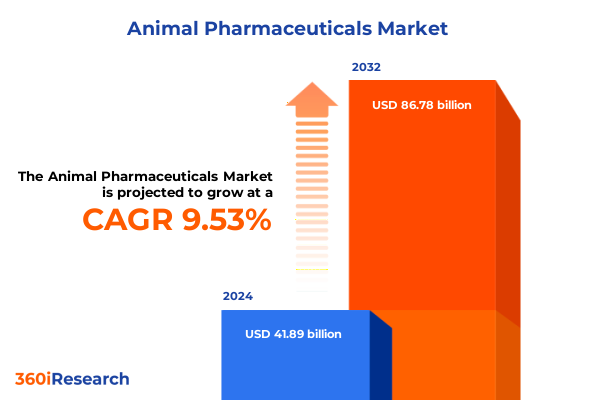

The Animal Pharmaceuticals Market size was estimated at USD 45.74 billion in 2025 and expected to reach USD 49.97 billion in 2026, at a CAGR of 9.57% to reach USD 86.78 billion by 2032.

Unveiling the Core Dynamics and Strategic Imperatives Shaping the Animal Pharmaceuticals Industry Amid Accelerated Innovation and Market Evolution

The animal pharmaceuticals industry stands at a critical juncture where evolving veterinary practices, heightened regulatory expectations, and shifting animal health needs intersect. Growing concerns over antimicrobial resistance and biosecurity are prompting stakeholders to prioritize robust disease prevention strategies and sustainable therapeutic approaches. Concurrently, increasing pet ownership across mature markets and the intensification of livestock operations in emerging economies are driving an unprecedented demand for advanced veterinary treatments. As a result, companies are racing to balance innovation pipelines with operational excellence to address diverse clinical indications while ensuring product safety and affordability.

Amid this complexity, technological integration is becoming indispensable. Molecular diagnostics and digital health tools are transforming disease surveillance, facilitating earlier interventions and precise treatment protocols that enhance both livestock productivity and companion animal well-being. The convergence of biologic therapies, next-generation vaccines, and novel parasiticides is redefining therapeutic standards. This landscape, characterized by rapid innovation cycles and intricate supply chains, compels industry players to adopt agile strategies and deepen collaboration with academic, governmental, and end-user partners to maintain market relevance and drive sustainable growth.

Identifying Transformative Shifts Driving Disruptive Change and New Growth Trajectories in the Global Animal Health and Veterinary Medicine Ecosystem

Recent years have witnessed transformative shifts reshaping the animal health landscape. Integration of digital technologies such as telemedicine, electronic health records, and advanced data analytics is enabling veterinarians to make evidence-based decisions, optimize treatment schedules, and predict disease outbreaks with unprecedented accuracy. Telehealth solutions are broadening access to veterinary care, particularly in remote and underserved areas, while EHR platforms streamline clinical workflows and enhance adherence to vaccination protocols.

At the same time, personalized veterinary medicine is gaining traction. Advances in genomics and bioinformatics empower tailored therapeutic regimens, allowing clinicians to consider breed-specific susceptibilities and individual health profiles when administering biologics and pharmaceuticals. This precision approach not only improves treatment efficacy but also mitigates adverse drug interactions and supports responsible stewardship of antimicrobial agents.

Furthermore, sustainability concerns and antimicrobial resistance trends are spurring the development of eco-friendly parasiticides and feed additives that promote gut health and reduce reliance on traditional antibiotics. Stakeholders are increasingly leveraging circular economy principles, from green manufacturing processes to transparent supply chain tracking, aligning profitability with environmental responsibility. Collectively, these shifts are forging a more integrated, technology-enabled ecosystem in which therapeutics, diagnostics, and digital services converge to meet evolving animal health challenges.

Evaluating the Cumulative Impact of Escalating United States Tariffs on Animal Pharmaceutical Supply Chains Costs and Strategic Responses

The cumulative impact of tariffs imposed by the United States in 2025 is exerting significant pressure on animal pharmaceutical supply chains. A 10% global tariff introduced in April extends to active pharmaceutical ingredients, packaging materials, and veterinary devices, escalating production costs across the value chain. Additionally, targeted duties of up to 25% on APIs from China and India, combined with 15% levies on sterile packaging and lab equipment, have inflated input costs for both branded and generic animal therapies.

Veterinary distributors, operating on narrow margins, are absorbing tariff pass-throughs that translate into higher prices for clinics and end users. Small animal practices have reported increased expenditures on imported anesthetics and injectables, while large animal operations face steeper costs for bulk vaccines and dewormers, with potential downstream effects on herd health decision-making and farm-level profitability. Delays at customs and added documentation requirements are further straining just-in-time inventory models, leading to intermittent drug shortages and forcing practitioners to seek alternative therapies or adjust treatment protocols.

In response, manufacturers and distributors are exploring strategic reshoring and regional sourcing partnerships to mitigate risk. Some animal health companies are accelerating domestic fill-finish investments, while others are securing long-term supply agreements with API producers outside high-tariff jurisdictions. These adaptive measures aim to preserve operational continuity, protect margins, and ensure reliable access to critical veterinary pharmaceuticals in a volatile trade environment.

Revealing Key Segmentation Insights Highlighting How Product Types Species Administration Routes Disease Profiles End Users and Channels Shape Market Dynamics

Insight into market segmentation reveals a nuanced tapestry of product categories, species considerations, administration modalities, disease types, end-user affiliations, and distribution mechanisms that collectively shape demand patterns. Anesthetics, anti-inflammatory medications, antibiotics, hormones and growth regulators, parasiticides, and vaccines each address distinct clinical needs, with antibiotics such as fluoroquinolones and macrolides serving as cornerstones in both companion and livestock health. Parasiticides, including anthelmintics and ectoparasiticides, are critical for preventive herd management, while vaccines-ranging from inactivated to live attenuated and subunit formats-underpin expansive immunization programs across global markets.

Species-based differentiation underscores unique health profiles and regulatory pathways. Aquatic animals require specialized diagnostics and water-stable formulations, while birds benefit from rapid-onset immunizations to curb avian influenza risks. Companion animals, particularly cats, dogs, and horses, drive demand for precision therapeutics and wellness diagnostics, whereas livestock segments like cattle, poultry, sheep, goats, and swine emphasize scalable, cost-effective solutions. Wild animals, though niche, demand targeted interventions to support conservation and zoo health initiatives.

Route of administration further influences product design and uptake. Oral formulations-capsules, liquid solutions, powders, and tablets-offer noninvasive compliance, whereas parenteral injections deliver rapid pharmacokinetics for acute treatments. Topical applications such as creams, ointments, and sprays enable localized therapy, ideal for dermatological conditions. Disease type segmentation, from bacterial and viral infections to inflammatory disorders and reproductive dysfunctions, drives specialized R&D focus. End users span government and public health organizations, livestock and poultry farms, pet owners, research institutions, and veterinary clinics and hospitals. Finally, distribution channels encompass offline pharmacies for traditional fulfillment and online pharmacies that cater to direct-to-consumer convenience, redefining market access and accelerating adoption of novel therapies.

This comprehensive research report categorizes the Animal Pharmaceuticals market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Species

- Route of Administration

- Disease Type

- End User

- Distribution Channels

Uncovering Regional Disparities and Strategic Opportunities Across Americas EMEA and AsiaPacific Animal Health Markets in the PostPandemic Era

Regional dynamics in the animal pharmaceuticals landscape reflect divergent growth drivers, regulatory contours, and market preferences across the Americas, EMEA (Europe, Middle East & Africa), and Asia-Pacific. In the Americas, the United States leads with advanced veterinary infrastructure, high companion animal healthcare expenditure, and sophisticated distribution networks. Canada’s expanding livestock vaccine programs complement U.S. innovation, while Brazil’s robust cattle industry is driving demand for large-scale preventive biologics. Trade pacts within North America are also fostering collaborative research and harmonized regulatory standards.

Within EMEA, Europe’s stringent regulatory frameworks and emphasis on sustainable farming practices are elevating demand for eco-friendly parasiticides and precision biologics. The Middle East focuses investments on disease surveillance capabilities and transboundary livestock health, while African markets present untapped potential for low-cost generic therapeutics, bolstered by public-private partnerships in zoonotic disease control. Regulatory convergence efforts, spearheaded by the European Medicines Agency and regional blocs, are streamlining approvals for novel vaccines and feed additive solutions.

Asia-Pacific is the fastest-growing region, propelled by expanding middle-class pet ownership in China and India, intensive poultry and aquaculture operations in Southeast Asia, and rising government immunization mandates in Australia and New Zealand. Less restrictive approval pathways enable quicker market entry for biosimilars and inactivated vaccines, while digital health platforms are scaling telemedicine and remote monitoring in rural provinces. Collectively, these regional nuances underscore the importance of tailored market strategies that align with local animal health priorities and regulatory landscapes.

This comprehensive research report examines key regions that drive the evolution of the Animal Pharmaceuticals market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Collaborations Innovation Pathways and Competitive Initiatives of Leading Animal Pharmaceutical Companies Driving Market Leadership

A deep dive into the competitive landscape reveals that industry leadership increasingly hinges on integrated portfolios, strategic collaborations, and innovation ecosystems. Zoetis maintains a dominant position through extensive offerings across companion animal parasiticides and livestock vaccines, fortified by data-driven health management platforms. Merck Animal Health is investing heavily in domestic production capacity, exemplified by its USD 895 million expansion in Kansas to bolster antigen manufacturing and R&D capabilities. Elanco focuses on targeted growth acquisitions, exemplified by its partnership with Medgene to commercialize avian influenza vaccines, marrying startup agility with incumbent distribution reach.

Boehringer Ingelheim leverages vertical integration, securing its supply chain from raw-material sourcing to fill-finish, while Virbac and Ceva concentrate on specialist segments-veterinary dermatology and aquaculture biologics, respectively. Notably, Advanced Instruments’ acquisition of Nova Biomedical in March 2025 signals a trend toward consolidation of diagnostic platforms to complement therapeutic offerings. Competitive differentiation is further achieved through value-added services such as predictive analytics for outbreak forecasting, cold-chain monitoring solutions, and integrated telehealth applications. As e-commerce pharmacies gain traction, companies that orchestrate omnichannel strategies, balancing traditional distribution with direct-to-clinic digital channels, are poised to capture incremental market share and reinforce customer loyalty.

This comprehensive research report delivers an in-depth overview of the principal market players in the Animal Pharmaceuticals market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aurora Pharmaceutical, Inc.

- Bimeda Inc.

- Biogénesis Bagó S.A.

- Biovac Ltd.

- Boehringer Ingelheim International GmbH

- Ceva Santé Animale

- Chanelle Pharma

- China Animal Husbandry Industry Co., Ltd.

- Dechra Pharmaceuticals PLC

- ECO Animal Health Group PLC

- Elanco Animal Health Incorporated

- Hester Biosciences Limited

- Huvepharma, Inc.

- Indian Immunologicals Ltd.

- Intas Pharmaceuticals Ltd.

- Laboratorio Drag Pharma Chile Invetec S.A.

- Merck & Co., Inc.

- Neogen Corporation

- Nippon Zenyaku Kogyo Co., Ltd.

- Norbrook Group

- Nutramax Laboratories Veterinary Sciences, Inc

- Orion Corporation

- PetIQ, LLC

- Phibro Animal Health Corporation

- Teknofarma S.r.l.

- Veterinary Pharmaceutical Solutions

- Vetoquinol Group

- Vetpharma Animal Health S.L. by Insud Pharma S.L.U.

- Virbac S.A.

- Zendal Group

- Zoetis Inc.

Actionable Recommendations Offering Strategies to Strengthen Supply Chains Drive Innovation and Foster Sustainable Growth in the Animal Pharmaceutical Industry

Industry leaders must prioritize strategic investments in supply chain resilience to mitigate tariff-related disruptions and ensure uninterrupted access to critical inputs. This involves diversifying supplier networks, establishing regional manufacturing hubs, and adopting real-time logistics tracking to preempt bottlenecks. Concurrently, accelerating digital transformation initiatives-such as deploying telemedicine platforms and AI-powered diagnostics-will unlock operational efficiencies, enhance disease surveillance, and expand service coverage into underserved regions.

R&D portfolios should be recalibrated to emphasize next-generation biologics, including mRNA and vector-based vaccines, along with novel parasiticides that address emerging resistance profiles. Collaborative innovation models, forging alliances with biotech startups and academic institutions, can expedite platform technology transfers while sharing development risk. Stakeholders should also integrate circular economy principles, implementing green chemistry protocols and sustainable manufacturing processes that align with global environmental commitments.

Finally, market access strategies must adapt to evolving end-user preferences. Pet owners and livestock producers increasingly value personalized care pathways and integrated service models, blending therapeutics with digital health offerings. Embracing omnichannel networks-combining traditional veterinary channels with online pharmacies and teleconsultation services-will be essential for maximizing reach and reinforcing brand trust. By adopting these recommendations, industry participants can secure long-term competitiveness and foster sustainable value creation within the dynamic animal pharmaceuticals sector.

Detailing Robust Research Methodology Emphasizing Data Sources Analytical Frameworks and Validation Processes Underpinning the Pharmaceuticals Market Analysis

This research leverages a comprehensive, multi-tiered methodology to ensure robust and unbiased insights. Secondary research entailed an extensive review of regulatory filings, peer-reviewed journals, industry white papers, and proprietary databases. Key public sources included the U.S. Food and Drug Administration, European Medicines Agency guidelines, and World Organisation for Animal Health standards, which provided critical context on approval pathways and compliance requirements.

Primary research comprised in-depth interviews with senior executives, R&D leaders, and procurement specialists spanning pharmaceutical manufacturers, distributors, veterinary practitioners, and regulatory agencies. This qualitative input was triangulated against quantitative data points derived from customs records, trade publications, and financial disclosures to validate trend trajectories and strategic imperatives.

Analytical frameworks such as Porter’s Five Forces and SWOT analyses were applied at each segmentation level-product type, species focus, administration route, disease category, end-user, and distribution channel-to assess competitive intensity and market attractiveness. Regional market modeling incorporated localized regulatory nuances, CAGR projections from reputable think tanks, and tariff schedules published under Section 232 of the Trade Expansion Act. All findings underwent iterative peer review by subject-matter experts to ensure accuracy, relevance, and actionable value for decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Animal Pharmaceuticals market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Animal Pharmaceuticals Market, by Product Type

- Animal Pharmaceuticals Market, by Species

- Animal Pharmaceuticals Market, by Route of Administration

- Animal Pharmaceuticals Market, by Disease Type

- Animal Pharmaceuticals Market, by End User

- Animal Pharmaceuticals Market, by Distribution Channels

- Animal Pharmaceuticals Market, by Region

- Animal Pharmaceuticals Market, by Group

- Animal Pharmaceuticals Market, by Country

- United States Animal Pharmaceuticals Market

- China Animal Pharmaceuticals Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2544 ]

Synthesizing Core Findings and Strategic Imperatives to Illuminate the Path Forward for Stakeholders in the Evolving Animal Pharmaceuticals Industry Landscape

Drawing together these insights reveals a sector defined by accelerating innovation, complex regulatory landscapes, and evolving end-user expectations. Breakthroughs in biologic platforms and digital health integration are setting new clinical benchmarks, while sustainability imperatives and trade policy shifts are reshaping supply chain strategies. Segmentation analysis underscores the diverse requirements across species, administration methods, and disease profiles, highlighting fertile opportunities in both high-density companion animal markets and emerging livestock regions.

Regional perspectives illustrate that while the Americas and EMEA prioritize regulatory rigor and infrastructure investment, Asia-Pacific offers rapid expansion driven by pet humanization and intensive animal farming. Competitive dynamics are increasingly informed by strategic collaborations, M&A activity, and digital service layering, as leading companies seek to differentiate through integrated offerings.

Collectively, these findings point to a future in which agility, technological proficiency, and sustainability ethos will be the hallmarks of market leadership. Stakeholders that align their product pipelines, operational models, and customer engagement strategies with these imperatives will be best positioned to capitalize on the evolving animal pharmaceuticals landscape and deliver resilient growth.

Encouraging Industry Leaders to Engage with Associate Director Ketan Rohom to Access Comprehensive Market Research Insights and Secure Strategic Advantage

Thank you for exploring these insights into the dynamic animal pharmaceuticals sector. To secure comprehensive analysis and strategic guidance tailored to your organization’s unique challenges and opportunities, reach out today to Ketan Rohom, Associate Director, Sales & Marketing. His expertise will ensure you gain access to the full market research report, enabling your team to make informed, data-driven decisions that drive growth and competitive advantage. Engage with Ketan to begin unlocking actionable insights and positioning your organization at the forefront of the animal health industry’s next wave of innovation and expansion.

- How big is the Animal Pharmaceuticals Market?

- What is the Animal Pharmaceuticals Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?