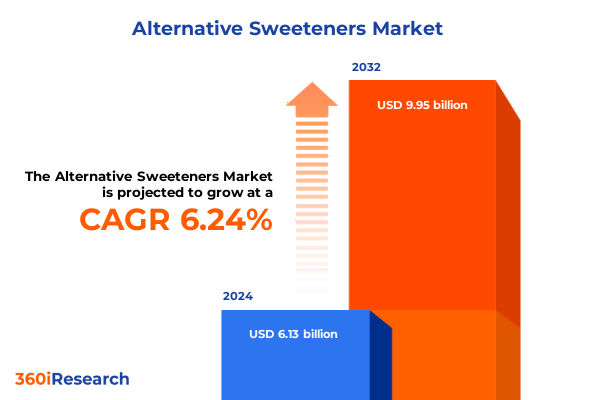

The Alternative Sweeteners Market size was estimated at USD 13.75 billion in 2025 and expected to reach USD 14.56 billion in 2026, at a CAGR of 5.96% to reach USD 20.64 billion by 2032.

Exploring the Evolving Terrain of Alternative Sweeteners and Their Rising Significance in Global Food and Beverage Innovation Trends

Consumer demand for healthier formulations continues to reshape the food and beverage landscape, with alternative sweeteners rapidly advancing from niche ingredients to mainstream staples. This shift is driven by a convergence of health consciousness, sugar reduction regulations, and innovation in sweetening agents that cater to both taste and wellness. In light of growing scientific evidence linking excessive sugar intake to metabolic and dental health issues, manufacturers are actively exploring both high-intensity and low-intensity sweeteners to satisfy evolving preferences without compromising on flavor or texture.

As the market moves beyond traditional sugar substitutes, a diverse portfolio of options-from natural extracts like stevia to sugar alcohols such as erythritol-has emerged, enabling formulators to tailor sweetness profiles with precision. Furthermore, regulatory bodies worldwide are encouraging reformulation through sugar taxes and labeling requirements, creating an imperative for agile product development. Given this dynamic context, understanding the interplay between consumer expectations, ingredient functionality, and regulatory drivers has never been more critical. Consequently, this executive summary provides a comprehensive exploration of key market developments, segmentation insights, regional nuances, and strategic considerations that will inform decision-making in the rapidly evolving alternative sweetener arena.

Unpacking the Transformative Shifts Reshaping the Alternative Sweetener Industry Amidst Health and Sustainability Imperatives

Over the past decade, alternative sweetener manufacturers have navigated a series of transformative shifts that underline the industry’s resilience and capacity for innovation. Initially, the focus centered on replicating sugar’s sweetness profile through high-intensity compounds such as aspartame and sucralose. However, consumer skepticism toward synthetic additives prompted an accelerated pivot toward plant-derived and clean-label alternatives, most notably stevia extracts. Moreover, ongoing advances in extraction technologies have enhanced purity and reduced off-flavors, fostering broader adoption among premium and mass-market brands alike.

In parallel, low-intensity sugar alcohols like erythritol and xylitol have seen resurgence as formulators seek bulking agents that contribute to mouthfeel and caramelization properties absent in high-intensity sweeteners. Furthermore, the integration of sweetener blends has become an essential strategy, leveraging synergistic effects to approximate sucrose functionality while masking individual shortcomings. Consequently, partnerships between ingredient producers, flavor houses, and research institutions are proliferating, driving continuous improvement across taste, stability, and digestive tolerance. In essence, the landscape of alternative sweeteners is being reshaped by a dual imperative: meeting stringent health and clean-label demands while delivering multisensory experiences that resonate with discerning consumers.

Assessing the Cumulative Impact of 2025 United States Tariffs on Import Dynamics and Supply Chain Strategies in the Sweetener Sector

In early 2025, the United States introduced new import tariffs on specific categories of sugar alcohols and synthetic sweeteners, aimed at bolstering domestic production and addressing trade imbalances. These measures have directly influenced cost structures for downstream manufacturers who traditionally rely on lower-cost imports for raw ingredient supply. Accordingly, procurement teams have been compelled to reevaluate sourcing strategies, balancing the higher landed cost of imported sweeteners against the expanding capacity of domestic producers leveraging advanced bioconversion processes.

Furthermore, the tariff regime has accelerated the search for alternative supply corridors, with several companies turning to Latin American and Southeast Asian markets to secure competitive pricing and ensure continuity of supply. In response to these pressures, ingredient suppliers have explored vertical integration and strategic joint ventures to achieve greater control over production economics. Consequently, the tariff-driven cost paradigm has catalyzed a broader reassessment of value chains, prompting manufacturers to invest in inventory management systems and long-term supplier contracts that mitigate volatility. As a result, the industry is witnessing a recalibration of global trade flows and supply chain resilience strategies, underscoring the importance of agility in navigating evolving policy environments.

Revealing Key Segmentation Insights That Illuminate Product, Form, Source, Application, and Distribution Trends Shaping the Sweetener Marketplace

Segmentation analysis reveals that the alternative sweetener market’s complexity is largely defined by the contrast between high-intensity and low-intensity compounds. High-intensity sweeteners include a range of formulations such as acesulfame potassium, aspartame, neotame, saccharin, stevia, and sucralose, each offering potent sweetness profiles at minimal usage levels. Conversely, sugar alcohols like erythritol, maltitol, mannitol, sorbitol, and xylitol occupy the low-intensity segment, functioning as both sweeteners and bulking agents within various formulations. This bifurcation highlights the necessity for product developers to select the appropriate sweetening system based on factors such as taste threshold, bulking requirements, and digestive tolerance.

Moving from molecular functionality to end‐form considerations, the liquid, powder, and tablet forms of alternative sweeteners cater to diverse manufacturing processes and consumer preferences. Liquid extracts are prized for beverage applications and ease of blending, while powdered forms offer versatility across bakery systems and dry mixes. Tablets have found a niche in tabletop sweeteners, enabling portion control and convenience for consumers on the go. The source of these sweetening agents further distinguishes market offerings. Natural extracts derived from plants or fermentation contrast with synthetic or artificial alternatives produced through chemical synthesis, with branding and consumer perception playing pivotal roles in product positioning.

Application-driven segmentation underscores how alternative sweeteners permeate disparate end markets, from animal feed formulations seeking energy-efficient additives to food and beverage categories that span bakery and confectionery, beverages, canned goods, dairy, and meat products. Beyond edible applications, personal care products harness sweeteners for mouthfeel in oral hygiene and confectionery-inspired skincare, while pharmaceuticals utilize them to mask bitterness in syrups and chewable tablets. Finally, distribution channels, including convenience stores, online platforms, and supermarkets or hypermarkets, shape the accessibility and marketing strategies of sweetener products, reflecting evolving consumer shopping behaviors and digital engagement trends.

This comprehensive research report categorizes the Alternative Sweeteners market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- Sweetness Intensity

- Manufacturing Method

- Application

- Distribution Channel

Analyzing Regional Variations in Demand, Regulation, Consumer Preferences, and Production Across the Americas, EMEA, and Asia Pacific

Regional analysis illustrates that the Americas remain a pivotal arena for alternative sweetener innovation, driven by substantial consumer demand for low‐calorie and clean‐label products. North America’s regulatory environment, characterized by stringent labeling laws and sugar reduction initiatives, has propelled manufacturers to accelerate reformulation efforts. Meanwhile, Latin American countries are emerging as important growth markets, fueled by rising health awareness and an expanding middle‐class appetite for functional foods.

In the Europe, Middle East & Africa region, regulatory frameworks and taxation policies have created both challenges and opportunities. The European Union’s proactive stance on sugar taxes and health claims has incentivized the introduction of novel sweeteners, while Middle Eastern markets are navigating supply constraints rooted in climatic and logistic factors. Africa’s nascent food processing sector is gradually integrating alternative sweeteners, with local production of certain sugar alcohols beginning to take shape in response to import cost pressures.

Asia‐Pacific stands as the fastest‐growing region, underpinned by robust urbanization, shifting dietary preferences, and substantial investments in ingredient manufacturing. Countries such as China and India are scaling up production capacity for both high-intensity sweeteners and sugar alcohols, leveraging cost-competitive feedstocks. Furthermore, consumer education campaigns around health and wellness are gaining traction across the region, elevating demand for products that reduce sugar content without sacrificing taste.

This comprehensive research report examines key regions that drive the evolution of the Alternative Sweeteners market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlighting Leading Companies Advancing Innovation, Partnerships, and Strategic Moves That Define the Competitive Landscape in Alternative Sweeteners

Leading players in the alternative sweetener space are distinguished by their emphasis on research and development, strategic collaborations, and vertical integration. Companies such as major agribusinesses have invested heavily in fermentation technologies and plant breeding to optimize yields of natural sweetener precursors. At the same time, specialty ingredient firms have pursued targeted acquisitions to expand their portfolios, incorporating novel sweetening agents and advanced flavor masking systems to address taste profile challenges.

Strategic partnerships between ingredient suppliers and beverage or food formulators have facilitated co‐creation initiatives, accelerating route‐to‐market for new sweetener blends. Meanwhile, certain players have established dedicated centers of excellence that consolidate sensory evaluation, regulatory affairs, and application engineering, ensuring that innovation pipelines align with consumer insights and compliance requirements. Additionally, several industry participants are piloting blockchain and digital traceability solutions to enhance transparency across supply chains, catering to heightened demands for provenance and sustainability.

This comprehensive research report delivers an in-depth overview of the principal market players in the Alternative Sweeteners market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Cargill Incorporated

- Archer Daniels Midland Company

- Tate & Lyle PLC

- Ingredion SA

- Koninklijke DSM N.V

- Ajinomoto Co., Inc.

- Roquette Frères SA

- International Flavors & Fragrances Inc.

- Evonik Industries AG

- Givaudan S.A.

- Südzucker AG

- Apura Ingredients, Inc.

- Batory Foods

- Bonumose, Inc.

- Cumberland Packing Corporation

- Fooditive Group

- Foodmate Co., Ltd.

- Galam Group

- GLG Life Tech Corporation

- Irca S.p.A.

- JK Sucralose Inc by Feishang Group, Ltd

- Kruger Group

- Manus Bio Inc.

- MORITA KAGAKU KOGYO CO., LTD.

- NOW Health Group, Inc.

- NutraEx Food Inc.

- Oobli, Inc.

- SweeGen, Inc.

- Whole Earth Brands, Inc.

- Wisdom Natural Brands

Actionable Recommendations Guiding Industry Leaders to Navigate Regulatory Complexities and Capitalize on Emerging Sweetener Opportunities

Industry leaders should prioritize the development of clean-label and naturally derived sweeteners, aligning product portfolios with consumer preferences for transparency and minimal processing. Investing in advanced extraction and fermentation technologies can not only improve flavor profiles but also drive down production costs over time. Moreover, companies should consider establishing strategic alliances with feedstock producers and academic institutions to secure long‐term access to critical raw materials and breakthrough scientific advancements.

In parallel, manufacturers must enhance supply chain resilience by diversifying sourcing strategies, establishing regional manufacturing hubs, and deploying predictive analytics to anticipate policy shifts or logistic disruptions. Proactive engagement with regulatory authorities and participation in industry associations can facilitate early awareness of labeling or tariff changes, enabling timely reformulation and cost management. Furthermore, brands should implement targeted consumer education campaigns that articulate the benefits and safety profiles of alternative sweeteners, thereby fostering trust and demand. Ultimately, an integrated approach that balances technological innovation with stakeholder collaboration will empower industry participants to capture growth and mitigate risk.

Outlining a Robust Research Methodology Ensuring Reliability, Transparency, and Comprehensive Coverage of Alternative Sweetener Market Dynamics

The research methodology underpinning this report integrates both secondary and primary data collection to ensure robust and reliable insights. Secondary research encompassed the review of industry journals, trade publications, and regulatory databases to map out historical trends, policy developments, and competitive activities. This phase provided a comprehensive baseline understanding of market drivers, technological breakthroughs, and consumer sentiment.

Primary research involved structured interviews with key stakeholders, including ingredient innovators, food and beverage formulators, regulatory experts, and distribution channel representatives. These in‐depth discussions yielded qualitative perspectives that enriched the quantitative analysis, enabling triangulation of market dynamics. Additionally, data from proprietary surveys and panel studies offered real‐time visibility into purchase behaviors and preference shifts. To enhance methodological rigor, data triangulation and validation exercises were conducted, cross‐referencing multiple sources and applying consistency checks. The result is a detailed framework that captures the nuanced interplay between demand, supply, and regulatory forces shaping the alternative sweetener ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Alternative Sweeteners market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Alternative Sweeteners Market, by Product Type

- Alternative Sweeteners Market, by Form

- Alternative Sweeteners Market, by Sweetness Intensity

- Alternative Sweeteners Market, by Manufacturing Method

- Alternative Sweeteners Market, by Application

- Alternative Sweeteners Market, by Distribution Channel

- Alternative Sweeteners Market, by Region

- Alternative Sweeteners Market, by Group

- Alternative Sweeteners Market, by Country

- United States Alternative Sweeteners Market

- China Alternative Sweeteners Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Concluding Insights That Synthesize Key Findings and Emphasize Strategic Implications for Stakeholders in Sweetener Innovation

This executive summary has illuminated the multifaceted landscape of alternative sweeteners, from the evolving consumer drivers that favor clean-label and sugar-reduced formulations to the strategic implications of newly implemented United States import tariffs. The segmentation analysis underscored the diversity of product types, forms, sources, applications, and distribution channels that define a complex ingredient ecosystem. Furthermore, regional insights highlighted the varied regulatory frameworks and growth trajectories across the Americas, Europe, Middle East & Africa, and Asia-Pacific.

Key companies are actively leveraging innovation, partnerships, and digital solutions to stay competitive, while industry leaders are advised to pursue technological advancements alongside strategic alliances and supply chain diversification. Methodological transparency has ensured that these findings rest on a foundation of both qualitative and quantitative research, offering stakeholders a coherent view of prevailing trends and strategic opportunities. In sum, this summary provides a cohesive narrative that equips decision‐makers with the contextual understanding required to navigate the challenges and embrace the potential of the alternative sweetener market.

Take the Next Step and Engage with Ketan Rohom to Unlock In-Depth Alternative Sweetener Market Intelligence and Drive Informed Decisions

To gain access to comprehensive insights into alternative sweetener market trends, cost implications, regulatory landscapes, and competitive strategies, connect with Ketan Rohom, Associate Director of Sales & Marketing. Engaging directly will provide you with tailored guidance that aligns with your organization’s strategic priorities, ensuring that decision-makers have the actionable intelligence needed to stay ahead of emerging sweetener innovations and supply chain complexities. Don’t miss the opportunity to secure your copy of this indispensable research report and leverage expert analysis to unlock growth potential and mitigate market risks.

- How big is the Alternative Sweeteners Market?

- What is the Alternative Sweeteners Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?