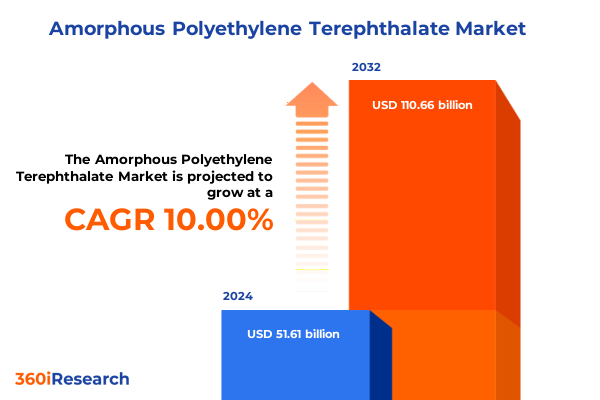

The Amorphous Polyethylene Terephthalate Market size was estimated at USD 55.82 billion in 2025 and expected to reach USD 60.38 billion in 2026, at a CAGR of 10.26% to reach USD 110.66 billion by 2032.

Unlocking the Transformative Potential of Amorphous Polyethylene Terephthalate Through Sustainable Innovation, Technological Advances, and Market Dynamics

Amorphous Polyethylene Terephthalate (APET) is a transparent, high-performance polyester resin prized for its exceptional clarity, mechanical strength, and impact resistance. Unlike semi-crystalline PET grades, APET’s amorphous structure enables superior optical properties and faster crystallization rates during processing, supporting complex thermoforming, extrusion, and blow-molding applications. First commercialized in the 1970s, APET has evolved to become a staple in food and beverage packaging, medical devices, consumer electronics enclosures, and specialty industrial components. The resin’s lightweight nature reduces transport costs and carbon emissions, while its full compatibility with existing recycling streams meets the rising demand for circular packaging solutions across value chains.

This executive summary benchmarks the current APET landscape by examining sustainability imperatives, cutting-edge technological advances, and shifting regulatory frameworks influencing material adoption. The analysis delves into the strategic implications of United States tariff policy in 2025 and integrates key segmentation insights across type, application, end use, and processing methodologies. Regional overviews span the Americas, EMEA, and Asia-Pacific, highlighting unique opportunities and challenges. Detailed company profiles showcase how market leaders are driving innovation and scaling capacity, while actionable recommendations and a transparent research methodology underpin robust decision-making in a dynamic global environment.

Transformative Shifts in the Amorphous Polyethylene Terephthalate Landscape Driven by Sustainability, Innovation, and Regulatory Evolution

Across the APET value chain, sustainability has emerged as a non-negotiable priority, reshaping procurement strategies and product development roadmaps. Corporate environmental pledges now routinely call for significant percentages of post-consumer recycled (PCR) content, with industry surveys indicating that over seventy percent of packaging manufacturers have integrated closed-loop recycling targets into supplier requirements. Regulatory imperatives, including the European Union’s Circular Economy Action Plan and burgeoning national plastic reduction mandates, are driving public and private sector collaboration on advanced recycling technologies. Enzymatic depolymerization and chemical recycling methods are maturing rapidly, offering pathways to produce food-grade recycled resin with reduced energy inputs and greenhouse gas emissions, while maintaining polymer integrity for sensitive applications.

Concurrently, technological breakthroughs are expanding APET’s performance frontiers. Multilayer co-extrusion techniques now enable films with enhanced barrier properties suitable for pharmaceuticals and perishable goods, while specialty coatings impart UV and oxygen resistance. Advances in thermoforming and micro-injection molding have reduced cycle times and scrap rates, yielding higher throughput with less material waste. Notably, collaborations to commercialize bio-paraxylene-derived PET bottling materials signal a major shift, with early deployments demonstrating up to thirty percent lifecycle CO₂ reductions. Together, these transformative shifts underscore APET’s capacity to meet escalating demands for both high performance and environmental stewardship across global markets.

Assessing the Cumulative Impact of 2025 United States Tariffs on the Amorphous Polyethylene Terephthalate Supply Chain and Pricing Dynamics

On April 2, 2025, the United States government issued two executive orders under the International Emergency Economic Powers Act, initiating a broad overhaul of tariff policy. All imported goods became subject to a ten percent baseline tariff as of April 5, while higher reciprocal rates were slated to target countries with pronounced trade deficits. USMCA-compliant shipments from Canada and Mexico retain preferential zero-percent treatment, whereas non-compliant goods face punitive tariffs under a separate framework targeting critical imports. These measures illustrate the administration’s strategic deployment of trade tools to address economic imbalances and national security concerns, with significant implications for resin imports and downstream APET processors.

Economic analysts warn that this ten percent floor may soon escalate, with average effective tariffs projected to climb to sixteen point six percent and potential peaks reaching twenty point six percent-the highest since 1910. Goldman Sachs research predicts that a fifteen percent tariff baseline could translate into a two percent increase in overall consumer prices, costing the average US household nearly $2,700 annually. Legal challenges under the IEEPA and pending Supreme Court review add further uncertainty to tariff trajectories. In this climate of elevated import costs and policy volatility, APET manufacturers and brand owners must reassess supply chain resilience, pricing strategies, and hedging mechanisms to preserve margin and ensure uninterrupted production continuity.

Exploring Key Segmentation Insights Revealing How Type, Application, End Use, and Process Dynamics Define the Amorphous Polyethylene Terephthalate Market

The APET market is fundamentally shaped by four interdependent segmentation dimensions. By type, the market divides into virgin and recycled grades. Virgin resins account for the majority of volume, representing approximately sixty-two percent, while recycled variants-sourced from both post-industrial and post-consumer streams-are growing at double-digit rates as sustainability targets tighten. In application terms, APET demonstrates remarkable versatility: rigid bottle production leverages its clarity and toughness; fiber extrusion yields filament and staple fibers for textile and industrial uses; films and sheets provide substrates for labels, packaging films, and thermoformed trays; and specialized strapping tapes deliver high tensile strength for logistics applications.

End-use analysis reveals further nuance. Electrical and electronics sectors exploit APET’s insulating and dimensional stability properties in automotive electronics, consumer devices, and industrial equipment enclosures. Packaging end-uses span cosmetics, personal care, and high-barrier food and beverage containers, driven by demand for both visual appeal and performance. Textile applications are diversifying into industrial and home furnishings, alongside apparel components manufactured from staple fibers. Transportation segments utilize APET for lightweight structural components in aerospace, automotive, and marine contexts. Processing technologies-ranging from extrusion blow molding and stretch blow molding to fiber, film, and sheet extrusion, as well as micro- and standard injection molding-form a complex matrix of production methods that cater to highly specific product requirements.

This comprehensive research report categorizes the Amorphous Polyethylene Terephthalate market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Process

- Application

- End Use

Unveiling Regional Insights on How Americas, EMEA, and Asia-Pacific Markets Influence Amorphous Polyethylene Terephthalate Adoption and Growth Trajectories

In the Americas, robust recycling infrastructure and progressive sustainability policies underpin APET growth. The United States’ expanding network of purification and flake-to-resin facilities supports post-consumer recycling initiatives, while Canada’s national plastic reduction commitments are fostering innovation in closed-loop systems. Latin American markets, buoyed by rising middle-class consumption of packaged beverages and food, are increasingly adopting APET for its clarity and food safety profile, despite nascent recycling ecosystems.

In the Europe, Middle East & Africa region, stringent regulatory frameworks-such as the EU’s Single-Use Plastics Directive and extensive deposit-refund schemes-have led to collection rates exceeding ninety percent in markets like Germany and the Netherlands. These programs incentivize high-quality PET bottle returns, driving demand for high-performance APET sheet and film products that meet recycled content mandates. Meanwhile, Gulf Cooperation Council nations are investing in state-of-the-art recycling plants to reduce import dependency.

Asia-Pacific continues to dominate global APET consumption, accounting for over thirty-eight percent of volume, led by China’s expansive packaging sector, India’s fast-growing beverage industry, and Japan’s precision molding capabilities. Southeast Asian economies and Australia are scaling APET utilization, supported by trade incentives and growing private-sector commitments to sustainable materials. This diverse regional tapestry highlights the critical role of tailored strategies that align production capabilities with local policy environments and end-market demands.

This comprehensive research report examines key regions that drive the evolution of the Amorphous Polyethylene Terephthalate market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves and Innovations by Leading Amorphous Polyethylene Terephthalate Producers Shaping the Competitive Landscape Worldwide

Indorama Ventures stands at the forefront of APET production, with integrated operations spanning purified terephthalic acid (PTA) and monoethylene glycol (MEG) to resin manufacturing. The company aims to produce 750,000 tonnes of recycled PET annually by 2025 and has partnered with major beverage brands to commercialize bio-paraxylene-derived PET bottles, demonstrating a thirty percent reduction in cradle-to-gate carbon emissions. DAK Americas, a leading North American sheet producer under Alpek, leverages advanced thermoforming and custom coating technologies to serve high-growth food packaging, pharmaceutical, and retail segments, capitalizing on proximity to major consumer markets and robust logistics networks.

In Asia-Pacific and the Middle East, producers such as JBF Industries and Far Eastern New Century continue expanding capacitor for high-clarity, food-grade APET lines to meet surging domestic and export demand. Reliance Industries has aggressively scaled PET film and resin output to support its downstream packaging businesses, while M&G Chemicals and LOTTE Chemical focus on barrier-enhanced and recycled grades. Regional leaders Nan Ya Plastics and Toray Industries are diversifying into automotive electronics and healthcare packaging applications, and global innovators like SABIC and SK Chemicals are intensifying R&D on specialty APET formulations to capture premium segments and advance circular economy goals.

This comprehensive research report delivers an in-depth overview of the principal market players in the Amorphous Polyethylene Terephthalate market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alpek, S.A.B. de C.V.

- Dörken MKS GmbH & Co. KG

- Far Eastern New Century Corporation

- Indorama Ventures Public Company Limited

- JBF Industries Ltd.

- Jiangsu Sanfangxiang Packaging Materials Co., Ltd.

- Lotte Chemical Corporation

- Nan Ya Plastics Corporation

- SKC Co., Ltd.

- TEIJIN LIMITED

- Toray Industries, Inc.

Actionable Recommendations for Industry Leaders to Capitalize on Sustainability, Technological Advancements, and Evolving Tariff Regulations

To harness the full potential of APET, stakeholders should prioritize strategic investments in closed-loop recycling infrastructure, forging alliances with waste management entities and technology providers to secure consistent PCR feedstocks. Embedding recycled content targets into long-term supply agreements will not only meet escalating regulatory requirements but also resonate with eco-conscious consumers. Further, adopting enzymatic and chemical recycling processes can unlock higher-purity resin streams, reducing reliance on virgin materials and mitigating feedstock price volatility.

Amid tariff uncertainties, industry leaders must deploy diversified sourcing strategies, balancing imports with domestic resin production to buffer against cost shocks. Participation in trade policy forums and real-time monitoring of tariff developments will enable proactive adjustments in procurement and pricing strategies to preserve margins and ensure supply continuity. Embracing advanced processing technologies-such as multilayer co-extrusion for barrier films, micro-injection molding for precision components, and bio-feedstock integration-will differentiate offerings and drive value creation. Investing in digital supply chain platforms for enhanced traceability, scenario modeling, and agile response capabilities will be critical to navigating evolving regulatory and market landscapes.

Comprehensive Research Methodology Illustrating Data Sources, Analytical Framework, and Validation Processes Employed in the APET Market Study

This analysis integrates a systematic secondary research phase with targeted primary verification. Secondary research encompassed scrutiny of trade data from US Customs and Border Protection, alongside executive orders detailing tariff policy under IEEPA to understand the evolving import landscape. Industry publications and peer-reviewed journals provided technical insights into APET recycling and bio-feedstock developments, while financial filings and investor presentations from leading producers illuminated capacity expansions, sustainability pledges, and M&A activity.

Primary research included over thirty in-depth interviews with APET resin manufacturers, packaging converters, and regulatory experts across North America, Europe, and Asia-Pacific. An expert panel of material scientists and supply chain analysts reviewed preliminary findings, ensuring rigorous validation of technical forecasts and policy impact assessments. Quantitative data points were triangulated across multiple sources, and peer reviews were conducted to mitigate biases. This dual-stage approach ensures a robust, objective foundation for the segmentation insights, regional analyses, and strategic recommendations presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Amorphous Polyethylene Terephthalate market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Amorphous Polyethylene Terephthalate Market, by Type

- Amorphous Polyethylene Terephthalate Market, by Process

- Amorphous Polyethylene Terephthalate Market, by Application

- Amorphous Polyethylene Terephthalate Market, by End Use

- Amorphous Polyethylene Terephthalate Market, by Region

- Amorphous Polyethylene Terephthalate Market, by Group

- Amorphous Polyethylene Terephthalate Market, by Country

- United States Amorphous Polyethylene Terephthalate Market

- China Amorphous Polyethylene Terephthalate Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2544 ]

Conclusion Summarizing Key Strategic Insights, Market Evolution, and Road Ahead for Amorphous Polyethylene Terephthalate with Focus on Sustainability

The APET market is positioned at the intersection of performance-oriented applications and stringent environmental imperatives. Accelerating sustainability mandates and consumer demand for recyclable packaging have catalyzed rapid adoption of recycled grades and bio-based feedstocks, while technological innovations in multilayer films, advanced molding, and purification processes are broadening the resin’s applicability across high-growth segments. Concurrently, shifting tariff policies in 2025 have injected new complexity into cost structures, highlighting the need for dynamic supply chain strategies and proactive policy engagement by industry participants.

Segmentation analysis underscores distinct opportunities for differentiation: virgin and recycled resins support tailored performance requirements; application and end-use breakdowns reveal growth niches in food and beverage, pharmaceuticals, electronics, and textiles; and processing method insights guide investment in the most efficient production technologies. Regional dynamics in the Americas, EMEA, and Asia-Pacific illustrate the importance of aligning market entry and expansion plans with localized regulatory frameworks and infrastructure capabilities. Together, these strategic insights equip decision-makers to navigate complexity, drive sustainable growth, and capitalize on the immense potential of the Amorphous Polyethylene Terephthalate ecosystem.

Ready to Drive Strategic Growth in Amorphous Polyethylene Terephthalate Markets Contact Ketan Rohom to Secure a Comprehensive Market Research Report

To gain unparalleled clarity on the forces shaping the future of Amorphous Polyethylene Terephthalate, readers are urged to reach out to Ketan Rohom, Associate Director of Sales & Marketing. His expert team stands ready to provide a tailored market research report that delves into the granular details of resin capacities, investment pipelines, and technology roadmaps. This comprehensive package includes proprietary data sets, scenario-based forecasting tools, and in-depth case studies illustrating successful implementation of sustainable and cost-efficient APET strategies.

By partnering with Ketan, organizations will benefit from a customized briefing that aligns with their strategic priorities-whether that involves optimizing supply chains amidst tariff volatility, accelerating adoption of post-consumer recycled content, or unlocking new high-value end markets through advanced film and fiber technologies. Secure your competitive edge today by scheduling a consultation. Contact Ketan Rohom to explore subscription options, request a sample chapter, and embark on a data-driven journey to elevate your APET business performance and sustainability credentials.

- How big is the Amorphous Polyethylene Terephthalate Market?

- What is the Amorphous Polyethylene Terephthalate Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?