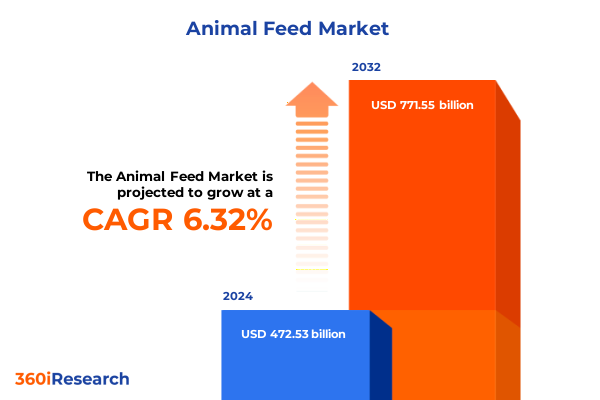

The Animal Feed Market size was estimated at USD 503.05 billion in 2025 and expected to reach USD 531.34 billion in 2026, at a CAGR of 6.30% to reach USD 771.55 billion by 2032.

Unveiling the Key Driving Forces and Foundational Trends Reshaping the Global Animal Feed Industry and Defining Strategic Imperatives

The animal feed industry today stands at a pivotal juncture driven by shifting consumer expectations, evolving regulatory frameworks, and accelerating technological advancement. As livestock and companion animal populations expand globally, the demand for high-quality, nutritionally optimized feed solutions has never been greater. Against this backdrop, producers, ingredient suppliers, and distributors must navigate complex dynamics to maintain competitiveness and meet sustainability goals. By examining the interplay of macroeconomic factors, innovation corridors, and stakeholder priorities, this section lays out the foundational forces shaping the trajectory of animal nutrition.

A convergence of digital transformation and sustainability imperatives is redefining value creation across the supply chain. Advanced analytics, precision feeding technologies, and alternative ingredient sourcing are catalyzing operational efficiencies and enhancing nutritional outcomes. Concurrently, heightened consumer consciousness around animal welfare and environmental footprint is prompting industry leaders to adopt transparent practices and pursue regenerative feed systems. In light of these developments, decision-makers must understand how these driving forces interact to inform strategic investments and partnerships. This introduction primes the reader for a thorough exploration of the landscape, setting the stage for insights into emerging trends and actionable intelligence.

Exploring the Convergence of Technological Innovation Regulatory Evolution and Sustainability Imperatives Driving a New Era in Animal Feed

The animal feed sector is undergoing transformative shifts that extend beyond incremental improvement, marking a new era in which technology, policy, and sustainability intersect to elevate industry standards. Innovations in ingredient formulation, such as precision amino acid balancing and functional additive integration, are revolutionizing nutrient delivery while reducing environmental impacts. These technical advancements are complemented by the adoption of real-time monitoring systems that enable feed producers to optimize formulation and manufacturing processes based on predictive analytics and machine learning models.

Moreover, regulatory landscapes are evolving in response to both public health considerations and climate commitments. Stricter residue limits and emission reduction targets are prompting feed mills to invest in cleaner production technologies and source raw materials from traceable and ethically managed supply chains. Sustainability initiatives are also driving the proliferation of alternative protein sources, including insect meal and single-cell proteins, which promise to alleviate pressure on conventional cereal and grain supplies. Together, these shifts underscore a holistic modernization of the animal feed ecosystem, requiring stakeholders to adapt rapidly and collaborate across silos to harness emerging opportunities.

Assessing How 2025 United States Tariff Measures on Key Feed Ingredients Are Redrawing Supply Chains and Cost Structures

In 2025, United States tariffs have exerted a cumulative effect on both import dynamics and domestic cost structures within the animal feed sector. Heightened duties on key raw materials, particularly cereal and grain imports, have elevated production expenses for feed manufacturers who rely on competitive sourcing from major exporting countries. This has spurred a reconfiguration of supply chains as companies seek to diversify procurement strategies, including expanding relationships with local growers and exploring nontraditional markets with favorable trade terms.

Concurrently, these tariffs have accelerated investment in domestic grain storage and processing infrastructure, as stakeholders aim to mitigate volatility and ensure reliable feedstock availability. While these capital expenditures contribute to long-term resilience, they also present short-term financial burdens that must be balanced against price sensitivity among end users. Moreover, variations in duty structures across ingredient categories, such as fats, oils, and protein meals, have underscored the need for agile sourcing teams capable of navigating complex trade regulations. Within this context, industry leaders are reassessing their global footprints and joint venture strategies to optimize cost efficiency and maintain product quality amid escalating trade tensions.

Uncovering How Detailed Multi-Dimensional Segmentation by Animal Type Ingredient Class Additive Technology Feed Form and Distribution Pathway Reveals Market Dynamics

The multi-dimensional segmentation framework unveils nuanced growth dynamics across different animal types, ingredient categories, additive classes, feed forms, and distribution channels. Analysis by animal type illuminates the varied demand drivers present in aquaculture, pet, poultry, ruminant, and swine segments. While the aquaculture cohort accelerates adoption of specialized feeds to support rapid growth cycles, the pet nutrition sector benefits from premiumization and functional formulations tailored to health and longevity. Poultry, ruminant, and swine operations each display distinct adoption curves for enhanced feed solutions based on herd size, production intensity, and target end markets.

Ingredient type segmentation highlights evolving preferences across cereals and grains, fats and oils, protein meals, and vitamins and minerals. Increasing emphasis on nutrient density and bioavailability is steering formulators toward refined grains, tailored oil blends, high-purity protein concentrates, and fortification strategies leveraging micronutrient chelation. Within additives, demand segmentation across acidifiers, amino acids, antioxidants, enzymes, and probiotics underscores a shift toward science-backed performance enhancers that support gut health, feed conversion efficiency, and immune resilience. Form-related distinctions between crumbles, mash, and pellets reflect processing requirements and feeding behaviors across species, with pellet production witnessing heightened innovation in binder technologies. Finally, distribution channel segmentation between offline and online pathways reveals a burgeoning digital marketplace enabling direct-to-farm ordering, subscription models, and data-driven customer engagement, even as traditional feed retailers maintain essential roles in local supply ecosystems.

This comprehensive research report categorizes the Animal Feed market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Animal Type

- Ingredient Type

- Additives Type

- Form

- Distribution Channel

Revealing How Diverse Regulatory Landscapes Consumer Demands and Agronomic Resources Shape Regional Animal Feed Market Characteristics Globally

Regional analysis identifies distinct patterns of consumption, regulatory frameworks, and innovation across the Americas, Europe, Middle East & Africa, and Asia-Pacific regions. In the Americas, well-established feed industries leverage advanced agricultural technologies and extensive grain production to support cost-effective feed solutions. Sustainability mandates in key markets such as Canada and Brazil are driving investments in carbon footprint reduction and regenerative sourcing. Across Europe, Middle East & Africa, stringent animal welfare regulations and emission targets foster the adoption of precision nutrition and cleaner production methods.

Meanwhile, the Asia-Pacific region stands as the fastest-evolving arena, propelled by rapid urbanization, growing middle-class populations, and rising protein demand. Feed producers in countries like China, India, and Vietnam are expanding capacity and integrating digital supply chain platforms to address scale and traceability challenges. Furthermore, cross-border collaborations and regional trade agreements within this triad of Asia-Pacific markets are opening pathways for ingredient diversification and technology transfer, positioning this region as a critical hub for future innovation in feed formulation and manufacturing excellence.

This comprehensive research report examines key regions that drive the evolution of the Animal Feed market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Strategic R&D Investments Vertical Integration Initiatives and Collaborative Partnerships Driving Competitive Advantage

Leading enterprises in the animal feed domain continue to differentiate through strategic investments in research and development, vertical integration, and collaborative partnerships. Industry frontrunners have intensified their focus on developing proprietary feed additives and precision nutrition platforms that deliver measurable performance improvements. Simultaneously, control over upstream operations such as grain origination, oilseed processing, and additive manufacturing has become a hallmark of market leaders seeking to secure ingredient quality and cost stability.

Partnerships with technology firms and academic institutions are proliferating, allowing companies to co-develop novel feed formulations and digital tools for real-time performance monitoring. Additionally, mergers and acquisitions have consolidated key segments, enabling broader geographical coverage and streamlined distribution networks. Sustainability certification programs and third-party audits further differentiate companies that can demonstrate transparent sourcing and environmental stewardship. As competitive pressures mount, these strategic imperatives underscore the importance of innovation ecosystems and integrated supply chain governance for maintaining leadership positions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Animal Feed market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alltech

- Archer Daniels Midland Company

- Avanti Feeds Limited

- BASF SE

- Biomar Group

- Bluestar Adisseo Co Ltd

- BRF S.A.

- Cargill, Incorporated

- Charoen Pokphand Foods PCL

- De Heus Animal Nutrition

- Evonik Industries AG

- ForFarmers N.V.

- Godrej Agrovet Limited

- Guangdong HAID Group Co Ltd

- Harim Group

- JA Zen-Noh

- Kemin Industries, Inc.

- Kent Nutrition Group

- Land O'Lakes Inc.

- Muyuan Foodstuff

- New Hope Group

- Nutreco N.V.

- Shuangbaotai Group Twins Group

- Tyson Foods, Inc.

Crafting an Integrative Five-Pronged Strategic Blueprint Focused on Resilience Innovation Digitalization Partnership and ESG Excellence

To capitalize on emerging trends and mitigate industry headwinds, leaders should align their strategies around five pivotal actions. First, enhancing supply chain resilience through diversification of raw material sources and investment in storage and processing infrastructure will buffer against trade-induced shocks and cost fluctuations. Second, accelerating the development of precision nutrition and functional additive portfolios will meet escalating customer expectations around performance, animal welfare, and sustainability.

Third, advancing digital transformation initiatives-ranging from predictive analytics for formulation optimization to blockchain-enabled traceability-will unlock efficiency gains and foster transparency across stakeholders. Fourth, cultivating strategic alliances with academia, technology providers, and contract manufacturing partners will expedite the commercialization of innovative feed solutions. Finally, embedding environmental and social governance principles throughout operations-from regenerative sourcing programs to emissions management-will enhance brand reputation and align with evolving policy requirements. By executing this multi-pronged approach, industry leaders can navigate complexity, drive differentiation, and secure long-term value creation.

Detailing a Robust Hybrid Research Methodology Combining Primary Stakeholder Interviews Secondary Literature Analysis and Expert Validation

This analysis is underpinned by a rigorous research methodology that amalgamates primary and secondary data sources to ensure accuracy and depth. Primary insights were garnered through structured interviews with key stakeholders including feed mill executives, livestock producers, ingredient suppliers, and regulatory authorities. These engagements provided firsthand perspectives on operational challenges, innovation drivers, and regional nuances.

Complementing these inputs, extensive secondary research was conducted across peer-reviewed journals, industry white papers, trade publications, and government reports to validate trends and contextualize market developments. Quantitative data were triangulated through cross-verification of industry databases, customs records, and corporate disclosures to establish reliable qualitative frameworks. The final analysis was subjected to expert reviews and iterative feedback loops to refine conclusions and ensure alignment with current market realities. This comprehensive approach affords confidence in the robustness and relevance of the insights presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Animal Feed market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Animal Feed Market, by Animal Type

- Animal Feed Market, by Ingredient Type

- Animal Feed Market, by Additives Type

- Animal Feed Market, by Form

- Animal Feed Market, by Distribution Channel

- Animal Feed Market, by Region

- Animal Feed Market, by Group

- Animal Feed Market, by Country

- United States Animal Feed Market

- China Animal Feed Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing the Critical Interplay of Innovation Sustainability and Strategic Adaptation Shaping the Future Trajectory

The animal feed industry’s evolution is marked by a confluence of technological innovation, shifting regulatory standards, and strategic supply chain adaptations. As this executive summary has illustrated, stakeholders must navigate a complex tapestry of tariff influences, segmented demand drivers, and regional heterogeneity to maintain competitiveness and foster growth. By synthesizing segmentation insights, regional distinctions, and corporate strategies, it becomes evident that agility and innovation will define the leaders of tomorrow.

Moreover, the interplay between sustainability objectives and performance requirements underscores the need for a balanced approach that integrates environmental stewardship with economic viability. Companies that successfully align digital capabilities, research-driven formulation, and resilient procurement strategies will be best positioned to capture emerging opportunities. Ultimately, this report emphasizes the imperative for ongoing collaboration among industry participants to drive continuous improvement and deliver sustainable, high-quality nutrition solutions for animals worldwide.

Engage with Our Leading Industry Expert to Unlock Exclusive Strategic Insights and Acquire the Comprehensive Animal Feed Market Research Report Tailored to Your Needs

For a deeper exploration of these comprehensive insights and to secure tailored strategic guidance, reach out to Ketan Rohom, Associate Director, Sales & Marketing. Partnering with an expert of his caliber will not only unlock the full potential of this rigorous research but also empower your organization with actionable roadmaps to navigate the dynamic animal feed industry. Engage with Ketan today to acquire the complete market research report and position your enterprise at the forefront of innovation and growth

- How big is the Animal Feed Market?

- What is the Animal Feed Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?