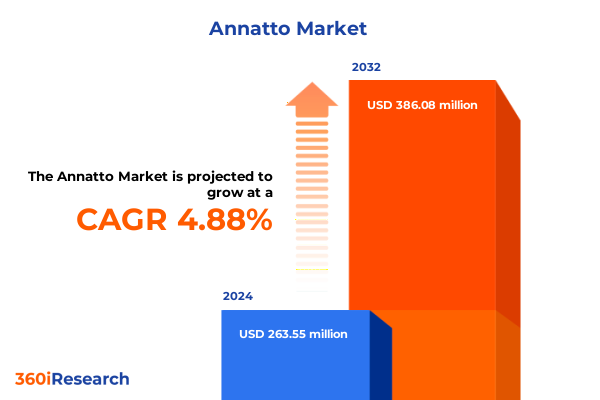

The Annatto Market size was estimated at USD 275.88 million in 2025 and expected to reach USD 293.39 million in 2026, at a CAGR of 4.91% to reach USD 386.08 million by 2032.

Delving into the Rising Significance of Natural Annatto Pigments as Drivers of Innovation and Consumer Preference in Global Markets

The natural pigment derived from the seeds of Bixa orellana has emerged as a cornerstone for innovation across food, cosmetic, pharmaceutical, and textile industries. As consumer preferences increasingly gravitate toward plant-based, clean-label, and sustainably sourced ingredients, annatto’s vibrant hues and functional versatility solidify its position in product development strategies worldwide. Over recent years, this pigment’s appeal has transcended its traditional role as a coloring agent, finding new applications as an antioxidant, UV protector, and natural preservative. Consequently, stakeholders throughout the value chain-from cultivators and extractors to formulators and brand marketers-are recalibrating their priorities to harness the multifaceted potential of annatto.

Building on these developments, the broader landscape of natural colorants is witnessing intensified research into enhanced extraction techniques, regulatory harmonization, and standardized quality metrics that ensure consistent performance and safety. In turn, this has stimulated collaborative ventures between raw material suppliers and end users aimed at co-creating tailored annatto formulations that satisfy stringent clean-label mandates and regulatory requirements. Against this backdrop, the executive summary provides an overarching lens on the critical drivers, emerging challenges, and strategic opportunities shaping annatto’s trajectory toward mainstream adoption.

Unprecedented Shifts in Production Processes, Regulatory Frameworks, and Consumer Demand are Redefining the Global Annatto Market Landscape

A confluence of factors is redefining the contours of the annatto market at an unprecedented pace. On the regulatory front, recent updates in food safety authorities have accelerated approvals for solvent-extracted and emulsified variants, enabling formulators to achieve more stable color profiles in diverse matrices. Concurrently, advanced green extraction technologies-such as supercritical CO₂ and enzymatic-assisted processes-are reducing solvent residues while preserving bioactive constituents, thereby addressing sustainability imperatives and cost pressures.

Equally transformative is the surge in demand for organic and non-GMO ingredients within the food and personal care sectors, which has forced suppliers to augment traceability mechanisms and secure certified organic cultivation sites. Furthermore, the proliferation of direct-to-consumer and e-commerce channels has disrupted traditional distribution norms, compelling industry participants to recalibrate logistics, packaging innovations, and digital marketing strategies. As these shifts gain momentum, they are converging to create an ecosystem in which agility, transparency, and product differentiation become non-negotiable prerequisites for competitive advantage.

Assessing How the Introduction of United States Tariffs in 2025 Has Reshaped Import Dynamics, Pricing Structures, and Competitive Positioning of Annatto

The imposition of new tariff structures by the United States in 2025 has introduced a complex layer of cost implications that reverberate across the entire annatto value chain. Importers now contend with elevated duties that have incrementally increased landed costs for both solvent-extracted and oil-soluble varieties. In response, manufacturers have begun exploring alternative sourcing arrangements, including nearshoring to Latin American and Asian suppliers with preferential trade terms, as well as vertical integration strategies that hedge against volatility in import expenses.

Consequently, pricing dynamics have shifted from simple spot-purchase models to long-term framework agreements designed to lock in favorable rates and volume commitments. Domestic processors have seized the moment to invest in in-house extraction capabilities, striving to mitigate dependency on imports and preserve margin structures. Nonetheless, smaller-scale extractors face capital constraints that challenge their ability to adapt, prompting a reshaping of competitive hierarchies within the market. In this environment, strategic collaborations and joint ventures have become pivotal in sharing infrastructure costs and accelerating time to market under the new tariff regime.

Unraveling the Multifaceted Segmentation of the Annatto Market to Reveal Nuanced Insights Across Types, Sources, Forms, Packaging, and End-User Applications

Segmenting the annatto market reveals diverse growth trajectories and performance benchmarks across its various dimensions. When categorizing by type, emulsified and solvent-extracted annatto lead innovation pipelines focused on enhanced color stability and functional attributes, while oil soluble and water soluble forms cater to specific formulation requirements in fatty or aqueous matrices. Shifting to source differentiation, organic annatto is capturing premium positioning as clean-label trends intensify, even as conventional variants remain the workhorse for cost-sensitive applications.

Examining product form exposes a dichotomy in end-user preferences: liquid and paste concentrations dominate high-throughput industrial processes where rapid dispersion is critical, whereas powdered annatto appeals to niche segments seeking precise dosing and extended shelf stability. Packaging typologies further elucidate market nuances; bottles, jars, and pouches are selected based on handling convenience, shelf presence, and protection against light and moisture. In terms of end-user verticals, cosmetic and personal care brands prioritize color cosmetics for visual appeal, haircare for UV filtration benefits, and skincare for antioxidant properties. The food and beverages sector spans bakery items requiring uniform crumb coloration, dairy products seeking natural hue enhancement, and snack foods targeting eye-catching appeal. Pharmaceutical users utilize supplements for nutraceutical positioning, syrups for functional formulations, and topical medications for tinting purposes. Lastly, distribution channels bifurcate into offline retail chains and specialty stores offering experiential displays, and online platforms including company websites and e-commerce marketplaces where digital transparency and convenience drive purchasing behavior.

This comprehensive research report categorizes the Annatto market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Source

- Product Form

- Packaging Type

- End-User

- Distribution Channel

Exploring Regional Differentiators in Annatto Demand and Supply Dynamics Across the Americas, Europe Middle East and Africa, and Asia Pacific Regions

Geographic regions exhibit distinct consumption patterns, regulatory landscapes, and supply chain configurations that collectively shape annatto’s performance and potential. In the Americas, long-standing production hubs in Brazil and Peru underpin a well-established export network, with robust domestic demand for natural colorants in processed foods and beverage applications. Shifting focus to the Europe Middle East and Africa region, strict regulatory oversight by bodies such as the European Food Safety Authority has fostered rigorous quality control measures, driving higher acceptance rates for certified organic and solvent-extracted variants.

Transitioning to Asia Pacific, burgeoning economic growth in nations like India and China is fueling demand for annatto in both traditional culinary uses and emerging personal care formulations. Supply chain innovation is particularly pronounced in this region, where investments in extraction and purification technologies are accelerating localization efforts. Across all territories, cross-border collaborations in research alliances and trade agreements continue to facilitate knowledge transfer and streamline logistical pathways, underscoring the strategic importance of region-specific insights for market participants aiming to optimize their footprints.

This comprehensive research report examines key regions that drive the evolution of the Annatto market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Their Strategic Initiatives to Enhance Market Leadership and Innovation in the Annatto Sector

Leading players in the annatto sector are deploying a range of strategies to solidify their market positions and unlock new sources of value. Major ingredient suppliers are investing in advanced extraction facilities that combine mechanical and enzymatic processes, thereby improving pigment yield and purity while reducing solvent use. Research and development initiatives are increasingly collaborative, with partnerships between multinational corporations and specialized extractors yielding co-developed formulations tailored to premium cosmetics and functional foods.

At the same time, smaller niche operators are carving out customized service offerings, such as clean-label certification support and small-batch pilot runs, to cater to emerging vegan and allergen-free segments. Value chain integration is another notable trend, with some participants establishing in-house cultivation plots to secure consistent raw material quality and reinforce traceability. In addition, digital platforms for real-time supply chain tracking are gaining traction, enabling stakeholders to monitor quality parameters and compliance status at every stage. These collective moves illustrate a competitive landscape where scale, innovation capabilities, and operational transparency define leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Annatto market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aarkay Food Products Ltd.

- AICA Colour

- Amerilure, Inc.

- Archer Daniels Midland Company

- BioconColors

- Botanic Healthcare Pvt. Ltd.

- Chr. Hansen A/S-Oterra A/S

- colorMaker, Inc.

- Curio Spice Company

- Dairy Connection, Inc.

- DDW, Inc

- Döhler GmbH

- Frutarom Natural Solutions Ltd part of INTERNATIONAL FLAVORS & FRAGRANCES INC.

- GNT group

- IFC Solutions

- Imbarex

- Kalsec Inc.

- Kolorjet Chemicals Pvt. Ltd.

- MANE KANCOR INGREDIENTS PRIVATE LIMITED

- McCormick & Company, Inc.

- Medikonda Nutrients.

- Moksha Lifestyle Products

- ROHA Group.

- Royaldivine Produce Products LLP

- Sensient Technologies Corporation

- Sun Chemical Group Cooperatief U.A.

- VEDAN International (Holdings) Limited

- Vinayak Ingredients India Pvt. Ltd

Strategic Imperatives and Proactive Measures Industry Leaders Must Adopt to Capitalize on Emerging Opportunities and Mitigate Risks in the Annatto Market

To thrive amid evolving market dynamics, industry leaders should prioritize targeted investments in sustainable extraction technologies that reduce environmental footprint and align with emerging regulatory benchmarks. Simultaneously, forging strategic alliances with certified organic growers can secure preferred access to premium-quality raw materials, enabling premium product positioning. Furthermore, companies should explore co-development partnerships with end-user brands to co-create differentiated annatto formulations that address specific functional requirements and consumer trends.

In parallel, enhancing digital supply chain platforms will bolster real-time visibility, quality assurance, and provenance verification-capabilities that are increasingly becoming prerequisites for market access. On the commercial front, segment-specific marketing strategies that leverage storytelling around annatto’s natural origin and health benefits can strengthen brand equity in both online and offline channels. Finally, flexible pricing models incorporating long-term purchase agreements and value-added service bundles will help mitigate tariff-induced cost pressures and foster loyal customer relationships.

Comprehensive Research Framework Integrating Primary Engagements, Secondary Analysis, and Data Triangulation to Ensure Robust Annatto Market Insights

This study employs a rigorous research framework combining primary and secondary methodologies to uncover comprehensive insights into the annatto market. Primary engagements include in-depth interviews with key stakeholders spanning raw material cultivators, extraction technology providers, formulators, and end-user brand managers. These interactions yield qualitative context around production challenges, regulatory developments, and innovation pipelines. Secondary analysis draws on reputable scientific journals, trade association publications, and regulatory agency databases to establish historical baselines, validate qualitative findings, and map evolving policies affecting annatto commercialization.

To ensure robustness, data triangulation is conducted by cross-verifying primary insights with secondary sources, while scenario analysis helps delineate potential impacts of tariff changes and shifting consumer preferences. Additionally, supply chain mapping exercises identify critical nodes and logistics pathways, providing a clear understanding of cost drivers and risk factors. The combination of these methods yields a 360-degree perspective on market dynamics, enabling stakeholders to make evidence-based strategic decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Annatto market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Annatto Market, by Type

- Annatto Market, by Source

- Annatto Market, by Product Form

- Annatto Market, by Packaging Type

- Annatto Market, by End-User

- Annatto Market, by Distribution Channel

- Annatto Market, by Region

- Annatto Market, by Group

- Annatto Market, by Country

- United States Annatto Market

- China Annatto Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Synthesis of Core Findings and Strategic Implications Underscoring the Transformative Potential of Annatto as a Natural Pigment Across Industries

The synthesis of current trends underscores annatto’s emergence as a pivotal natural pigment with applications extending beyond coloration to include antioxidant protection and UV filtration. Regulatory harmonization and advanced extraction methods are setting new quality benchmarks, while clean-label and organic certifications are driving premiumization. The 2025 tariff landscape has reconfigured supply chains, compelling stakeholders to pursue nearshoring and vertical integration to preserve competitiveness. Moreover, segmentation analysis reveals differentiated growth trajectories across type, source, form, packaging, and end-user verticals, underscoring the importance of tailored strategies.

Regional insights highlight the Americas’ established production capabilities, the stringent quality regimes in Europe Middle East and Africa, and the rapid demand growth and localization initiatives in Asia Pacific. Leading companies are responding through collaborative R&D, digital supply chain platforms, and traceability enhancements. To capitalize on these developments, actionable measures around sustainable technologies, strategic partnerships, and dynamic pricing models are essential. Collectively, these findings illuminate a market on the cusp of accelerated innovation and expansion, presenting significant opportunities for stakeholders across the value chain.

Engage with Ketan Rohom to Unlock In-Depth Insights, Customized Solutions, and Exclusive Access to the Comprehensive Annatto Market Research Report

In an increasingly competitive landscape, securing comprehensive, data-driven insights is paramount for driving strategic growth in the annatto market. I encourage you to connect directly with Ketan Rohom, who brings extensive expertise in translating complex market dynamics into actionable strategies. His personalized guidance will illuminate the nuances of supply chain adaptations, tariff influences, and segmentation opportunities tailored to your unique business objectives.

Engaging with Ketan Rohom ensures you receive exclusive access to the full market research report, enriched with detailed analysis spanning regulatory developments, regional consumption patterns, and leading company initiatives. His collaborative approach allows you to customize deliverables to focus on priority geographies, product forms, or end-user verticals, enabling your organization to make confident, informed decisions without delay. Reach out today to elevate your market positioning and capitalize on emerging trends before your competitors gain traction.

- How big is the Annatto Market?

- What is the Annatto Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?