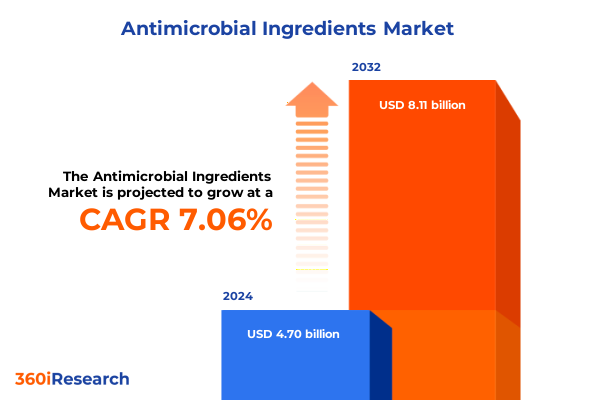

The Antimicrobial Ingredients Market size was estimated at USD 5.04 billion in 2025 and expected to reach USD 5.40 billion in 2026, at a CAGR of 7.22% to reach USD 8.21 billion by 2032.

Charting the Rising Importance of Antimicrobial Ingredients in Modern Industries Fueled by Innovation, Regulation, and Consumer Demand

Antimicrobial ingredients have emerged as a pivotal component across a multitude of sectors, shaping product performance, safety standards, and consumer perceptions alike. From agricultural applications that protect livestock and crops against pathogenic threats to healthcare innovations focused on advanced medical-device coatings and hospital-grade disinfectants, these functional additives fulfill critical roles amid heightened hygiene expectations and stringent regulatory environments. Recent global health events have accelerated end-user awareness, driving organizations to reevaluate supply chains and integrate robust antimicrobial strategies into their core operations.

The convergence of evolving regulatory frameworks, rising consumer demand for ‘clean’ and sustainable solutions, and ongoing technological breakthroughs has transformed the antimicrobial ingredients landscape into a hotbed of innovation. Market participants are increasingly investing in research programs targeting novel natural extracts, bio-based synthetics, and hybrid formulations that deliver superior efficacy with reduced environmental footprints. Meanwhile, manufacturers are challenged to maintain cost efficiencies and ensure uninterrupted supply in the face of complex international trade dynamics. Consequently, stakeholders from start-ups to established chemical corporations are placing antimicrobial ingredients at the center of product portfolios and strategic roadmaps.

Navigating Regulatory Pressures and Sustainable Innovation Shaping the Antimicrobial Ingredients Ecosystem

In recent years, the antimicrobial ingredients market has undergone transformative shifts driven by a trifecta of regulatory tightening, consumer-driven sustainability mandates, and rapid technological advancement. Heightened scrutiny from agencies such as the U.S. Environmental Protection Agency and the European Chemicals Agency has compelled producers to phase out legacy compounds of concern, prompting a migration toward greener chemistries and stringent efficacy validation protocols. As a result, novel natural extracts and plant-based antimicrobials have advanced from niche offerings to mainstream adoption, enabled by scalable microbial-fermentation platforms and precision-extraction techniques.

Simultaneously, end users across industries have elevated their expectations, demanding formulations that not only inhibit microbial growth but also align with broader sustainability and health-and-wellness narratives. In response, suppliers are integrating multifunctional performance attributes-such as enhanced stability in challenging matrices, rapid kill-time, and compatibility with eco-friendly packaging-into next-generation products. Furthermore, digital innovations in process monitoring and quality assurance are streamlining the commercialization pipeline, allowing developers to accelerate time-to-market without compromising on safety or regulatory compliance. Taken together, these shifts are redefining competitive boundaries and setting new benchmarks for antimicrobial efficacy and environmental stewardship in manufacturing and application.

Evaluating the Complex Implications of New U.S. Import Tariffs on Cost Structures and Supply Chain Resilience in 2025

The imposition of targeted tariffs on imported antimicrobial chemicals by the United States in early 2025 has reshaped supply chain strategies and cost structures across the value chain. Key raw materials such as benzoic acid, quaternary ammonium compounds, and specialty silver-based antimicrobials have seen input cost increases, compelling domestic and international producers alike to pursue alternative sourcing strategies. Smaller suppliers have experienced the greatest volatility, prompting several to renegotiate long-term contracts or pivot toward domestic feedstock suppliers to mitigate import duties.

Downstream segments have felt the ripple effects in differentiated ways. Healthcare providers confronting elevated cost bases for hospital disinfectants and medical-device coatings have accelerated deployment of in-house compounding and bulk procurement strategies. Similarly, water-treatment operators reevaluating drinking water and wastewater formulations have adopted blended portfolios that balance tariff-impacted chemistries with locally produced organic acids. Despite these adaptations, the tariff regime has stimulated capital investment within U.S. production facilities, accelerating capacity expansions for foam, gel, and liquid antimicrobial forms aimed at domestic consumption. As a result, industry stakeholders are anticipating a medium-term rebalancing wherein stabilized domestic production alleviates price pressures and reinforces supply chain resilience.

Uncovering Divergent Growth Paths Across Application, Ingredient Type, and Performance Demands in Antimicrobial Segmentation

Analyzing the antimicrobial ingredients market through the lens of end-use applications reveals nuanced growth trajectories and performance priorities. In agriculture, demand is bifurcating between animal feed additives that safeguard livestock health and crop-protection agents engineered for minimal environmental impact. Food and beverage processors are increasingly combining traditional food-preservation chemistries with antimicrobial surface-sanitation protocols, reflecting more stringent safety regimes under global food-safety standards. Within healthcare, hospital disinfectants remain indispensable for infection control, while medical-device coatings focus on extending device longevity and patient safety. Household cleaners encompass everything from laundry-additive boosters to multi-surface cleaners, each requiring distinct compatibility profiles, and personal care is witnessing surges in antimicrobial soaps, deodorants, and oral-care formulations designed to balance efficacy with skin and mucosal tolerability. Water treatment, segmented across drinking water and wastewater applications, continues to prioritize cost-effective, broad-spectrum biocides that comply with tightening discharge regulations without forming harmful disinfection byproducts.

Beyond applications, the type of antimicrobial ingredient has emerged as a critical differentiator. Natural extracts-spanning essential oils such as tea tree oil and thyme oil to grapefruit seed extracts-are capitalizing on their ‘clean label’ positioning, though they must surmount challenges related to stability and spectrum of activity. Organic acids like benzoic acid, propionic acid, and sorbic acid maintain steady demand in food applications, while phenolic compounds including orthophenylphenol and triclosan are under heightened regulatory scrutiny. Quaternary ammonium compounds, such as benzalkonium chloride and didecyldimethylammonium chloride, continue as mainstays in disinfectant formulations, even as silver-based technologies-including colloidal silver and silver zeolite-stake claim in premium segments due to broad-spectrum efficacy and low propensity for resistance.

This comprehensive research report categorizes the Antimicrobial Ingredients market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Form

- Function

- Source

- Application

Revealing the Distinct Regulatory Landscapes and Demand Drivers Shaping Antimicrobial Ingredient Adoption Globally

Regional dynamics in the antimicrobial ingredients arena are shaped by varied regulatory frameworks, infrastructure maturity, and end-user priorities. In the Americas, stringent enforcement of EPA and FDA guidelines has driven accelerated uptake of advanced antimicrobial solutions, particularly within healthcare and food processing. Investment in domestic production capacity and research initiatives has further supported supply-chain resilience, enabling U.S. companies to serve both local and export markets effectively. Meanwhile, Latin American markets are increasingly looking to imported technologies for water treatment and agricultural applications, though import tariffs have spurred interest in local manufacturing partnerships.

Europe, the Middle East, and Africa present a diverse mosaic of market conditions. The European Union’s Biocidal Products Regulation imposes rigorous data requirements and approval timelines, prompting many suppliers to consolidate portfolios around high-value, well-validated compounds. Demand in the Middle East remains concentrated in water treatment and healthcare infrastructure projects, underpinned by government-led hygiene and sanitation programs. In Africa, rapid urbanization and evolving public-health initiatives are driving nascent demand for antimicrobial surface sanitation and personal-care products, albeit tempered by price sensitivity and distribution logistics.

Asia-Pacific continues to be the fastest-growing region, with China and India at the forefront of industrial-scale adoption. Expanding public-health infrastructure and stringent effluent standards have fueled demand for drinking water and wastewater treatment chemistries. Simultaneously, rising consumer awareness in East Asia is boosting demand for antimicrobial formulations in personal care and household cleaning. Regional innovation hubs are also investing heavily in microbial-fermentation platforms and biotechnology-driven extraction methods to develop next-generation natural antimicrobial ingredients.

This comprehensive research report examines key regions that drive the evolution of the Antimicrobial Ingredients market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining How Top Innovators Are Forging Partnerships and Streamlining Operations to Lead the Antimicrobial Ingredients Market

Leading suppliers in the antimicrobial ingredients market are leveraging differentiated strategies to navigate competitive pressures and regulatory complexity. Major chemical and specialty ingredient companies are reinforcing their R&D pipelines through targeted acquisitions of biotech innovators and collaborations with academic research centers. These alliances are designed to fast-track development of novel phenolic compounds, advanced quaternary ammonium blends, and plant-derived antimicrobials with optimized performance profiles.

Simultaneously, key players are streamlining global manufacturing footprints by consolidating production assets in cost-advantaged regions, while ensuring compliance with local regulatory mandates. Sustainability commitments are also influencing product design, with several firms piloting closed-loop manufacturing and carbon-neutral production processes for microbial-fermentation platforms. On the commercial front, strategic partnerships with end-users-ranging from food processors to hospital systems-are facilitating co-development of custom formulations and service-based offerings, such as on-site monitoring and refilling programs. Taken together, these initiatives underscore a broader shift toward integrated solutions that address both efficacy requirements and broader operational challenges faced by customers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Antimicrobial Ingredients market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arkema S.A.

- Ashland Global Holdings Inc.

- BASF SE

- BioCote Limited

- Clariant AG

- Dow Inc.

- DuPont de Nemours, Inc.

- Evonik Industries AG

- International Flavors & Fragrances Inc.

- LANXESS AG

- Lonza Group AG

- Solvay S.A.

- Spectrum Chemical Mfg. Corp.

Implementing a Strategic Framework That Integrates Sustainable Innovation, Supply-Chain Resilience, and Customer-Centric Services for Long-Term Growth

Industry leaders seeking to capitalize on the evolving antimicrobial ingredients landscape should prioritize the development of sustainable, high-performance formulations that align with end-user expectations for efficacy and environmental stewardship. This entails investing in microbial-fermentation platforms and green-extraction techniques to produce plant-based and essential-oil derived antimicrobials at scale, while expanding R&D efforts into hybrid chemistries that combine natural and synthetic modalities for enhanced stability and spectrum.

To mitigate supply-chain volatility, companies should cultivate a diversified supplier base, including domestic feedstock producers and alternative material sources, thereby reducing exposure to import tariffs and trade disruptions. Moreover, engaging proactively with regulatory bodies across key markets can streamline product registration pathways and preempt emerging policy shifts. Senior leadership should also explore value-added service models-such as custom application consulting, on-site formulation support, and digital monitoring platforms-to foster deeper customer relationships and unlock recurring revenue streams. By adopting a holistic approach that integrates innovation, operational agility, and customer-centric service, organizations can secure a sustainable competitive advantage within this rapidly advancing sector.

Detailing the Rigorous Multi-Phased Approach Combining Interviews, Data Analysis, and Regulatory Review to Ensure Analytical Rigor

This research employs a robust, multi-phased methodology combining primary and secondary data sources to ensure comprehensive and unbiased analysis. Primary research included structured interviews with senior R&D leaders, procurement executives, and regulatory experts across major end-use segments. These insights were triangulated with surveys of end customers in agriculture, food processing, healthcare, and personal care to validate demand drivers and performance requirements.

Secondary research encompassed a thorough review of public policy documents, regulatory filings, and patent databases alongside technical literature published in peer-reviewed journals. Global trade data, customs records, and financial disclosures were analyzed to quantify the impact of the 2025 U.S. tariffs on material flows and pricing trends. Advanced data-analysis techniques-such as regression modeling and scenario simulation-were applied to segment performance metrics and forecast potential supply-chain disruptions. All findings were subjected to validation workshops with industry experts to ensure accuracy and relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Antimicrobial Ingredients market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Antimicrobial Ingredients Market, by Type

- Antimicrobial Ingredients Market, by Form

- Antimicrobial Ingredients Market, by Function

- Antimicrobial Ingredients Market, by Source

- Antimicrobial Ingredients Market, by Application

- Antimicrobial Ingredients Market, by Region

- Antimicrobial Ingredients Market, by Group

- Antimicrobial Ingredients Market, by Country

- United States Antimicrobial Ingredients Market

- China Antimicrobial Ingredients Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 4611 ]

Synthesizing Market Dynamics and Competitive Imperatives to Highlight Critical Success Factors in Antimicrobial Ingredients Development

In summary, the antimicrobial ingredients market is undergoing a period of dynamic transformation propelled by stricter regulations, sustainability imperatives, and rapid technological innovation. Diverse demand across applications-from agricultural biosecurity to medical-grade coatings-underscores the need for highly specialized formulations. The imposition of U.S. import tariffs in 2025 has further highlighted the critical importance of supply-chain resilience and domestic manufacturing capabilities.

Regional disparities in regulatory environments and growth drivers present both challenges and opportunities, with Asia-Pacific leading in volume adoption, the Americas refining compliance-driven innovation, and EMEA balancing regulatory stringency with high-value portfolio development. As leading companies refine their strategies-focusing on R&D collaborations, sustainable production, and service-based models-the competitive landscape will continue to evolve. Ultimately, success in this sector will hinge on the ability to integrate performance efficacy, environmental stewardship, and customer engagement into coherent, forward-looking solutions.

Contact Associate Director Ketan Rohom to Acquire the Comprehensive Antimicrobial Ingredients Market Report and Drive Strategic Growth

To unlock comprehensive insights into the dynamic antimicrobial ingredients market and gain a competitive advantage in this rapidly evolving ecosystem, reach out to Ketan Rohom to secure your copy of the full research report and empower your strategic decision-making today

- How big is the Antimicrobial Ingredients Market?

- What is the Antimicrobial Ingredients Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?