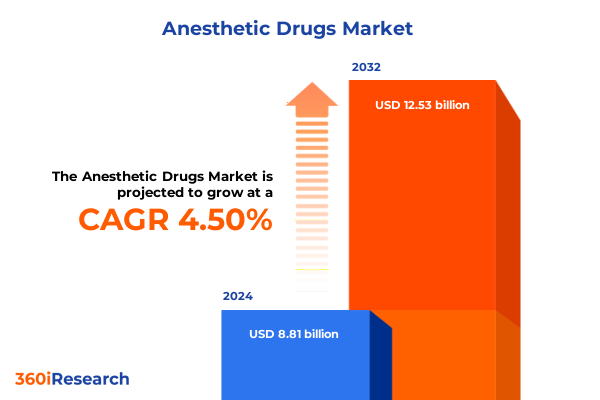

The Anesthetic Drugs Market size was estimated at USD 9.19 billion in 2025 and expected to reach USD 9.59 billion in 2026, at a CAGR of 4.52% to reach USD 12.53 billion by 2032.

Navigating the evolving anesthetic drugs sector with strategic overview of innovation drivers and market imperatives

The anesthetic drugs sector is undergoing a period of profound evolution driven by accelerating technological advancements, shifting patient demographics, and heightened regulatory scrutiny. In this dynamic environment, decision-makers spanning pharmaceutical firms, healthcare providers, and supply chain stakeholders must navigate a complex interplay of innovation, cost pressures, and clinical demands. An in-depth understanding of core value drivers, coupled with timely awareness of emerging trends, is essential to formulate winning strategies and safeguard competitive advantage.

Against this backdrop, the market report provides a holistic overview of the latest developments shaping the global anesthetic drug landscape. By examining the interplay of new molecule development, digital delivery systems, and tailored patient-centric approaches, the analysis illuminates how market participants are redefining therapeutic protocols and operational models. As hospitals and ambulatory centers alike strive to enhance safety, efficiency, and patient experience, insights into evolving anesthesia practices will inform investment decisions and drive next-generation product portfolios.

This executive summary distills the critical findings of the research, outlining transformative shifts, regulatory impacts, segmentation insights, regional nuances, and leading company strategies. It serves as a strategic compass for executives and clinical leaders alike, charting a clear path through the complexities of a market where precision medicine and digital integration are becoming increasingly interdependent. By laying out a cohesive narrative of market trajectories and actionable recommendations, the introduction sets the stage for an informed exploration of opportunities and challenges ahead.

Unveiling technological convergence and personalized medicine driving unprecedented transformation in anesthesia practice

In recent years, the anesthetic drugs market has witnessed transformative shifts characterized by the convergence of molecular innovation and digital integration. Breakthroughs in pharmacology have delivered novel agents that offer faster onset times, superior hemodynamic stability, and reduced post-operative side effects. These next-generation molecules are reshaping clinical protocols, prompting hospitals to invest in complementary real-time monitoring solutions and closed-loop delivery systems to maximize efficacy and safety.

Parallel to pharmaceutical advancements, the integration of digital technologies has unlocked new dimensions in anesthesia management. Artificial intelligence–driven decision support tools now assist anesthesiologists in tailoring dosages based on individual physiology and intraoperative variables, while augmented reality training platforms are accelerating the proficiency of new practitioners in simulated environments. Meanwhile, tele-anesthesia services are emerging in remote and resource-constrained settings, extending the reach of expert clinicians via secure, high-fidelity communication channels.

Moreover, the rise of personalized medicine has permeated anesthesia care pathways, with pharmacogenomic profiling guiding agent selection and dosing regimens to mitigate adverse reactions and optimize recovery. As these transformative trends coalesce, market participants are realigning R&D pipelines, forging cross-sector partnerships, and reconfiguring supply chains to meet the demands of precision anesthesia. The result is a rapidly evolving landscape where technological synergy and therapeutic innovation drive sustained growth and competitive differentiation.

Examining the wide-ranging repercussions of 2025 US trade measures on anesthetic drug supply chains pricing and strategic sourcing

The implementation of new US tariffs in early 2025 has introduced a distinct set of challenges and adjustments across the anesthetic drugs supply chain. With import duties levied on key active pharmaceutical ingredients and specialized excipients, manufacturers have experienced upward pressure on raw material costs, provoking a reassessment of procurement strategies and supplier relationships. In turn, contract manufacturers and API producers are exploring domestic or nearshore partnerships to insulate operations from tariff volatility and maintain supply continuity.

These tariff measures have also influenced pricing negotiations between pharmaceutical companies and healthcare providers. Hospitals and ambulatory surgical centers have become more vigilant in cost containment, often leveraging group purchasing organizations to secure volume-based discounts or alternative supply sources. At the same time, some global manufacturers have elected to absorb portions of the tariff impact to preserve market access, thereby compressing margins but safeguarding long-term customer relationships.

On a strategic level, the tariff environment has accelerated initiatives to develop localized production capabilities. Collaborative ventures between multinational drug makers and domestic biopharma firms have gained traction, aiming to produce high-value anesthetic intermediates onshore and reduce dependency on tariff-affected supply chains. As these shifts take root, stakeholders are recalibrating risk models to factor in trade policy dynamics, ensuring that sourcing, inventory management, and pricing frameworks remain robust in the face of evolving regulatory landscapes.

Integrating multidimensional segmentation lenses to uncover deep insights across drug types routes durations applications and end users

The anesthetic drugs market can be dissected through multiple vantage points to reveal nuanced demand patterns and growth vectors. From the perspective of drug classification, general anesthetics continue to dominate inpatient surgical suites, while local anesthetics, segmented into amide and ester families, underpin a broad array of minimally invasive procedures and outpatient interventions. Delving further, administration routes distinguish inhalation therapies utilized predominantly in hospital settings from intramuscular and intravenous formulations favored for rapid onset in emergency medicine and ambulatory contexts.

Another critical lens is the duration of pharmacological action, with long-acting agents enabling sustained analgesia in complex surgeries and post-operative recovery, whereas short-acting compounds facilitate quick patient turnover in outpatient and day-care environments. Application-wise, the market spans dental procedures-ranging from operative interventions to preventive care-obstetric applications such as epidural analgesia, acute and chronic pain management in medical wards, and a spectrum of surgical disciplines including cardiac, general, neuro, orthopedic, and plastic surgery. This breadth of use cases underscores the essential role of anesthetics across the continuum of care.

Finally, end-user segmentation distinguishes ambulatory surgical centers, where efficiency and rapid patient recovery are paramount, from hospitals and clinics that balance high-volume elective surgeries with emergency and critical care demands. By weaving these segmentation dimensions together, market participants can tailor their portfolios, marketing messages, and distribution strategies to address the specific clinical, regulatory, and operational requirements of each segment, thereby capturing value with precision.

This comprehensive research report categorizes the Anesthetic Drugs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Drug Type

- Administration Route

- Duration of Action

- Application

- End User

Highlighting distinct regional market drivers regulatory landscapes and adoption patterns across the Americas EMEA and Asia-Pacific

Regional market dynamics exhibit distinctive characteristics shaped by healthcare infrastructure, regulatory frameworks, and epidemiological profiles. In the Americas, established healthcare systems and significant investment in perioperative care have cultivated robust demand for both general and advanced local anesthetics, with an increasing focus on enhancing patient safety through advanced monitoring and automated delivery devices. The United States, in particular, continues to drive innovation adoption, supported by well-established reimbursement pathways and a culture of clinical research integration.

Transitioning to Europe, the Middle East, and Africa, diverse regulatory environments and varying resource allocations result in a patchwork of market maturity levels. Western European markets often parallel North American trends in adopting novel anesthetic agents and digital monitoring platforms, while emerging economies in the Middle East and Africa emphasize cost-effective formulations and capacity-building initiatives to expand surgical access. Pan-regional collaborations and public–private partnerships are gaining momentum to elevate clinical standards and supply chain resilience.

In the Asia-Pacific region, rapid expansion of healthcare infrastructure and rising surgical volumes are propelling demand for a wide spectrum of anesthetic drugs. Countries such as China and India are witnessing substantial growth in both hospital and ambulatory sectors, underpinned by government-led healthcare modernization programs. Concurrently, Japan and Australia remain at the forefront of adopting next-generation anesthesia delivery technologies, buoyed by stringent safety regulations and ongoing clinical innovation. Altogether, the regional mosaic presents a landscape of mature innovation hubs alongside high-potential emerging markets.

This comprehensive research report examines key regions that drive the evolution of the Anesthetic Drugs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing the competitive landscape where integrated platforms innovative pipelines and strategic alliances shape the future of anesthesia care

The competitive arena of anesthetic drugs is anchored by a cadre of multinational pharmaceutical and medical device corporations, each leveraging unique strengths in R&D, manufacturing, and global distribution networks. Strategic investments in novel formulations and digital anesthesia management platforms have become a key battleground, as companies vie to deliver end-to-end solutions that enhance clinician workflows and patient outcomes. Collaborative licensing deals and co-development partnerships have surged, reflecting a shift towards ecosystem-driven innovation.

Leading companies have prioritized pipeline diversification, balancing next-generation small molecules with specialty injectables and inhalation systems. Those with integrated device capabilities are increasingly bundling pharmacological agents with proprietary delivery hardware and software suites, aiming to create lock-in effects and drive recurring revenue streams. Moreover, mergers and acquisitions remain prevalent as larger firms seek to augment their anesthetic portfolios and penetrate high-growth regional markets.

In parallel, a cohort of agile specialty players focuses on niche segments such as long-acting local anesthetics and pain management injectables, investing heavily in clinical trials to substantiate extended efficacy and safety profiles. Their targeted approaches enable swift market entry and the ability to navigate country-specific regulatory pathways. Collectively, this competitive fabric underscores an industry in motion, where scale and specialization converge to redefine the future of anesthesia care.

This comprehensive research report delivers an in-depth overview of the principal market players in the Anesthetic Drugs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Apotex Inc.

- Aspen Pharmacare Holdings Limited

- AstraZeneca PLC

- B. Braun SE

- Baxter International Inc.

- Boehringer Ingelheim International GmbH

- Claris Lifesciences Limited

- Eisai Co. Ltd.

- F. Hoffmann-La Roche Ltd.

- Fresenius SE & Co. KGaA

- Hikma Pharmaceuticals PLC

- Mylan N.V.

- Novartis AG

- Pacira Pharmaceuticals, Inc.

- Pfizer Inc.

- Piramal Enterprises LTD

- Septodont Healthcare India Pvt. Ltd.

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Limited

- Viatris Inc.

- Weefsel Pharma

Implementing future-proof strategies focusing on innovation partnerships supply chain resilience sustainability and value-driven engagement

Industry leaders must chart a proactive course to capitalize on emerging opportunities and mitigate evolving risks in the anesthetic drugs domain. A primary initiative should involve deepening investment in molecular research targeting ultra-fast onset and ultra-short recovery agents, coupled with data-driven pharmacovigilance programs to accelerate regulatory approvals and build clinician confidence. Furthermore, forging partnerships with technology firms to co-create intelligent delivery platforms will position organizations at the forefront of digital anesthesia management.

Simultaneously, companies should develop resilient supply chain architectures by diversifying raw material sources and establishing regional manufacturing hubs to circumvent tariff disruptions. Leveraging advanced analytics to enhance demand forecasting and inventory optimization will further shield operations from market fluctuations. Parallel efforts in sustainability-such as eco-friendly packaging and carbon footprint reduction in manufacturing-will resonate with increasingly conscious healthcare providers and patients.

Finally, embedding a customer-centric sales approach that emphasizes value-based care outcomes and tailored training for anesthesiology teams will unlock differentiation. By offering comprehensive service packages that integrate product, platform, and performance insights, market participants can foster long-term partnerships with hospitals and ambulatory centers. This multidimensional strategy will enable industry leaders to thrive amid accelerating change.

Detailing a comprehensive research approach combining primary expert interviews secondary literature reviews and quantitative validation techniques

The insights presented in this report are underpinned by a rigorous research methodology designed to ensure accuracy, reliability, and relevance. Primary research comprised in-depth interviews with key opinion leaders including leading anesthesiologists, procurement officers at major hospital networks, and senior executives of pharmaceutical and device companies. These discussions provided firsthand perspectives on clinical adoption barriers, procurement priorities, and innovation imperatives.

Secondary research involved a comprehensive review of scientific journals, regulatory filings, clinical trial registries, and government health expenditure reports. Data from industry conferences and peer-reviewed publications were systematically analyzed to track the evolution of anesthetic drug pipelines and the commercialization timelines of novel delivery technologies. Proprietary databases were also leveraged to validate product launch dates and patent expirations.

Quantitative analysis entailed triangulating hard data points through statistical modeling and cross-referencing multiple sources to mitigate bias. Segmentation frameworks were rigorously tested using historical consumption patterns and real-world evidence. All findings were subjected to quality checks, including peer review by external clinical experts, to confirm validity and enhance the credibility of the strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Anesthetic Drugs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Anesthetic Drugs Market, by Drug Type

- Anesthetic Drugs Market, by Administration Route

- Anesthetic Drugs Market, by Duration of Action

- Anesthetic Drugs Market, by Application

- Anesthetic Drugs Market, by End User

- Anesthetic Drugs Market, by Region

- Anesthetic Drugs Market, by Group

- Anesthetic Drugs Market, by Country

- United States Anesthetic Drugs Market

- China Anesthetic Drugs Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Summarizing key strategic imperatives to excel in an evolving market defined by innovation complexity and shifting care paradigms

As the anesthetic drugs market continues to expand and diversify, stakeholders across the value chain must adopt an agile mindset and data-driven strategies. Technological innovation, regulatory dynamics, and shifting care models are converging to redefine anesthesia protocols and supply chain paradigms. To stay ahead, industry participants must align R&D investments with clinical needs, build resilient sourcing frameworks, and harness digital platforms to optimize patient outcomes.

Segmentation insights reveal that tailored product portfolios addressing nuances in drug type, administration route, duration, application, and end-user preferences will unlock differentiated growth paths. Regional disparities underscore the importance of customizing market entry and expansion tactics to local regulatory, infrastructure, and reimbursement landscapes. Meanwhile, competitive intensity is driving a shift toward integrated solutions that blend pharmacology with smart delivery systems and outcome analytics.

By operationalizing the actionable recommendations outlined herein-spanning innovation partnerships, supply chain strategies, sustainability initiatives, and customer-centric engagement-organizations can navigate uncertainty with confidence. The path forward demands collaboration across disciplines, relentless focus on safety and efficacy, and an unwavering commitment to delivering value in an ever-evolving market environment.

Connect with the Associate Director of Sales & Marketing to acquire your comprehensive report and unlock critical anesthetic drugs market insights

If you are ready to gain comprehensive insights and strategic guidance for thriving in the dynamic anesthetic drugs market landscape, reach out to Ketan Rohom, Associate Director, Sales & Marketing, to secure your copy of the full market research report. Discover actionable intelligence that will empower your organization to capitalize on emerging opportunities, mitigate risks, and drive sustainable growth. Engage with an expert consultation and unlock the data-driven strategies you need to stay ahead in a rapidly evolving industry.

- How big is the Anesthetic Drugs Market?

- What is the Anesthetic Drugs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?