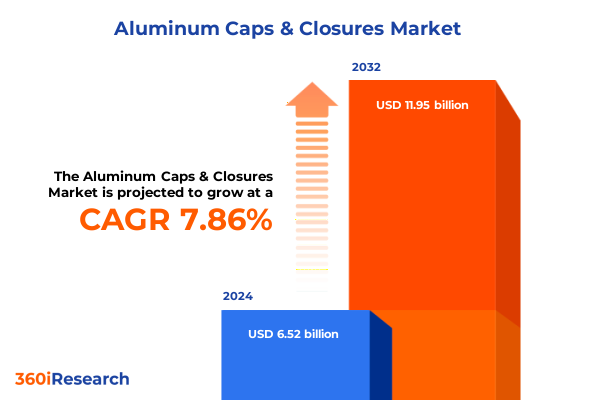

The Aluminum Caps & Closures Market size was estimated at USD 6.93 billion in 2025 and expected to reach USD 7.36 billion in 2026, at a CAGR of 8.10% to reach USD 11.95 billion by 2032.

Exploring the Convergence of Sustainability, Advanced Manufacturing, and Evolving Consumer Demands Transforming the Aluminum Caps and Closures Landscape

Aluminum caps and closures stand at the forefront of packaging innovation, marrying lightweight design with exceptional barrier performance to protect a wide array of products ranging from beverages and foods to pharmaceuticals and personal care formulations. These components have evolved far beyond simple sealants, emerging as critical touchpoints for brand storytelling, security features, and sustainability differentiation. In much the same way that the broader packaging industry has embraced circular economy principles, manufacturers are integrating high percentages of recycled aluminum and pioneering eco-friendly coatings that reduce environmental footprints without compromising functional integrity. This shift has been accelerated by stringent regulations and consumer demand for recyclable materials, prompting a wave of product redesigns and material substitutions that underscore aluminum’s unique recyclability and strength-to-weight advantages.

Navigating the Rapid Technological, Regulatory, and Sustainability Shifts Redefining Aluminum Caps and Closures Across Industries

The aluminum caps and closures sector is experiencing a profound transformation driven by converging technological breakthroughs, tightening regulatory mandates, and rising environmental expectations. Digital direct printing on metal surfaces now enables brands to deploy intricate graphics, QR codes, and traceability markers without secondary labels, creating new avenues for engagement and supply chain transparency. Simultaneously, the advent of smart closures embedded with near-field communication sensors and anti-tampering technologies is reshaping consumer interaction and authenticity verification, with early adopters reporting enhanced shelf differentiation and reduced recall risks.

Moreover, global sustainability frameworks-from Europe’s Directive 2019/904 mandating tethered closures to emerging recycled content incentives in China-are compelling manufacturers to upgrade their designs and processes in alignment with circular economy goals. These initiatives have spurred investments in lightweight alloys, bio-based coatings, and more efficient stamping and extrusion techniques, ensuring that product safety, performance, and environmental compliance advance in lockstep.

Assessing the Full Spectrum of 2025 United States Aluminum Tariffs on Caps and Closures and Their Cascading Effects on Supply Chains

In June 2025, the United States enacted a sweeping increase of import duties on steel and aluminum, raising tariff rates to 50%. While initially targeting raw metal commodities for national security reasons, the ripple effects have swiftly reached specialized packaging components, imposing significant cost pressures on aluminum cap and closure producers and their end-use customers. Beverage can converters and specialty closure manufacturers reliant on imported coil face immediate margin compression, compelling some to explore alternative materials or renegotiate long-term supply contracts.

These tariff escalations have also highlighted the strategic importance of recycled aluminum, which remains exempt from levies and thereby offers a short-term buffer against escalating raw material prices. Companies such as AB InBev have accelerated procurement of post-consumer scrap to mitigate input volatility, although logistical challenges and limited domestic smelting capacity constrain the pace of substitution. Despite these adaptations, smaller manufacturers without established recycling partnerships are reporting supply chain disruptions and delayed production schedules, underscoring the uneven distribution of tariff impacts across the value chain.

Unlocking Deep Market Understanding Through Sophisticated Segmentation of Aluminum Caps and Closures by Type, Industry, Technique, Size, and Channels

Deep segmentation analysis reveals critical pathways for differentiation and growth within the aluminum caps and closures market. Product development teams are tailoring solutions for specialized closure types-ranging from child-resistant and press-on caps to roll-on, screw, and twist-off variants-each designed to meet specific functionality and compliance requirements. At the same time, end use industries are carving out unique value propositions: food and beverage applications demand tamper-evident performance for beer, carbonated and non-carbonated beverages, and juice products, while home care manufacturers are seeking compatibility with detergents, fabric softeners, and surface cleaners. Industrial and chemical clients require robust closures for automotive lubricants, paints and coatings, and specialty chemicals, and personal care and cosmetics brands prioritize aesthetic finishes for hair care, perfume, and skin cream packaging. In parallel, pharmaceutical and healthcare segments impose stringent container-closure integrity testing for injectable, oral liquid, and oral solid formats. Production technique further differentiates market offerings, with extrusion, precision machining, metal injection molding, and stamp forming unlocking varying trade-offs in cost, lead time, and tolerances. Adding another layer, cap sizes from up to 28 millimeters to above 38 millimeters define application fit across neck finishes, while distribution channels-direct sales, traditional distributors, and emerging online platforms-shape go-to-market strategies and customer accessibility.

This comprehensive research report categorizes the Aluminum Caps & Closures market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Closure Type

- Production Technique

- Cap Size

- End Use Industry

- Distribution Channel

Analyzing Regional Dynamics Shaping Aluminum Caps and Closures Adoption Across Americas, Europe Middle East Africa, and Asia Pacific Markets

Regional dynamics continue to exert powerful influences on aluminum caps and closures adoption worldwide. In the Americas, North American beverage producers are rapidly upgrading to lightweight, recyclable caps to align with sustainability pledges and capture premium ready-to-drink market segments. Meanwhile, Latin American manufacturers benefit from proximity to scrap aluminum pools, fostering more competitive recycled feedstock pricing. Across Europe, the Middle East, and Africa, regulatory frameworks such as tethered cap mandates and rising environmental levies are accelerating the shift toward higher-functionality closures, especially in premium spirits and non-alcoholic beverage categories. Sustainability certification schemes in EMEA markets are also guiding procurement decisions, making closed-loop aluminum programs a differentiator for global brands. Asia-Pacific emerges as both a manufacturing hub and a dynamic consumer market, leveraging cost-efficient production bases in Southeast Asia and expanding recycled aluminum capacity in China. Rapid urbanization and rising disposable incomes in markets such as India and Southeast Asia are further driving demand for sophisticated closures in personal care, pharmaceuticals, and high-end beverage applications.

This comprehensive research report examines key regions that drive the evolution of the Aluminum Caps & Closures market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Strategic Competitive Strengths and Innovations Among Leading Global Aluminum Caps and Closures Manufacturers Driving Market Leadership

The competitive terrain of the aluminum caps and closures industry is marked by a blend of global leaders and nimble regional players. Crown Holdings has consistently secured high-volume beverage contracts through fully integrated coil sourcing and automated production lines, while Silgan expanded its specialty closures portfolio by acquiring Weener Packaging and extending into personal care markets. Guala Closures combines technical expertise with design innovation, particularly in child-resistant applications, enabling partnerships with top pharmaceutical firms. Meanwhile, Amcor’s strategic merger with Berry Global has created a comprehensive packaging solutions provider, leveraging USD 650 million in projected synergies across films, dispensing systems, and metal closures. Novelis stands out for its aggressive 3x30 recycled content initiative, setting a benchmark for circular aluminum supply. At the same time, regional specialists across Asia-Pacific and Latin America are capturing second-tier beverage and consumer goods customers through shorter lead times and localized scrap access. This evolving landscape underscores a continued push toward consolidation, vertical integration, and technology-driven differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aluminum Caps & Closures market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ALPLA Werke Alwin Lehner GmbH & Co. KG

- Amcor Limited

- AptarGroup, Inc.

- Ardagh Group S.A.

- BERICAP GmbH & Co. KG

- Berry Global Group, Inc.

- Can-Pack S.A.

- Crown Holdings, Inc.

- Oneplus Packaging Ltd

- Silgan Holdings, Inc.

- United Caps S.A.

Crafting Actionable Strategic Recommendations to Drive Growth, Efficiency, and Sustainable Practices in the Aluminum Caps and Closures Sector

To thrive in this dynamic environment, industry leaders should adopt a multifaceted strategy focused on resilience, innovation, and sustainability. First, establishing strategic recycling partnerships will hedge against tariff-induced input cost volatility while advancing environmental commitments. Second, accelerating the commercialization of smart closures and direct digital printing capabilities can unlock new value streams through enhanced traceability and premium branding. Third, investing in flexible manufacturing platforms-such as programmable stamping presses and modular machining cells-will enable rapid adaptation to evolving neck finish specifications and seasonal demand shifts. Furthermore, forging collaborative R&D alliances with end-use customers and technology providers will expedite the development of next-generation coatings and closure geometries. Lastly, enhancing supply chain visibility through integrated analytics platforms will allow real-time monitoring of raw material sourcing, production performance, and logistics, driving informed decision making and operational agility.

Implementing Robust Research Methodology Practices to Ensure Reliability, Credibility, and Actionability of the Aluminum Caps and Closures Market Insights

The insights presented in this report are the result of a rigorous research methodology blending primary and secondary data collection, providing a robust foundation for strategic recommendations. Our approach began with in-depth interviews and surveys conducted with senior executives at leading aluminum closure manufacturers, converters, and brand owners to capture firsthand perspectives on market drivers, challenges, and innovation priorities. These insights were augmented by site visits and case studies of production facilities, enabling verification of manufacturing techniques, quality control processes, and sustainability initiatives. On the secondary side, comprehensive desk research encompassed analysis of regulatory documents, industry association publications, trade journals, and publicly disclosed financial reports. Data triangulation and validation steps ensured consistency across multiple sources and statistical analyses, while expert reviews provided an additional layer of quality assurance. This blended methodology ensures that the report’s conclusions and recommendations are both actionable and grounded in the latest market realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aluminum Caps & Closures market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aluminum Caps & Closures Market, by Closure Type

- Aluminum Caps & Closures Market, by Production Technique

- Aluminum Caps & Closures Market, by Cap Size

- Aluminum Caps & Closures Market, by End Use Industry

- Aluminum Caps & Closures Market, by Distribution Channel

- Aluminum Caps & Closures Market, by Region

- Aluminum Caps & Closures Market, by Group

- Aluminum Caps & Closures Market, by Country

- United States Aluminum Caps & Closures Market

- China Aluminum Caps & Closures Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Summarizing Key Takeaways and Future Outlook for Aluminum Caps and Closures Amid Evolving Industry Trends and Market Forces

In summary, the aluminum caps and closures market is poised at the intersection of sustainability imperatives, technological advancement, and regulatory evolution. Industry stakeholders face the dual challenge of navigating input cost pressures driven by U.S. tariff increases while capitalizing on the growing demand for recyclable, high-functionality closures. Segmentation analysis highlights clear growth pockets in beverage, personal care, and pharmaceutical applications, with production techniques and distribution channels offering further avenues for differentiation. Regional dynamics underscore the importance of tailored strategies that leverage local cost advantages, regulatory frameworks, and consumer preferences. Competitive analysis reveals a landscape increasingly defined by vertical integration, recycled content commitments, and digital innovation. By synthesizing these insights and implementing the outlined recommendations, companies can secure resilient supply chains, expedite sustainable product development, and maintain a leadership position in this fast-evolving market.

Take the Next Step to Secure Comprehensive Aluminum Caps and Closures Market Intelligence in Partnership with Ketan Rohom for Informed Decision Making

Elevate your strategic decision making with unparalleled insights into the aluminum caps and closures market. Connect with Ketan Rohom to gain access to a comprehensive, expertly curated report that delivers deep analysis of supply chain dynamics, segmentation breakdowns, regional performance, and competitive benchmarking. Leverage this rigorously researched intelligence to refine product development roadmaps, optimize sourcing strategies, and enhance sustainability credentials across your organization. Reach out today to secure your copy and partner with a dedicated Associate Director of Sales & Marketing to unlock customized support and drive measurable impact for your business.

- How big is the Aluminum Caps & Closures Market?

- What is the Aluminum Caps & Closures Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?