging sensor technologies, optimize supply networks, and accelerate innovation across the AI sensor value chain

Industry leaders poised to capitalize on the AI sensor revolution must pursue a multifaceted strategic agenda. Foremost, investing in edge AI integration within sensor modules can dramatically enhance data processing speed and reduce bandwidth dependencies, creating differentiated value for end users. Parallel efforts should focus on supply chain diversification, establishing flexible agreements with alternative foundries and component suppliers to absorb trade policy fluctuations without disrupting delivery timelines.

In addition, forging collaborative ecosystems that unite sensor innovators, software developers, and system integrators will accelerate development of cohesive, multi-modal platforms. These partnerships can also facilitate alignment on emerging interoperability and security standards, mitigating fragmentation risks. Finally, directing research and development toward low-power, miniaturized sensor architectures will unlock new application domains in wearable health devices and remote monitoring systems, positioning firms to lead in next-wave adoption scenarios.

Delve into the rigorous mixed-method research framework combining expert interviews, secondary analysis, and data triangulation underpinning market insights

This analysis employs a rigorous mixed-method research framework combining both qualitative and quantitative approaches. Secondary research entailed comprehensive reviews of industry publications, patent filings, and regulatory documents to map the evolving technological landscape. To complement these insights, primary research was conducted via in-depth interviews with senior executives and technical experts across sensor manufacturing, semiconductor fabrication, and end-user verticals.

Collected data underwent systematic triangulation, reconciling findings from disparate sources to enhance credibility and minimize bias. Key performance indicators and technology adoption patterns were distilled through a bottom-up examination of deployment case studies, while expert panels validated critical assumptions and strategic inferences. The resulting synthesis delivers a robust, multi-layered perspective designed to inform executive decision-making with clarity and confidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our AI Sensor market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- AI Sensor Market, by Sensor Type

- AI Sensor Market, by Deployment

- AI Sensor Market, by Application

- AI Sensor Market, by Region

- AI Sensor Market, by Group

- AI Sensor Market, by Country

- United States AI Sensor Market

- China AI Sensor Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1590 ]

Synthesize the critical takeaways highlighting the strategic importance of AI sensor advancements and the imperative for agile adaptation in a dynamic market

AI sensor technologies stand at the cusp of a paradigm shift, where the fusion of advanced detection capabilities and embedded intelligence unlocks transformative outcomes. Organizations that embrace this evolution by integrating edge AI, diversifying supply channels, and fostering strategic partnerships will be best positioned to harness the next generation of applications spanning autonomous systems, smart infrastructure, and precision healthcare.

As the market continues to fragment around specialized use cases and bespoke solutions, agility and foresight become paramount. Stakeholders must vigilantly monitor emerging standards, regulatory trajectories, and competitive movements to navigate complexity and capture growth opportunities. Ultimately, the confluence of sensor innovation and machine learning presents a compelling frontier for enhancing operational efficiency, elevating user experiences, and sustaining long-term competitive advantage.

Engage with Associate Director Ketan Rohom to secure exclusive market intelligence and actionable insights through comprehensive AI sensor research reports

To explore this comprehensive analysis in full depth and secure tailored insights that empower decision-making, reach out to Associate Director Ketan Rohom to acquire the complete AI Sensor market research report today. His expertise will guide you through the data-driven findings and strategic recommendations, ensuring your organization stays at the forefront of sensor innovation and competitive differentiation. Engage directly to unlock exclusive access to advanced intelligence, competitive benchmarking, and actionable roadmaps that can accelerate your success in the rapidly evolving AI sensor landscape.

- How big is the AI Sensor Market?

- What is the AI Sensor Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?