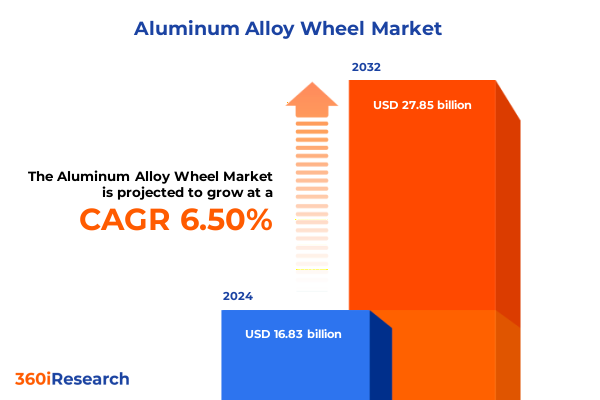

The Aluminum Alloy Wheel Market size was estimated at USD 17.87 billion in 2025 and expected to reach USD 18.99 billion in 2026, at a CAGR of 6.54% to reach USD 27.85 billion by 2032.

Forging Ahead with Aluminum Alloy Wheels Insights Revealing Key Market Dynamics Driving Commercial, Electric, and Passenger Vehicle Innovation

The automotive industry’s relentless pursuit of weight reduction has elevated aluminum alloy wheels as a vital component in contemporary vehicle engineering. Aluminum alloys provide significant weight savings compared to steel wheels, improving fuel efficiency, range, and handling while meeting stringent emissions regulations. Since 2010, average aluminum usage per vehicle in North America rose from 154 kg to 208 kg by 2020, reflecting a broader adoption of lightweight materials in body structures and components.

Within this context, aluminum alloy wheels stand out for their ability to deliver performance, durability, and design flexibility. Advanced casting and forging techniques enable intricate spoke designs and optimized structural integrity, appealing to both OEMs and aftermarket customers. The inherent recyclability of aluminum supports circular economy initiatives, with secondary aluminum recycling consuming only 5 percent of the energy required for primary production, aligning wheel manufacturers with sustainability goals amid global decarbonization efforts.

Looking ahead, market drivers such as electric vehicle proliferation, regulatory emphasis on fuel efficiency standards, and consumer preference for premium aesthetics are expected to intensify demand for aluminum alloy wheels. Stakeholders across the value chain, from smelters to wheel designers, are investing in novel alloys and process innovations. As competitive pressure grows, strategic differentiation through lightweighting, customization, and eco-friendly manufacturing will become paramount for industry players.

Driving Innovation and Sustainability in Aluminum Alloy Wheels How Transformative Shifts Like EV Adoption and Lightweighting Redefine the Competitive Landscape

Electric vehicle proliferation is reshaping aluminum alloy wheel demand and design priorities. Global EV sales exceeded 15 million units in 2023, with Europe seeing over 80 percent of new EVs fitted with alloy wheels to maximize battery range and energy efficiency through weight reduction. OEMs now prioritize flow-forming and forged wheel technologies to meet the rigorous performance and safety specifications for electric drive platforms, driving significant advancements in wheel architecture and production processes.

Beyond electrification, consumer preferences for customization and aesthetic differentiation have triggered a surge in demand for machined, painted, polished, and powder-coated wheel finishes. Personalization trends are influencing wheel diameters and spoke patterns, with oversized rims increasingly popular among SUV and pickup owners seeking both enhanced performance and visual impact. This evolution has spurred collaborations between wheel designers and automakers to integrate bespoke finishes and limited-edition designs into factory options.

Concurrently, sustainability considerations are propelling the adoption of recycled aluminum alloys and innovative joining techniques such as friction stir welding, which reduce energy consumption compared to conventional die-casting and forging. Suppliers are developing high-strength aluminum chemistries that enhance durability while enabling thinner cross-sections and reduced mass. These material and process innovations are fostering a new era of lightweighting where performance, environmental stewardship, and cost efficiency converge.

Navigating the Ripple Effects of 2025 U.S. Aluminum and Steel Tariffs on Alloy Wheel Manufacturers Supply Chains and Cost Structures

On March 12, 2025, the U.S. government imposed a 25 percent tariff on all steel and aluminum imports, including derivative products such as cast wheel components, effectively ending prior exemptions for major trading partners. This action expanded Section 232 measures to encompass previously exempt countries, significantly raising input costs for imported wheel assemblies and raw aluminum billets.

Less than three months later, on June 4, 2025, the tariff rate on aluminum articles was further increased from 25 percent to 50 percent, doubling the duty burden for wheel manufacturers reliant on imported alloys and subassemblies. The proclamation also introduced stricter content reporting requirements and penalties for under-declaration of alloy percentages, creating additional compliance complexities for importers and downstream processors.

These cumulative tariff actions have pressured wheel producers to reevaluate supply chains, spurring reshoring discussions, near-sourcing initiatives in North America, and leveraging exemptions under the U.S.-UK Economic Prosperity Deal for U.K.-origin wheels. This landscape of elevated duties and regulatory oversight is challenging margins, prompting cost-pass-through strategies, renegotiation of long-term contracts, and accelerated investment in domestic casting and forging assets to mitigate tariff exposure.

Decoding Market Segmentation Insights for Aluminum Alloy Wheels Tailoring Strategies Across Vehicle Types Channels Construction Techniques and Finishes

Insights drawn from vehicle type segmentation reveal that passenger cars, ranging from compact hatchbacks to SUVs, drive significant alloy wheel customization, with each body style demanding tailored diameter options and finish aesthetics to match design cues and performance requirements. In electric vehicle programs, OEMs increasingly specify flow-formed and forged wheels to offset battery weight, while in heavy and light commercial applications, durability and load-rating considerations influence the choice of construction technique and finish type.

Distribution channel segmentation underscores the divergent needs of OEM and aftermarket segments: original equipment manufacturers prioritize process consistency, regulatory compliance, and long-term cost efficiencies, whereas aftermarket channels emphasize design variety, rapid production cycles, and premium finish options to cater to enthusiast and replacement markets.

Considering construction techniques, casting methods such as gravity die, high-pressure die, and low-pressure die casting offer cost-effective solutions for high-volume runs, while cold forging, hot forging, and isothermal forging deliver superior strength-to-weight ratios for performance-oriented wheels. Friction stir welding is gaining traction for complex multi-material wheels, blending weight savings with structural integrity.

Wheel diameter segmentation from 14-15 inch compact car applications to 20 inch and above luxury and sport variants highlights the market’s broad spectrum of consumer preferences and performance demands. Pricing tiers-economy for cost-conscious segments, mid-range for mainstream vehicles, and premium for luxury and high-performance models-further refine product positioning. Finish options spanning machined, painted, polished, and powder-coated surfaces complete the segmentation landscape, enabling targeted strategies for each market niche.

This comprehensive research report categorizes the Aluminum Alloy Wheel market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Wheel Diameter

- Construction Technique

- Price Range

- Finish Type

- Vehicle Type

- Distribution Channel

Unveiling Regional Nuances in Aluminum Alloy Wheel Consumption Patterns and Growth Drivers Across Americas EMEA and Asia Pacific Markets

In the Americas, robust light vehicle production hubs in the United States and Mexico are driving alloy wheel demand through a combination of regulatory fuel-efficiency mandates and consumer appetite for premiumized vehicle packages. The region’s mature aftermarket ecosystem also supports rapid adoption of specialty wheel finishes and customization trends, particularly in motorsport and performance segments.

Europe, Middle East & Africa exhibits a nuanced mix of advanced OEM programs and regulatory pressures on emissions, prompting automakers to integrate lightweight wheels into vehicle platforms to meet stringent CAFE and Euro 7 standards. Luxury car markets in Germany, the U.K., and Italy continue to lead in premium wheel adoption, while growth in the Middle East is fueled by high-performance SUVs and aftermarket personalization.

Asia-Pacific remains the largest global production base, with China, Japan, South Korea, and India expanding capacity for both cast and forged wheels. Government incentives for electric and hybrid vehicle programs are accelerating demand for aluminum alloy wheels tailored to EV and hybrid platforms. Regional supply chains are evolving, with tier-1 suppliers investing in digitalization and smart manufacturing to support high-volume production and quality consistency across distributed facilities.

This comprehensive research report examines key regions that drive the evolution of the Aluminum Alloy Wheel market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders in Aluminum Alloy Wheels Examining the Strategies and Innovations of Ronal Maxion BBS and Other Global Players

Ronal Group maintains a leading position in Europe through its extensive network of twelve production sites and strong OEM partnerships with brands such as Mercedes-Benz and Volkswagen. The company’s investment in carbon-neutral wheel solutions, including its R70-blue recycled aluminum line, underscores its commitment to sustainable manufacturing and design innovation.

Iochpe-Maxion, recognized as the largest global wheel manufacturer by volume, leverages a vast manufacturing footprint across the Americas, Europe, and Asia to supply major automakers and commercial vehicle fleets. Its recent introduction of Maxion BIONIC technology addresses the growing demand for affordable, lightweight wheels in light vehicle programs, demonstrating its agility in responding to evolving OEM requirements.

BBS Autotechnik, a pioneer in three-piece forged wheel design, remains influential in the high-performance and luxury segments by marrying motorsport heritage with advanced alloy metallurgy. Its Fortega proprietary aluminum alloy offers enhanced rigidity at reduced weight, catering to the dynamic demands of electric and high-performance platforms.

CITIC Dicastal, the world’s largest aluminum wheel producer, operates over thirty facilities worldwide and continuously advances integrated die-casting solutions. Its focus on digital use cases for high-precision production and lightweight R&D systems positions it at the forefront of mass-customized, high-volume wheel supply for both OEMs and new energy vehicle programs.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aluminum Alloy Wheel market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AEZ GmbH

- ALCAR Holding GmbH

- Alcoa Corporation

- BBS GmbH

- Borbet GmbH

- Central Motor Wheel Co., Ltd.

- CITIC Dicastal Co., Ltd.

- Dotz Wheels

- Enkei Corporation

- Forgeline Motorsports Inc.

- HRE Performance Wheels

- Konig Wheels

- Lizhong Wheel Group Limited

- Mangels Industrial S.A.

- Rays Engineering Co., Ltd.

- Ronal AG

- TSW Alloy Wheels

- Uniwheels AG

- Vossen Wheels

- Wanfeng Auto Wheel Co., Ltd.

- Work Wheels Co., Ltd.

- YHI International Limited

- Zhejiang Jinfei Holding Co., Ltd.

Strategic Roadmap for Aluminum Alloy Wheel Manufacturers Actionable Recommendations to Enhance Competitiveness in a Dynamic Automotive Landscape

Manufacturers should accelerate adoption of advanced forming technologies such as flow-forming, friction stir welding, and isothermal forging to deliver lighter, stronger wheel designs that align with evolving EV and performance requirements. Investing in digital twins and predictive maintenance can optimize throughput and quality while reducing scrap and downtime.

To mitigate tariff exposure and supply disruptions, industry leaders must diversify alloy procurement by developing domestic smelter partnerships and leveraging preferential trade agreements such as the U.S.-UK Economic Prosperity Deal. Establishing regional assembly or finishing centers can further localize value chains and enhance responsiveness to OEM and aftermarket demands.

Embracing sustainability requires integrating high-recycled aluminum content and pursuing carbon-neutral manufacturing certifications. Transparent reporting of lifecycle emissions and supply chain traceability will strengthen relationships with automakers committed to net-zero targets.

Finally, driving differentiation through modular wheel platforms and configurable finish libraries can address the growing consumer demand for personalization. Collaborating closely with OEMs and design studios to co-create signature wheel offerings will secure premium positioning and capture higher margin opportunities.

Rigorous Research Methodology Underpinning the Aluminum Alloy Wheel Market Analysis Combining Primary Interviews Secondary Data and Quantitative Techniques

This analysis integrates primary research comprising in-depth interviews with tier-1 wheel suppliers, OEM purchasing executives, and materials experts, providing firsthand perspectives on technology adoption, cost pressures, and regulatory compliance requirements. Secondary research included a rigorous review of publicly available government proclamations, trade association reports, patent filings, and academic journals to validate market drivers and material innovations.

Quantitative insights were derived from global trade data on aluminum and wheel imports, tariff schedules under Section 232, and vehicle production statistics published by industry bodies. Data triangulation techniques ensured consistency across multiple sources, while scenario modeling assessed the financial impact of tariff escalations and supply chain realignments.

Process methodologies incorporated SWOT and PESTEL frameworks to contextualize industry dynamics, and benchmarking analyses compared leading players across production capacity, technological capabilities, and sustainability initiatives. This multi-faceted approach provides a comprehensive and objective foundation for strategic decision-making in the aluminum alloy wheel sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aluminum Alloy Wheel market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aluminum Alloy Wheel Market, by Wheel Diameter

- Aluminum Alloy Wheel Market, by Construction Technique

- Aluminum Alloy Wheel Market, by Price Range

- Aluminum Alloy Wheel Market, by Finish Type

- Aluminum Alloy Wheel Market, by Vehicle Type

- Aluminum Alloy Wheel Market, by Distribution Channel

- Aluminum Alloy Wheel Market, by Region

- Aluminum Alloy Wheel Market, by Group

- Aluminum Alloy Wheel Market, by Country

- United States Aluminum Alloy Wheel Market

- China Aluminum Alloy Wheel Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Concluding Reflections on Aluminum Alloy Wheel Market Evolution and Strategic Imperatives for Stakeholders in an Era of Disruption

The aluminum alloy wheel market is undergoing profound transformation driven by electrification, sustainability imperatives, and evolving consumer expectations. Lightweight materials and advanced manufacturing processes have elevated wheel design from a mere functional component to a strategic differentiator, enabling OEMs to meet regulatory, performance, and styling objectives.

Tariff escalations throughout 2025 have added complexity to global supply chains, prompting strategic shifts toward localized production and preferential trade partnerships. While these measures present near-term cost challenges, they also catalyze investment in domestic capabilities and supply chain resilience.

Segmentation by vehicle type, distribution channel, construction technique, wheel diameter, price range, and finish demonstrates the market’s diversity, requiring tailored strategies to capture segment-specific opportunities. Regional nuances in the Americas, EMEA, and Asia-Pacific further underscore the importance of agile, localized approaches.

As the competitive landscape converges around technological excellence and sustainability leadership, industry stakeholders must balance innovation with operational discipline. Those who anticipate market shifts, invest in digital and material technologies, and cultivate strategic partnerships will secure long-term success in this dynamic arena.

Engage Directly with Our Associate Director of Sales & Marketing to Unlock Comprehensive Aluminum Alloy Wheel Market Insights

To gain a deeper understanding of emerging opportunities, supply chain strategies, and tariff implications shaping the aluminum alloy wheel market, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, who can provide personalized guidance and secure access to the comprehensive market research report. Ketan’s expertise will help you navigate complex market dynamics, benchmark against industry leaders, and capitalize on segment-specific growth areas. Engage with him today to leverage tailored insights, seamless report delivery, and dedicated support for your strategic decision-making needs.

- How big is the Aluminum Alloy Wheel Market?

- What is the Aluminum Alloy Wheel Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?