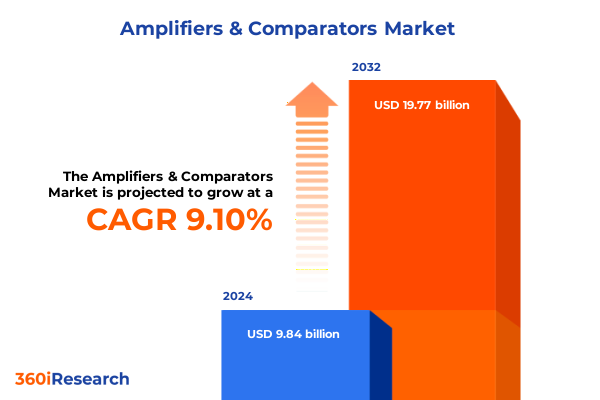

The Amplifiers & Comparators Market size was estimated at USD 10.64 billion in 2025 and expected to reach USD 11.51 billion in 2026, at a CAGR of 9.24% to reach USD 19.77 billion by 2032.

A clear and practical framing of amplifiers and comparators that connects analog device innovation to system constraints, sourcing risks and strategic priorities

The market for amplifiers and comparators sits at the intersection of analog innovation, systems integration and evolving global supply chains, demanding clarity for leaders who must translate component‑level choices into system‑level advantage. This introduction frames the technologies, end‑use pressures and commercial tradeoffs that define contemporary competitive dynamics, and it outlines the actionable lens the report takes when assessing risk, opportunity and differentiation in component design and sourcing.

Across industries from automotive electrification to aerospace avionics and connected healthcare devices, designers and procurement teams face converging constraints: power efficiency, signal integrity, thermal management and long product life cycles that stretch vendor relationships. At the same time, technological advances in mixed‑signal integration, process nodes and radio‑frequency design are creating new performance tiers and enabling function consolidation that shifts value from discrete components to subsystem solutions. Consequently, technical roadmaps and go‑to‑market strategies must account for both the microeconomics of analog device engineering and the macro forces reshaping trade, investment and regional sourcing.

This executive summary synthesizes those forces into a pragmatic foundation for decision making. It highlights where immediate tactical actions are required and where longer‑term strategic adjustments will pay dividends, setting the stage for deeper segmentation, regional and policy analysis that follow in subsequent sections.

How technology convergence, geopolitical policy and shifting system requirements are reshaping supplier roles, product roadmaps and sourcing strategies across analog components

The industry landscape is undergoing transformative shifts driven by a blend of technological maturation, policy intervention and changing product architectures. Device designers are moving beyond single‑function parts toward integrated mixed‑signal solutions that reduce board area and power while increasing system reliability; this evolution accelerates demand for advanced process compatibility and closer collaboration between IC vendors and OEM system architects.

Concurrently, supply‑chain resilience has become a boardroom imperative rather than an operational afterthought. Investment incentives, export controls and trade measures are reconfiguring where capital is deployed and where critical processes are performed. As a result, companies are increasingly evaluating dual‑sourcing strategies, regional manufacturing options, and capacity reservation agreements to protect long lead‑time components. These shifts are forcing suppliers to re‑examine product roadmaps and to offer broader systems support, including extended lifecycle assurance, firmware compatibility guarantees and enhanced technical documentation.

On the demand side, electrification in automotive and power electronics, expansion of telecom infrastructure for wireless backhaul and 5G derivatives, and higher regulatory scrutiny in medical and aerospace sectors are driving both performance and qualification requirements. Together, these forces are realigning competitive advantage: incumbents that can pair analog design expertise with supply‑chain flexibility stand to preserve margin and market access, while new entrants with novel process technologies can displace legacy suppliers if they can demonstrate long‑term reliability and qualification pathways.

What 2025 United States tariff actions and semiconductor trade investigations mean for procurement, qualification cycles and supply‑chain resilience in component sourcing

Throughout 2025, United States trade policy actions have materially influenced sourcing calculus for components embedded with analog front ends, RF stages and comparator circuits. Policy updates announced in the statutory review and related measures targeted strategic subsegments such as wafers and certain semiconductor inputs, and they have catalyzed renewed scrutiny of downstream products that incorporate those inputs. As trade measures take effect or are investigated, procurement teams and OEMs are reassessing bill‑of‑materials strategies, qualification workflows and long‑term supplier commitments to ensure continuity of supply and cost predictability. These policy signals have also incentivized accelerated capital deployment into domestic and allied production footprints as firms hedge against tariff and export‑control risk. USTR communications published in late 2024 and early 2025 confirmed tariff increases on some wafer‑level inputs that took effect at the start of 2025, formalizing a higher‑cost environment for specific upstream materials and intensifying the premium on qualifying alternative sources or qualifying domestic content when feasible.

In parallel, the Office of the U.S. Trade Representative opened targeted inquiries into semiconductor industry practices with an initial focus on legacy and foundational chips that are widely used as embedded components in automotive, telecommunications and industrial controls. That investigation signaled the potential for further policy shifts or targeted tariffs on categories of finished chips and assemblies that contain amplifiers, comparators or their enabling substrates. Firms should interpret that development as an indicator that trade policy will remain an active variable in supplier selection and capital planning.

Industry commentary and reporting through 2025 underscored the operational implications: public hearings and government inquiries elevated the probability that tariffs or export controls would extend to broader classes of semiconductors used in downstream applications, prompting manufacturers to revalidate supply chains and evaluate mitigation measures such as localized testing, inventory buffers and contractual pass‑through provisions. Practically, this means that product teams must incorporate policy‑driven cost differentials into component selection criteria and that commercial teams should renegotiate lead‑time and price commitments with an eye to potential tariff adjustments during a multi‑year product lifecycle.

Deep segmentation insights linking product classes, applications, process technologies and distribution channels to qualification, sourcing and go‑to‑market imperatives

Segmentation analysis reveals differentiated pressures and opportunities across product classes, applications, technologies and channels that should guide product strategy and commercial focus. By product type, the competitive dynamics differ markedly between audio amplifiers where cost and low‑noise performance are primary differentiators, instrumentation amplifiers where precision and common‑mode rejection drive qualification timelines, operational amplifiers that straddle price and integration tradeoffs, RF amplifiers that demand RF‑grade process familiarity and thermal management, and voltage comparators where speed, hysteresis and output compatibility determine adoption in embedded controllers.

Based on application, requirements shift from the ruggedness and long qualification cycles demanded by aerospace and defense to the cost sensitivity and scale considerations of consumer electronics; automotive imposes stringent functional safety and extended temperature ranges, healthcare insists on validated supply chains and traceability, industrial systems require robustness and lifecycle support, while telecom and data communications prioritize linearity, noise figure and manufacturability at scale. These end‑use variations translate directly into different certification burdens, return‑material‑authorization profiles and qualification windows for suppliers.

From a technology perspective, analog performance and manufacturability tradeoffs map differently across BiCMOS, bipolar, CMOS and GaAs process families. BiCMOS and bipolar solutions remain attractive for high‑performance analog and mixed‑signal functions where transconductance and noise performance are paramount; CMOS continues to win on integration density and cost for many general‑purpose op‑amp functions; GaAs retains advantages in high‑frequency RF amplification scenarios where power and gain at microwave bands matter. These technology choices cascade into sourcing complexity and supplier selection criteria.

Finally, when considering end‑user industry and distribution channel dynamics, buyers must account for different procurement pathways: aerospace and defense, automotive, consumer electronics, healthcare, industrial and telecom IT each impose unique supplier qualification and documentation needs, while aftermarket, direct sales, distributors and online sales routes create distinct margin, warranty and logistics models that influence commercialization strategies and inventory policies.

This comprehensive research report categorizes the Amplifiers & Comparators market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Distribution Channel

- Application

How regional manufacturing ecosystems, regulatory expectations and geopolitical exposure shape sourcing choices and product qualification strategies globally

Regional dynamics materially influence where firms choose to locate manufacturing, design centers and inventory pools, and understanding those differences is essential for resilient planning. In the Americas, proximity to major OEMs, strong IP protections and incentives for onshore investment support a strategy oriented toward high‑value design, final assembly and politically sensitive qualification runs; the region’s regulatory and procurement environment often favors suppliers that can demonstrate sustained domestic presence and compliance with rigorous quality systems.

Across Europe, Middle East & Africa, the regulatory environment emphasizes standards alignment, long product lifecycles and traceability, with many governments and large tier‑one customers requiring robust compliance and sustainability reporting. That region’s diverse industrial base rewards suppliers that can deliver certified quality systems, local technical support and flexible logistics for complex assemblies.

In the Asia‑Pacific region, scale and a dense manufacturing ecosystem support rapid prototyping, aggressive cost structures and deep supplier networks for both discrete components and wafer fabrication. Asia‑Pacific remains the primary locus for volume manufacturing and many specialized process flows, so companies that rely on that region must actively manage geopolitical, logistics and tariff exposures. Across all regions, forward‑looking firms are balancing the cost advantages of concentrated manufacturing with the resilience benefits of geographically diversified supply and are structuring multi‑region sourcing strategies that reflect both customer needs and policy risk.

This comprehensive research report examines key regions that drive the evolution of the Amplifiers & Comparators market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Why supplier strength is now defined by product performance, qualification support, localized services and ecosystem partnerships that accelerate customer adoption

Competitive dynamics in the amplifiers and comparators space are shaped by a mix of incumbent analog specialists, systems‑oriented semiconductor houses and emerging foundry‑partnered entrants. These participants compete not only on die‑level performance but also on ecosystem services such as lifecycle support, design‑in assistance and qualification documentation that enterprise customers require. Some companies differentiate through proprietary process tuning that delivers unique noise, offset or RF characteristics, while others pursue economies of scale and broad product portfolios to meet diverse application needs.

In addition to product roadmaps, corporate strategies increasingly emphasize contractual commitments for supply continuity, capacity reservations, and localized test and packaging capabilities. Strategic partnerships with foundries and assembly/test providers have become essential to control time‑to‑market and to enable rapid turn‑around for variant SKUs. Companies that successfully bind customers through co‑development and early qualification frameworks tend to secure longer order visibility and improved margin profiles.

Finally, leadership in this market increasingly depends on the ability to translate component attributes into system‑level value propositions. Firms that can provide application notes, validated reference designs and cross‑domain engineering services strengthen their position with OEMs who prefer fewer suppliers with deeper system expertise. The net effect is that competitive advantage is shifting from single‑item performance specifications toward integrated service bundles that de‑risk adoption for large industrial and regulated customers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Amplifiers & Comparators market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AMETEK.Inc.

- Analog Devices, Inc.

- Anthem

- Bose Corporation

- Bryston Ltd.

- Cirrus Logic, Inc.

- Diodes Incorporated

- DIOO Microcircuits Co., Ltd.

- Harman International Industries, Incorporated by Samsung Electronics Co., Ltd.

- Infineon Technologies AG

- Integrated Silicon Solution Inc.

- Kenwood Corporation

- McIntosh Laboratory, Inc.

- Monolithic Power Systems, Inc.

- NAD Electronics International by Lenbrook Industries Limited

- Nice North America LLC

- Nuvoton Technology Corporation

- Qualcomm Incorporated

- Renesas Electronics Corporation

- Robert Bosch GmbH

- ROHM Co., Ltd.

- SANSUI Electric (China) Co.,Ltd.

- Semiconductor Components Industries, LLC

- Texas Instruments Incorporated

Practical and immediate actions for suppliers and OEMs to harden supply chains, accelerate product differentiation and align commercial models with trade policy dynamics

Industry leaders should pursue a multi‑track strategy that simultaneously secures supply resilience, accelerates technical differentiation and aligns commercial models with evolving policy realities. First, secure diversified supplier footprints that combine trusted domestic capacity with vetted allied‑region manufacturing to mitigate tariff and export‑control shocks while preserving cost competitiveness. Establish contractual mechanisms such as capacity reservation agreements and dual‑sourcing clauses to reduce single‑source exposure and to preserve manufacturing flexibility.

Second, invest in product roadmaps that emphasize integration and system value: accelerate development of mixed‑signal and RF‑integrated solutions, provide validated reference designs and optimize part families for common qualification regimes across automotive, aerospace and healthcare. These moves reduce bill‑of‑materials complexity for OEMs and embed suppliers deeper into product architectures.

Third, align commercial practices with policy headwinds by building transparent cost‑pass‑through models, revising lead‑time commitments, and engaging proactively with trade‑policy processes to secure exclusions or mitigation where feasible. Maintain an active government affairs posture, document domestic content and localization efforts, and participate in public comment or exclusion processes when policy actions affect critical inputs.

Finally, enhance customer engagement by offering lifecycle services that include extended qualification support, firmware compatibility guarantees and joint reliability programs. These investments preserve long‑term revenue streams and strengthen the supplier’s position during periods of market volatility.

A transparent mixed‑method research framework combining primary expert interviews, product audits and policy analysis to evaluate supplier risk and technical readiness

This research applied a mixed‑method approach combining primary expert interviews, technical product audits, supplier capability assessments and secondary policy and industry reporting to produce an actionable picture of the amplifiers and comparators landscape. Primary inputs included structured interviews with design engineers, procurement leaders and quality managers across relevant end‑use industries, supplemented by supplier technical briefings and factory capability reviews to validate process claims and lifecycle support commitments.

Secondary analysis relied on authoritative public records, regulatory filings, trade‑policy announcements and reputable industry commentary to frame the macro environment and to contextualize supplier actions. Where policy changes were material to supply‑chain risk, the study reviewed government notices and public comment dockets to map likely timelines and to identify potential exemptions and mitigation pathways. Quantitative elements used normalized performance matrices and qualification horizon models to compare product suitability across applications, while scenario analysis explored the operational consequences of tariff shifts, regional disruptions and accelerated electrification trends.

Together, these methods produced a structured, repeatable assessment framework that prioritizes actionable signals: supplier qualification risk, design‑in friction points, regional sourcing tradeoffs and policy exposure. Readers can use the methodology to reproduce targeted sub‑analyses or to request tailored deep dives for specific product families or geographic scenarios.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Amplifiers & Comparators market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Amplifiers & Comparators Market, by Product Type

- Amplifiers & Comparators Market, by Technology

- Amplifiers & Comparators Market, by Distribution Channel

- Amplifiers & Comparators Market, by Application

- Amplifiers & Comparators Market, by Region

- Amplifiers & Comparators Market, by Group

- Amplifiers & Comparators Market, by Country

- United States Amplifiers & Comparators Market

- China Amplifiers & Comparators Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Final strategic synthesis showing how technical differentiation, lifecycle services and multi‑region sourcing will convert disruption into long‑term competitive advantage

In conclusion, the amplifiers and comparators market sits in a period of managed disruption where technical innovation, customer qualification rigor and trade‑policy uncertainty coexist. Suppliers that integrate deep analog design capabilities with robust lifecycle services and geographically diversified manufacturing will be best positioned to capture durable share and to sustain pricing discipline. Conversely, firms that rely on narrow cost advantages or single‑region supply models face elevated operational and commercial risk as policy adjustments and qualification demands accelerate.

Decision‑makers should treat trade policy as an enduring variable rather than a one‑off event: incorporate scenario planning into product roadmaps, reassess sourcing with an eye toward dual‑sourcing or regional buffering, and prioritize investments that shorten qualification timelines for regulated customers. By doing so, organizations can convert near‑term disruption into a competitive advantage-using differentiated technical offerings and service models to deepen customer relationships and to justify premium positioning in mission‑critical applications.

Taken together, these strategic priorities will help executives align R&D, procurement and commercial efforts so that component choices become enablers of system‑level differentiation rather than sources of supply‑chain vulnerability.

Engage with an Associate Director to secure the full amplifiers and comparators research package and accelerate executive decisions with tailored briefings

If your leadership team needs bespoke market intelligence, or if procurement and product strategy teams would benefit from a tailored briefing, contact Ketan Rohom, Associate Director, Sales & Marketing at our research division to explore the purchase options for the full market research report. Ketan can arrange targeted briefings that align report findings to your commercial priorities, facilitate licensing or enterprise access, and recommend add‑on deliverables such as custom data tables, competitor deep dives, or scenario planning workshops to accelerate decision making.

Taking the next step will provide you with the complete methodology, segmented datasets across product, application, technology, end‑user industry and distribution channel, and the granular regional modeling that informs tactical supplier negotiations, product roadmaps and sourcing strategies. A purchased report also unlocks access to analyst inquiries so your team can validate assumptions, test product positioning, and prioritize R&D investments against trade‑policy and supply‑chain scenarios. For boards or executive committees seeking an accelerated executive briefing, Ketan can coordinate a concise, outcomes‑focused session that translates technical detail into actions for procurement, operations and go‑to‑market leaders.

Act now to secure a licensing arrangement or single‑user purchase and fast‑track a custom presentation that maps the research to your commercial plays and risk mitigation strategies. Ketan will guide you through available editions, optional add‑ons, and tailored support to ensure the report becomes a practical decision tool for near‑term and strategic planning.

- How big is the Amplifiers & Comparators Market?

- What is the Amplifiers & Comparators Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?