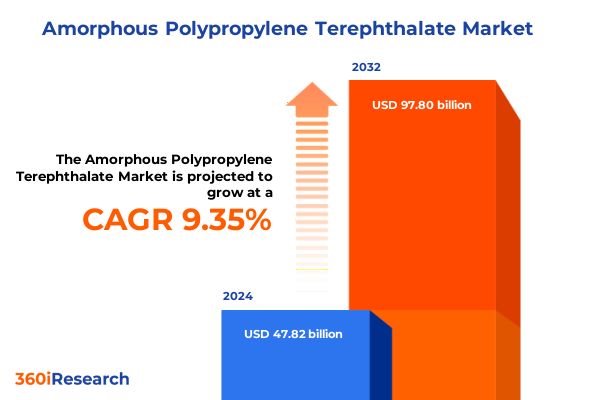

The Amorphous Polypropylene Terephthalate Market size was estimated at USD 52.31 billion in 2025 and expected to reach USD 57.22 billion in 2026, at a CAGR of 9.50% to reach USD 98.80 billion by 2032.

Exploring the Growing Role of Amorphous Polypropylene Terephthalate as a Key Enabler of Modern Material Innovations and Design Flexibility

Amorphous Polypropylene Terephthalate (APPT) has emerged as a pivotal material in contemporary manufacturing, offering a balance of transparency, mechanical resilience, and chemical resistance. Its distinct molecular arrangement, devoid of crystalline regions, enables superior clarity and surface finish, positioning it favorably among polymers designed for aesthetic and functional applications. In recent years, evolving material demands across industries such as packaging, medical devices, and consumer electronics have underscored the value of APPT’s unique properties. As stakeholders prioritize lightweight, recyclable, and high-performance alternatives, this polymer’s role has expanded from niche applications to mainstream adoption.

Against this backdrop, the purpose of this executive summary is to provide a concise yet comprehensive overview of key market dynamics, transformative trends, and strategic considerations shaping the APPT landscape. By examining regulatory influences, segmentation insights, regional variations, and competitive strategies, readers will gain a structured understanding of current conditions and future trajectories. Ultimately, this document serves as an essential guide for decision-makers seeking to harness the full potential of APPT in product innovation, operational efficiency, and sustainable growth.

Unveiling the Major Technological and Market Shifts Redefining Amorphous Polypropylene Terephthalate Applications and Competitive Dynamics

The landscape of Amorphous Polypropylene Terephthalate has undergone profound transformation driven by technological breakthroughs and shifting market demands. Advances in polymerization techniques have enhanced molecular uniformity, enabling manufacturers to deliver materials with tighter tolerances and more consistent optical properties. Concurrently, the integration of digital printing and co-extrusion processes has opened new avenues for customization, allowing brands to differentiate products with intricate graphics directly on polymer substrates. These innovations have not only elevated APPT’s performance but also expanded its applicability across sectors requiring precise visual and dimensional standards.

Moreover, sustainability considerations continue to reshape competitive dynamics. The emergence of solvent-free recycling methods and chemical depolymerization technologies has improved closed-loop recovery of APPT, signaling a shift toward circular business models. As regulatory frameworks tighten on single-use plastics, producers have responded by formulating high-recycled-content grades without compromising clarity or mechanical strength. This evolution reflects a broader industry move toward eco-efficient manufacturing, where material selection aligns with corporate sustainability goals and consumer expectations for responsible packaging.

Overall, these transformative shifts highlight an ecosystem in flux, characterized by collaborative innovation between material scientists, equipment suppliers, and end users. As the market adapts, stakeholders who capitalize on emerging processing techniques and circular initiatives will define the next chapter of APPT growth.

Assessing the Ripple Effects of 2025 United States Trade Tariffs on the Supply Chain Dynamics and Cost Structures of Amorphous Polypropylene Terephthalate

The implementation of new tariff measures by the United States in early 2025 has introduced notable pressures on the Amorphous Polypropylene Terephthalate value chain. By increasing duties on specific polymer imports, policymakers have aimed to protect domestic producers, yet these actions have reverberated across sourcing and pricing structures. Suppliers reliant on overseas feedstocks have faced elevated input costs, prompting a reassessment of procurement strategies and supplier partnerships. In some cases, companies have accelerated the qualification of local resin alternatives to mitigate exposure to trade-induced fluctuations.

These trade adjustments have also influenced supply chain resilience initiatives. Manufacturers with geographically diversified production footprints have managed to offset cost increases by reallocating volumes between plants and leveraging regional trade agreements in the Americas. At the same time, end users engaged in global sourcing have intensified negotiations to secure fixed-price contracts or volume discounts, thereby stabilizing their raw material budgets. Beyond cost management, the tariff landscape has spurred conversations around near-shoring, with several organizations evaluating investments in domestic capacity enhancements or joint ventures to ensure long-term supply security.

Looking ahead, the cumulative impact of these measures underscores the importance of agile supply chain governance. Companies that incorporate tariff scenario planning into their strategic roadmaps and develop contingency frameworks will be best positioned to preserve margin integrity while sustaining market responsiveness in an evolving trade environment.

Decoding the Multifaceted Segmentation Landscape of Amorphous Polypropylene Terephthalate and Its Implications for Diverse End Use and Manufacturing Strategies

A nuanced understanding of market segmentation reveals differentiated value pools within the Amorphous Polypropylene Terephthalate landscape, driven by application, end use industry, polymer type, processing method, and material grade. In applications, the requirements for bottles, films, and sheets diverge significantly: while bottles demand formability and barrier performance, films prioritize optical clarity and printability, and sheets emphasize rigidity and dimensional consistency for thermoforming operations. These distinctions shape the development of tailored resin formulations and additive systems that address each application’s specific performance criteria.

Turning to end use industries, demand patterns for automotive, electrical and electronics, medical, and packaging segments reflect unique performance and regulatory standards. The automotive sector seeks materials that withstand high temperatures and chemicals, while the electronics industry values flame retardancy and dielectric properties. Medical applications mandate rigorous biocompatibility and sterilization resilience, and packaging continues to focus on consumer safety and recyclability. Within each vertical, downstream converters collaborate closely with resin producers to co-engineer solutions that balance functionality with cost efficiency.

The dichotomy between recycled and virgin polymer types has grown more pronounced as sustainability imperatives intensify. Recycled APPT grades now nearly match the clarity and mechanical benchmarks of virgin materials through advanced purification methods, widening their adoption across applications. In processing, blow molding, extrusion, injection molding, and thermoforming each impose distinct melt flow and heat distortion requirements, prompting equipment calibrations and resin customizations. Finally, material grade variations-including high clarity, high molecular weight, specialty, and standard-enable precise tuning of properties such as toughness, gloss, and thermal stability. Collectively, these segmentation insights inform strategic decisions on product portfolios, process investments, and go-to-market positioning.

This comprehensive research report categorizes the Amorphous Polypropylene Terephthalate market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Manufacturing Process

- Grade

- Application

- End Use Industry

Mapping Regional Trends and Demand Drivers Shaping the Growth Trajectory of Amorphous Polypropylene Terephthalate Across Global Markets

Regional dynamics play a pivotal role in shaping the Amorphous Polypropylene Terephthalate ecosystem, with each geography presenting distinct demand drivers and regulatory frameworks. In the Americas, consumer preferences for sustainable packaging and increasing regulatory support for plastic recycling have fueled demand for recycled APPT. North American manufacturers leverage robust logistic networks and proximity to feedstock sources to optimize production costs, while innovation hubs in the United States and Canada spearhead high-performance specialty formulations.

Across Europe, the Middle East, and Africa, stringent environmental directives and the European Green Deal have accelerated circular economy initiatives. Stakeholders in this region prioritize chemical recycling technologies and advanced deposit-return systems that bolster APPT’s value proposition in packaging and medical devices. Meanwhile, the Middle East’s growing petrochemical infrastructure continues to expand resin production capacities, enhancing export potential into neighboring markets.

In the Asia-Pacific region, rapid urbanization and rising consumer spending underpin a surge in demand for premium packaging and electronic components. Manufacturers in China, South Korea, and Southeast Asia are expanding APPT output, driven by investments in compounding and film-casting facilities. Notably, collaboration between local resin producers and global equipment suppliers has cultivated integrated manufacturing clusters that reduce lead times and foster product innovation. By recognizing these regional nuances, industry participants can tailor strategies to address localized opportunities while ensuring global coherence in product development and supply chain management.

This comprehensive research report examines key regions that drive the evolution of the Amorphous Polypropylene Terephthalate market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the Strategic Initiatives and Competitive Positioning of Leading Players Driving Innovation in the Amorphous Polypropylene Terephthalate Industry

Leading actors in the Amorphous Polypropylene Terephthalate market demonstrate a diverse array of strategic initiatives aimed at strengthening their competitive stance and fostering innovation. One prominent producer has prioritized the expansion of circular product lines, aligning with sustainability mandates by incorporating advanced depolymerization capabilities into its operations. This approach not only secures feedstock flexibility but also underscores a commitment to closed-loop resource management.

Another multinational conglomerate has focused on collaborative research partnerships to advance next-generation APPT grades optimized for digital printing and high barrier applications. By co-developing solutions with equipment manufacturers and end users in the medical and electronics sectors, this player accelerates time-to-market while tailoring offerings to precise performance specifications. Similarly, regional specialty resin suppliers have adopted modular production platforms, enabling rapid grade modifications that cater to emerging application niches without the need for extensive capital investments.

Furthermore, a leading research-oriented company has launched a suite of comprehensive customer support services, including application laboratories and technical training modules. These services facilitate on-site troubleshooting and process optimization, enhancing overall customer experience and strengthening long-term partnerships. Collectively, these strategic moves illustrate how market frontrunners leverage innovation ecosystems, strategic alliances, and service excellence to maintain leadership in a rapidly evolving APPT landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Amorphous Polypropylene Terephthalate market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alpek S.A.B. de C.V.

- AVI Global Plast

- Equipolymers S.R.L.

- Far Eastern New Century Corporation

- Indorama Ventures Public Company Limited

- JBF Industries Ltd.

- LOTTE Chemical Corporation

- MPI Polyester Industries

- NAN YA Plastics Industrial Co., Ltd.

- Neo Group

- Plastiverd, Pet Reciclado SA

- Polisan Holding

- PolyQuest, Inc.

- Reliance Industries Limited

- Shahid Tondgooyan Petrochemical Company

- Sinopec Yizheng Chemical Fibre Limited Liability Company

- Teijin Limited

Strategic Roadmap for Industry Leaders to Capitalize on Emerging Opportunities and Mitigate Risks in the Amorphous Polypropylene Terephthalate Sector

To maintain a competitive advantage and capitalize on emerging market opportunities, industry leaders should adopt a series of targeted actions. First, diversifying feedstock sources through partnerships with regional resin producers and dedicated recycling initiatives will mitigate exposure to supply disruptions and tariff-induced cost increases. By engaging in long-term offtake agreements and pilot programs for chemical recycling, organizations can secure a stable pipeline of high-quality recycled APPT and enhance overall supply chain resilience.

Second, intensifying investment in R&D focused on specialty grades will unlock new applications, particularly in high-growth sectors such as electric vehicles, smart packaging, and advanced medical devices. Cross-functional teams that integrate material scientists, processing engineers, and application developers can accelerate product innovation cycles and respond promptly to evolving customer requirements. In parallel, scaling digital process controls and real-time monitoring systems will optimize manufacturing yields, reduce waste, and ensure consistent quality across diverse production lines.

Third, embedding sustainability metrics into product development and go-to-market strategies will strengthen brand positioning and facilitate compliance with tightening environmental regulations. Transparent reporting on recyclate content, life cycle assessments, and carbon footprint reduction initiatives will resonate with stakeholders across the value chain. Finally, proactive scenario planning for potential trade policy shifts and market disruptions will enable executives to model financial and operational impacts, preserving margin integrity while maintaining agility. Through these focused initiatives, companies can navigate complex market dynamics and emerge as resilient, future-ready leaders in the APPT sector.

Detailing the Rigorous Research Framework and Analytical Approaches Underpinning the Comprehensive Study of Amorphous Polypropylene Terephthalate Market Dynamics

This market analysis employs a rigorous research methodology to ensure the validity and reliability of the findings. Primary data collection involved structured interviews with senior executives, technical managers, and procurement specialists from polymer producers, converters, and end-user organizations across key regions. These insights were complemented by surveys designed to capture emerging trends in material preferences, processing innovations, and sustainability practices.

Secondary research included an extensive review of industry publications, regulatory documents, patent filings, and equipment supplier reports. This process facilitated a comprehensive understanding of technological advancements, trade developments, and competitive positioning. Throughout the study, data triangulation methods were applied to reconcile discrepancies and validate qualitative observations against quantitative benchmarks.

Additionally, a series of expert advisory sessions provided iterative feedback on draft findings, ensuring that emerging developments and regional peculiarities were accurately represented. Statistical analyses and process mapping tools were utilized to uncover underlying market drivers and identify potential inflection points. This structured approach guarantees that the conclusions and recommendations presented herein reflect a holistic and up-to-date perspective on the Amorphous Polypropylene Terephthalate market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Amorphous Polypropylene Terephthalate market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Amorphous Polypropylene Terephthalate Market, by Type

- Amorphous Polypropylene Terephthalate Market, by Manufacturing Process

- Amorphous Polypropylene Terephthalate Market, by Grade

- Amorphous Polypropylene Terephthalate Market, by Application

- Amorphous Polypropylene Terephthalate Market, by End Use Industry

- Amorphous Polypropylene Terephthalate Market, by Region

- Amorphous Polypropylene Terephthalate Market, by Group

- Amorphous Polypropylene Terephthalate Market, by Country

- United States Amorphous Polypropylene Terephthalate Market

- China Amorphous Polypropylene Terephthalate Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Consolidating Key Insights and Future Outlook for the Amorphous Polypropylene Terephthalate Market to Guide Strategic Decision Making and Investment Planning

The exploration of Amorphous Polypropylene Terephthalate’s evolving landscape reveals multiple converging trends-technological advancements in polymer processing, increasing emphasis on sustainability and circularity, and shifting trade policies-that are redefining competitive parameters. Stakeholders who harness the nuanced segmentation insights across applications, end-use industries, polymer types, processing methods, and material grades will identify high-value niches and optimize product portfolios accordingly. Similarly, recognizing regional variations in regulatory support, infrastructure capacity, and consumer expectations will inform targeted market entry and expansion strategies.

In this rapidly changing environment, leading companies must balance agility with strategic foresight. Investments in R&D, digital manufacturing, and sustainable feedstock supply chains will drive differentiation and long-term resilience. Concurrently, proactive engagement with policy developments and industry consortia will facilitate smoother adaptation to emerging trade frameworks. By synthesizing these insights and embedding them into core decision-making processes, organizations can position themselves for sustainable growth and innovation leadership in the APPT sector.

This executive summary distills the critical themes and strategic considerations that will shape the trajectory of Amorphous Polypropylene Terephthalate in the coming years, serving as a catalyst for informed, data-driven action.

Connect with Ketan Rohom to Unlock Tailored Insights and Secure Your Access to the Definitive Amorphous Polypropylene Terephthalate Market Research Report Today

To explore how these comprehensive insights can inform your strategic decisions and secure your competitive edge, reach out today to Ketan Rohom, Associate Director, Sales & Marketing. He can guide you through tailored solutions that align with your priorities and unlock the full value of this in-depth market research report on Amorphous Polypropylene Terephthalate. Engage now to ensure your organization benefits from the latest trends, supply chain analyses, and actionable recommendations needed to drive growth and innovation across your operations. Your path to a more resilient and future-ready strategy begins with a single conversation.

- How big is the Amorphous Polypropylene Terephthalate Market?

- What is the Amorphous Polypropylene Terephthalate Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?