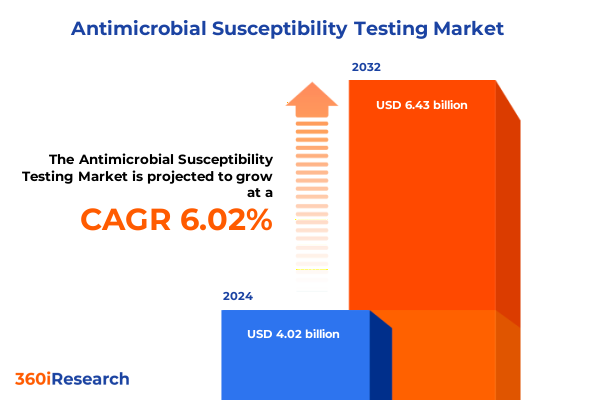

The Antimicrobial Susceptibility Testing Market size was estimated at USD 4.25 billion in 2025 and expected to reach USD 4.50 billion in 2026, at a CAGR of 6.07% to reach USD 6.43 billion by 2032.

Navigating the Growing Imperative of Antimicrobial Susceptibility Testing in Modern Healthcare and Microbial Control Landscapes Worldwide

The landscape of antimicrobial susceptibility testing is being reshaped by an intensifying global imperative to combat rising antimicrobial resistance and safeguard public health. As bacterial, fungal, viral, and parasitic pathogens evolve, healthcare systems worldwide face mounting pressure to deploy precise diagnostic tools that inform targeted therapies and minimize broad-spectrum antibiotic misuse. In this context, susceptibility testing has emerged as a critical pillar of diagnostic stewardship, driving improved patient outcomes, reducing hospitalization times, and curbing the spread of multidrug-resistant organisms.

Against this backdrop, laboratories and clinical decision-makers are increasingly investing in advanced instrumentation, streamlined workflows, and robust data analytics to deliver rapid, reliable results. Automated analyzers and high-throughput plate readers are transforming traditional manual methods, while specialized kits for organism identification and antibiotic susceptibility streamline sample processing. Concurrently, custom analytical services are partnering with research institutions and biotech companies to support method validation and novel drug discovery, heralding a new era of collaborative innovation.

Through this executive summary, we aim to provide a structured overview of the pivotal forces, segmentation dynamics, and regional variations that define today’s antimicrobial susceptibility testing market. The subsequent sections will explore transformative technological and policy shifts, quantify the effects of recent tariff changes in the United States, and deliver strategic recommendations designed to help stakeholders navigate an environment defined by regulatory complexity, rapid scientific advancement, and intense competitive activity.

Examining the Transformative Technological and Regulatory Shifts Reshaping Antimicrobial Susceptibility Testing Practices and Market Dynamics in 2025

In recent years, the antimicrobial susceptibility testing field has witnessed a profound transformation driven by technological breakthroughs, evolving regulatory frameworks, and shifting clinical priorities. High-resolution genotypic methods have complemented classic phenotypic approaches, enabling laboratories to detect resistance determinants with greater speed and precision. Innovations in microfluidics and lab-on-a-chip platforms are streamlining sample preparation and reducing time-to-result from days to hours, while AI-driven algorithms analyze susceptibility patterns to predict emergent resistance trends.

Regulatory bodies have also adapted their guidelines to address the growing urgency of antimicrobial stewardship. Revised standards for method validation and quality control emphasize real-world performance, urging manufacturers to demonstrate reliability across diverse sample types and geographic regions. Simultaneously, reimbursement models are beginning to align incentives with rapid diagnostic adoption, rewarding laboratories that integrate susceptibility testing into antibiotic utilization programs and resulting in more consistent funding for advanced platforms.

These technological and policy shifts have converged to accelerate the deployment of comprehensive testing solutions within hospital networks and reference laboratories. As a result, the market has moved towards modular systems that offer both qualitative and quantitative outputs, underpinned by robust software suites that facilitate data sharing across healthcare ecosystems. Such integration is fostering greater collaboration between clinical microbiologists, infectious disease specialists, and pharmacy departments, strengthening the collective response to antimicrobial resistance.

Assessing the Cumulative Impact of 2025 United States Tariff Policies on Supply Chains, Costs, and Adoption Trends in Antimicrobial Susceptibility Testing

In 2025, the United States introduced a set of targeted tariffs on imported diagnostic instruments, reagents, and ancillary laboratory equipment used in antimicrobial susceptibility testing. These measures were designed to bolster domestic manufacturing but have had far-reaching implications for supply chain stability and overall test affordability. Providers reliant on imported automated analyzers and specialized antibiotic susceptibility kits encountered cost increases that rippled through procurement budgets and, in certain cases, led to measurable reductions in testing volumes.

Manufacturers responded by exploring dual-sourcing strategies, identifying domestic component suppliers, and investing in local production capabilities. While these initiatives have gradually mitigated supply disruptions, the recalibration of supplier networks required significant capital investment and logistical reconfiguration. Parallel to these efforts, laboratories adjusted their test menus and consolidated purchases to negotiate volume discounts, trading broad product selection for economy of scale.

Looking forward, the cumulative effect of these tariff policies underscores the importance of resilient supply chains and diversified sourcing. Laboratories and diagnostic providers that embrace a hybrid procurement model-blending domestically produced reagents and instruments with select imports-are better positioned to maintain service continuity and cost control. Stakeholders will continue to monitor tariff revisions closely, advocating for transparent policy frameworks and collaborative approaches to sustain innovation without compromising access to essential diagnostic tools.

Uncovering Critical Insights Across Diverse Segments of Antimicrobial Susceptibility Testing by Product Type, Test Method, Application, and End User

A multifaceted segmentation analysis reveals distinct opportunities and challenges across product type, test type, methodology, application, and end user. Within product type, instrumentation ranges from fully automated analyzers to manual bench-top devices, each serving different throughput and budget requirements. Instrument-focused laboratories are increasingly integrating automated plate readers alongside analyzers to enhance data consistency, while reagent and kit selections are expanding beyond basic antibiotic susceptibility modules to include specialized microbial identification and genotypic resistance detection. Complementing these core offerings, analytical testing services and custom testing solutions are gaining traction among clients seeking tailored protocols for novel antimicrobial compounds and complex sample matrices.

When examining test types, antibacterial susceptibility testing remains the dominant segment due to the prevalence of bacterial infections, yet antifungal, antiviral, and antiparasitic susceptibility tests are experiencing accelerated adoption driven by rising concerns over invasive fungal diseases, emergent viral pandemics, and parasitic resistance in tropical medicine. Methodological choices bifurcate into qualitative and quantitative approaches: classic phenotypic methods such as agar dilution and disk diffusion maintain their role in cost-sensitive settings, while broth macrodilution and Etest provide precise minimum inhibitory concentration values critical for nuanced therapeutic decisions. Genotypic methods are carving out a niche for rapid resistance gene identification but currently complement rather than replace phenotypic assays.

Applications vary from routine clinical diagnostics to drug discovery pipelines and epidemiological surveillance. Clinical laboratories prioritize reliability and turnaround time, pharmaceutical developers require high-throughput custom testing platforms to screen new drug candidates, and public health agencies depend on robust epidemiology-focused protocols to monitor resistance trends on a population scale. End users span academic and government research institutes that push the boundaries of methodological innovation, hospitals and diagnostic centers that anchor patient care pathways, and pharmaceutical and biotechnology companies that invest in both product development and companion diagnostic research. This intricate segmentation underscores the necessity for vendors to align product roadmaps with distinct user needs while ensuring interoperability across methodologies.

This comprehensive research report categorizes the Antimicrobial Susceptibility Testing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Test Type

- Method

- Application

- End User

Illuminating Regional Dynamics and Opportunities Across the Americas, Europe Middle East Africa, and Asia-Pacific Markets for Antimicrobial Susceptibility Testing

Geographic dynamics significantly shape the antimicrobial susceptibility testing landscape, with each region presenting unique drivers and market characteristics. In the Americas, strong healthcare infrastructure combined with proactive antimicrobial stewardship initiatives has fostered widespread adoption of advanced testing platforms. Laboratories in North America are increasingly upgrading to high-throughput automated systems and integrating digital reporting tools, driven by well-established reimbursement frameworks and stringent regulatory oversight. Latin American markets are also evolving, with government programs investing in regional reference labs and partnerships to expand testing access in underserved communities.

The Europe, Middle East, and Africa region showcases a dynamic interplay of high-income markets with advanced diagnostic ecosystems and emerging economies grappling with infrastructure gaps. Western Europe’s focus on rapid diagnostics is propelled by stringent infection control mandates, while Eastern European and Middle Eastern countries are investing in capacity building and workforce training to bolster laboratory competencies. In Africa, donor-funded initiatives are expanding the installation of modular testing platforms and deploying mobile testing units to address the high burden of infectious diseases and antimicrobial resistance surveillance needs.

Asia-Pacific represents one of the fastest-growing markets, driven by rising healthcare expenditures, expanding private diagnostic networks, and increasing public awareness of antimicrobial resistance. Hospitals and centralized reference laboratories in East Asia and Oceania are early adopters of next-generation susceptibility platforms, while South and Southeast Asian nations are focusing on scaling access through public-private collaborations and cost-effective instrument leasing models. Across these regions, data integration initiatives and cross-border surveillance programs are emerging as critical enablers for real-time resistance monitoring and coordinated public health responses.

This comprehensive research report examines key regions that drive the evolution of the Antimicrobial Susceptibility Testing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Participants Driving Innovation, Collaboration, and Market Expansion in the Antimicrobial Susceptibility Testing Ecosystem

Leading industry participants are advancing the antimicrobial susceptibility testing market through continuous innovation and strategic collaborations. Some of the most influential companies have diversified their portfolios to offer integrated instrument-reagent-service ecosystems, enabling seamless workflows and consolidated vendor management. Technology providers are investing heavily in automation upgrades, introducing next-generation analyzers with built-in artificial intelligence capabilities that enhance result interpretation and predictive resistance modeling.

Key players are also forging partnerships with academic institutions and public health agencies to co-develop novel testing protocols and resistance gene libraries. These collaborations extend to joint validation studies, ensuring that new systems meet rigorous performance criteria under real-world conditions. Additionally, several vendors have expanded their global footprint through targeted acquisitions of regional service providers and reagent producers, broadening market access while maintaining in-country support for enterprise clients.

In parallel, a growing number of specialized contract research organizations have emerged to address niche demands such as high-throughput drug screening and bespoke assay development. By combining deep domain expertise with advanced laboratory infrastructure, these companies complement the offerings of traditional instrument and reagent manufacturers, fostering an ecosystem where innovation is driven by both competition and collaboration.

This comprehensive research report delivers an in-depth overview of the principal market players in the Antimicrobial Susceptibility Testing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accelerate Diagnostics, Inc.

- Alifax S.r.l.

- Becton, Dickinson and Company

- Bio-Rad Laboratories, Inc.

- BIOANALYSE Tıbbi Malz. San. ve Tic. Ltd. Sti.

- Biological Safety Solutions Ltd/Oy

- BioMérieux SA

- Bruker Corporation

- Creative Diagnostics

- Danaher Corporation

- Erba Lachema s.r.o.

- Eurofins Scientific SE

- F. Hoffmann-La Roche AG

- Himedia Laboratories Private Limited

- INTEGRA Biosciences AG

- Laboratorios Conda, S.A.

- Launch Diagnostics Limited

- Leading Biology, Inc.

- Liofilchem S.r.l.

- Mast Group Ltd.

- MP Biomedicals, LLC

- Pfizer Inc.

- Qiagen N.V.

- QuantaMatrix Inc.

- Resistell AG

- Synoptics Group

- Thermo Fisher Scientific Inc.

- Zhuhai DL Biotech Co., Ltd.

Strategic Recommendations for Industry Leaders to Capitalize on Emerging Trends, Optimize Operations, and Strengthen Competitive Positioning in AST

Industry leaders can capitalize on emerging trends by prioritizing the adoption of modular, scalable testing platforms that accommodate both phenotypic and genotypic methods. By investing in open architecture systems, organizations can seamlessly integrate future technological advances without overhauling existing workflows, thereby protecting capital investments and accelerating time to market. Strengthening relationships with reagent and service partners will also facilitate rapid protocol enhancements, ensuring that laboratories can respond swiftly to novel resistance mechanisms.

Operational efficiency can be significantly enhanced through centralized data management solutions that link susceptibility results with electronic health records and antimicrobial stewardship programs. Such integration not only streamlines clinical decision-making but also generates real-world evidence critical for regulatory submissions and payer negotiations. Furthermore, companies should explore subscription-based models and reagent leasing arrangements to offer flexible financing options that lower barriers to entry for resource-constrained laboratories.

Finally, proactive engagement with policymakers and professional societies will be essential to shape reimbursement frameworks that incentivize rapid diagnostics. By participating in guideline development and real-world performance studies, industry stakeholders can demonstrate the clinical and economic value of advanced antimicrobial susceptibility testing, fostering more favorable coverage policies and accelerating adoption across diverse healthcare settings.

Methodological Approach Detailing Data Sources, Analytical Frameworks, and Validation Techniques Applied to Antimicrobial Susceptibility Testing Market Research

This research applied a comprehensive blend of primary and secondary methodologies to ensure accuracy and depth. Primary data were collected through structured interviews with key opinion leaders including clinical microbiologists, laboratory directors, and procurement specialists, providing qualitative insights into workflow preferences and purchasing drivers. Quantitative data were gathered from surveys of regional diagnostic laboratories, capturing detailed information on instrument utilization rates, test volumes, and evolving method preferences.

Secondary research encompassed an extensive review of scientific publications, regulatory guidelines, and publicly available financial disclosures to map historical trends and forecast potential disruption pathways. Industry white papers, patent filings, and conference proceedings were analyzed to identify emerging technologies and assess their readiness for commercialization. Data triangulation techniques were employed to cross-validate findings, ensuring that estimates and thematic conclusions were grounded in multiple data sources.

To verify the robustness of the analysis, a multi-stage validation process was undertaken. Draft findings were presented to an advisory panel of external experts for critique and refinement, while sensitivity analyses tested the impact of varying assumptions on key market drivers. This iterative approach fostered a high degree of confidence in the insights and recommendations detailed throughout this summary.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Antimicrobial Susceptibility Testing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Antimicrobial Susceptibility Testing Market, by Product Type

- Antimicrobial Susceptibility Testing Market, by Test Type

- Antimicrobial Susceptibility Testing Market, by Method

- Antimicrobial Susceptibility Testing Market, by Application

- Antimicrobial Susceptibility Testing Market, by End User

- Antimicrobial Susceptibility Testing Market, by Region

- Antimicrobial Susceptibility Testing Market, by Group

- Antimicrobial Susceptibility Testing Market, by Country

- United States Antimicrobial Susceptibility Testing Market

- China Antimicrobial Susceptibility Testing Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Drawing Together Key Takeaways on Market Drivers, Challenges, and Strategic Imperatives Shaping the Future of Antimicrobial Susceptibility Testing Services

This executive summary has highlighted the critical inflection points shaping the antimicrobial susceptibility testing landscape, from breakthrough diagnostic technologies and tariff-induced supply chain recalibrations to nuanced segmentation patterns and distinctive regional trajectories. The convergence of automation, data analytics, and collaborative partnerships is accelerating the transition from manual, labor-intensive testing toward integrated, high-throughput ecosystems capable of delivering rapid, actionable results. At the same time, policy frameworks and reimbursement models are evolving to recognize the tangible clinical and economic benefits of precise resistance profiling.

Market participants that align their strategies with these dynamics-investing in flexible platforms, forging cross-sector alliances, and advocating for supportive regulatory environments-will be best positioned to thrive in an increasingly competitive arena. By leveraging comprehensive insights into product, method, application, and end-user segments, stakeholders can tailor their value propositions to meet diverse laboratory requirements and end-user expectations.

Ultimately, the path forward will require a delicate balance between innovation and accessibility, ensuring that advanced susceptibility testing capabilities are both technically robust and economically viable across global healthcare systems. Organizations that embrace this balanced approach will play a pivotal role in combating antimicrobial resistance and safeguarding the efficacy of life-saving therapies.

Engage with Associate Director Ketan Rohom Today to Secure Comprehensive Antimicrobial Susceptibility Testing Research Insights and Drive Informed Decision-Making

If you are seeking to gain a competitive edge in the rapidly evolving field of antimicrobial susceptibility testing, engaging directly with Ketan Rohom, the Associate Director of Sales & Marketing, will provide you with tailored insights and personalized guidance. By partnering with Ketan, you can unlock exclusive access to the comprehensive market research report that delivers deep analysis of emerging diagnostic technologies, regulatory influences, and strategic vendor landscapes. This engagement is designed to equip your organization with the clarity and foresight necessary to make informed decisions, optimize procurement strategies, and anticipate future market shifts.

Through a collaborative consultation, Ketan will walk you through the critical findings, demonstrate how the data can be applied to real-world commercial and clinical challenges, and outline actionable next steps to integrate these insights into your growth roadmap. Whether you aim to refine your product portfolio, enhance laboratory workflows, or identify high-potential partnership opportunities, this conversation will lay the groundwork for sustainable success. Reach out to schedule a dedicated briefing and begin harnessing the power of advanced market intelligence today.

- How big is the Antimicrobial Susceptibility Testing Market?

- What is the Antimicrobial Susceptibility Testing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?