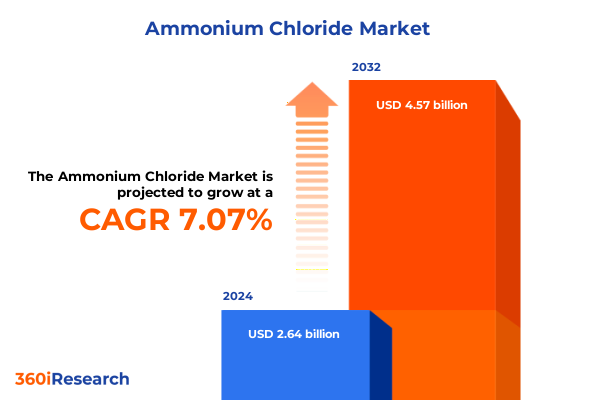

The Ammonium Chloride Market size was estimated at USD 2.81 billion in 2025 and expected to reach USD 3.00 billion in 2026, at a CAGR of 7.14% to reach USD 4.57 billion by 2032.

Unlocking the Strategic Importance and Application Versatility of Ammonium Chloride for Modern Industrial and Life Sciences Use

The unique chemical and physical properties of ammonium chloride have positioned it as an indispensable compound across a wide spectrum of industries. Characterized by high solubility, precise pH buffering capability, and reliable conductivity calibration properties, ammonium chloride underpins critical processes in laboratories, agriculture, pharmaceuticals, and food processing. Its neutral pH profile and compatibility with both aqueous and non-aqueous systems make it a preferred reagent for conductivity calibrants and pH buffers, while its nitrogen content renders it a valuable fertilizer component that supports both foliar and soil applications. In pharmaceutical contexts, it continues to be integral as a cough suppressant and expectorant, reinforcing its role in respiratory care formulations. Transitioning from traditional applications to emerging uses in electronics and battery technology, the compound’s adaptability reflects the ongoing drive toward multifunctional materials in modern production environments.

Moreover, the manufacturing landscape for ammonium chloride is evolving in response to sustainability and regulatory pressures. Producers are increasingly exploring energy-efficient synthesis routes such as electrochemical and membrane-based processes to reduce carbon footprints. Simultaneously, stringent quality control protocols are being reinforced to ensure compliance with food-grade and pharmaceutical-grade standards, especially in regions with rigorous regulatory frameworks. As factors like raw material availability, feedstock pricing, and environmental legislation continue to shape market dynamics, stakeholders must maintain a clear understanding of the compound’s technical attributes and value propositions. This foundational knowledge sets the stage for appreciating the transformative shifts and competitive forces that are redefining the ammonium chloride market on a global scale.

Navigating Supply Chain Evolution and Sustainable Innovations Reshaping the Ammonium Chloride Market Dynamics in Recent Years

The ammonium chloride landscape has undergone a series of transformative shifts driven by global supply chain reconfigurations, intensifying sustainability mandates, and technological breakthroughs. In recent years, supply constraints stemming from geopolitical tensions and trade disruptions have prompted manufacturers to reassess sourcing strategies, leading to localized production and strategic stockpiling. At the same time, the rise of green chemistry has spurred investment in alternative synthesis methods, including electrochemical ammonia production and membrane separation techniques, which promise to lower energy consumption and emissions. These developments underscore a broader industrial pivot toward cleaner process technologies and circular economy principles, reshaping how raw materials are procured, processed, and recycled.

Concurrently, innovation in downstream applications has expanded the role of ammonium chloride beyond traditional sectors. The formulation of specialized reagents with enhanced purity for advanced research facilities, the development of slow-release fertilizer blends to improve nutrient uptake efficiency, and the integration of ammonium chloride in next-generation battery electrolytes all illustrate the compound’s evolving utility. As digital platforms gain traction, distribution models have also transitioned, with online sales channels complementing established direct and specialty store networks. These shifts collectively signal a market in flux, where agility, technological adoption, and sustainability commitments are emerging as critical differentiators for industry participants.

Assessing How New Tariff Policies Have Disrupted North American Ammonium Chloride Supply Chains and Cost Structures in 2025

In 2025, the imposition of new tariff policies on ammonium chloride imports into the United States has led to pronounced ripple effects across value chains. By introducing heightened duties on primary supply nations, these measures have elevated cost structures for downstream users, compelling chemical distributors and end-use industries to explore domestic and alternative international sources. Consequently, domestic producers have enjoyed short-term advantages, yet many are now facing pressure to expand capacity and enhance operational efficiency to absorb the increased demand without inflating prices excessively for agricultural and pharmaceutical customers.

Furthermore, the tariff-induced realignment has catalyzed a rebalancing of trade flows, with import volumes from non-tariffed regions rising sharply and contractual renegotiations becoming commonplace. This realignment has introduced complexity into logistics networks, as firms adapt to extended lead times and diversified supplier portfolios. While some companies have mitigated exposure through strategic agreements and backward integration, others are still grappling with inventory fluctuations and margin compression. Looking ahead, industry leaders will need to monitor policy developments closely and invest in flexible supply chain frameworks to navigate ongoing trade uncertainties and maintain resilience.

Decoding Market Demand through Application Form Grade Distribution Channel and Purity Segmentation Trends for Strategic Positioning

Deep analysis of ammonium chloride segmentation reveals that demand drivers vary substantially by end-use application, reflecting nuanced performance and regulatory considerations. In laboratory settings, analytical reagent demand for conductivity calibrant and pH buffer applications continues to grow in tandem with increased R&D expenditure across biotechnology and environmental monitoring sectors. Simultaneously, agricultural stakeholders are placing greater emphasis on both foliar and soil application fertilizers, seeking formulations that balance rapid nutrient delivery with controlled nutrient release to optimize crop yields while minimizing runoff. The food industry likewise pursues ammonium chloride for its dual role as a flavor enhancer in confectionery and leavening agent in baked goods, aligning with consumer preferences for cleaner label ingredients. Within pharmaceuticals, manufacturers prioritize high-grade cough suppressant and expectorant grades that meet stringent purity and safety thresholds.

Beyond applications, variations in grade classification-such as food, industrial, and pharmaceutical-underscore the importance of compliance and quality assurance. Crystal versus powder forms appeal to different process requirements, with crystals favored for ease of handling in fertilizer blending and powders sought after in precise reagent preparations. Distribution channels exhibit a bifurcated trajectory: offline sales remain critical for high-volume industrial contracts facilitated through direct sales, specialty stores, and supermarkets, whereas digital commerce platforms and company websites are rapidly gaining traction among smaller consumers and niche markets. Lastly, purity tiers ranging from below 99 percent to above 99.9 percent dictate suitability across critical operations, with premium segments commanding higher margins but necessitating rigorous process controls. These intersecting segmentation dynamics provide a roadmap for stakeholders to tailor product portfolios, align pricing strategies, and forge targeted marketing initiatives.

This comprehensive research report categorizes the Ammonium Chloride market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Grade

- Purity

- Application

- Distribution Channel

Analyzing Regional Market Drivers and Growth Catalysts across the Americas EMEA and Asia Pacific Ammonium Chloride Sectors

Regional analysis of the ammonium chloride market reveals distinctive growth patterns and strategic considerations across the Americas, Europe Middle East & Africa, and Asia-Pacific regions. In the Americas, strong agricultural demand for nitrogenous fertilizers continues to underpin market expansion, particularly in large-scale farming areas of the United States and Brazil. Concurrently, growth in pharmaceutical manufacturing hubs in North America has driven demand for high-purity grades, fostering investments in domestic production. Logistics networks across the region are also adapting to tariff-driven supply realignments by enhancing storage capacity and establishing distribution hubs closer to end-markets.

Meanwhile, the Europe Middle East & Africa corridor displays a complex mosaic of regulatory environments and consumption profiles. Western Europe’s stringent chemical safety regulations and environmental mandates have accelerated adoption of eco-friendly production practices, while Eastern European agricultural markets rely heavily on cost-effective industrial grades for large-scale soil applications. In Africa and the Middle East, infrastructure development projects and expanding food processing industries are generating new pockets of demand, encouraging strategic partnerships and greenfield investments.

In the Asia-Pacific region, two dominant trends stand out: the concentration of production capacity in major manufacturing centers of China and India, and the rapid growth in domestic consumption driven by industrialization and population support needs. Producers in this region are leveraging low-cost feedstocks and rising economies of scale to serve both internal and export markets. Additionally, increasing regulatory focus on product safety and environmental impact is pushing regional players to upgrade facilities and secure international certifications, further enhancing competitiveness on the global stage.

This comprehensive research report examines key regions that drive the evolution of the Ammonium Chloride market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Ammonium Chloride Producers Strategic Initiatives and Competitive Positioning in a Fragmented Global Marketplace

A handful of key companies command significant influence within the global ammonium chloride market, shaping competitive dynamics through strategic investments and innovation. Leading European specialty chemicals producers have fortified their positions by expanding capacity at advanced manufacturing facilities and integrating automated quality control systems to ensure consistent grade certifications. At the same time, major Chinese and Indian players are capitalizing on cost efficiencies, investing in large-scale plants that leverage low-cost energy and feedstock sources while pursuing international quality accreditations to access export markets.

Meanwhile, several multinational distributors have strengthened their market coverage by forging alliances with regional producers to optimize supply reliability and logistics performance. These partnerships frequently include joint R&D initiatives aimed at developing value-added formulations, such as slow-release fertilizers and high-stability reagent blends, designed to meet evolving customer requirements. Collectively, these strategic maneuvers by key industry participants underscore an environment of competitive collaboration, where capacity expansions, sustainability programs, and product portfolio diversification serve as primary vectors for growth and differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ammonium Chloride market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Apollo Fertilizer

- BASF SE

- Central Glass Co., Ltd

- Chemcon Speciality Chemicals Limited

- Chongqing Jieniuhua Chemical Group Co., Ltd.

- Dallas Group

- Gansu Jinchuan Hengxin Polymer Technology Co., Ltd.

- Henan Tianfu Chemical Co., Ltd.

- Honeywell International Inc.

- Hubei Yihua Chemical Industry Co Ltd

- Jost Chemical Co., Inc.

- Merck KGaA

- Noah Chemicals, INC.

- Nutrien Ltd.

- Shanxi Yangmei Fengxi Fertilizer Industry Co., Ltd.

- Sumitomo Chemical Company, Limited

- Sunglow Agrichem Pte Ltd.

- Tianjin Bohua YongLi Chemical

- Tinco Chemicals Private Limited

- Tokyo Chemical Industry Co., Ltd.

- Tuticorin Alkali Chemicals And Fertilizers Limited

- Vinipul Inorganics Pvt. Ltd

- Zaclon LLC

Strategic Imperatives for Market Participants to Optimize Production Distribution and Innovation in the Ammonium Chloride Industry

To effectively navigate the complex forces shaping the ammonium chloride industry, market participants should prioritize investments in high-purity production capabilities and process intensification technologies. By enhancing crystallization and purification systems, companies can address the growing demand for premium reagent and pharmaceutical grades while commanding superior margins. Similarly, adopting advanced membrane separation or catalytic ammonia electrolysis can reduce energy intensity and greenhouse gas emissions, aligning manufacturing operations with emerging environmental regulations.

In parallel, firms should cultivate diversified supply chains by establishing strategic alliances across tariff-free regions and reinforcing backup sourcing agreements to mitigate trade policy volatility. Strengthening digital sales platforms will further enable direct engagement with end users, particularly in the food additive and specialty reagent segments where smaller order sizes and rapid delivery are critical. Additionally, focusing R&D efforts on value-added product innovations-such as encapsulated fertilizers and stabilized buffer blends-can unlock new applications and drive incremental revenue streams. Ultimately, by balancing efficiency gains with portfolio differentiation and supply chain resilience, industry leaders can secure long-term competitive advantage in a dynamic market landscape.

Comprehensive Research Framework and Data Validation Approach Underpinning the Ammonium Chloride Market Analysis and Insights

This analysis synthesizes a multi-phased research methodology combining extensive secondary and primary data collection to ensure a holistic understanding of the ammonium chloride market. Initially, publicly available sources-including regulatory filings, technical white papers, and industry journals-were reviewed to map the global supply chain, identify key stakeholders, and track recent technological developments. Subsequently, structured interviews were conducted with senior executives, procurement managers, and technical specialists across production, distribution, and end-use segments to validate secondary findings and uncover on-the-ground insights regarding emerging trends, cost pressures, and regulatory impacts.

To triangulate data accuracy, a bottom-up approach was employed, aggregating plant-level capacity and regional consumption figures, then cross-referencing these with trade statistics and customs databases. Segmentation analysis was refined through iterative workshops with subject matter experts, ensuring alignment with practical considerations and market definitions. Rigorous data quality checks, including outlier analysis and source reliability weighting, were implemented throughout to deliver robust, actionable insights. This comprehensive methodological framework underpins the credibility of the findings and supports strategic decision-making by stakeholders across the ammonium chloride ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ammonium Chloride market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ammonium Chloride Market, by Form

- Ammonium Chloride Market, by Grade

- Ammonium Chloride Market, by Purity

- Ammonium Chloride Market, by Application

- Ammonium Chloride Market, by Distribution Channel

- Ammonium Chloride Market, by Region

- Ammonium Chloride Market, by Group

- Ammonium Chloride Market, by Country

- United States Ammonium Chloride Market

- China Ammonium Chloride Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesis of Transformational Trends Tariff Impacts and Strategic Opportunities Defining the Future of the Ammonium Chloride Market

Through the convergence of evolving supply chain paradigms, sustainability imperatives, and dynamic application requirements, the ammonium chloride market stands at a pivotal juncture. The introduction of new tariff structures in North America has underscored the importance of supply diversification and policy-sensitive planning, while the rise of high-purity reagent and pharmaceutical grades highlights growing opportunities beyond traditional fertilizer use. Concurrently, ongoing segmentation trends-spanning application, grade, form, distribution channels, and purity tiers-offer finely grained levers for stakeholders to tailor their strategies, optimize product offerings, and align with targeted customer needs.

Regional disparities in demand drivers and regulatory landscapes further emphasize the necessity of localized approaches, whether that entails capacity expansions in Asia-Pacific, sustainability collaborations in Europe Middle East & Africa, or logistical enhancements in the Americas. Within this context, leading companies are already leveraging strategic partnerships, process innovations, and digital channels to solidify their competitive positions. By synthesizing these transformational trends and aligning actionable recommendations with robust market intelligence, organizations can chart a clear path toward sustainable growth and resilience in a rapidly shifting industrial environment.

Engage with Ketan Rohom to Access the Comprehensive Ammonium Chloride Market Research Report and Drive Informed Strategic Decisions Today

Seize the opportunity to enhance your strategic planning with an in-depth, specialized analysis of the ammonium chloride market developed by our expert research team. By acquiring this comprehensive report, you will gain access to granular insights into supply chain dynamics, tariff impacts, evolving application landscapes, and regional growth catalysts. With actionable intelligence at your fingertips, you can proactively address emerging challenges, optimize product portfolios, and refine distribution strategies to secure a competitive advantage. Connect directly with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, to explore tailored packages, discuss detailed findings, and initiate a collaboration that will empower your organization to make informed, data-driven decisions. Reach out to Ketan Rohom today to purchase the full market research report and embark on a path to sustainable growth and market leadership

- How big is the Ammonium Chloride Market?

- What is the Ammonium Chloride Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?