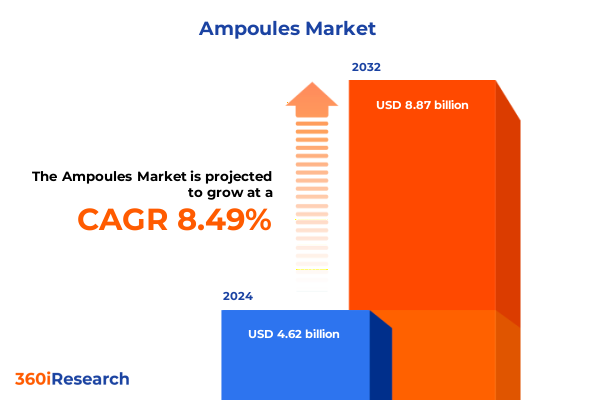

The Ampoules Market size was estimated at USD 5.00 billion in 2025 and expected to reach USD 5.42 billion in 2026, at a CAGR of 8.52% to reach USD 8.87 billion by 2032.

Unveiling the Dynamics That Define Ampoules Packaging Excellence and Market Evolution in Pharmaceutical and Cosmetic Applications to Guide Strategic Choices

Ampoules remain indispensable in both pharmaceutical and cosmetic sectors, offering a sterile, tamper-evident solution for preserving sensitive formulations and ensuring patient and consumer safety. As injectable therapies and at-home aesthetic treatments continue to expand, manufacturers are seeking packaging that not only meets rigorous regulatory demands but also enhances user convenience and brand prestige. The evolution of eco-friendly materials has further propelled the industry into innovating beyond traditional glass, giving rise to sustainable alternatives without compromising performance or sterility.

In parallel, plastic ampoules crafted from advanced polymers such as cyclic olefin copolymer and cyclic olefin polymer are gaining rapid traction for their superior moisture barrier, chemical inertness, and optical clarity. These materials support high-value biologics, vaccines, and cosmetic serums by reducing breakage risks and improving visual inspection workflows on high-speed production lines. Yet, glass continues to hold a notable share where chemical inertness and established pharmacopeial acceptance are non-negotiable for injectable drugs with extended stability requirements.

Regulatory landscapes are shifting in tandem with packaging innovation. The final phase of the Drug Supply Chain Security Act demands full serialization and electronic traceability for all drug units by the end of 2025, prompting providers to upgrade coding, aggregation, and data-exchange systems. This mandate is accelerating digital integration across production and distribution channels, requiring collaboration between packaging suppliers, pharmaceutical manufacturers, and technology partners to safeguard supply chain integrity and maintain uninterrupted patient access.

Exploring the Transformative Material, Technological, and Regulatory Shifts Redefining Ampoules Packaging through Sustainable and Digitalized Innovations

The ampoules packaging landscape is undergoing profound transformation driven by converging pressures on sustainability, operational efficiency, and regulatory compliance. Sustainability mandates have accelerated the adoption of eco-ampoules molded from recycled or compostable materials, reducing carbon footprints while aligning with circular economy goals. Brands are increasingly prioritizing lightweight, refillable designs that lower transportation emissions and minimize waste without sacrificing sterility or user experience.

Meanwhile, technological innovation is rewriting the rulebook for production and quality assurance. Automated visual inspection systems powered by AI and spectral imaging are achieving defect-detection rates approaching 99.95 percent, superseding manual checks and enabling faster throughput. Yet the integration of such systems also introduces new cost considerations, as the additional hardware and validation frameworks can add incremental expenses per unit, especially in high-precision injectable segments.

On the materials front, the surge in demand for cyclic olefin copolymer and cyclic olefin polymer underscores a shift away from glass in segments where breakage resistance, lightweight transport, and compatibility with cold-chain logistics are paramount. These polymers exhibit exceptional moisture barrier and chemical resistance properties, making them ideally suited for biologics and temperature-sensitive formulations. Regulatory initiatives around traceability and serialization are further influencing material choice and design, as packaging must now accommodate tamper-evident features and machine-readable identifiers without impeding fill-finish operations.

Unraveling the Cumulative Effects of 2025 U.S. Trade Tariffs on Ampoules Packaging Costs, Supply Chains and Strategic Sourcing across the Pharmaceutical Sector

In 2025, sweeping U.S. tariff measures are reshaping cost structures and sourcing strategies for ampoules packaging suppliers and users alike. A global tariff of ten percent applies uniformly to all imported goods, including primary packaging materials such as glass vials and polymer components, aiming to bolster domestic manufacturing yet raising input expenses across the board. In parallel, China-specific duties of up to twenty-five percent on active pharmaceutical ingredients and intermediates are amplifying inflationary pressures on drug formulation, indirectly impacting packaging demand and pricing dynamics.

Directly pertinent to ampoules, a fifteen-percent levy on medical packaging imports-covering sterile glass vials and related equipment-has disrupted established supply chains by extending lead times and elevating landed costs. Both multinational and niche glass producers are reevaluating logistics networks, with some redirecting orders to avoid U.S. ports or negotiating long-term contracts to mitigate volatility. These changes echo across cosmetic and pharmaceutical applications, where brand owners must balance cost containment against the imperative to maintain uninterrupted drug and product release schedules.

Healthcare stakeholders are already responding to these tariff pressures by seeking alternative domestic suppliers, increasing onshore production capacity, and revising supplier agreements. Hospitals, clinics, and specialty centers report rising procurement costs for ampoules and vials, while upstream glass and polymer manufacturers explore investment in U.S. facilities to sidestep import duties. Ultimately, the cumulative tariff burden is prompting a strategic realignment of the industry’s global sourcing footprint, compelling participants to weigh the long-term benefits of near-shoring against the short-term costs of higher-duty inputs.

Highlighting the Segmentation Framework Fueling Ampoules Packaging Markets through Material Types Use Cases End Users Dosage Volumes and Distribution Channels

The ampoules packaging market unfolds across multiple critical dimensions that guide product development, production strategy, and market positioning. Material types span glass, further segmented into Type I borosilicate glass renowned for its chemical inertness, as well as Type II and Type III grades suited for specialized thermal and chemical profiles, alongside plastics such as cyclic olefin copolymer, cyclic olefin polymer, and polyvinyl chloride each chosen for unique barrier and handling properties. Use cases differentiate cosmetic domains-primarily anti-aging serums and hydration ampoules-from pharmaceutical applications, where injectable formulations demand stringent sterility and ophthalmic solutions require optimized light transmission and particle control.

End user segments further refine demand profiles, encompassing large and small clinics, hospitals both private and public, homecare administered either by professionals or through self-injection, and specialty centers focused on dermatology or oncology therapies. These customer distinctions influence packaging design criteria, from easy-open break systems for self-administration to heavy-duty stem designs for clinical use. Dose volumes range from up to one milliliter configurations, subdivided into half-milliliter or half-to-one-milliliter options, to one-to-five-milliliter and above-five-milliliter formats that include 5–10 mL and those exceeding 10 mL, each tailored to specific treatment protocols.

Distribution channels traverse hospital pharmacies, both in-house and outsourced, retail pharmacies in chain and independent formats, and online platforms segmented into general e-commerce and specialized pharmacy e-tailers. Packaging type choices then distill into multi-dose vials optimized for repeated access and single-dose ampoules engineered for one-time use, a division that steers production line configuration, shelf-life considerations, and regulatory compliance pathways.

This comprehensive research report categorizes the Ampoules market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Use Type

- Dose Volume

- Packaging Type

- End User

- Distribution Channel

Comparing Regional Dynamics That Influence Ampoules Packaging Adoption and Growth Patterns across the Americas, Europe Middle East and Africa, and Asia Pacific

Regional landscapes present divergent opportunities and challenges for ampoules packaging providers, reflecting local regulatory regimes, supply chain infrastructures, and end-market dynamics. In the Americas, robust pharmaceutical manufacturing in the United States drives demand for both glass and advanced polymer ampoules, underpinned by ongoing investments in domestic production capacity. Tariff measures have accelerated near-shoring initiatives and reshaped import strategies, prompting many suppliers to explore greenfield sites or expand existing glass and plastic facilities to guarantee supply continuity.

Europe, the Middle East, and Africa are governed by stringent sustainability regulations and circular economy mandates that elevate recycled content and closed-loop processes. Procurement policies reward packaging solutions that demonstrate reduced lifecycle emissions and traceable recycled inputs, compelling manufacturers to innovate lightweight glass designs and invest in hybrid glass-plastic systems. In parallel, serialization and traceability requirements under regional frameworks are more advanced, driving early adoption of laser-etched identifiers and RFID tags to ensure compliance and secure supply chains.

Asia-Pacific is characterized by rapid growth in biologics and specialty injectables, supported by government incentives for local pharmaceutical hubs in China, South Korea, and India. Cost sensitivity remains high, encouraging the use of blow–fill–seal plastic technologies for high-volume generics, while premium therapeutic segments still prefer Type I glass ampoules. Infrastructure gaps in cold-chain logistics are spurring demand for materials that combine optical clarity with robust temperature resilience, setting the stage for continued innovation in polymer chemistry and thermal performance.

This comprehensive research report examines key regions that drive the evolution of the Ampoules market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering the Strategic Approaches and Competitive Differentiators of Leading Ampoules Packaging Suppliers Driving Innovation and Sustainability Globally

Leading suppliers in ampoules packaging are distinguishing themselves through strategic investments in material science, automation, and sustainability. Schott Pharma continues to command attention with its high-value Type I borosilicate offerings featuring one-point-cut break systems, while advancing closed-loop recycling pilots that aim to halve greenhouse gas emissions compared to virgin glass production. The company’s emphasis on traceable recycled content has resonated with major biopharma customers seeking to meet ambitious Scope 3 carbon reduction targets.

Gerresheimer has responded to digitalization demands by integrating AI-powered vision systems into its production lines, elevating defect detection and ensuring consistent quality for both glass and polyethylene teraphthalate plastic ampoules. Concurrently, the firm is piloting hybrid glass-plastic designs that merge the inertness of borosilicate with the toughness of polymers, targeting specialized oncology and high-viscosity therapeutic segments.

Corning’s Valor glass formulation has gained traction in cold-chain applications, offering enhanced delamination resistance and cold-temperature performance for mRNA vaccines and biologics. Meanwhile, Braskem’s sugarcane-derived ethylene-vinyl alcohol barrier materials are being adopted by several multinational pharmaceutical companies for injectable and ophthalmic uses, demonstrating a credible pathway to reduce fossil-fuel dependency while preserving critical barrier properties. Collectively, these strategic approaches underscore a competitive landscape where material innovation, sustainability credentials, and digital integration define market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ampoules market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AAPL Solutions Pvt. Ltd.

- Accu-Glass LLC

- Amcor plc

- AptarGroup, Inc.

- Ardagh Group S.A.

- Baxter International Inc.

- Becton, Dickinson and Company

- Bormioli Pharma S.p.A.

- Borosil Limited

- Borosil Scientific Limited

- Catalent, Inc.

- Corning Incorporated

- DURAN Life Science Holding GmbH (DWK Life Sciences)

- Essentra plc

- Gerresheimer AG

- Hindustan National Glass & Industries Limited

- J. Penner Corporation

- James Alexander Corporation

- Nipro Corporation

- Owens-Illinois, Inc.

- Piramal Glass Limited

- Schott AG

- SGD Pharma

- Shandong Pharmaceutical Glass Co., Ltd.

- Stevanato Group

- Vitro S.A.B. de C.V.

- West Pharmaceutical Services, Inc.

Delivering Actionable Recommendations for Industry Leaders to Navigate Tariff Challenges, Embrace Sustainable Innovations, and Strengthen Ampoules Supply Chains

To navigate the complexities of modern ampoules packaging, industry leaders should prioritize a multipronged strategy. First, engaging proactively with domestic glass and polymer producers can mitigate the impact of import tariffs and global trade uncertainties. Structured long-term agreements and investments in near-shoring initiatives will bolster supply security, while collaborative forecasting with suppliers ensures shared visibility on material availability and pricing.

Second, accelerating the adoption of sustainable materials and closed-loop manufacturing systems will align packaging portfolios with evolving regulatory mandates and customer expectations. Incorporating recycled glass content, exploring bio-based polymers, and implementing lightweighting techniques can reduce lifecycle emissions and support corporate ESG objectives. Early involvement in circular economy programs and pilot projects will secure procurement incentives and foster competitive differentiation.

Third, integrating digital traceability and automation across fill-finish operations will streamline compliance with global serialization requirements and enhance quality assurance. Investing in AI-driven visual inspection, RFID tagging, and machine-readable identifiers will improve defect detection, reduce manual errors, and strengthen supply chain resilience. Finally, segment-specific customization-tailoring designs for self-administered homecare, high-volume vaccine programs, or niche oncology therapies-will deepen market relevance and unlock new revenue streams.

Outlining the Rigorous Research Methodology Used to Collect, Validate, and Analyze Ampoules Packaging Market Insights from Primary Interviews and Secondary Data

This report combines rigorous primary and secondary research to deliver a comprehensive view of the ampoules packaging landscape. Primary insights derive from structured interviews with senior executives at leading packaging suppliers, pharmaceutical manufacturers, and regulatory bodies, providing firsthand perspectives on strategic priorities, operational challenges, and innovation roadmaps.

Secondary data were obtained through an exhaustive review of industry publications, regulatory filings, technical standards, and patent databases to capture material developments, tariff policies, and sustainability mandates. Market trends around polymer chemistry, glass recycling, and digital traceability were validated against third-party databases and peer-reviewed studies, ensuring the accuracy and integrity of the analysis.

Data synthesis involved cross-referencing material segmentation, use-case requirements, and regional dynamics to construct a multidimensional framework. Quantitative inputs were triangulated through reconciled benchmarks, while scenario analyses tested the resilience of supply chains under varying tariff regimes and sustainability targets. The resulting methodology provides a transparent, repeatable, and defensible foundation for strategic decision making across the ampoules packaging value chain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ampoules market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ampoules Market, by Material Type

- Ampoules Market, by Use Type

- Ampoules Market, by Dose Volume

- Ampoules Market, by Packaging Type

- Ampoules Market, by End User

- Ampoules Market, by Distribution Channel

- Ampoules Market, by Region

- Ampoules Market, by Group

- Ampoules Market, by Country

- United States Ampoules Market

- China Ampoules Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3339 ]

Summarizing Key Findings from Ampoules Packaging Analysis to Emphasize Strategic Imperatives, Market Drivers, and Pathways for Future Innovation and Growth

The landscape of ampoules packaging is defined by the interplay of material innovation, sustainability imperatives, regulatory evolution, and global trade dynamics. Glass and advanced polymers each offer distinctive advantages, with designers balancing chemical inertness against flexibility, barrier performance, and carbon footprint to meet diverse end-user needs. Sustainability mandates and circular economy initiatives are catalyzing the emergence of eco-friendly ampoules, while digital traceability requirements under DSCSA and similar frameworks are driving integration of machine-readable identifiers.

Trade policies, notably the 2025 U.S. tariff measures, have introduced new cost considerations that compel manufacturers and brand owners to reassess sourcing strategies and invest in domestic production capacity. Across regions, the Americas emphasize near-shoring and tariff mitigation; EMEA champions recycled content and stringent traceability; Asia-Pacific focuses on cost-effective cold-chain materials and high-volume platforms. Competitive advantage will accrue to those organizations that align segmentation strategies-ranging from dosage volume to distribution channels-with targeted technical innovations and agile supply chains.

As the industry progresses, action on sustainability, digitalization, and strategic partnerships will be paramount. Embracing these imperatives today positions players to lead market transitions, secure regulatory compliance, and capture emerging opportunities in pharmaceutical, cosmetic, and specialty care applications.

Engage with Ketan Rohom to Access Detailed Ampoules Packaging Market Research Insights and Unlock Bespoke Strategic Guidance for Your Organization’s Growth

To explore tailored insights, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your comprehensive report on the ampoules packaging landscape and gain bespoke guidance to catalyze growth. Ketan will guide you through the rich analytical depth of the study, elaborating on emerging opportunities, strategic imperatives, and sector-specific nuances. Engage directly to arrange a personalized briefing and unlock the actionable intelligence your team needs to stay ahead in this dynamic space.

- How big is the Ampoules Market?

- What is the Ampoules Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?