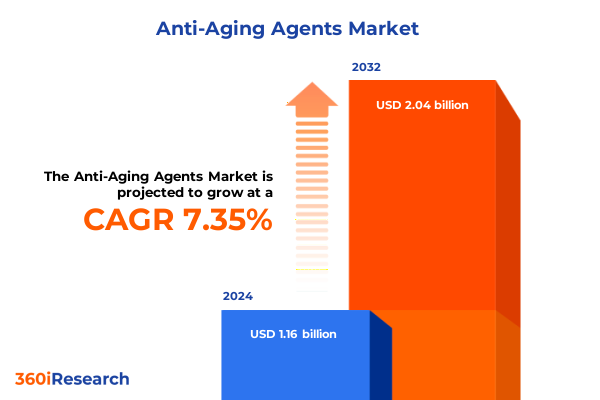

The Anti-Aging Agents Market size was estimated at USD 1.23 billion in 2025 and expected to reach USD 1.32 billion in 2026, at a CAGR of 7.45% to reach USD 2.04 billion by 2032.

Setting the Stage for an In-Depth Exploration of Pioneering Anti-Aging Agents That Are Redefining Wellness Innovation and Consumer Expectations

The anti-aging agents market represents a dynamic intersection of cutting-edge science, consumer wellness aspirations, and cosmetic innovation. Over the past decade, advancements in molecular biology and dermatological research have unlocked potent ingredients and formulations that go beyond superficial wrinkle reduction to target cellular aging pathways. As a result, skincare has evolved from a beauty accessory to an integral component of holistic health regimens, supported by clinical validation and rigorous safety standards.

In this report, we embark on a deep exploration of the trends, drivers, and strategic considerations shaping the landscape for anti-aging agents. By examining product innovation, distribution models, regulatory frameworks, and consumer behaviors, we uncover the forces driving market maturation and the pathways for sustainable growth. Through a balanced mix of quantitative assessments and qualitative insights, our objective is to empower industry decision-makers with actionable intelligence that informs both short-term tactics and long-term strategic planning.

Charting the Unprecedented Technological, Regulatory, and Consumer-Driven Shifts Reshaping the Anti-Aging Agents Market Landscape Globally

In recent years, transformative forces within the beauty and wellness sector have converged to redefine anti-aging strategies. Consumers are no longer content with one-dimensional wrinkle treatments; instead, they seek products rooted in longevity science that promise cellular rejuvenation and enhanced skin resilience. This shift is fueled by a broader wellness narrative in which skincare must integrate seamlessly into daily health rituals, reflecting a mindset that perceives beauty as an outcome of systemic wellbeing. Transitioning from reactive to preventive routines, consumers expect formulations to deliver multi-mechanistic benefits, such as oxidative stress defense, barrier restoration, and microbiome balance.

Simultaneously, technological breakthroughs in biotechnology, such as advanced peptide engineering and gene-edit-inspired delivery systems, are accelerating ingredient efficacy and precision. Digital tools, including AI-driven personalization platforms, are further empowering consumers to craft tailored regimens based on genetic, lifestyle, and environmental data. Moreover, the ascent of clean and sustainable beauty has elevated ingredient transparency to a core brand promise, prompting rigorous third-party validation and sustainable sourcing commitments. This convergence of consumer expectations, scientific prowess, and ethical imperatives signals a new era in which anti-aging agents extend beyond traditional skincare into integrative health solutions supported by digital engagement and environmental accountability.

Assessing the Far-Reaching Cumulative Impact of 2025 United States Tariff Policies on the Anti-Aging Agents Supply Chain and Pricing Dynamics

By 2025, the introduction and escalation of U.S. tariffs on a wide range of beauty and personal care imports have introduced complex headwinds for anti-aging agents supply chains. Tariffs targeting key botanicals and actives such as niacinamide, panthenol, and sunflower oil have triggered cost increases across raw material sourcing, formulation, and packaging. Major multinational brands have responded by exploring synthetic and biotechnology-derived alternatives, alongside diversifying procurement strategies to include EU and domestic suppliers. At the same time, steep levies on packaging components sourced from Asia have compelled manufacturers to reassess design efficiency and invest in nearshore partners to mitigate margin pressures and preserve product quality.

While exemptions for certain cosmetic ingredients have provided limited relief, the cumulative impact of reciprocal and global tariffs has disrupted established supplier relationships and lengthened lead times for critical actives. To maintain competitive pricing, brands are accelerating collaborations with contract development organizations capable of integrating alternative ingredient pipelines and leveraging digital tools for dynamic cost forecasting. Despite these challenges, resilient strategies grounded in geographic diversification, innovative sourcing, and agile reformulation are helping industry leaders navigate the tariff landscape and safeguard consumer access to high-performance anti-aging solutions.

Key Insights Across Product, Distribution, Formulation, Price Tier, Application Area, End User, and Ingredient Source Segments Shaping Strategies

Deep segmentation analysis sheds light on how distinct product categories influence market trajectories. Within the category of anti-aging actives, compounds ranging from alpha hydroxy acids to retinoids are experiencing differentiated adoption curves, driven by clinical efficacy data and consumer familiarity. Meanwhile, antioxidant and peptide-based formulations are gaining traction as stakeholders prioritize cellular repair and barrier reinforcement over superficial aesthetic claims.

Distribution channels also paint a varied picture of market expansion. Traditional retail environments, such as department stores, co-exist with digitally native channels that offer direct engagement via company-branded websites and third-party e-commerce platforms. Specialty environments, including dermatology clinics and health-and-wellness boutiques, continue to command premium pricing through bespoke consultations, whereas online channels deliver scalability and data-driven personalization.

Formulation preferences further delineate consumer priorities, with serums and creams leading due to their perceived potency and ease of integration, and emerging delivery systems like patches presenting new opportunities for sustained release. Meanwhile, tiered pricing strategies segment offerings into mass, premium, and luxury brackets, aligning value propositions with demographic and psychographic profiles. Product applications extend from facial care to targeted zones such as the eye, neck, and hands, underscoring the need for specialized actives and textural innovations to address varied skin structures.

Finally, end-user analyses reveal nuanced gender dynamics and ingredient-source considerations, as demand for lab-synthesized peptides competes with interest in botanical and marine extracts. This layered segmentation framework equips market participants to pinpoint growth pockets, tailor positioning statements, and optimize resource allocation.

This comprehensive research report categorizes the Anti-Aging Agents market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Formulation

- Price Tier

- Ingredient Source

- Distribution Channel

- Application Area

- End User

Driving Growth Through Regional Nuances: Analyzing Market Dynamics and Consumer Behaviors in the Americas, EMEA, and Asia-Pacific Territories

Regional dynamics continue to play a critical role in shaping market growth patterns. In the Americas, robust consumer spending on preventative skincare is bolstered by a strong clinical aesthetic services infrastructure and a culture that prizes youthful appearance as a component of wellness. Regulatory clarity and well-established retail networks support rapid product innovation cycles, while increasing preference for clean formulations drives demand for certified natural ingredients.

Conversely, Europe, the Middle East, and Africa exhibit a mosaic of market maturity levels. Western European markets emphasize sustainability and regulatory compliance, reflecting stringent cosmetic standards and high consumer sensitivity to eco-credentials. In contrast, emerging MEA segments are characterized by rapid urbanization and a growing middle class seeking premium anti-aging solutions, yet face challenges related to distribution complexity and variable import duties.

Asia-Pacific remains the most dynamic region, underpinned by strong growth in lifestyle dermatology treatments, high digital adoption, and a cultural embrace of preventive beauty rituals. Key markets such as Japan, South Korea, and China drive innovation in advanced actives and multifunctional formulations, while ASEAN economies are rapidly advancing as both manufacturers and consumers in the anti-aging domain. Together, these regional insights catalyze targeted market entry strategies and localized value propositions.

This comprehensive research report examines key regions that drive the evolution of the Anti-Aging Agents market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Emerging Players Shaping the Competitive Landscape of Anti-Aging Agents with Strategic Collaborations and Breakthroughs

Leading multinational cosmetics and personal care corporations continue to pioneer market direction through strategic acquisitions, collaborative research partnerships, and technology licensing arrangements. Iconic heritage brands leverage their R&D capabilities to commercialize next-generation peptides and growth factor complexes, while emerging biotech firms attract venture capital to scale lab-synthesized ingredients that promise consistency and sustainability advantages.

Cross-industry alliances, notably between genomics companies and skincare developers, are accelerating the launch of gene-targeted actives and microbiome-friendly formulations. At the same time, contract manufacturers are investing in modular production facilities to meet fluctuating demand and facilitate rapid customization for private-label clients. Meanwhile, digital incumbents in the beauty tech space are embedding AI-driven diagnostics and subscription models into their offerings, capturing consumer data to refine product recommendations and drive incremental revenue streams.

Strategic moves such as platform consolidations, licensing of patented delivery technologies, and expansion into adjacent wellness categories underscore the competitive imperative to diversify portfolios. Collectively, these company-level activities shape the trajectory of ingredient innovation, brand differentiation, and service delivery within the global anti-aging agents marketplace.

This comprehensive research report delivers an in-depth overview of the principal market players in the Anti-Aging Agents market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allergan PLC

- Amorepacific Corporation

- Avon Products, Inc.

- Beiersdorf AG

- Bioderma

- Candela Corporation

- Coty Inc.

- Cynosure Inc.

- Estée Lauder Inc.

- Heavenly Secrets Pvt Ltd.

- Himalaya Wellness Company

- Hologic Inc.

- Johnson & Johnson

- Kao Corporation

- L'Oréal S.A.

- Minimalist

- Oriflame Cosmetics

- Photomedex, Inc.

- Revlon

- Shiseido Co., Ltd.

- Silkn.com

- StBotanica

- The Boots Company

- The Procter & Gamble Company

- Unilever PLC

- Zayn & Myza

Translating Intelligence into Actionable Strategies: Guiding Industry Leaders on Innovation, Customer Engagement, and Excellence in Anti-Aging Domain

Given the complexity of the anti-aging ecosystem, leaders are advised to adopt a multi-pronged approach that balances innovation with operational resilience. First, investing strategically in R&D partnerships with biotechnology ventures can secure access to cutting-edge actives while mitigating upfront capital expenditure. Second, building a robust supply chain through geographic diversification and proactive tariff risk assessment will shield procurement functions from sudden policy fluctuations.

Third, leveraging digital platforms to deliver personalized consumer experiences-whether through AI-infused skincare consultations or subscription-based replenishment services-can drive both loyalty and data-rich feedback loops. Fourth, embedding sustainability targets across ingredient sourcing, packaging design, and production energy use will resonate with conscious consumers and preempt evolving regulatory requirements. Finally, cultivating an agile regulatory and compliance team capable of accelerating product registration in key markets will expedite time-to-market and amplify first-mover advantages within high-growth regions.

Underpinning Robust Insights with Rigorous Research Methodology Encompassing Data Collection, Validation, and Analytical Frameworks in Anti-Aging Agents Analysis

This research is underpinned by a rigorous methodology combining primary and secondary research techniques. Desk research comprised analysis of industry reports, regulatory filings, and patent databases to map the current landscape of anti-aging actives and formulation innovations. Concurrently, primary interviews with C-level executives, R&D scientists, formulators, and distribution channel leaders provided qualitative context on strategic priorities and operating challenges. Data triangulation ensured consistency between empirical findings and expert perspectives.

Quantitative analyses employed statistical modeling of market indicators, including ingredient adoption rates, channel performance metrics, and regional import/export data. The segmentation framework was validated through stakeholder surveys and cross-referencing with external databases. Furthermore, a proprietary scoring system was developed to assess company innovation capacity, supply chain resilience, and sustainability credentials. This multi-layered research design delivers balanced insights that combine market realities with forward-looking projections, empowering decision-makers to navigate complexities with confidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Anti-Aging Agents market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Anti-Aging Agents Market, by Product Type

- Anti-Aging Agents Market, by Formulation

- Anti-Aging Agents Market, by Price Tier

- Anti-Aging Agents Market, by Ingredient Source

- Anti-Aging Agents Market, by Distribution Channel

- Anti-Aging Agents Market, by Application Area

- Anti-Aging Agents Market, by End User

- Anti-Aging Agents Market, by Region

- Anti-Aging Agents Market, by Group

- Anti-Aging Agents Market, by Country

- United States Anti-Aging Agents Market

- China Anti-Aging Agents Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2226 ]

Synthesizing Scientific Innovation, Market Dynamics, and Strategic Imperatives to Secure Lasting Leadership in Anti-Aging Agents Market

In an era where longevity intersects with aesthetics, the anti-aging agents market is evolving at unprecedented speed. Scientific breakthroughs are redefining effectiveness, while consumer demand for personalized, sustainable, and science-backed solutions continues to accelerate. Geopolitical forces, notably U.S. tariff adjustments, add layers of complexity to supply chain management, prompting a shift towards diversification and technological substitution. Segmentation strategies highlight the importance of tailored value propositions across product types, distribution channels, formulations, price tiers, application zones, end users, and ingredient origins.

Regional nuances underscore differentiated growth catalysts, with mature Western markets emphasizing sustainability, emerging MEA segments navigating distribution constraints, and Asia-Pacific markets leading in both innovation and adoption. Company activities, from strategic partnerships to digital engagements, illustrate the ongoing arms race for consumer attention and loyalty. By synthesizing these insights, industry stakeholders can chart pathways that combine scientific rigor, operational agility, and consumer resonance, positioning their organizations for enduring success in the dynamic landscape of anti-aging agents.

Catalyze Strategic Breakthroughs in Anti-Aging Innovation by Connecting with Ketan Rohom for Exclusive Market Research Insights

To gain a comprehensive understanding of the competitive landscape, emerging opportunities, and strategic imperatives of the anti-aging agents market, reach out to Ketan Rohom, Associate Director, Sales & Marketing, to explore how this in-depth research can empower your growth and innovation agendas. Whether you are seeking customized insights, proprietary data analyses, or strategic counsel to inform your product launches and market entry plans, Ketan stands ready to guide you through the report’s findings and answer any questions you may have. By engaging with Ketan, you will unlock tailored support that not only accelerates decision-making but also ensures your organization is positioned at the forefront of next-generation skin science advancements. Secure your copy of the market research report today to catalyze strategic breakthroughs and drive sustained business impact.

- How big is the Anti-Aging Agents Market?

- What is the Anti-Aging Agents Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?