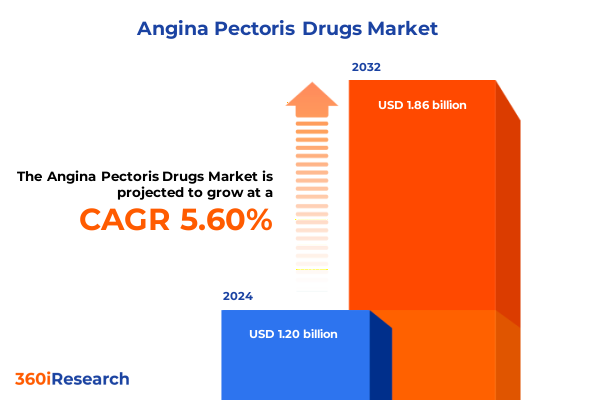

The Angina Pectoris Drugs Market size was estimated at USD 1.27 billion in 2025 and expected to reach USD 1.32 billion in 2026, at a CAGR of 5.59% to reach USD 1.86 billion by 2032.

Exploring the Current State of Angina Pectoris Drugs Amidst Shifting Clinical Practices Technological Advances and Patient-Centric Care Strategies

Angina pectoris remains a critical cardiovascular condition affecting millions worldwide, characterized by chest pain resulting from myocardial ischemia. As healthcare providers navigate an increasingly complex environment of comorbidities, patient expectations, and regulatory scrutiny, the demand for effective and safe pharmacological solutions has never been more pressing. This executive summary offers a concise overview of the angina pectoris drugs landscape, highlighting the intersection of clinical efficacy, patient-centric delivery methods, and evolving market dynamics.

In recent years, advancements in drug discovery and formulation have expanded therapeutic options and improved patient adherence. Therapeutic classes such as ACE inhibitors, beta blockers, calcium channel blockers, antiplatelet agents, and nitrates now include both established and novel molecules tailored to individual risk profiles. These developments coincide with rising emphasis on long-acting delivery and precision dosing to address variable patient responses. Consequently, industry stakeholders must adapt to a dynamic environment where innovation and patient experience converge.

This introduction sets the stage for a deeper exploration of transformative shifts, policy impacts, segmentation nuances, regional trends, and strategic imperatives shaping the future trajectory of angina pectoris therapies. By synthesizing multidisciplinary insights, this report empowers decision-makers with actionable intelligence to navigate the complexities of clinical practice, regulatory frameworks, and market access in 2025 and beyond.

How Digital Therapeutics Precision Medicine Innovative Formulations and Telemedicine Integration Are Transforming Angina Pectoris Treatment Landscape

The angina pectoris treatment paradigm is undergoing a profound transformation driven by integration of digital health tools, precision medicine, and innovative formulation strategies. Remote patient monitoring powered by Internet of Things devices enables clinicians to capture continuous cardiovascular metrics such as blood pressure and ECG data, facilitating timely interventions and reducing hospital readmissions. Consequently, pharmaceutical companies are exploring companion diagnostics and integrated telehealth platforms to complement traditional drug therapies.

Simultaneously, the rise of pharmacogenomic profiling allows tailoring of calcium channel blocker and beta blocker therapies to genetic variants influencing drug metabolism. This precision approach reduces adverse events while optimizing therapeutic outcomes for patients with heterogeneous responses. Capitalizing on these insights, developers are advancing combination therapies that merge mechanisms of action within a single dosage form, enhancing efficacy and adherence.

Innovative delivery systems such as extended-release formulations, transdermal patches, and sublingual sprays are also redefining patient convenience. By bypassing gastrointestinal variability and minimizing peak–trough fluctuations, these modalities support more consistent plasma concentrations and improved tolerability. Ultimately, the convergence of digital therapeutics, genomics, and next-generation delivery platforms represents a paradigm shift in managing angina pectoris, driving both clinical value and market differentiation.

Assessing the Cumulative Impact of United States Tariff Policies in 2025 on the Supply Chain and Access to Angina Pectoris Medications

In 2025, United States tariff policies have introduced a complex layer of challenges for the pharmaceutical supply chain, especially for angina pectoris medications reliant on globally sourced active pharmaceutical ingredients (APIs). The administration’s 10% global tariff on most imported goods, combined with reciprocal tariffs ranging from 125% to 145% on Chinese-origin pharmaceuticals and raw materials, has directly increased procurement costs for generic and branded drugs alike.

Despite initial exemptions for certain finished pharmaceutical products under Annex II of the Executive Order, key starting materials and critical APIs remain subject to heightened duties. For example, raw materials for nitrates, beta blockers, and calcium channel blockers sourced from China now incur elevated levies, compelling manufacturers to reassess supplier portfolios and consider reshoring or nearshoring alternatives to mitigate tariff exposure and maintain supply reliability.

The tariffs have also triggered industry-wide advocacy for tailored exemptions, with professional associations urging policymakers to avoid disruptions in patient access. Hospitals and generic manufacturers warn that sustained tariffs could exacerbate existing shortages and drive up treatment costs, undermining both affordability and therapeutic continuity for vulnerable populations. Navigating this uncertain policy landscape requires agile supply chain strategies, diversified sourcing, and proactive engagement with regulatory bodies to safeguard the availability of essential angina pectoris drugs.

Unlocking Critical Insights into Drug Class Dosage Forms Administration Routes Channels and End User Dynamics for Angina Pectoris Therapies

Understanding the multifaceted segmentation of the angina pectoris drugs market offers critical insights into product development, commercialization, and patient engagement strategies. Segmentation by drug class captures the therapeutic diversity, with ACE inhibitors such as enalapril and lisinopril, antiplatelet agents including aspirin and P2Y12 inhibitors, beta blockers differentiated into selective and nonselective subclasses, calcium channel blockers spanning dihydropyridines and nondihydropyridines, and both long-acting and short-acting nitrates each addressing specific clinical needs.

Consideration of dosage form segmentation further refines market understanding. Oral solid dosage forms like tablets and capsules are complemented by injectable solutions and transdermal patches, reflecting varying patient preferences and clinical indications. By examining route of administration, stakeholders can evaluate the role of sublingual sprays versus tablets in acute angina relief, or intravenous and intramuscular injections during hospital-based interventions, ensuring that therapeutic options align with both outpatient and inpatient care settings.

Distribution channel segmentation highlights the interplay between hospital, retail, and online pharmacies, underscoring the growing influence of digital health commerce. Business-to-business and business-to-consumer models within online pharmacies expand access while challenging traditional supply chains. Finally, end-user segmentation across hospitals, clinics, and homecare environments reveals shifting patterns of care delivery. Within homecare, caregiver-administered and self-administered scenarios emphasize the importance of user-friendly formulations and patient education to support adherence and clinical outcomes.

This comprehensive research report categorizes the Angina Pectoris Drugs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Drug Class

- Dosage Form

- Route Of Administration

- Distribution Channel

- End User

Navigating Regional Variations in Patient Demographics Regulatory Environments and Market Drivers across Americas EMEA and Asia-Pacific Regions

Regional dynamics significantly influence the commercial viability and strategic priorities of angina pectoris therapies. In the Americas, robust healthcare infrastructure, high per capita pharmaceutical expenditure, and favorable reimbursement policies drive demand for innovative combination therapies and premium delivery systems. The United States, in particular, continues to lead in telemedicine adoption and precision health initiatives, positioning it as a key market for digital health–enabled angina management solutions.

Europe, the Middle East, and Africa present a more heterogeneous landscape shaped by stringent price controls, regulatory harmonization efforts, and public health imperatives. Central European markets often mandate health technology assessments that favor generics and biosimilars, while Gulf Cooperation Council countries invest heavily in modernizing cardiovascular care through public-private partnerships. Simultaneously, Africa’s growing urban populations and rising incidence of cardiovascular risk factors underscore the need for affordable therapies and scalable delivery platforms.

Asia-Pacific emerges as a critical growth region, propelled by rapidly expanding healthcare access, generics manufacturing capabilities, and progressive regulatory frameworks in markets such as China and India. Regional governments are incentivizing domestic API production to reduce import dependency, aligning with broader supply chain resilience strategies. As insurers and health authorities prioritize cost-effective care, manufacturers must balance affordability with innovation to capitalize on Asia-Pacific’s burgeoning angina pectoris market.

This comprehensive research report examines key regions that drive the evolution of the Angina Pectoris Drugs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Leading Pharmaceutical Companies’ Strategies Partnerships and Innovation Portfolios Driving Progress in Angina Pectoris Therapies

Major pharmaceutical companies have strategically diversified their angina pectoris portfolios through research collaborations, acquisitions, and internal innovation programs. Pfizer has expanded its calcium channel blocker capacity in European facilities to address both hospital and retail demand, while simultaneously exploring biosimilar partnerships to lower treatment costs and broaden market reach. Sanofi’s launch of dual-action formulations combining calcium channel blockers with diuretics represents a significant step in combination therapy development, enhancing hypertension control and angina symptom management.

AstraZeneca and Novartis have leveraged digital health integration, incorporating patient monitoring apps into their beta blocker and ACE inhibitor therapies to improve adherence and capture real-world evidence. Roche’s commitment to expanding U.S. manufacturing capacity and direct-to-patient distribution models underscores its proactive approach to tariff mitigation and price reform pressures in the American market. Meanwhile, Bayer’s introduction of pediatric-friendly syrup formulations addresses an underserved segment, demonstrating how specialty formulations can unlock new patient populations and revenue streams.

Smaller biotechs are driving niche innovation, particularly in the development of next-generation nitric oxide donors and precision-targeted P2Y12 inhibitors. Their agility in clinical development and willingness to partner with larger players accelerates the translation of novel mechanisms into late-stage assets. Collectively, these strategic maneuvers by established and emerging companies illustrate the competitive landscape’s emphasis on differentiation through formulation, digital engagement, and regional supply chain resilience.

This comprehensive research report delivers an in-depth overview of the principal market players in the Angina Pectoris Drugs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Amgen Inc.

- AstraZeneca PLC

- Aurobindo Pharma Limited

- Bayer AG

- Boehringer Ingelheim International GmbH

- Bristol-Myers Squibb Company

- Daiichi Sankyo Company Limited

- Dr. Reddy's Laboratories Ltd.

- Eli Lilly and Company

- Gilead Sciences Inc.

- GlaxoSmithKline PLC

- Hikma Pharmaceuticals PLC

- Johnson & Johnson

- Merck & Co. Inc.

- Mylan N.V.

- Novartis AG

- Pfizer Inc.

- Regeneron Pharmaceuticals Inc.

- Roche Holding AG

- Sanofi S.A.

- Sun Pharmaceutical Industries Ltd.

- Takeda Pharmaceutical Company Limited

- Teva Pharmaceutical Industries Ltd.

Actionable Recommendations to Strengthen Supply Chain Resilience Embrace Innovation and Enhance Patient Outcomes in Angina Pectoris Treatments

To navigate the evolving angina pectoris drugs market, industry leaders should prioritize supply chain diversification by securing alternative API sources outside traditional hubs to mitigate tariff exposure and ensure uninterrupted production. Concurrently, investing in pharmacogenomic research and companion diagnostics will enable precision medicine approaches that enhance therapeutic efficacy and minimize adverse events, fostering stronger payer and provider partnerships.

Embracing digital health platforms, including remote monitoring and patient engagement apps, will not only elevate adherence and outcomes but also generate valuable real-world data to support market access and regulatory submissions. Additionally, expanding formulation portfolios to include extended-release, transdermal, and sublingual options can address diverse patient preferences and clinical scenarios, driving differentiation and unlocking new end-user segments.

Collaboration with regulatory agencies to advocate for strategic tariff exemptions and streamlined approval pathways will help stabilize costs and accelerate time to market. Lastly, forging alliances with local manufacturers and healthcare systems in key regions-particularly within Asia-Pacific and emerging EMEA markets-will enhance distribution agility and reinforce competitive positioning in a landscape defined by cost controls and evolving reimbursement models.

Transparent Research Methodology Combining Primary Insights Secondary Research and Robust Data Validation Processes for Market Analysis

This research employed a mixed-methods approach, beginning with comprehensive secondary research to map the competitive landscape, regulatory developments, and emerging therapeutic trends. Authoritative journals, patent filings, government policy documents, and industry white papers formed the foundation of the analysis, complemented by proprietary databases tracking clinical pipeline progress.

Primary interviews with cardiologists, pharmacologists, supply chain managers, and health economics experts provided nuanced perspectives on clinical practice patterns, patient adherence challenges, and reimbursement dynamics. These insights were triangulated with quantitative data to validate segment-specific observations and identify strategic inflection points.

Data validation protocols included cross-referencing multiple sources, applying consistency checks, and engaging subject-matter experts to ensure the accuracy and relevance of key findings. This rigorous methodology underpins the report’s actionable recommendations and offers stakeholders a transparent view of the analytical framework supporting the conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Angina Pectoris Drugs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Angina Pectoris Drugs Market, by Drug Class

- Angina Pectoris Drugs Market, by Dosage Form

- Angina Pectoris Drugs Market, by Route Of Administration

- Angina Pectoris Drugs Market, by Distribution Channel

- Angina Pectoris Drugs Market, by End User

- Angina Pectoris Drugs Market, by Region

- Angina Pectoris Drugs Market, by Group

- Angina Pectoris Drugs Market, by Country

- United States Angina Pectoris Drugs Market

- China Angina Pectoris Drugs Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3021 ]

Synthesizing Key Findings on Market Dynamics Innovation Trends and Strategic Imperatives Shaping the Future of Angina Pectoris Therapies

The angina pectoris drugs market is poised at a pivotal juncture, driven by technological convergence, evolving policy landscapes, and shifting patient expectations. Innovation in drug classes and delivery mechanisms offers significant opportunities to enhance efficacy and adherence, while digital health integration promises to transform care delivery and patient engagement.

Simultaneously, the complex repercussions of U.S. tariff policies underscore the importance of proactive supply chain strategies and collaborative policymaking to maintain access and affordability. Segmentation analyses reveal diverse pathways to market growth across drug classes, dosage forms, administration routes, distribution channels, and end-user categories, enabling stakeholders to tailor approaches to distinct clinical and commercial contexts.

Regional and company-specific insights highlight the need for adaptive strategies that address both global trends and local market dynamics. By leveraging precision medicine, digital therapeutics, and supply chain resilience, pharmaceutical companies can meet the dual imperatives of innovation and accessibility. This conclusion synthesizes the report’s core themes, guiding stakeholders toward informed strategic decisions in the angina pectoris drugs market.

Contact Ketan Rohom Associate Director of Sales and Marketing to Secure Your Comprehensive Angina Pectoris Drugs Market Research Report Today

To explore the comprehensive insights and strategic recommendations presented in this executive summary, we invite you to engage directly with Ketan Rohom, Associate Director of Sales & Marketing. Ketan’s deep expertise in pharmaceutical market dynamics and his hands-on approach to client partnerships ensure that you will unlock the full value of our research.

By reaching out to Ketan, you will receive personalized guidance on how this market research report can address your organization’s unique needs, whether it’s supply chain optimization, product pipeline planning, or regional market entry strategies. His collaborative consultation process will help you tailor the findings and recommendations to drive your business objectives effectively.

Don’t miss the opportunity to secure this vital resource for your strategic initiatives. Contact Ketan Rohom today to arrange a detailed discussion and take the first step toward leveraging actionable intelligence for sustained competitive advantage in the angina pectoris drugs market.

- How big is the Angina Pectoris Drugs Market?

- What is the Angina Pectoris Drugs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?