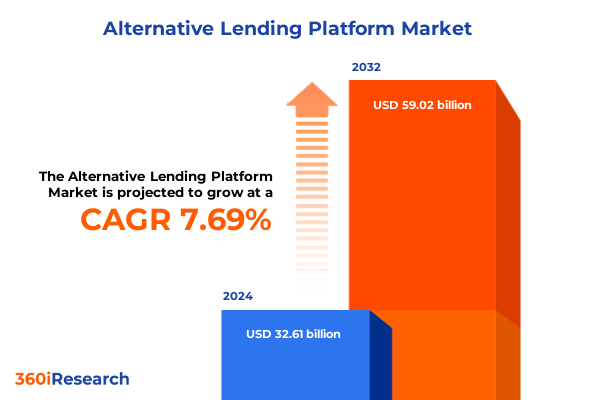

The Alternative Lending Platform Market size was estimated at USD 11.07 billion in 2025 and expected to reach USD 15.08 billion in 2026, at a CAGR of 36.90% to reach USD 99.79 billion by 2032.

An In-Depth Portal to the Evolving World of Alternative Lending Platforms and Their Strategic Significance for Modern Financial Ecosystems

The alternative lending ecosystem has undergone a remarkable evolution, driven by technological breakthroughs, shifting regulatory frameworks, and growing borrower sophistication. As traditional financial institutions grapple with legacy systems and risk-averse capital allocation, new digital-first platforms are creating more accessible, transparent, and customized financing solutions. These platforms leverage advanced data analytics, real-time credit scoring, and automated decisioning algorithms to streamline application processes and expand credit access for underserved segments. Consequently, the financing journey now places speed and adaptability at its core, fundamentally altering expectations for borrowers and lenders alike.

This transition is not purely technological; it represents a broader shift toward customer-centric financial services. Platforms designed to deliver seamless user experiences are reshaping perceptions around borrowing convenience, driving widespread adoption of nonbank lending solutions. With borrowers demanding instant approvals and flexible terms across business lines of credit, mortgage refinancing, personal secured and unsecured loans, and both graduate and undergraduate student financing, market participants must recalibrate their offerings to fulfill diverse credit needs. Immersed in this dynamic backdrop, stakeholders must understand the strategic implications of digital innovation, operational agility, and evolving compliance considerations to successfully navigate the future of credit provision.

Unveiling the Transformational Forces Reshaping Alternative Lending Landscape Through Innovation, Technology Integration, and Evolving Regulatory Paradigms

Over the past several years, a converging set of forces has driven a seismic transformation within the alternative lending space. Foremost among these is the rapid integration of artificial intelligence and machine learning, enabling more granular risk assessment and dynamic pricing models that adjust to real-time market conditions. This capability has evolved beyond basic credit scoring to encompass behavioral analytics, social data mining, and predictive modeling, facilitating more inclusive credit decisions even for borrowers with limited histories.

Concurrently, the regulatory environment has adapted to this innovation wave, with policymakers introducing standardized frameworks for digital underwriting, data privacy, and anti–money laundering compliance. These regulatory refinements foster credible governance structures while affording platforms the latitude to experiment with novel credit products. The surge in partnerships between technology providers, balance sheet lenders, and marketplace intermediaries underscores a shift toward collaborative ecosystems, in which bank partnerships, broker-facilitated channels, and direct online distribution coalesce to deliver robust credit solutions. Taken together, these transformative shifts are reshaping the competitive landscape and redefining the essence of lending agility and customer-centricity.

Assessing the Cumulative Effects of 2025 United States Tariffs on Alternative Lending Dynamics Across Supply Chains, Pricing Models, and Borrower Accessibility

In 2025, a new suite of tariffs enacted by the United States government rippled through global supply chains, affecting the cost structures of technology providers, loan servicing platforms, and ancillary service partners within the alternative lending sphere. As overseas components for underwriting engines and cloud-based infrastructures experienced escalated import duties, platform operators faced margin pressures that necessitated a recalibration of fee schedules and service arrangements. Borrowers, especially small and medium enterprises reliant on lines of credit and term loans, encountered incremental cost pass-throughs that, over time, influenced loan affordability and financing demand.

These tariff-induced cost adjustments triggered an accelerated pivot toward onshore technology sourcing and greater investment in in-house development capabilities. Industry participants proactively diversified supplier bases to mitigate exposure, with some forging strategic alliances with domestic fintech vendors and cloud service providers. While this transition stimulated localized innovation ecosystems, it also introduced transitional challenges around scalability and platform interoperability. Ultimately, the 2025 tariff landscape has underscored the importance of resilient operational models and adaptive pricing frameworks, thereby shaping a more self-reliant and strategically diversified alternative lending industry.

Deriving Strategic Insights from Comprehensive Segmentation Analyses to Illuminate Nuanced Alternative Lending Demand Drivers and Growth Pathways

A nuanced examination of segment performance reveals critical demand drivers and risk profiles across loan types, funding models, credit ratings, distribution channels, and end-use applications. Business financing, whether through revolving lines of credit or longer-term term loans, remains pivotal for enterprises seeking working capital, yet its growth trajectory diverges significantly from personal financing streams. Within mortgage refinancing, the distinctions between cash-out and rate-and-term strategies reflect borrowers’ shifting priorities-some unlocking home equity for investment, while others optimize interest obligations. Personal loans, spanning secured vehicles and unsecured credit facilities, underscore differing collateral dynamics and borrower risk appetites. Meanwhile, the student financing segment highlights unique behavioral patterns, with graduate borrowers often demonstrating higher income trajectories relative to their undergraduate counterparts.

Examining funding model choices further clarifies market mechanics. Platforms rooted in balance sheet lending carry distinct capital allocation responsibilities compared to marketplace intermediaries that expedite loan matching and peer-to-peer networks that disintermediate traditional credit intermediation. Borrower credit ratings shape underwriting stringency, with near prime and subprime cohorts presenting elevated default considerations relative to prime applicants. Distribution channels likewise influence borrower touchpoints: bank partnerships embed alternative solutions within established financial brands, broker-facilitated avenues offer advisory-led placement, and direct online interfaces grant frictionless access. Finally, end-use motivations-from debt consolidation and home improvement to medical expenses, education financing, and working capital requirements-drive product customization and portfolio diversification strategies. Viewed collectively, these segmentation insights furnish a comprehensive roadmap for tailoring value propositions to specific risk-return profiles and growth opportunities.

This comprehensive research report categorizes the Alternative Lending Platform market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Loan Type

- Funding Model

- Borrower Credit Rating

- Distribution Channel

- End Use

Revealing Critical Regional Disparities and Emerging Trends in the Alternative Lending Sector Across the Americas, Europe, Middle East, Africa, and Asia-Pacific

A geographic lens reveals that the Americas continue to spearhead alternative lending proliferation, propelled by robust digital adoption, favorable regulatory sandboxes, and heightened demand for small-business working capital solutions. Market maturity in the United States and Canada is mirrored by surging activity in Brazil and Mexico, where digital credit platforms cater to SMEs underserved by traditional banks. In contrast, Europe, the Middle East, and Africa illustrate a diverse regulatory tapestry: while the European Union advances harmonized digital finance regulations, Middle Eastern jurisdictions experiment with fintech innovation zones and Africa leverages mobile-based lending to expand financial inclusion.

The Asia-Pacific region presents a patchwork of advanced and emerging economies. In Australia, established marketplace intermediaries coexist with bank-led digital ventures, whereas Southeast Asian markets like Indonesia and the Philippines witness rapid growth in unsecured personal lending via mobile channels. China’s pivot toward regulatory tightening has refocused platforms on credit risk controls, while India’s digital infrastructure initiatives drive scalable student financing and mortgage refinancing models. These regional insights underscore the necessity for market participants to engineer adaptive strategies that reconcile local regulations, technological readiness, and borrower preferences across each global cluster.

This comprehensive research report examines key regions that drive the evolution of the Alternative Lending Platform market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Alternative Lending Players to Highlight Competitive Strategies, Innovation Benchmarks, Partnership Models, and Market Positioning in a Rapidly Evolving Environment

Leading alternative lending institutions have differentiated themselves through distinctive strategic levers, spanning technological innovation, partnership ecosystems, and service specialization. Certain balance sheet lenders have fortified their competitive moats by investing heavily in proprietary underwriting engines, enabling sub-second credit decisions while maintaining disciplined risk controls. Meanwhile, prominent marketplace intermediaries emphasize open application programming interfaces that facilitate plug-and-play integrations with bank partners, broker networks, and third-party service providers.

Peer-to-peer models have evolved beyond simple borrower-lender matchmaking, expanding into community-driven credit circles that leverage collective guarantees and social incentives to mitigate default risk. Many of the most influential players have also pursued geographic diversification, replicating successful platform blueprints across multiple regions to capture high-growth opportunities. Moreover, strategic acquisitions of data analytics startups and partnerships with identity verification specialists have emerged as critical tactics to enhance fraud prevention and streamline on-boarding. By benchmarking these competitive strategies, industry participants can identify value creation levers-from API-driven distribution and embedded finance partnerships to advanced machine learning capabilities-that define market leadership in a dynamically evolving environment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Alternative Lending Platform market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Affirm Holdings, Inc

- Avant, LLC

- Funding Circle Holdings plc

- GreenSky, LLC

- Kabbage, Inc

- LendingClub Corporation

- On Deck Capital, Inc

- Prosper Marketplace, Inc

- SoFi Technologies, Inc

- Upstart Network, Inc

Delivering Pragmatic and Impactful Recommendations to Empower Industry Leaders to Navigate Regulatory Complexities and Accelerate Innovation in Alternative Lending

Industry leaders seeking to capitalize on the alternative lending surge should prioritize investments in data-driven decisioning frameworks that not only bolster underwriting accuracy but also unlock personalized borrower experiences. By integrating real-time analytics and machine learning models, platforms can refine risk segmentation, enabling differentiated pricing and tailored credit solutions that resonate with borrowers’ unique financial profiles. Additionally, cultivating strategic alliances with banks, brokers, and embedded finance partners amplifies distribution reach and enhances customer trust, while compliance-centric collaborations with regulatory bodies ensure that product innovation aligns with evolving standards.

Operational resilience demands a proactive approach to technology and supply chain diversification. Firms should evaluate onshore versus offshore technology sourcing and explore modular platform architectures that facilitate rapid feature deployment without incurring extensive reengineering costs. Embedding robust fraud detection and identity verification layers safeguards against credit losses and reputational risks, while continuous feedback loops informed by borrower behavior data guide iterative product enhancements. Executed in tandem, these recommendations enable industry stakeholders to navigate regulatory complexities, accelerate innovation pipelines, and cultivate sustainable growth trajectories within the competitive alternative lending arena.

Detailing a Robust and Transparent Research Methodology That Blends Primary Data Collection, Expert Interviews, and Secondary Source Analysis

This research synthesis draws upon a balanced combination of primary interviews, secondary data sources, and rigorous validation protocols. Primary data collection entailed structured interviews and surveys with senior executives from leading platforms, technology vendors, regulatory agencies, and borrower focus groups to capture firsthand perspectives on market dynamics, technological adoption, and evolving credit behaviors. Secondary research encompassed a comprehensive review of industry publications, regulatory filings, corporate disclosures, and publicly available financial statements to establish a robust factual baseline and identify emerging trends.

To ensure analytical integrity, the research team employed cross-validation techniques, aligning interview insights with quantitative data patterns and triangulating findings against independent market analyses. Data flows were subjected to consistency checks, and key model assumptions were stress-tested across multiple scenarios. The resulting framework offers transparent documentation of research assumptions, methodological limitations, and validation outcomes, equipping decision-makers with credible insights into the structural underpinnings of alternative lending platform dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Alternative Lending Platform market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Alternative Lending Platform Market, by Loan Type

- Alternative Lending Platform Market, by Funding Model

- Alternative Lending Platform Market, by Borrower Credit Rating

- Alternative Lending Platform Market, by Distribution Channel

- Alternative Lending Platform Market, by End Use

- Alternative Lending Platform Market, by Region

- Alternative Lending Platform Market, by Group

- Alternative Lending Platform Market, by Country

- United States Alternative Lending Platform Market

- China Alternative Lending Platform Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Key Insights to Illustrate the Strategic Imperatives, Opportunities, and Future Directions Shaping the Alternative Lending Ecosystem

The alternative lending sector stands at a critical juncture, poised to redefine traditional credit paradigms through advanced analytics, strategic partnerships, and adaptive regulatory alignment. Key insights underscore the pivotal role of data-driven underwriting in unlocking new borrower segments while maintaining credit quality. Moreover, segmentation analyses reveal targeted growth pathways across business credit solutions, personal financing, mortgage refinancing variations, and specialized student loan channels. Regional disparities illustrate the imperative for localized strategies attuned to regulatory heterogeneity and technological readiness.

As industry leaders reposition their platforms amid tariff-induced cost shifts and emerging compliance frameworks, the capacity to integrate flexible funding models, optimize distribution channels, and tailor offerings to end-use applications will determine market preeminence. A cohesive strategic response that leverages collaboration, innovation, and operational resilience will empower stakeholders to harness the full potential of alternative lending dynamics. Collectively, these synthesized perspectives chart a clear roadmap for capitalizing on opportunity vectors and navigating the evolving credit landscape with confidence.

Empower Your Organization with In-Depth Market Intelligence by Connecting with Ketan Rohom to Access the Alternative Lending Platform Research Report

To explore how your institution can unlock bespoke strategies and unparalleled insights for capitalizing on evolving credit demand, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. His expertise bridges rigorous market analysis with actionable guidance, ensuring that your organization secures timely access to the Alternative Lending Platform research report. Engage today to gain immediate clarity on emerging credit trends, partnership opportunities, and strategic roadmaps that drive competitive advantage within this dynamic sector.

- How big is the Alternative Lending Platform Market?

- What is the Alternative Lending Platform Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?