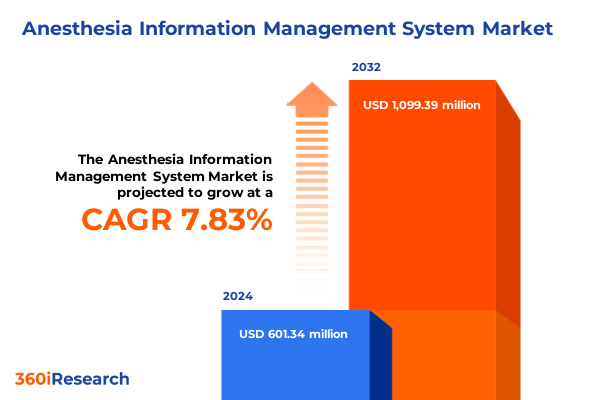

The Anesthesia Information Management System Market size was estimated at USD 648.56 million in 2025 and expected to reach USD 701.33 million in 2026, at a CAGR of 10.43% to reach USD 1,299.39 million by 2032.

Navigating the Complexities of Perioperative Digitalization to Enhance Patient Safety and Operational Efficiency Across Healthcare Settings

The growing complexity of perioperative workflows and the imperative for enhanced patient safety have elevated anesthesia information management systems to a critical position within modern healthcare delivery. Digital transformation initiatives across hospitals and outpatient settings now prioritize the seamless capture, storage, and analysis of perioperative data. This integration of vital signs, medication records, and procedural documentation is rapidly shifting from manual, paper-based records to real-time digital platforms that empower anesthesiologists and care teams with immediate, actionable insights.

As healthcare institutions strive to optimize efficiency and reduce the risk of adverse events, interoperability has emerged as a linchpin for success. By connecting anesthesia machines, monitoring devices, and electronic health record solutions through standardized interfaces and communication protocols, clinicians gain a unified view of patient data. This convergence not only streamlines documentation but also supports advanced clinical decision support, enabling early detection of anomalies and automated alerts that uphold safety standards during every phase of care.

Against this backdrop, this executive summary synthesizes the key trends, regulatory influences, and technological innovations shaping the anesthesia information management landscape. It aims to equip industry stakeholders-ranging from system integrators to hospital administrators-with a clear understanding of current dynamics and strategic considerations essential for fostering sustainable growth and clinical excellence.

Uncovering How Convergence of Advanced Analytics and Cloud Architectures Is Redefining Anesthesia Records Management With Real-Time Insights

The anesthesia information management ecosystem has entered a new era defined by the convergence of advanced analytics and cloud-native architectures. Healthcare organizations are moving beyond legacy on-premise deployments to hybrid and public cloud environments that deliver scalability, remote access, and cost-effective maintenance. This shift has been propelled by the need to support telemedicine initiatives and multisite clinical networks, where centralized data repositories enable anesthesiology teams to share protocols, review performance metrics, and conduct peer benchmarking regardless of geographic boundaries.

Simultaneously, the integration of artificial intelligence and machine learning into clinical decision support modules is transforming the way anesthesiologists approach perioperative risk assessment. Predictive analytics tools analyze historical patient data alongside live vital sign feeds to forecast potential complications, facilitating proactive interventions that can reduce postoperative morbidity. At the same time, the maturation of voice recognition and real-time documentation capabilities has minimized clerical burden, allowing clinicians to devote greater attention to direct patient care.

Adding momentum to these technological advances are evolving regulatory frameworks that emphasize data security, patient privacy, and interoperability standards. By enforcing stringent compliance requirements, policymakers are accelerating the adoption of robust reporting and audit functions. This environment has encouraged system vendors to prioritize modular software architectures and open APIs, laying the groundwork for a more modular and extensible AIMS landscape.

Assessing the Ripple Effects of New Tariff Regulations in 2025 on Anesthesia Information Management Systems Supply Chain Dynamics

The introduction of new United States tariffs in 2025 has exerted considerable pressure on the supply chains for anesthesia information management components. Hardware elements such as connectivity modules, including Ethernet and wireless devices, have seen heightened import costs, prompting both providers and technology integrators to reassess global sourcing strategies. In response, many organizations are diversifying their supplier base and increasing reliance on domestic manufacturing partnerships to mitigate potential disruptions and absorb the financial burden.

This shift has had downstream effects on service provisioning as well. Implementation services that encompass customization and integration are now navigating more complex vendor negotiations and lead times, while maintenance operations face higher spare-parts costs for barcode scanners, touchscreen consoles, and vital sign monitors. To offset these increased operational expenses, anesthesia care teams are exploring long-term service contracts that bundle preventive maintenance with remote diagnostics, ensuring system uptime without compromising budgetary constraints.

Software licensing models have also adapted to the new tariff environment, with vendors offering flexible subscription structures and cloud-based hosting to reduce upfront hardware expenditures. Documentation modules that leverage voice recognition and real-time dashboards, alongside reporting tools for regulatory compliance, are increasingly deployed through centralized platforms that bypass tariff-affected hardware altogether. These strategic adjustments underscore the resiliency of the sector in maintaining clinical performance despite evolving trade policies.

Decoding Multidimensional Market Segmentation Across Components Deployment Modes End Users and Anesthesia Types to Uncover Critical Opportunities

Component analysis reveals a layered architecture in which hardware, services, and software each play pivotal roles. Hardware configurations encompass connectivity modules such as Ethernet and wireless units, interfaces including barcode scanners and touchscreen consoles, and monitoring devices from gas analyzers to vital sign monitors. On the services front, implementation spans customization and integration services, while maintenance includes both corrective and preventive approaches, complemented by training offerings delivered online and onsite. Software suites bring together clinical decision support-powered by predictive analytics and protocol management-alongside documentation solutions integrating electronic health records and voice recognition, as well as reporting platforms offering real-time dashboards and regulatory compliance functionalities.

The deployment mode segmentation contrasts cloud and on-premise strategies, with hybrid, private cloud, and public cloud variants each presenting different trade-offs between data control, scalability, and capital expenditure commitments. End-user differentiation highlights distinct needs across ambulatory surgical centers-whether hospital-affiliated or standalone-clinics differentiated into dental and physician practices, and hospitals of varying sizes. In ambulatory environments, lean interfaces and streamlined documentation are critical, whereas large hospital networks prioritize extensibility and advanced analytics. Anesthesia types also influence system requirements, with general anesthesia workflows demanding integrated vital sign logging, regional techniques such as epidural or nerve block emphasizing protocol adherence, and both conscious and deep sedation necessitating specialized monitoring and safety alerts.

By understanding these intersecting layers of segmentation, stakeholders can tailor solution roadmaps to address the nuanced expectations of each user group. Whether optimizing training delivery for onsite nursing teams or configuring clinical decision support rules for spinal anesthesia protocols, this multi-dimensional view uncovers targeted opportunities for differentiation.

This comprehensive research report categorizes the Anesthesia Information Management System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Anesthesia Type

- Deployment Mode

- End User

Highlighting Regional Dynamics and Growth Drivers Shaping Adoption of Anesthesia Information Systems Across the Americas EMEA and Asia-Pacific

Regional analysis underscores the diverse drivers and barriers shaping anesthesia information management adoption across three broad geographies. In the Americas, particularly within the United States and Canada, the emphasis lies on seamless integration with electronic health record platforms and compliance with stringent patient safety standards. High capital availability has enabled pilot programs that validate interoperability frameworks, driving broader acceptance among academic medical centers and integrated delivery networks.

Europe, the Middle East, and Africa present a mosaic of regulatory environments, from the European Union’s General Data Protection Regulation to localized health agency mandates. In this region, data sovereignty concerns and legacy infrastructure constraints often favor on-premise deployments, although public and private cloud adoption is steadily gaining traction in countries with robust digital health initiatives. Customized service offerings that address language localization and regional clinical guidelines have proven essential for vendors seeking to scale across diverse markets.

Across Asia-Pacific, rapid expansion of surgical capacity has created demand for cost-effective and mobile-friendly solutions, especially in emerging markets where hospital funding is more limited. Hybrid cloud models have emerged as a popular compromise, allowing facilities to host critical patient data onsite while offloading analytics workloads to regional data centers. Moreover, partnerships between local system integrators and international vendors are streamlining training delivery through a mix of online modules and hands-on workshops, thereby accelerating adoption among smaller clinics and standalone ambulatory centers.

This comprehensive research report examines key regions that drive the evolution of the Anesthesia Information Management System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Pioneering Industry Players And Their Strategies Driving Innovation Integration And Competitive Positioning In Anesthesia Information Management

Key industry players have demonstrated an array of strategic maneuvers to strengthen their positions in the anesthesia information management sphere. Leading technology vendors have invested heavily in software modernization, embedding machine learning algorithms into clinical decision support offerings and refining voice recognition accuracy to minimize documentation errors. These firms have also pursued partnerships with medical device manufacturers to ensure device-agnostic connectivity modules that simplify integration workflows for end users.

Service-oriented organizations have differentiated themselves by developing comprehensive training ecosystems, blending online learning platforms with onsite coaching to support diverse clinical audiences. By curating role-based curricula for anesthesiologists, nurse anesthetists, and biomedical engineers, these providers have accelerated end-user proficiency and reduced time to value. Maintenance specialists have introduced remote monitoring capabilities, enabling predictive servicing of vital sign monitors and gas analyzers that prolong equipment lifecycles and lower total cost of ownership.

In parallel, incumbent healthcare IT companies have bolstered their portfolios through targeted acquisitions, adding specialized reporting modules focused on regulatory compliance and real-time dashboards. These acquisitions not only expand functional breadth but also reinforce vendor credibility in serving large hospital networks. Emerging entrants are carving niche positions by offering modular deployment options, particularly in private cloud environments, to meet the growing security and data sovereignty demands of regional health systems.

This comprehensive research report delivers an in-depth overview of the principal market players in the Anesthesia Information Management System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ACOMA Medical Industry Co., Ltd

- Allscripts Healthcare, LLC

- Becton, Dickinson and Company

- BPL Medical Technologies

- Cerner Corporation

- Danmeter ApS

- Drägerwerk AG & Co. KGaA

- Fisher & Paykel Healthcare Limited

- Flexicare Medical Ltd.

- Fukuda Denshi Co., Ltd.

- GE HealthCare Technologies, Inc.

- HEYER Medical AG

- iMDsoft Ltd.

- Infinium Medical

- Koninklijke Philips N.V.

- Medtronic plc

- Mindray Medical International Limited

- Optum Clinical Solutions, Inc.

- Picis Clinical Solutions, Inc. by N. Harris Computer Corporation

- Plexus Technology Group, LLC. by Coronis Health Company

- Provation Software, Inc.

- Surgical Information Systems, LLC

- Synopsis by VitalHub Company

- Talis Clinical, LLC

Formulating Actionable Strategies To Strengthen Market Entry Expansion And Operational Excellence In the Evolving Anesthesia Information Systems Ecosystem

To solidify leadership in an evolving marketplace, system providers should prioritize open interoperability frameworks that align with emerging industry standards. By contributing to collaborative standards consortia and developing robust APIs, organizations can facilitate seamless data exchange across operating rooms, intensive care units, and enterprise information systems. This approach not only enhances patient safety but also cultivates long-term customer loyalty through reduced integration complexity.

A dual focus on predictive analytics and protocol management will unlock new value propositions for anesthesia care teams. Vendors are advised to integrate real-time monitoring analytics with alert customization capabilities, ensuring that risk thresholds are both clinically relevant and aligned with institutional protocols. Simultaneously, expanding training services to include virtual reality-based simulations can accelerate user adoption and proficiency while reinforcing best practices in crisis management.

Finally, in light of shifting trade policies, diversified supply-chain strategies that include regional manufacturing partnerships and long-term service agreements can stabilize operating expenses for end users. Offering tiered service models-ranging from basic preventive maintenance to advanced remote diagnostics-will accommodate varying budget constraints and support broader deployment in resource-constrained settings. These steps collectively provide a roadmap for industry leaders seeking to drive sustainable growth and enhance clinical outcomes.

Implementing Rigorous Research Frameworks Combining Qualitative Interviews Quantitative Analysis And Secondary Data For Deep Market Understanding

This research initiative combined primary and secondary methodologies to ensure a comprehensive and balanced perspective. Primary insights were collected through in-depth interviews with anesthesia department leaders, biomedical engineers, and IT decision makers across a spectrum of healthcare settings. These qualitative conversations provided nuanced understanding of implementation challenges, user preferences, and strategic priorities.

Secondary data gathering involved systematic review of regulatory filings, clinical guidelines, and peer-reviewed literature to contextualize technology trends and compliance requirements. Vendor documentation and product white papers were analyzed to map feature sets and deployment models. Quantitative analysis was performed on anonymized utilization data and service contract records to identify adoption patterns and support segmentation validation.

Triangulating these data sources enabled the development of a rigorous framework that captures the interplay between technological innovation, clinical workflows, and regulatory landscapes. This multi-faceted approach ensures that the conclusions and recommendations presented herein reflect real-world constraints and emerging opportunities within anesthesia information management.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Anesthesia Information Management System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Anesthesia Information Management System Market, by Component

- Anesthesia Information Management System Market, by Anesthesia Type

- Anesthesia Information Management System Market, by Deployment Mode

- Anesthesia Information Management System Market, by End User

- Anesthesia Information Management System Market, by Region

- Anesthesia Information Management System Market, by Group

- Anesthesia Information Management System Market, by Country

- United States Anesthesia Information Management System Market

- China Anesthesia Information Management System Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 3657 ]

Summarizing Key Takeaways And Implications To Enable Stakeholders To Assess Future Trajectories And Leverage System Upgrades In Clinical Practice

In summary, anesthesia information management systems have transitioned from isolated documentation tools into integrated platforms that drive clinical decision making, operational efficiency, and regulatory compliance. The interplay of cloud deployments, advanced analytics, and modular architectures has created a dynamic environment where vendors and healthcare providers must collaborate closely to realize the full potential of digital perioperative care.

Segmentation insights highlight clear pathways for targeted solution offerings, whether optimizing connectivity and monitoring hardware for ambulatory surgical centers or deploying protocol management software in high-acuity hospital environments. Regional nuances in the Americas, EMEA, and Asia-Pacific further underscore the importance of customizing approaches to address local regulatory, economic, and infrastructural factors.

By leveraging the actionable recommendations and strategic frameworks outlined above, stakeholders can better navigate the challenges posed by supply chain adjustments, tariff influences, and rapidly evolving clinical requirements. Ultimately, embracing open interoperability, predictive analytics, and diversified service portfolios will position organizations to deliver safer, more efficient anesthesia care and sustain competitive differentiation.

Encouraging Decision Makers To Secure Comprehensive Anesthesia System Insights Through Direct Engagement With Sales Leadership And Detailed Service Offerings

For those seeking to gain a comprehensive understanding of the latest trends and transformative strategies within anesthesia information management, direct engagement with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, offers an efficient pathway to access the full research report. Through a personalized consultation, decision makers can explore tailored insights, clarify scope and deliverables, and secure the detailed analysis necessary to drive technology adoption and operational improvement in their clinical environments. Reach out to Ketan Rohom to arrange a briefing that aligns with your organization’s objectives and to initiate the purchase process for immediate access to the in-depth survey findings and strategic guidance.

- How big is the Anesthesia Information Management System Market?

- What is the Anesthesia Information Management System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?