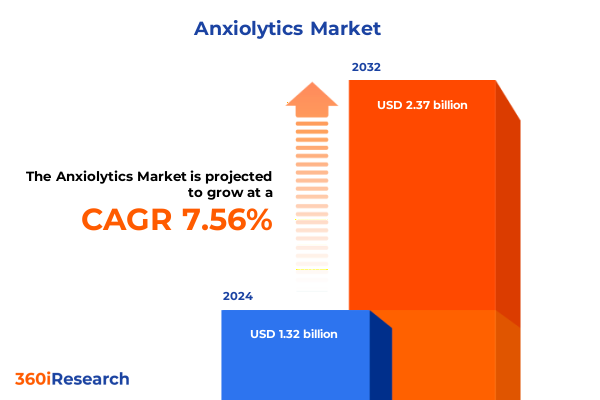

The Anxiolytics Market size was estimated at USD 1.42 billion in 2025 and expected to reach USD 1.54 billion in 2026, at a CAGR of 7.53% to reach USD 2.37 billion by 2032.

Launching a comprehensive overview of anxiolytic therapies highlighting market drivers, clinical innovation, and evolving patient needs across global healthcare

The anxiolytic landscape is undergoing profound evolution as stakeholders navigate a complex intersection of clinical innovation, regulatory shifts, and evolving patient expectations. Traditional therapies continue to anchor clinical practice, yet they are increasingly complemented by digital-first solutions and emerging compound classes that promise differentiated efficacy and tolerability. This dynamic environment underscores the need for an integrated market intelligence framework to understand how therapeutic advancements, policy changes, and competitive actions converge to shape future growth trajectories.

Against this backdrop, this executive summary distills the critical forces at play, from paradigm-shifting digital therapeutics to the ripple effects of recent tariff policies. It provides a strategic lens through which decision-makers can assess the opportunities and challenges inherent in the anxiolytic sector. By synthesizing qualitative insights with robust segmentation analyses, this report lays the groundwork for strategic initiatives that can unlock sustainable value in a rapidly changing treatment ecosystem.

Unveiling paradigm-changing trends reshaping the anxiolytic landscape through digital integration, precision medicine, and novel therapeutic modalities

The anxiolytic market is witnessing unprecedented transformation driven by the integration of digital health technologies and precision medicine frameworks. Digital therapeutics platforms now leverage AI-enabled cognitive behavioral modules and real-world patient data to deliver personalized care pathways, bridging longstanding gaps in accessibility and adherence. These platforms are increasingly validated by robust clinical evidence, with large-scale studies confirming significant anxiety reductions compared to traditional care models. Simultaneously, artificial intelligence tools are reshaping drug discovery and clinical development processes, accelerating timelines and enabling highly targeted molecule selection based on genomic and phenotypic patient profiles.

In parallel, the shift toward value-based care and outcome-driven reimbursement frameworks is prompting manufacturers and providers to align treatment efficacy with real-world performance metrics. Clinical trials for novel anxiolytic compounds are embedding digital biomarkers and remote monitoring to capture continuous efficacy signals, while payers are piloting risk-share agreements that tie payment to patient outcomes. Together, these developments represent a fundamental redefinition of how anxiety disorders are diagnosed, managed, and reimbursed, signaling a new era of integrated, evidence-based therapeutic strategies.

Analyzing the cumulative effects of 2025 trade tariffs on anxiolytic supply chains, manufacturing costs, and strategic market realignment

Starting in early April 2025, the United States implemented blanket tariffs on nearly all imported goods, with critical healthcare inputs such as active pharmaceutical ingredients (APIs) now subject to a 10% global duty. More strikingly, the administration has imposed tariffs of up to 25% on APIs and key drug intermediates sourced from China and India, and a 15% levy on pharmaceutical packaging and lab equipment, creating immediate inflationary pressures on drug production costs. Given that over 40% of generic drug APIs are imported from China and India, manufacturers have been compelled to reassess sourcing strategies, triggering supply chain disruptions and accelerating the exploration of alternative suppliers or reshoring initiatives.

These tariff measures compound pre-existing vulnerabilities in generic drug supply chains, as highlighted by industry experts who warn of potential drug shortages and cost pass-through to patients if resilience measures are not implemented swiftly. In response, major pharmaceutical companies are announcing strategic capital investments in domestic manufacturing and R&D facilities to mitigate future exposure. This wave of onshore expansion, while resource-intensive, is aimed at securing supply continuity and aligning with national policy objectives, thus reshaping the competitive landscape for anxiolytic therapies in the United States.

Revealing deep segmentation dynamics across drug classes, administration routes, dosage forms, distribution avenues, and end user environments

When dissecting market dynamics by drug class, benzodiazepines demonstrate enduring prominence due to their rapid onset profiles, with short-acting formulations favored for acute interventions and long-acting variants preferred for maintenance therapies. Within this class, intermediate-acting agents have carved out a niche for balancing efficacy with safety. Selective serotonin reuptake inhibitors such as escitalopram, paroxetine, and sertraline continue to sustain momentum, driven by their favorable tolerability and broad-spectrum anxiolytic properties, while serotonin norepinephrine reuptake inhibitors like duloxetine and venlafaxine are increasingly leveraged for complex anxiety comorbidities. Meanwhile, azapirones, exemplified by buspirone, are gaining traction for non-sedative anxiety management and offer an alternative mechanism of action.

By route of administration, oral therapies remain the backbone of chronic anxiety management, yet intranasal formulations are emerging for rapid-onset scenarios, and parenteral approaches-including intramuscular, intravenous, and subcutaneous delivery-serve critical roles in acute and inpatient care settings. Within oral and injectable treatments, dosage form evolution is evident: hard and soft gelatin capsules accommodate patient preferences for swallowability, and controlled-release tablets are engineered to optimize pharmacokinetic profiles, while immediate-release formats provide flexible dosing. Distribution channels such as hospital pharmacies, retail outlets, and online pharmacies each present distinct advantages for patient access and adherence. Finally, end users ranging from specialized clinics to home care settings and hospitals dictate tailored service models, underscoring the need for manufacturers to calibrate product offerings and support services to meet diverse care environments.

This comprehensive research report categorizes the Anxiolytics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Drug Class

- Route Of Administration

- Form

- Distribution Channel

- End User

Exploring regional variances in anxiolytic adoption driven by healthcare infrastructure, regulatory frameworks, and patient accessibility across global territories

Across the Americas, robust healthcare infrastructure and established reimbursement frameworks foster high adoption rates of both branded and generic anxiolytics. The United States in particular leads in digital therapeutic integration, while Canada’s regulatory synergy under health technology assessment protocols supports the entry of novel compounds. In contrast, Latin American markets are characterized by pricing pressures and fragmented distribution networks, prompting manufacturers to deploy tiered pricing and local partnerships to enhance accessibility.

In the Europe, Middle East & Africa region, regulatory harmonization via centralized EMA approvals accelerates pan-regional market access, though diverse national health systems require strategic market access planning. Western European countries are pioneers in outcome-based reimbursement pilots, while Gulf Cooperation Council nations are expanding local production capacities. Sub-Saharan Africa remains reliant on generic imports, underscoring the importance of cost-effective supply chain solutions. Meanwhile, the Asia-Pacific region exhibits heterogeneous growth: mature markets like Japan and Australia drive innovation uptake and digital health adoption, whereas emerging economies in Southeast Asia and South Asia prioritize affordability, leveraging local generic manufacturers and biosimilar producers to meet demand.

This comprehensive research report examines key regions that drive the evolution of the Anxiolytics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Dissecting the strategic moves of key innovators, from specialty pipelines to digital therapeutics partnerships and generic supply chain resilience

Innovative small-molecule developers are advancing differentiated anxiolytics through strategic grant funding and precision formulation platforms. For instance, Cingulate Inc. recently secured a $3 million grant to accelerate its once-daily buspirone formulation, positioning it to address dependency and adherence challenges inherent to benzodiazepine alternatives. At the same time, established players such as Otsuka and Lundbeck have fortified their neuroscience portfolios by securing FDA acceptance for supplemental filings that combine brexpiprazole with sertraline, signaling a commitment to expanding therapeutic options for complex anxiety and trauma-related disorders.

Digital therapeutics innovators are also reshaping the competitive terrain. Prescription-grade behavioral-health software is now certified by regulatory bodies and integrated into payer formularies, with Pear Therapeutics and Otsuka’s Click Therapeutics partnership launching prescription‐only apps that complement pharmacotherapy regimens. Concurrently, generic manufacturers and distributors are under pressure to enhance supply chain resilience in light of tariff-driven cost shifts, prompting dialogue with standards organizations and regulatory agencies to prevent drug shortages and safeguard patient access.

This comprehensive research report delivers an in-depth overview of the principal market players in the Anxiolytics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Accord Healthcare US

- Akorn Operating Company LLC

- Alvogen

- Amneal Pharmaceuticals LLC

- Apotex Inc.

- AstraZeneca PLC

- Bausch Health Companies Inc.

- Dellwich Healthcare LLP

- Eli Lilly and Company

- F. Hoffmann-La Roche Ltd.

- GlaxoSmithKline PLC

- H. Lundbeck A/S

- Hameln Pharma GmbH

- Hikma Pharmaceuticals PLC

- Johnson & Johnson Services, Inc.

- Lifecare Neuro Products Limited

- Lifegenix

- Neurocon Inc.

- Noreva Biotech

- Novartis AG

- Pfizer Inc.

- Sanofi S.A.

- Sun Pharmaceutical Industries Ltd.

Empowering industry leaders with strategic directives to navigate market complexities, optimize supply chains, and foster innovation in anxiolytic therapies

Leaders should forge robust partnerships between pharmaceutical R&D and digital health innovators to pilot integrated care solutions that combine pharmacotherapy with evidence-based digital interventions. This collaborative approach will not only improve patient outcomes but also align treatment efficacy with emerging reimbursement models that reward demonstrable real-world results.

To mitigate tariff-related risks, organizations must actively diversify API sourcing to include geographies with stable trade relations and invest in domestic manufacturing expansions or contract development at scale. Concurrently, engaging with policy stakeholders to secure targeted tariff exemptions or transitional support will be critical to maintaining supply continuity.

Finally, segmentation-driven go-to-market strategies should be refined by leveraging granular insights across drug classes, administration routes, dosage forms, distribution channels, and end user environments. Tailored value propositions for each stakeholder-from hospital systems to homecare providers-will maximize market penetration and optimize patient adherence.

Documenting the rigorous research procedures, data sources, and analytical frameworks employed to ensure comprehensive insights into anxiolytic markets

This analysis synthesizes data from an extensive secondary research phase, which included peer-reviewed literature, regulatory filings, and proprietary intelligence from trusted healthcare databases. Primary research comprised in-depth interviews with industry experts across pharmaceutical R&D, regulatory affairs, supply chain management, and digital health services to validate market drivers and identify emerging trends.

Quantitative insights were derived through rigorous data triangulation of historical sales performance, drug utilization statistics, and payer reimbursement patterns. The market segmentation framework was developed iteratively, aligning clinical classifications with commercial channels and patient care settings. Throughout the study, findings underwent multiple rounds of peer review and data validation to ensure methodological transparency, reliability, and actionable relevance for stakeholders seeking to navigate the increasingly complex anxiolytic ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Anxiolytics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Anxiolytics Market, by Drug Class

- Anxiolytics Market, by Route Of Administration

- Anxiolytics Market, by Form

- Anxiolytics Market, by Distribution Channel

- Anxiolytics Market, by End User

- Anxiolytics Market, by Region

- Anxiolytics Market, by Group

- Anxiolytics Market, by Country

- United States Anxiolytics Market

- China Anxiolytics Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Synthesizing critical insights on current anxiolytic market dynamics and future opportunities for innovation and growth in global healthcare

The anxiolytic sector stands at a strategic inflection point where technological innovation, policy directives, and shifting care paradigms converge. Digital therapeutics and precision-guided pharmacology are redefining treatment pathways, while tariff pressures and regional disparities underscore the importance of resilient supply chains and adaptive market access strategies. Effective navigation of this landscape requires an integrated perspective that harmonizes clinical advancement with operational agility.

By leveraging the insights within this report-spanning transformative trends, tariff implications, segmentation nuances, and company strategies-stakeholders are equipped to craft data-driven approaches that capitalize on emerging opportunities and mitigate evolving risks. Collaborative partnerships, targeted investments, and policy engagement will be essential to shaping a future in which anxiolytic therapies meet the complex needs of patients and health systems worldwide.

Transform your anxiolytic strategy with expert insights—reach out to Ketan Rohom, Associate Director Sales & Marketing, to acquire the comprehensive market research report

For a deep dive into anxiolytic market dynamics and tailored strategies to elevate your organization’s competitive edge, connect with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. He can guide you through the report’s comprehensive findings-from segmentation overviews to regional nuances-and discuss how you can leverage these insights to inform your next strategic move. Reach out to schedule a personalized consultation and secure your copy of the full market research report today

- How big is the Anxiolytics Market?

- What is the Anxiolytics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?