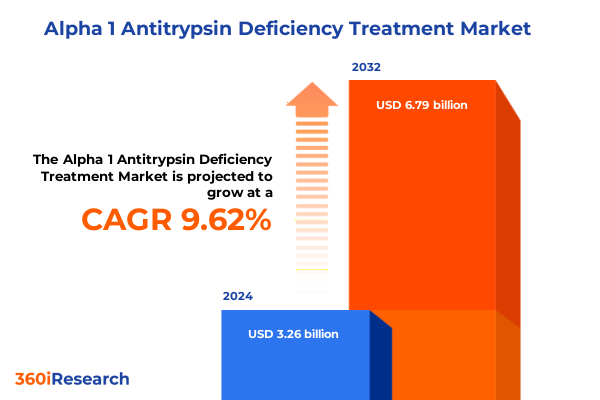

The Alpha 1 Antitrypsin Deficiency Treatment Market size was estimated at USD 3.53 billion in 2025 and expected to reach USD 3.83 billion in 2026, at a CAGR of 9.78% to reach USD 6.79 billion by 2032.

An In-Depth Overview of Alpha 1 Antitrypsin Deficiency Treatment Landscape and Its Strategic Imperatives for Stakeholders in 2025

Alpha 1 Antitrypsin Deficiency (AATD) is an inherited condition characterized by mutations in the SERPINA1 gene that lead to reduced levels of the alpha 1 antitrypsin (AAT) protein, which normally protects lung tissue from proteolytic damage. In the United States, the prevalence of the PI*ZZ genotype, associated with the most severe form of AATD, is estimated at approximately one in 3,500 individuals, with geographic variations showing higher rates in Eastern states and lower rates in Western regions; however, low disease awareness and inconsistent testing practices mean that a majority of affected patients remain undiagnosed, often experiencing a symptom‐to‐diagnosis delay of five to eight years that adversely impacts clinical outcomes. As of 2025, the standard of care for pulmonary manifestations involves weekly intravenous infusions of plasma‐derived augmentation therapy, yet innovations such as Kamada’s liquid, ready‐to‐use subcutaneous formulation designed for room‐temperature stability are poised to improve patient adherence and convenience, having garnered regulatory review in the United States and demonstrating strong year‐over‐year uptake in early commercial launches.

In parallel, the treatment landscape is undergoing a transformative shift toward novel modalities that aim to address the underlying genetic defect. Intellia Therapeutics has received authorization to initiate its first‐in‐human CRISPR/Cas9‐based gene insertion trial (NTLA-3001), which seeks to deliver a one‐time, permanent correction of the SERPINA1 gene via systemic administration, thereby eliminating the need for repeat infusions and offering the potential for durable therapeutic outcomes. Complementary to gene editing, advances in RNA interference strategies are targeting both pulmonary and hepatic disease pathways, exemplified by Arrowhead Pharmaceuticals’ ARO-AAT candidate achieving significant reductions in toxic Z‐AAT aggregates and demonstrating a quarterly dosing regimen that could disrupt the current treatment paradigm. These developments underscore the urgent need for stakeholders to align research priorities, clinical trial designs, and commercial strategies to capitalize on emerging opportunities and address residual unmet needs in patient care.

Emerging Innovations and Paradigm-Shifting Developments Revolutionizing Alpha 1 Antitrypsin Deficiency Treatment Approaches Globally

The Alpha 1 Antitrypsin Deficiency treatment landscape is being reshaped by breakthroughs in molecular medicine and precision delivery techniques. Gene therapy approaches using adeno‐associated virus (AAV) vectors have demonstrated sustained in vivo expression of therapeutic AAT protein in preclinical models, with vectors such as AAV8 achieving up to 52 weeks of stable lung transgene expression and even 29 percent persistent expression at 72 weeks, outperforming earlier AAV serotypes in murine studies. Concurrently, lentiviral vector platforms are being explored for their capacity to integrate into the host genome, offering the promise of permanent correction through stem cell therapy, though safety considerations around insertional mutagenesis remain an area of active investigation.

Advances in gene editing have introduced CRISPR/Cas and prime editing to this sphere, with companies like Prime Medicine unveiling preclinical programs that utilize proprietary lipid nanoparticles for efficient liver targeting of the Pi*Z mutation; this strategy aspires to achieve high‐fidelity correction of the E342K allele with minimal off‐target effects and plans for regulatory filings by mid-2026. Beyond genetic approaches, RNA‐based therapies are gaining traction, as illustrated by Alnylam Pharmaceuticals’ siRNA therapeutic that demonstrated over 90 percent knockdown of aberrant Z‐AAT production in hepatocytes from a single dose, offering long‐lasting hepatic benefit and heralding a potential shift toward curative treatment rather than symptomatic management.

These technological innovations are complemented by next‐generation protein engineering efforts aiming to extend half‐life, improve pharmacodynamics, and enable alternative delivery modes such as subcutaneous or inhalation administration. Taken together, these paradigm‐shifting developments are catalyzing a transition from chronic replacement therapy to potentially one‐time or infrequent dosing regimens, elevating patient quality of life and reducing long‐term healthcare burden, while demanding new regulatory frameworks, reimbursement paradigms, and real‐world evidence generation to support market adoption.

Assessing the Broad Consequences of 2025 United States Tariffs on the Alpha 1 Antitrypsin Deficiency Treatment Supply Chain and Market Dynamics

In 2025, the United States implemented a suite of tariffs designed to bolster domestic manufacturing of pharmaceuticals and related inputs, with direct implications for the Alpha 1 Antitrypsin Deficiency treatment supply chain. Active pharmaceutical ingredients (APIs) imported from China now bear a 25 percent duty, and those from India face a 20 percent levy, prompting immediate cost inflation for both branded and generic formulations; this is particularly significant for plasma‐derived augmentation therapies that depend on imported reagents for viral vector manufacturing and cold chain logistics. Tariffs have also been applied at a rate of 15 percent on medical packaging and laboratory equipment, impacting glass vials, sterile packaging materials, and analytical instrumentation essential for both clinical trial execution and commercial distribution, thereby extending cost pressures to both early‐stage biotechs and established producers.

Further challenges have emerged from a blanket 10 percent global tariff on all goods entering the U.S. as of April 5, 2025, which encompasses critical supplies such as diagnostic assays for AATD screening, cell culture reagents, and specialized raw materials for vector production. The potential for Section 232 investigations to trigger even higher duties on semiconductors and specialized machinery used in gene therapy manufacturing remains an area of strategic uncertainty, as evidenced by ongoing legal challenges that have already resulted in a U.S. Court of International Trade injunction against “Liberation Day” tariffs deemed beyond executive authority.

These policy shifts have accelerated supply chain diversification efforts, driving stakeholders to evaluate reshoring options, local API synthesis, and vertically integrated manufacturing partnerships. While the intent is to enhance national resilience, the immediate outcome has been upward pressure on drug production costs, extended timelines for clinical material release, and heightened complexity in cross‐border distribution, all of which require proactive mitigation strategies to safeguard patient access and preserve investment returns.

Uncovering Critical Insights Derived from Therapy Class, Distribution Channel, Delivery Mode, End User, and Patient Age Group Segmentation Analyses

The Alpha 1 Antitrypsin Deficiency treatment market can be understood by examining several intersecting segmentation dimensions, each offering unique insights into patient needs and commercial opportunities. When analyzed by therapy class, traditional augmentation therapy continues to anchor the patient care paradigm, while plasma infusion remains integral for acute management in severe exacerbations; emerging gene therapies leveraging both AAV and lentiviral vectors promise a step change in addressing the genetic root cause, with vector choice influencing durability of expression and safety profiles. Exploring distribution channels reveals that hospital pharmacies retain a leading role in initiating treatment regimens, whereas online pharmacies are rapidly gaining traction for maintenance dosing and direct‐to‐patient convenience, and retail pharmacies serve as critical touchpoints for refill management and patient education.

Delivery mode segmentation highlights a growing preference for less invasive formats: intravenous administration remains the gold standard for augmentation and infusion therapies, yet inhalation delivery is under development to improve pulmonary targeting and reduce systemic exposure, offering a differentiated value proposition for patient adherence. End user analysis underscores the importance of multi‐site care, where homecare services enable self‐administration in stable patients, hospitals manage acute episodes and infusion clinics, and specialty clinics provide expert monitoring and genetic counseling. Finally, patient age group segmentation reveals distinct demand patterns, with adult populations driving volume through chronic maintenance therapies, geriatrics requiring tailored dosing and comorbidity management, and pediatric cohorts needing specially formulated, weight‐adjusted protocols and early intervention strategies. Taken together, these segmentation lenses inform product development priorities, market access strategies, and channel partnerships to align with evolving stakeholder expectations.

This comprehensive research report categorizes the Alpha 1 Antitrypsin Deficiency Treatment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Therapy Class

- Delivery Mode

- Patient Age Group

- Distribution Channel

- End User

Regional Analysis Revealing Growth Trajectories, Challenges, and Strategic Opportunities across Americas, Europe Middle East & Africa, and Asia-Pacific

Regional dynamics play a pivotal role in shaping the Alpha 1 Antitrypsin Deficiency treatment landscape, reflecting diverse healthcare infrastructures, regulatory regimes, and epidemiologic profiles. In the Americas, the United States leads with robust clinical trial activity, early adoption of gene editing and RNAi therapies, and progressive reimbursement frameworks that support innovative modalities, although challenges remain around underdiagnosis and equitable patient access in rural areas. Canada’s smaller market has prioritized registry development and newborn screening programs, creating strong real‐world evidence platforms, while Latin American countries are gradually expanding access to augmentation therapy through public‐private partnerships and negotiated pricing agreements.

In Europe, Middle East & Africa (EMEA), Western European nations benefit from centralized regulatory pathways and well-established plasma donation networks, facilitating the rollout of next-generation subcutaneous formulations and vector-based therapies; however, reimbursement processes in key markets such as Germany, France, and the UK can extend time to market. The Middle East is emerging as a hub for rare disease centers of excellence, yet infrastructure gaps in North Africa and parts of sub-Saharan Africa constrain widespread screening and therapy availability. Across the Asia-Pacific region, rising healthcare expenditure and growing awareness of AATD are driving investments in diagnostic capacity and specialist training; Australia and Japan have initiated supportive regulatory measures for advanced therapies, while China and India are rapidly building domestic gene therapy and plasma production capabilities, underscoring the region’s potential as both a manufacturing base and a future growth engine.

This comprehensive research report examines key regions that drive the evolution of the Alpha 1 Antitrypsin Deficiency Treatment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Profiles and Competitive Dynamics of Leading Biopharmaceutical and Gene Therapy Developers Driving Alpha 1 Antitrypsin Deficiency Treatment Innovations

A diverse array of companies is vying for leadership in the Alpha 1 Antitrypsin Deficiency treatment space, with strategic positioning determined by modality, manufacturing capabilities, and partnership networks. CSL Behring and Grifols remain foundational players in plasma-derived augmentation therapy, leveraging large-scale fractionation facilities and extensive distribution systems to maintain broad patient reach, while simultaneously investing in next-generation subcutaneous and inhaled formulations to sustain differentiation. Kamada’s Glassia franchise has disrupted the market with its ready-to-use format and subcutaneous option, capturing share through patient‐centric convenience and insurance coverage expansions in the U.S.

On the innovation front, Intellia Therapeutics has advanced its in vivo CRISPR/Cas9 program into Phase 1/2 clinical trials, positioning itself at the forefront of gene editing for AATD, while Prime Medicine’s prime editing initiative underscores the competitive potential of lipid nanoparticle delivery for precise allelic correction. Meanwhile, RNA-based approaches are spearheaded by Arrowhead Pharmaceuticals’ ARO-AAT and Alnylam Pharmaceuticals’ siRNA candidate, each demonstrating substantial knockdown of aberrant proteins in early‐stage trials and offering differentiated dosing frequencies. Takeda’s recombinant plant-derived SHP656 and Sanofi’s recombinant fusion protein INBRX-101 further illustrate how biologics engineering and strategic acquisitions are broadening treatment modalities. Across this landscape, partnerships with contract development organizations, academic centers, and specialty pharmacies are accelerating trial enrollment, manufacturing scale-up, and market launch, defining the competitive dynamics for upcoming years.

This comprehensive research report delivers an in-depth overview of the principal market players in the Alpha 1 Antitrypsin Deficiency Treatment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AstraZeneca PLC

- Baxter International Inc.

- Bayer AG

- Biogen Inc.

- Biotest AG

- Boehringer Ingelheim International GmbH

- CSL Behring GmbH

- GlaxoSmithKline plc

- Grifols S.A.

- Kamada Pharmaceuticals

- Takeda Pharmaceutical Company Limited

- Vertex Pharmaceuticals

Practical Strategies and Tactical Initiatives for Industry Leaders to Enhance Commercial Success and Innovation in Alpha 1 Antitrypsin Deficiency Treatment

To navigate the evolving Alpha 1 Antitrypsin Deficiency treatment environment, industry leaders should prioritize strategic initiatives that maximize innovation impact and commercial success. First, forging collaborations across gene therapy developers, plasma fractionators, and CDMOs can accelerate pathway optimization, mitigate manufacturing bottlenecks, and enable technology transfer for onshore API and vector production. Engaging with regulatory authorities to define adaptive approval frameworks and real-world evidence requirements will facilitate earlier patient access to breakthrough modalities.

Second, strengthening patient identification through investment in targeted screening programs and digital diagnostic tools will address underdiagnosis and expand the treatable patient base. Aligning distribution strategies across hospital pharmacies, specialty clinics, and self-administration platforms will enhance patient convenience and retention. Third, building comprehensive outcomes registries that capture long-term safety and quality-of-life metrics will support value-based contracting and reimbursement negotiations, particularly for one-time gene therapies and curative approaches.

Finally, diversifying regional partnerships and supply chain sources will hedge against tariff volatility and geopolitical disruptions. By embracing these actionable recommendations, stakeholders can create resilient commercial models, unlock untapped patient segments, and deliver transformative therapies that redefine the standard of care for individuals living with Alpha 1 Antitrypsin Deficiency.

Rigorous Research Methodology and Data Collection Framework Underpinning Comprehensive Analysis of Alpha 1 Antitrypsin Deficiency Treatment Market Dynamics

The research methodology underpinning this analysis combined rigorous primary and secondary data collection to ensure a robust and credible framework. Primary research included in-depth interviews with clinical experts, patient advocacy groups, pharmaceutical executives, and supply chain specialists, providing qualitative insights into clinical adoption drivers, reimbursement barriers, and emerging scientific trends. Secondary research encompassed a comprehensive review of peer-reviewed journals, clinical trial registries such as ClinicalTrials.gov, regulatory filings, company presentations, and recent press releases to validate development pipelines, competitive initiatives, and policy changes.

Data triangulation was employed to cross-verify information from multiple sources, reconciling discrepancies in clinical trial outcomes, regulatory timelines, and commercial milestones. A structured market mapping exercise identified key stakeholders across therapy classes, geographic regions, and distribution channels, with data points synthesized into segmentation matrices. Quality control measures included independent reviews of data accuracy, logical consistency checks, and validation workshops with external experts to confirm interpretive findings.

While this study delivers a comprehensive overview of the Alpha 1 Antitrypsin Deficiency treatment market, limitations include evolving clinical trial outcomes, potential shifts in trade policy, and emerging competitive entrants that may alter market dynamics. These caveats underscore the importance of ongoing market monitoring and iterative analysis as new data become available.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Alpha 1 Antitrypsin Deficiency Treatment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Alpha 1 Antitrypsin Deficiency Treatment Market, by Therapy Class

- Alpha 1 Antitrypsin Deficiency Treatment Market, by Delivery Mode

- Alpha 1 Antitrypsin Deficiency Treatment Market, by Patient Age Group

- Alpha 1 Antitrypsin Deficiency Treatment Market, by Distribution Channel

- Alpha 1 Antitrypsin Deficiency Treatment Market, by End User

- Alpha 1 Antitrypsin Deficiency Treatment Market, by Region

- Alpha 1 Antitrypsin Deficiency Treatment Market, by Group

- Alpha 1 Antitrypsin Deficiency Treatment Market, by Country

- United States Alpha 1 Antitrypsin Deficiency Treatment Market

- China Alpha 1 Antitrypsin Deficiency Treatment Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Concluding Insights Synthesizing Key Findings and Strategic Considerations for Stakeholders in the Alpha 1 Antitrypsin Deficiency Treatment Ecosystem

In synthesizing the multifaceted insights across scientific innovation, market segmentation, regional dynamics, and competitive strategies, it becomes clear that the Alpha 1 Antitrypsin Deficiency treatment ecosystem is at a pivotal inflection point. Traditional augmentation and plasma infusion therapies maintain a critical role in patient management, yet the rise of gene editing, prime editing, and RNA-based therapeutics heralds a potential paradigm shift toward curative interventions. Segmentation analyses reveal nuanced opportunities in therapy class differentiation, channel optimization, and patient cohort targeting, while regional perspectives highlight diverse adoption curves shaped by regulatory landscapes and healthcare infrastructure.

Emerging challenges such as evolving U.S. tariffs, supply chain complexities, and reimbursement uncertainties necessitate proactive risk mitigation through onshoring initiatives, strategic alliances, and adaptive regulatory engagement. Leading companies are already charting competitive courses through targeted acquisitions, platform extensions, and collaborative research, signaling that the race to deliver next-generation therapies will be defined by speed to market, depth of clinical evidence, and the ability to demonstrate enduring value for payers and patients alike.

Ultimately, stakeholders who integrate these insights into cohesive strategies-balancing innovation with operational resilience and patient‐centric delivery-will be best positioned to capture emerging growth, address unmet clinical needs, and establish leadership in the evolving Alpha 1 Antitrypsin Deficiency treatment domain.

Take Action Now to Gain In-Depth Strategic Insights on Alpha 1 Antitrypsin Deficiency Treatment by Connecting with Associate Director of Sales & Marketing

To connect with Ketan Rohom, Associate Director of Sales & Marketing, and gain exclusive access to the comprehensive market research report on Alpha 1 Antitrypsin Deficiency Treatment, please reach out via our website inquiry portal or schedule a personalized briefing. Taking this step ensures you receive in‐depth strategic insights, customized analysis, and early previews of emerging data that will enhance your decision‐making and competitive positioning in this rapidly evolving field. Don’t miss the opportunity to leverage our expertise and comprehensive data to inform your next strategic move in the Alpha 1 Antitrypsin Deficiency Treatment market

- How big is the Alpha 1 Antitrypsin Deficiency Treatment Market?

- What is the Alpha 1 Antitrypsin Deficiency Treatment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?