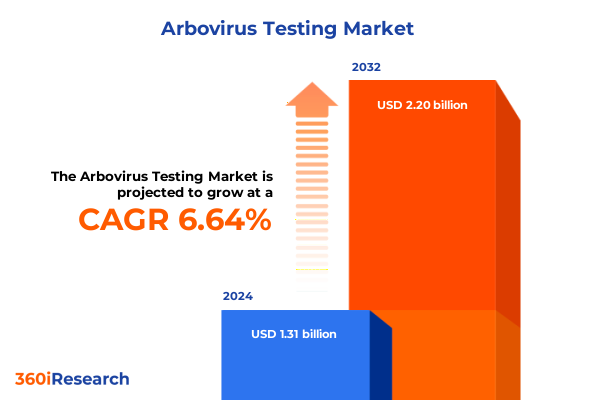

The Arbovirus Testing Market size was estimated at USD 1.39 billion in 2025 and expected to reach USD 1.48 billion in 2026, at a CAGR of 6.72% to reach USD 2.20 billion by 2032.

Unveiling the Critical Importance of Arbovirus Testing in a World Facing Escalating Mosquito-Borne Disease Threats and Diagnostic Challenges

Arbovirus infections, transmitted primarily by mosquitoes and ticks, continue to pose significant global public health challenges. In recent years, outbreaks of dengue, Zika, chikungunya, and West Nile virus have driven urgent demand for accurate, rapid diagnostic solutions. As these diseases expand their geographic reach, healthcare systems and public health agencies require robust testing frameworks to identify and contain emerging threats before they escalate into widespread epidemics. Moreover, evolving climate patterns, increasing international travel, and urbanization have amplified the risk of arboviral transmission, placing even resource-rich regions at heightened vulnerability.

Amid these dynamics, the arbovirus testing industry stands at a critical juncture, balancing the need for enhanced laboratory capacities with the imperative for decentralized point-of-care diagnostics. Public health bodies, including the World Health Organization and the Centers for Disease Control and Prevention, emphasize early detection and continuous surveillance to mitigate outbreak severity. At the same time, diagnostic developers are racing to deploy multiplex and digital platforms that can deliver high throughput screening alongside field-ready assays. As stakeholders from pharmaceutical companies to research institutions intensify collaboration, the industry’s trajectory will be shaped by technological innovation, regulatory adaptation, and the agility of supply chains to respond to surges in testing demand.

Emerging Technological and Operational Paradigm Shifts Redefining the Arbovirus Testing Landscape with Enhanced Precision and Speed

The arbovirus testing landscape has undergone profound transformation as novel technologies and integrated workflows redefine diagnostic paradigms. Just a few years ago, molecular assays were largely confined to centralized laboratories, constrained by the need for thermal cyclers and specialized personnel. Today, isothermal nucleic acid amplification techniques, such as loop-mediated isothermal amplification and recombinase polymerase amplification, are decentralizing molecular detection, enabling rapid, in-field screening that rivals traditional RT-PCR in sensitivity and specificity. Concurrently, advancements in digital PCR are delivering quantification precision that supports nuanced viral load monitoring, enhancing clinical decision-making for severe cases.

Beyond nucleic acid detection, the integration of microarray platforms with CRISPR-based sensors is paving the way for multiplexed assays capable of simultaneously identifying multiple arboviruses in a single run. Digital health tools, including smartphone-enabled readouts and cloud-based analytics, are streamlining data capture and epidemiological reporting. As these innovations converge, laboratories and field diagnostics are becoming more agile, with flexible cartridge-based systems that can adapt to emerging pathogens. In parallel, strategic partnerships between diagnostic developers and public health organizations are accelerating the translation of proof-of-concept assays into emergency use authorizations and routine testing workflows.

Assessing the Compounded Consequences of 2025 United States Tariffs on Arbovirus Testing Supply Chains and Industry Economics

In April 2025, new U.S. trade measures instituted baseline import tariffs that affect a broad spectrum of healthcare goods, including diagnostic reagents, laboratory instrumentation, and critical raw materials. A general 10 percent duty now applies to most diagnostic imports, while active pharmaceutical ingredients and related consumables sourced from China and India are subject to elevated rates reaching 20 to 25 percent. These levies have introduced additional cost pressures for manufacturers and laboratories, compelling many to reassess sourcing strategies and logistical models.

As a result, several leading hospitals and diagnostic networks have voiced concerns over potential delays in kit deliveries and increased procurement expenses. The American Hospital Association formally petitioned for tariff exemptions, warning that higher import costs could interrupt patient care and elevate operational budgets. To mitigate these impacts, diagnostic companies are exploring domestic manufacturing options and forging new alliances with U.S.-based suppliers. Moreover, some developers are optimizing reagent formulations to reduce reliance on tariffed components, while others are negotiating long-term supply contracts to stabilize pricing and ensure continuity.

Despite these adaptations, the cumulative effect of heightened import duties underscores the strategic importance of resilient supply chains. Organizations that swiftly diversify their procurement networks and engage proactively with policymakers are better positioned to weather the shifting trade environment, safeguarding uninterrupted testing capabilities in the face of evolving tariff landscapes.

Insightful Analysis of Market Segmentation Revealing Distinct Trends Across Test Types, Technologies, End Users, Applications, and Sample Types

A nuanced understanding of market segmentation is critical for stakeholders aiming to tailor their diagnostic offerings to diverse clinical and surveillance needs. When examining the market by test type, molecular assays, rapid diagnostic tests, and serological platforms each fulfill distinct roles. Molecular tests serve as the gold standard for early infection detection, while rapid diagnostic tests facilitate point-of-care screening in outbreak settings. Serological tests remain indispensable for confirming exposure history and guiding epidemiological studies.

In terms of technology, enzyme-linked immunosorbent assays have long been valued for their scalability and cost-effectiveness, with competitive, indirect, and sandwich ELISA formats addressing varied analytical requirements. Lateral flow assays have evolved to include both competitive and sandwich designs, optimizing sensitivity for field deployment. Microarray systems, encompassing DNA and protein arrays, provide high-throughput profiling for surveillance laboratories. Meanwhile, PCR technologies have diversified into conventional, digital, and real-time platforms, each offering a balance of throughput, quantification accuracy, and operational complexity.

Looking at end users, diagnostic laboratories and hospital networks lead in high-volume testing, whereas pharmaceutical companies rely on precise assays to support clinical trials and product development. Research institutions drive innovation through exploratory studies, and veterinary testing applications extend arbovirus surveillance to animal reservoirs. Across applications, clinical diagnostics remains the primary use case, but epidemiological surveillance, academic research, and veterinary monitoring are rapidly emerging as vital growth areas. Finally, the choice of sample matrix-whether plasma, saliva, serum, urine, or whole blood-influences assay design and usability, ensuring that each segment’s unique requirements are met with tailored diagnostic solutions.

This comprehensive research report categorizes the Arbovirus Testing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Test Type

- Technology

- Sample Type

- Application

- End User

Comparative Regional Perspectives Highlighting Unique Drivers, Challenges, and Opportunities for Arbovirus Testing in Key Global Markets

Regional dynamics play a pivotal role in shaping arbovirus testing strategies and investment priorities. In the Americas, robust public health infrastructure and recurring dengue and West Nile virus outbreaks drive demand for advanced molecular diagnostics and scalable serology platforms. Collaborative initiatives between federal agencies and private laboratories have accelerated the adoption of multiplex testing, enabling simultaneous detection of co-circulating arboviruses.

Conversely, Europe, the Middle East, and Africa exhibit a dual-market profile in which well-established diagnostic markets in Western Europe coexist with emerging surveillance needs in parts of the Middle East and sub-Saharan Africa. These regions are prioritizing point-of-care solutions to overcome laboratory access constraints, while also investing in central reference facilities equipped with high-throughput platforms for large-scale prevalence studies.

In the Asia-Pacific region, changing climate patterns and population density pressures have intensified the incidence of dengue and chikungunya. Governments and health organizations are deploying comprehensive surveillance networks that integrate field testing with centralized data analytics. A marked shift toward mobile diagnostic units and digital reporting tools underscores the region’s commitment to rapid outbreak response. Across all territories, strategic partnerships with global health agencies and local governments are catalyzing the expansion of testing infrastructure to meet both routine and emergency needs.

This comprehensive research report examines key regions that drive the evolution of the Arbovirus Testing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Profiles of Leading Diagnostic and Life Science Companies Driving Innovations, Collaborations, and Competitive Dynamics in Arbovirus Testing

Leading companies in arbovirus diagnostics are navigating a competitive landscape marked by rapid technological change and shifting regulatory requirements. Major players such as Roche, Abbott, Thermo Fisher Scientific, and Qiagen maintain extensive portfolios that span molecular assays, serological kits, and point-of-care devices. These incumbents are investing heavily in next-generation platforms, leveraging acquisitions and in-house research to strengthen their multiplexing capabilities.

Emerging specialists, including Bio-Rad Laboratories and Hologic, are carving niches in digital PCR and integrated lab-on-a-chip systems, differentiating their offerings through enhanced sensitivity and reduced time to result. At the same time, diagnostic disruptors like Twist Bioscience and newer biotech firms are exploring CRISPR-based and nanopore sequencing assays, aiming to commercialize plug-and-play solutions for decentralized testing. Partnerships between established manufacturers and biotechnology start-ups are proliferating, fostering co-development programs that accelerate assay validation and regulatory approval.

Across the value chain, these companies are also prioritizing supply chain optimization, with many establishing regional manufacturing hubs to circumvent trade-related bottlenecks. As competitive dynamics intensify, the ability to deliver high-quality diagnostics at scale, while maintaining cost-effective operations, will determine market leadership in the evolving arbovirus testing arena.

This comprehensive research report delivers an in-depth overview of the principal market players in the Arbovirus Testing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Becton, Dickinson and Company

- bioMérieux SA

- Controllab

- Danaher Corporation

- F. Hoffmann-La Roche AG

- Hangzhou Clongene Biotech Co., Ltd.

- Hologic, Inc.

- PerkinElmer, Inc.

- QIAGEN N.V.

- Response Biomedical Corp.

- Siemens Healthineers AG

- Thermo Fisher Scientific Inc.

Practical Strategic Recommendations to Empower Industry Stakeholders to Navigate Technological Advances, Regulatory Complexities, and Supply Chain Risks

Industry leaders seeking to capitalize on emerging opportunities in arbovirus diagnostics must adopt multifaceted strategies that align technological innovation with operational resilience. First, investing in next-generation molecular platforms, particularly digital PCR and isothermal amplification systems, will enhance sensitivity and throughput across laboratory and field settings. Early adoption of multiplex test formats can also streamline differential diagnosis when multiple arboviruses co-circulate.

Second, supply chain diversification is critical. Organizations should establish dual-source agreements for key reagents and leverage domestic manufacturing partnerships to mitigate the impacts of trade restrictions. Engaging proactively with regulatory bodies to secure tariff exemptions and maintain uninterrupted access to imported components will further strengthen procurement resilience.

Third, forging collaborative alliances with public health agencies and academic institutions can accelerate validation studies and facilitate real-world performance evaluations. By participating in global surveillance networks and data-sharing consortia, companies can refine assay designs to address evolving pathogen profiles. Finally, integrating digital health solutions, such as cloud-based analytics and mobile reporting tools, will enhance laboratory efficiency, improve data transparency, and enable dynamic responses to outbreak imperatives.

Comprehensive Research Methodology Outlining Robust Primary and Secondary Data Collection Approaches Underpinning Rigorous Market Insights

This analysis leverages a comprehensive research methodology integrating primary and secondary data sources to ensure rigor and reliability. Secondary research entailed an exhaustive review of peer-reviewed publications, regulatory filings, industry white papers, and global health organization reports. Trade and tariff data were examined through customs databases and policy announcements to contextualize supply chain implications.

Primary research involved interviews with subject-matter experts spanning diagnostic manufacturers, clinical laboratory directors, procurement specialists, and public health officials. These conversations provided firsthand insights into operational challenges, technology adoption barriers, and strategic priorities. Additionally, qualitative workshops and virtual focus groups facilitated in-depth discussions on emerging diagnostic needs and best practices.

Data triangulation was achieved by cross-referencing quantitative findings, such as reagent import volumes and assay performance metrics, with qualitative feedback from industry stakeholders. This mixed-methods approach underpins the robustness of the insights presented, ensuring that the conclusions and recommendations reflect both empirical evidence and stakeholder perspectives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Arbovirus Testing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Arbovirus Testing Market, by Test Type

- Arbovirus Testing Market, by Technology

- Arbovirus Testing Market, by Sample Type

- Arbovirus Testing Market, by Application

- Arbovirus Testing Market, by End User

- Arbovirus Testing Market, by Region

- Arbovirus Testing Market, by Group

- Arbovirus Testing Market, by Country

- United States Arbovirus Testing Market

- China Arbovirus Testing Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Conclusive Reflections on the Evolving Arbovirus Testing Arena Emphasizing Collaborative Innovation, Resilience, and Future Preparedness

The arbovirus testing sector stands at an inflection point, driven by converging pressures of emerging pathogens, technological breakthroughs, and evolving trade landscapes. Throughout this report, the imperative for agile diagnostics has been underscored by the necessity to detect and contain outbreaks swiftly. Technological innovations, from decentralized isothermal assays to digital PCR and multiplex platforms, are expanding the frontiers of diagnostic capability.

At the same time, regulatory and trade dynamics-particularly the implementation of new import tariffs-have illuminated the fragility of global supply chains and the strategic value of diversified sourcing. Regional analyses reveal that no singular market narrative dominates; rather, tailored approaches are required to meet the distinct needs of public health agencies, clinical laboratories, and field surveillance units across the Americas, EMEA, and Asia-Pacific.

Ultimately, success in this arena will hinge on collaborative ecosystems that bridge industry, government, and academia. By aligning investments in innovative technologies with resilient procurement and regulatory engagement, stakeholders can forge a diagnostic framework capable of confronting current arboviral threats and anticipating future challenges. Such coordinated action will be essential to safeguarding public health and sustaining diagnostic readiness in the years to come.

Engage with Ketan Rohom to Gain Exclusive Access to In-Depth Arbovirus Testing Market Intelligence for Informed Strategic Decision Making

To gain unparalleled insights into the arbovirus testing industry and receive a tailored briefing on the latest technological breakthroughs, regulatory shifts, and supply chain strategies, reach out to Ketan Rohom, Associate Director of Sales & Marketing at our firm. His expertise will guide you through the nuances of the report's findings, ensuring you extract maximum value from the research. By connecting with Ketan, you secure direct access to actionable intelligence, detailed regional analyses, and executive summaries crafted to inform critical business decisions. Take the next step now and schedule an introductory consultation to explore customized market strategies and elevate your organization’s competitive advantage.

- How big is the Arbovirus Testing Market?

- What is the Arbovirus Testing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?