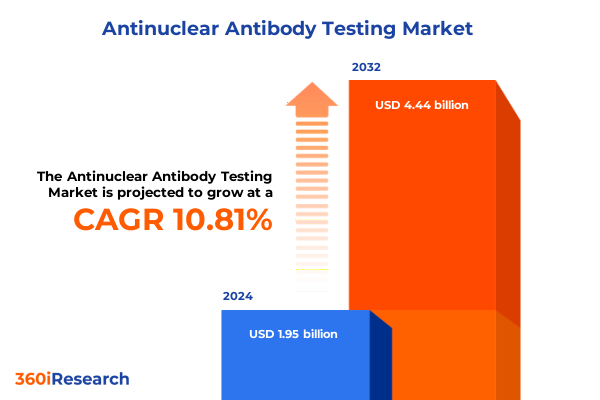

The Antinuclear Antibody Testing Market size was estimated at USD 2.16 billion in 2025 and expected to reach USD 2.40 billion in 2026, at a CAGR of 11.16% to reach USD 4.54 billion by 2032.

Exploring the Core Principles and Evolving Methodologies in Antinuclear Antibody Testing Driving Precision in Autoimmune Disease Detection

An antinuclear antibody (ANA) test detects antibodies that target components within the cell nucleus, a hallmark indicator of autoimmune activity and a critical screening tool for disorders such as systemic lupus erythematosus, Sjögren’s syndrome, and rheumatoid arthritis. By identifying these autoantibodies, clinicians can differentiate autoimmune conditions from other diseases with overlapping symptoms and ensure that patients receive timely, targeted therapy. The procedure typically involves drawing a blood sample, incubating it with cultured cells or purified antigens, and detecting bound antibodies either through fluorescence microscopy or immunoassay platforms.

Advances in automation and standardized workflows have significantly enhanced the reproducibility and throughput of ANA testing in clinical laboratories. Automated platforms streamline critical steps such as sample dilution, slide handling, staining, and image acquisition, reducing manual labor and the risk of operator bias during interpretation. Modern systems integrate high-resolution digital microscopy with classification software, enabling reliable positive/negative discrimination, pattern recognition, and titer calculations for diverse immunofluorescence patterns, including homogeneous, speckled, centromere, and nucleolar.

Looking ahead, the fusion of artificial intelligence with digital immunofluorescence promises to refine test precision by leveraging deep learning algorithms trained on expansive image libraries. These algorithms can distinguish subtle pattern variations and quantify fluorescence intensity, thereby expediting result verification and facilitating batch-wise oversight. As laboratories adopt these innovations, they are positioned to deliver faster turnaround times and more consistent results, aligning with the growing demand for accurate, high-volume autoimmune diagnostics.

Identifying the Pivotal Transformations Reshaping the Antinuclear Antibody Testing Environment Across Technologies and Workflows

The landscape of antinuclear antibody testing has been reshaped by a wave of technological breakthroughs aimed at enhancing diagnostic accuracy, reducing subjectivity, and boosting laboratory efficiency. Among the most notable shifts is the adoption of digital immunofluorescence systems that automate slide scanning and image capture. These platforms integrate pattern recognition tools based on artificial intelligence to identify ANA staining patterns and calculate titers, allowing laboratories to standardize interpretations that were previously reliant on manual microscopy.

Simultaneously, multiplex immunoassay technologies have emerged as transformative, enabling simultaneous detection of multiple autoantibodies in a single run. Bead-based or microarray formats reduce sample volume requirements and shorten assay times, facilitating comprehensive autoimmune profiling that can reveal disease-specific antibody signatures beyond conventional HEp-2 indirect immunofluorescence. The integration of machine learning further refines data analysis, distinguishing clinically relevant signals from background noise, and offering clinicians a nuanced view of patient immune status.

Another pivotal development lies in the convergence of point-of-care testing innovations with centralized laboratory workflows. Portable immunoassay readers and simplified cartridge-based systems allow for preliminary screening in outpatient settings, with reflex samples routed to high-throughput core facilities. This hybrid approach ensures rapid initial assessment and confirms results through automated, AI-enhanced platforms, maintaining a balance between accessibility and diagnostic rigor.

Assessing the Comprehensive Impact of 2025 United States Tariff Measures on Antinuclear Antibody Diagnostic Supplies and Equipment

In April 2025, the U.S. government instituted a universal 10% tariff on the majority of imported goods, including critical diagnostic instruments and consumables used in antinuclear antibody testing. Concurrently, country-specific levies introduced on April 9, 2025, raised tariff burdens significantly for key trading partners, with China facing a cumulative duty rate of 145% on laboratory goods and specialized clinical reagents. Such measures have contributed to recalibrated procurement strategies, compelling manufacturers and laboratories to examine domestic sourcing and supply chain diversification in order to manage elevated input costs.

Diagnostic equipment manufacturers reliant on offshore assembly now contend with tariff-induced price escalations that ripple through instruments such as chemiluminescence immunoassay (CLIA) analyzers, ELISA readers, and IFA scanners. The steeper duties on imported microscope optics, imaging modules, and microplate washers directly impact capital expenditures, leading stakeholders to explore rental models or seek partnerships with U.S.-based distributors to secure buffer stocks and mitigate lead-time uncertainties. Similarly, reagent suppliers have observed rising costs for antigens, conjugates, and specialized buffers, with some Chinese API providers facing additional duties of up to 245%, thereby intensifying the challenge of maintaining price stability for test kits and quality control materials.

To navigate these headwinds, laboratories and diagnostic companies are increasingly conducting comprehensive supplier origin audits, emphasizing USMCA-compliant options and consolidating purchases with domestic partners. By forging strategic alliances with local manufacturers and leveraging in-country warehousing, industry participants aim to reduce exposure to punitive tariffs, safeguard service levels, and uphold uninterrupted test availability for healthcare providers nationwide.

Deriving Strategic Insights from Multifaceted Segmentation of the Antinuclear Antibody Testing Market Across Products, Technologies, and User Profiles

A nuanced understanding of market segmentation offers critical insights into the varied dynamics influencing antinuclear antibody testing across multiple dimensions. When examining product types, the landscape extends from instruments-encompassing CLIA analyzers, ELISA readers, IFA scanners, and multiplex analyzers-to assay kits that cover CLIA, ELISA, IFA, and multiplex formats. Reagent categories include antigens, buffers, and conjugates designed for targeted autoantibody detection, while software solutions range from sophisticated data analysis applications to comprehensive laboratory information management systems.

Exploring the technological segmentation reveals a spectrum of immunoassay approaches. Chemiluminescence immunoassays deliver high sensitivity and dynamic range, whereas enzyme-linked immunosorbent assays remain a mainstay for routine screening. Indirect immunofluorescence assays continue to set the standard for pattern recognition, and multiplex immunoassays have introduced efficiency gains through parallel detection of diverse antibody specificities.

End-user segmentation underscores the distinct requirements of academic and research institutes, which prioritize customizable platforms for method development, in contrast to diagnostic laboratories that emphasize throughput and cost per test. Hospitals, particularly in larger health networks, demand scalable solutions with integrated patient-reporting features. Distribution channels further shape go-to-market strategies; direct sales to high-volume clients coexist with distributor networks that serve regional laboratories, while online channels and retail pharmacies cater to smaller outpatient settings.

Disease indication segmentation focuses on conditions such as rheumatoid arthritis, Sjögren’s syndrome, and systemic lupus erythematosus, each presenting unique autoantibody profiles and requiring tailored test panels. Finally, sample type differentiation-spanning plasma, serum, and whole blood-dictates assay design and processing workflows, influencing everything from sample stability requirements to equipment configuration.

This comprehensive research report categorizes the Antinuclear Antibody Testing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Disease Indication

- Sample Type

- End User

- Distribution Channel

Highlighting Regional Dynamics and Growth Drivers Shaping Antinuclear Antibody Testing Demand across the Americas, EMEA, and Asia-Pacific Regions

In the Americas, a well-established infrastructure of clinical laboratories and reference centers drives rapid adoption of cutting-edge automation and integrated digital solutions for ANA testing. Major academic institutions and large hospital systems lead validation studies for novel platforms, while direct engagement with local distributors ensures continuous access to reagents and maintenance services. This environment fosters collaboration between diagnostic companies and healthcare networks to refine assay performance and optimize cost structures.

Within Europe, the Middle East, and Africa, heterogeneous healthcare systems and regulatory frameworks shape ANA testing priorities. Germany-based firms have pioneered digital immunofluorescence suites that comply with stringent European IVDR requirements, and cross-border partnerships support harmonized workflows across member states. In emerging regions of the Middle East and Africa, capacity-building initiatives emphasize technology transfer and local reagent production to mitigate supply chain risks and reduce dependency on external imports, reinforcing resilience against external shocks such as elevated tariffs.

Asia-Pacific markets exhibit robust growth fueled by expanding public healthcare budgets and a rising prevalence of autoimmune conditions. Chinese diagnostic players are increasingly investing in indigenous manufacturing capabilities to circumvent high import duties, while regional research hubs in Japan, South Korea, and Australia collaborate on next-generation assay development. Stakeholders in these markets seek cost-effective multiplex solutions that address diverse patient populations, with an emphasis on joint ventures and licensing agreements to accelerate market entry.

This comprehensive research report examines key regions that drive the evolution of the Antinuclear Antibody Testing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Stakeholders and Their Strategic Initiatives That Are Advancing Antinuclear Antibody Testing Capabilities and Offerings

Leading diagnostics companies are advancing the ANA testing field through targeted investments in automation, assay innovation, and strategic collaborations. Thermo Fisher Scientific recently released its 2025 Phadia product catalogue, showcasing expanded immunoassay offerings for allergy and autoimmune diagnostics and reinforcing its commitment to integrated solutions for clinical laboratories. Similarly, Siemens Healthineers has introduced the Atellica LUMIX immunoassay system, which integrates automated sample handling with rapid fluorescence-based detection, enabling streamlined workflows in high-volume settings.

Roche Diagnostics has strengthened its position through the launch of the Elecsys ANA Profile Plus assay, combining a broad panel of extractable nuclear antigen measurements with electrochemiluminescence technology to enhance result sensitivity and specificity. Bio-Rad Laboratories distinguishes itself with bead-based multiplex platforms that leverage uniquely coded microspheres to simultaneously quantify multiple autoantibodies, optimizing laboratory efficiency and delivering comprehensive autoimmune profiles in one assay run.

Innovative niche players are also making significant contributions. Zeus Scientific secured FDA clearance for its dIFine IFA Imaging and Pattern Recognition System, which employs high-resolution imaging and built-in pattern atlases to support consistency in ANA interpretation and reducing manual verification time. Euroimmun’s Sprinter XL represents another milestone in ANA testing automation, offering fully automated slide processing and high-throughput screening capabilities that cater to growing clinical demands.

This comprehensive research report delivers an in-depth overview of the principal market players in the Antinuclear Antibody Testing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- ARUP Laboratories

- Bio-Rad Laboratories, Inc.

- bioMérieux SA

- DiaSorin S.p.A.

- Medline Industries, LP

- Ortho Clinical Diagnostics, Inc.

- PerkinElmer, Inc.

- Roche Diagnostics International Ltd.

- Siemens Healthineers AG

- Thermo Fisher Scientific Inc.

- Trinity Biotech plc

Formulating Practical Strategic Recommendations to Empower Industry Leaders in Navigating Challenges and Capitalizing on Antinuclear Antibody Testing Innovations

To remain competitive amid evolving technological and regulatory landscapes, industry leaders should prioritize investments in fully integrated automation platforms that combine digital immunofluorescence, robust AI-driven analysis, and seamless laboratory information management integration. Such platforms not only accelerate result turnaround times but also reduce inter-operator variability, enhancing diagnostic confidence and facilitating standardized care pathways.

Given the lasting impact of 2025 tariff policies, companies must diversify procurement strategies by establishing regional sourcing partnerships and expanding in-country manufacturing of key reagents and consumables. This approach will mitigate cost fluctuations, maintain uninterrupted supply, and foster supplier resilience, especially during periods of trade uncertainty.

Collaborative alliances between diagnostic manufacturers, academic research centers, and healthcare systems can accelerate the validation and adoption of emerging multiplex and point-of-care testing modalities. Shared data initiatives will enable cross-platform performance benchmarking, supporting regulatory submissions and driving broader acceptance of novel test formats.

Finally, aligning product development roadmaps with evolving clinical guidelines for autoimmune disease management will ensure that new assays address unmet needs, such as improved specificity for disease subtypes and earlier detection thresholds. By anticipating these clinical requirements, industry leaders can deliver solutions that enhance patient outcomes and strengthen their market leadership.

Outlining a Robust Research Framework for Comprehensive Analysis of Antinuclear Antibody Testing Market Dynamics and Methodological Rigor

This analysis is underpinned by a comprehensive research framework that integrates both primary and secondary data sources. Primary inputs include structured interviews with clinical laboratory directors, academic researchers specializing in autoimmune diagnostics, and senior executives from leading diagnostic companies. These firsthand insights were synthesized to capture emerging priorities and operational challenges.

Secondary research encompassed a systematic review of peer-reviewed literature, regulatory filings, industry white papers, and credible news outlets, ensuring a balanced perspective on technological advancements, tariff impacts, and competitive developments. Proprietary databases were queried for company announcements, product registrations, and FDA clearances to validate technical claims and assess market readiness.

Market segmentation analyses were conducted across product types, assay technologies, end users, distribution channels, disease indications, and sample types, following a top-down and bottom-up validation approach. Regional insights were corroborated with policy analysis reports and trade data to ascertain the real-time impact of tariff measures and local manufacturing trends.

Rigorous data triangulation methods were employed to cross-verify quantitative findings, while expert panel workshops refined key assumptions and scenario analyses. This multi-stage methodology ensures that the conclusions and recommendations presented are both robust and actionable.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Antinuclear Antibody Testing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Antinuclear Antibody Testing Market, by Product Type

- Antinuclear Antibody Testing Market, by Technology

- Antinuclear Antibody Testing Market, by Disease Indication

- Antinuclear Antibody Testing Market, by Sample Type

- Antinuclear Antibody Testing Market, by End User

- Antinuclear Antibody Testing Market, by Distribution Channel

- Antinuclear Antibody Testing Market, by Region

- Antinuclear Antibody Testing Market, by Group

- Antinuclear Antibody Testing Market, by Country

- United States Antinuclear Antibody Testing Market

- China Antinuclear Antibody Testing Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Synthesizing Key Findings and Forward-Looking Perspectives to Conclude the Executive Analysis of Antinuclear Antibody Testing Landscape

Throughout this executive analysis, critical themes have emerged: the shift from manual immunofluorescence to AI-enabled digital platforms, the rise of multiplex assay technologies for comprehensive autoimmune profiling, and the imperative to navigate complex tariff landscapes through strategic supply chain realignment. These converging factors are reshaping how laboratories approach antinuclear antibody testing and define success in an increasingly competitive environment.

Structural changes in laboratory workflows, driven by automation and integrated software solutions, are set to establish new benchmarks for throughput, reproducibility, and diagnostic accuracy. At the same time, localized manufacturing initiatives and regulatory harmonization efforts are creating more resilient ecosystems capable of withstanding external shocks such as elevated import duties.

Looking forward, the continued development of point-of-care devices and emerging biomarkers will further democratize autoimmune diagnostics, expanding access beyond central laboratories to outpatient settings. Collaboration across industry stakeholders-spanning manufacturers, clinical researchers, and healthcare systems-will be essential to translate these innovations into improved patient care and optimized operational efficiency.

Encouraging Decision-Makers to Engage with Associate Director Ketan Rohom for Gaining Exclusive Access to In-Depth Antinuclear Antibody Testing Insights

For a deeper understanding of these comprehensive insights and to acquire the full antinuclear antibody testing market research report, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. Ketan can provide tailored guidance, discuss your specific business needs, and arrange access to our detailed analysis, helping decision-makers to leverage the latest findings for strategic advantage.

- How big is the Antinuclear Antibody Testing Market?

- What is the Antinuclear Antibody Testing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?