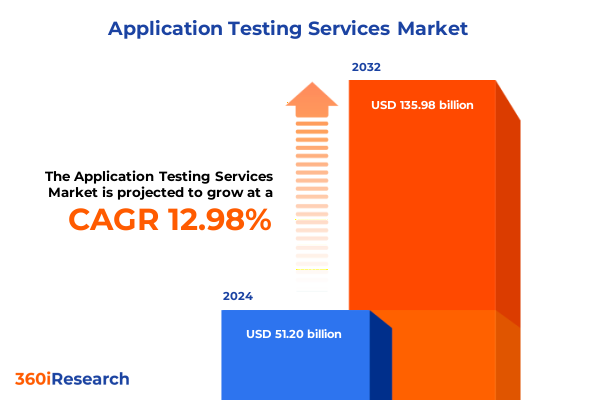

The Application Testing Services Market size was estimated at USD 57.43 billion in 2025 and expected to reach USD 64.43 billion in 2026, at a CAGR of 13.10% to reach USD 135.98 billion by 2032.

Pioneering the Future of Application Testing Services with Agile Methodologies and Advanced Automation Driving Quality and Efficiency

In a rapidly evolving digital economy, the demand for high-quality application performance and reliability has never been more critical. Organizations across every sector are under immense pressure to accelerate software delivery cycles while ensuring robust functionality and seamless user experiences. This dynamic has propelled application testing services to the forefront of strategic initiatives, positioning them as indispensable partners in accelerating digital transformation journeys. The convergence of agile methodologies, DevOps practices, and advanced automation is reshaping how businesses validate, deploy, and manage applications at scale. As software landscapes become more complex and interdependent, the ability to detect defects early in the lifecycle and to continuously monitor performance post-deployment is increasingly synonymous with competitive advantage. Consequently, application testing has grown beyond functional validation into a comprehensive discipline that encompasses security, performance, and user-centric assessments.

Against this backdrop, our executive summary provides a concise synthesis of the latest innovations, challenges, and actionable insights driving the application testing ecosystem. Through a structured exploration of market dynamics, we examine how transformations in technology stacks, regulatory frameworks, and global trade policies are influencing cost structures and service delivery models. By integrating diverse stakeholder perspectives-from enterprise IT leaders to specialized testing vendors-this introduction sets the stage for an in-depth analysis that will equip decision-makers with the intelligence necessary to navigate the future of testing services with confidence and clarity.

Embracing Emergent Technologies and DevOps Practices to Transform Testing Paradigms in the Era of Continuous Delivery and Continuous Innovation

The application testing landscape has been revolutionized by the emergence of continuous integration and continuous delivery (CI/CD) pipelines, ushering in an era where software validation is fully embedded within development cycles. This shift-left philosophy, which advocates for earlier and more frequent testing, has dramatically reduced defect resolution times and enhanced overall release velocity. Complementing this, the integration of artificial intelligence and machine learning has ushered in intelligent test automation frameworks capable of self-healing scripts, predictive analytics, and adaptive test coverage optimization. As a result, test engineers can allocate more time toward exploratory and risk-based testing, elevating the strategic value of human expertise.

Moreover, organizations are increasingly adopting DevSecOps, blurring the lines between development, security, and operations. Security testing, once a standalone phase, is now integrated into the CI/CD pipeline, ensuring that vulnerabilities are identified and remediated in near real time. The proliferation of microservices architectures and containerization has further increased the complexity of test environments, prompting service providers to offer specialized capabilities for end-to-end orchestration and environment management. Additionally, the rapid transition to cloud-native deployments has enabled on-demand scalability of testing infrastructure, empowering teams to simulate global traffic patterns and peak loads with unprecedented accuracy. These transformative shifts underscore the industry’s commitment to accelerating time-to-market without compromising on quality or resilience.

Assessing How Recent United States Tariffs Have Reshaped Cost Structures Supply Chains and Competitive Dynamics within Application Testing Services

Since the imposition of additional tariffs on key technology imports in early 2025, application testing service providers and end-user organizations alike have had to recalibrate their cost structures. Hardware components such as specialized testing appliances, load generators, and network emulators became more expensive, driving an increased reliance on virtualized and cloud-based testing environments. By shifting to public, private, and hybrid cloud deployment models, companies mitigated the direct impact of import duties while maintaining access to scalable, on-demand resources for performance and compatibility testing scenarios.

Furthermore, tariffs affected not only physical hardware but also globally sourced testing expertise. Offshore testing centers faced higher operational costs when procuring imported equipment or licenses, often passing these through in service fees. In response, many organizations began to diversify their vendor portfolios, blending onshore, nearshore, and offshore capabilities to balance cost efficiency with regulatory compliance and data sovereignty requirements. The cumulative effect has been a gradual reshaping of competitive dynamics, where providers demonstrating robust local delivery footprints and flexible pricing structures gained favor. Ultimately, these trade policy shifts have accelerated the acceleration of cloud-based adoption, fostered new strategic partnerships, and encouraged service providers to invest in proprietary tooling to reduce dependence on third-party hardware.

Unearthing Deep Strategic Insights from Multifaceted Segmentation Across Services Deployment Industries Enterprise Sizes and Application Environments

Analyzing the application testing ecosystem through multiple lenses reveals nuanced pathways for service differentiation and market demand alignment. Service type segmentation highlights a continuum from foundational functional testing-comprising unit, integration, system, and acceptance phases-through performance, security, compatibility, and usability assessments. Alongside these, test automation capabilities focusing on framework development, scripting, and maintenance have become indispensable for sustaining continuous validation efforts. Layered atop these is a robust suite of test management services covering defect tracking, meticulous planning, and comprehensive reporting, each element reinforcing the holistic testing lifecycle.

Deployment mode segmentation underscores the growing preference for cloud-based validation, whether in shared public clouds, isolated private environments, or tailored hybrid architectures. Organizations leveraging on-premises environments continue to rely on physical labs and virtualized test beds, particularly where stringent data residency mandates apply. Meanwhile, industry verticals such as financial services, healthcare, IT and telecom, and retail trade exhibit distinct testing priorities shaped by regulatory requirements, user expectations, and digital maturity. Enterprises spanning from large multinational conglomerates to small and medium businesses demonstrate varied appetites for desktop, web, mobile, and enterprise application testing, each application class presenting unique performance, security, and integration challenges worthy of specialized attention.

This comprehensive research report categorizes the Application Testing Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Deployment Mode

- Industry Vertical

- Application Type

- Organization Size

Navigating Regional Dynamics Revealing Growth Opportunities and Challenges across the Americas Europe Middle East Africa and Asia Pacific Testing Markets

Regional dynamics continue to inform how organizations strategize their testing investments and partner selections. In the Americas, rapid digital transformation initiatives in financial services and healthcare regulatory modernization have driven demand for end-to-end testing solutions that combine rigorous compliance checks with real-world user scenario simulations. Service providers with extensive local delivery centers and multilingual support are especially positioned to address the nuanced requirements of North American and Latin American markets.

Across Europe, the Middle East, and Africa, evolving data privacy laws and the migration toward digital government services have catalyzed a surge in security and performance testing engagements. Providers that can demonstrate alignment with GDPR and other regional frameworks, while offering robust environment management capabilities, stand out in these markets. Meanwhile, in Asia-Pacific, accelerated cloud adoption, mobile-first consumer demands, and government-led smart city initiatives have elevated the importance of scalable, automated validation platforms capable of supporting IoT, 5G, and digital payment ecosystems. The interplay of these regional trends highlights the necessity for adaptive delivery models and culturally attuned testing strategies.

This comprehensive research report examines key regions that drive the evolution of the Application Testing Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exploring Competitive Strategies Innovations Partnerships and Investments Driving Leadership Success in the Global Application Testing Landscape

Leading service providers are differentiating themselves through strategic investments in automation toolchains, AI-driven analytics, and global delivery networks. Some have pioneered proprietary platforms that integrate performance monitoring, security scanning, and test orchestration under a unified dashboard, enabling clients to gain holistic visibility into application health. Others have forged alliances with major public cloud vendors, embedding testing accelerators within cloud marketplaces to streamline procurement and deployment.

Strategic acquisitions have also reshaped the competitive landscape, as firms seek to augment their portfolios with niche capabilities in areas such as cybersecurity testing, IoT validation, and robotic process automation. Emphasis on talent development programs and proprietary training academies underscores the war for skilled testers who can navigate complex hybrid environments. Additionally, a subset of providers is exploring outcome-based pricing models, aligning service fees with tangible business metrics such as defect escape rates or production incident reductions. These competitive maneuvers reflect a market increasingly driven by innovation, operational flexibility, and the capacity to deliver demonstrable ROI.

This comprehensive research report delivers an in-depth overview of the principal market players in the Application Testing Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture plc

- Capgemini SE

- CGI Inc.

- Cigniti Technologies Limited

- Codoid Innovations

- Cognizant Technology Solutions Corporation

- DXC Technology Company

- HCL Technologies Limited

- Infosys Limited

- International Business Machines Corporation

- Tata Consultancy Services Limited

- Tech Mahindra Limited

- Wipro Limited

Delivering Strategic Recommendations to Empower Industry Leaders with Actionable Roadmaps for Excellence Resilience and Sustainable Growth in Testing Services

Industry leaders should prioritize the augmentation of automated testing capabilities with cognitive intelligence to rapidly adapt to shifting application architectures and usage patterns. By embedding machine learning algorithms that analyze historical defect trends and user behavior, organizations can anticipate risk areas and optimize test coverage dynamically. Furthermore, expanding hybrid deployment models that blend public, private, and on-premises resources will enable teams to balance cost efficiency with compliance and performance requirements.

Fostering strategic alliances with cloud hyperscalers and emerging tooling vendors can accelerate time-to-value by leveraging prebuilt integrations and best-practice frameworks. Equally important is the cultivation of internal centers of excellence focused on continuous improvement, where cross-functional teams collaboratively refine testing standards, share insights, and drive automation maturity. Organizations must also invest in upskilling their workforce through structured learning pathways in areas like security testing, container orchestration, and performance engineering. By adopting outcome-based engagement models, service buyers and providers can align incentives around measurable quality improvements and operational efficiency gains, thereby reinforcing a partnership ethos rather than a transactional service delivery mindset.

Illuminating Rigorous Research Frameworks Methodologies and Validation Approaches Employed to Ensure Unparalleled Insight Integrity and Depth

Our comprehensive research framework combined rigorous secondary data analysis, primary stakeholder interviews, and expert validation workshops to guarantee depth and accuracy. Secondary research included a thorough review of industry publications, regulatory documents, and emerging technology whitepapers to establish context and identify macroeconomic and policy influences. Primary insights were garnered through structured interviews with C-level executives, test managers, and service provider leaders across diverse geographies, ensuring a balanced representation of perspectives.

Quantitative data was triangulated through surveys and anonymized service performance benchmarks, enabling the calibration of qualitative observations against empirical metrics. Validation workshops convened domain experts to debate findings, uncover potential blind spots, and refine interpretive frameworks. This iterative approach, underpinned by stringent data integrity protocols and confidentiality safeguards, ensures that the insights presented in this report are both robust and actionable. The methodology’s transparency and repeatability provide a solid foundation for stakeholders seeking to replicate or expand upon our analysis in future strategic planning efforts.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Application Testing Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Application Testing Services Market, by Service Type

- Application Testing Services Market, by Deployment Mode

- Application Testing Services Market, by Industry Vertical

- Application Testing Services Market, by Application Type

- Application Testing Services Market, by Organization Size

- Application Testing Services Market, by Region

- Application Testing Services Market, by Group

- Application Testing Services Market, by Country

- United States Application Testing Services Market

- China Application Testing Services Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Synthesizing Key Findings to Highlight Transformational Trends Critical Decisions and Strategic Priorities Shaping the Future of Application Testing Services

Taken together, the findings underscore a market in the midst of profound transformation, where speed, reliability, and security are non-negotiable imperatives. The rise of AI-driven automation and cloud-native testing is redefining the boundaries of scalability and efficiency, while regulatory and geopolitical shifts continue to shape cost considerations and service delivery models. Segmentation analysis reveals that organizations must adopt nuanced strategies that align testing investments with specific application architectures, industry compliance needs, and organizational maturity levels.

Regional insights highlight the importance of culturally nuanced delivery models and regulatory acumen, as market requirements vary significantly across the Americas, EMEA, and Asia-Pacific. Competitive intelligence indicates that providers who combine proprietary platforms, strategic partnerships, and outcome-based engagement models will command market leadership. Moving forward, the integration of advanced analytics, security testing, and environment orchestration will serve as the cornerstone of a resilient testing ecosystem. Ultimately, the organizations that successfully navigate these dynamics will secure the agility and quality assurance capabilities necessary to deliver superior digital experiences and sustain long-term competitive advantage.

Engage with Associate Director Ketan Rohom to Unlock Comprehensive Market Intelligence and Propel Strategic Growth through Informed Investment Decisions

The journey of transforming market intelligence into actionable business outcomes reaches its culmination here. Engage directly with Associate Director Ketan Rohom to access the full breadth of our comprehensive analysis and evidence-based insights. By partnering with him, you will gain tailored guidance on how to apply the methodologies and recommendations laid out throughout this report to your organization’s unique context. His expertise in sales and marketing strategy ensures that your investment in this research will translate into measurable improvements in quality assurance processes, operational efficiency, and competitive positioning. Seize the opportunity to elevate your decision-making with precise data, in-depth sector expertise, and strategic foresight. Reach out now to unlock the complete report and initiate a dialogue that will empower your leadership team to navigate evolving market dynamics with confidence and agility

- How big is the Application Testing Services Market?

- What is the Application Testing Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?