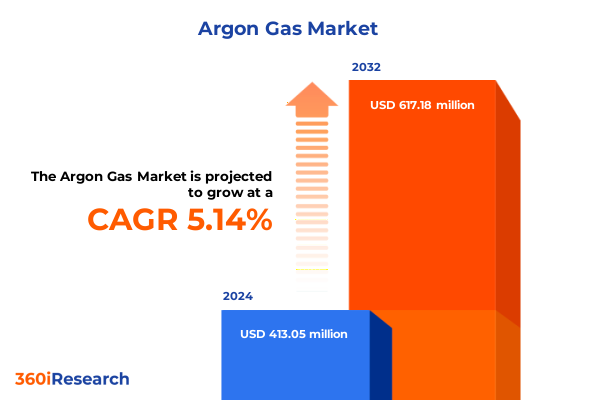

The Argon Gas Market size was estimated at USD 432.95 million in 2025 and expected to reach USD 455.56 million in 2026, at a CAGR of 5.19% to reach USD 617.18 million by 2032.

Understanding the Unique Properties and Multifaceted Applications of Argon Gas That Drive Its Industrial and Technological Significance

Argon is a chemically inert noble gas that constitutes nearly one percent of Earth’s atmosphere and is extracted industrially via cryogenic fractional distillation of liquid air. Its stability under high temperature and low reactivity make it indispensable for shielding applications in welding processes and high-temperature furnaces, where it prevents oxidation of reactive materials. Furthermore, argon’s ionization properties enable its use in semiconductor fabrication, particularly in plasma etching and deposition methods, ensuring precise control over nanoscale features on silicon wafers. In lighting, argon fills incandescent and fluorescent bulbs to prolong filament life and support distinct discharge spectra, while in specialized medical environments it serves as a cryogen for imaging and therapeutic applications.

Exploring Technological Breakthroughs and Sustainability Initiatives Transforming Argon Gas Production Supply Resilience and Environmental Footprint

Recent years have seen a convergence of digital innovation and sustainability objectives reshaping argon production and distribution. Advanced process modeling, such as simplified digital twins of pressure swing adsorption systems, allows operators to simulate adsorption-desorption cycles with high fidelity, optimizing cycle times and adsorbent usage for more efficient on-site generation. Concurrently, gas separation membranes are gaining traction as hybrid complements to traditional cryogenic distillation, reducing energy consumption and enabling modular deployment in decentralized facilities focused on hydrogen recovery and carbon capture. Additionally, manufacturers are increasingly integrating renewable energy sources into air separation units to lower the carbon intensity of argon production, reflecting corporate commitments to net-zero targets. These shifts are also accompanied by real-time tracking and telemetry for cylinder fleets, enhancing supply chain resilience through predictive maintenance and demand sensing across regional networks.

Evaluating the Comprehensive Impact of 2025 United States Tariff Regime on Argon Gas Import Export Flows Supply Chains and Pricing Structures

The introduction of broad-based U.S. tariffs in early 2025 has imposed additional duties on critical input imports, with steel and aluminum now subject to 25 percent tariffs and certain equipment from China facing levies of up to 20 percent. These measures have increased capital expenditures for new air separation units, pressure swing adsorption beds, cryogenic heat exchangers, and high-purity gas cylinders, prompting project timelines to adjust for higher equipment lead times and elevated material costs. Moreover, tariffs on energy imports from Canada and Mexico have driven regional stakeholders to revisit supply agreements and diversify sourcing to mitigate exposure, resulting in a realignment of import-export flows for industrial gases and associated infrastructure. This environment has also spurred negotiations for recycled and secondary supply models, especially in jurisdictions where tariff differentials undermine the viability of new greenfield facilities.

Comprehensive Segmentation Analysis Reveals Distinct Argon Gas Market Opportunities Across Grades Applications Purity Levels and Production Methods

The argon gas market is differentiated by grade classifications ranging from electronic and industrial to nuclear, with a specialty grade segment further subdivided into high purity and ultra high purity, reflecting rigorous quality demands for microelectronics and research applications. In terms of application, welding and cutting processes rely on argon for inert shielding, while semiconductor manufacturing utilizes argon in ion implantation and wafer cleaning, underscoring the critical role of ultra-clean gas streams in maintaining device yield. Purity level segmentation distinguishes high purity for advanced fabrication, standard purity for general industrial use, and ultra high purity for niche scientific and aerospace needs. Finally, production methodologies encompass cryogenic distillation of air separation units, membrane separation technologies, and pressure swing adsorption, each offering distinct capital, operational, and energy-efficiency profiles for gas producers and on-site generation providers.

This comprehensive research report categorizes the Argon Gas market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Grade

- Purity Level

- Production Method

- Application

In-Depth Regional Analysis Highlights Divergent Argon Gas Market Dynamics Challenges and Growth Opportunities in Americas Europe Middle East Africa and Asia-Pacific

The Americas benefit from mature industrial gas networks and a robust metal fabrication sector, where argon’s deployment in welding, aerospace, and semiconductor fabrication remains high. In Europe, Middle East & Africa, the market is shaped by energy-efficiency regulations driving argon-filled insulating windows in response to stringent building codes, alongside growing demand in the automotive and pharmaceutical industries. Asia-Pacific exhibits the strongest momentum, propelled by rapid expansion in electronics manufacturing hubs, increasing on-site gas generation in emerging economies, and government incentives for localized production to reduce import dependencies. This regional mosaic underscores varied market drivers and supply chain structures that stakeholders must navigate to capture growth and optimize distribution.

This comprehensive research report examines key regions that drive the evolution of the Argon Gas market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Competitor Analysis Uncovers Innovative Approaches and Competitive Positioning of Leading Argon Gas Market Players Driving Industry Evolution

Leading industrial gas producers are expanding capacity and optimizing regional networks to meet rising demand for argon. Linde has announced an air separation unit in South Texas slated to produce liquid oxygen, nitrogen, and argon by early 2026 to serve aerospace and emerging space-exploration clients, complementing recent capacity increases at its Florida facility which joined a solar power program to lower carbon intensity. Air Products & Chemicals is investing in new air separation units in Georgia and North Carolina expected online in 2026, replacing legacy assets to boost operational flexibility and energy efficiency. Meanwhile, Airgas, part of the Air Liquide group, has strategically installed additional argon storage nodes across the U.S. Midwest and Northeast to reinforce supply chain resilience amid rail disruptions. These moves reflect a competitive landscape where network density, sustainability credentials, and targeted infrastructure investments define market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Argon Gas market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Air Liquide S.A.

- Air Products and Chemicals, Inc.

- Air Water Inc.

- Airgas, Inc.

- Chem-Gas Pte Ltd.

- Cryotec Anlagenbau GmbH

- Ellenbarrie Industrial Gases Ltd.

- Gulf Cryo Holding C.S.C.

- Hangzhou Hangyang Co., Ltd.

- INDIANA OXYGEN COMPANY

- INOX Air Products Private Limited

- Iwatani Corporation

- Linde plc

- Matheson Tri-Gas

- Messer Group GmbH

- SOL Group

- SUMITOMO SEIKA CHEMICALS CO.,LTD.

- Taiyo Nippon Sanso Corporation

- Yunnan Yunli Industrial Gases Co., Ltd.

Strategic Action Plan for Industry Leaders Proposing Operational Innovations and Investment Priorities to Capitalize on Evolving Argon Gas Market Conditions

Industry leaders should prioritize flexible on-site generation solutions to reduce reliance on external supply and navigate tariff uncertainties while maintaining service continuity. Investing in hybrid production systems that blend membrane separation with pressure swing adsorption can yield both energy savings and operational agility. Emphasizing closer collaboration with end users through long-term supply agreements and digital tracking platforms will enhance demand forecasting accuracy and inventory management. Companies are encouraged to explore renewable energy contracts for ASU operations, demonstrating sustainability commitments that resonate with corporate social responsibility objectives. Finally, diversifying capital expenditure across regions with favorable trade conditions and incentives will mitigate geopolitical risk and optimize total cost of ownership over asset lifecycles.

Research Methodology Framework Detailing Rigorous Data Collection Analytical Techniques and Validation Processes Underpinning the Argon Gas Market Study

This study combines primary research with extensive secondary data analysis to build a robust understanding of the argon gas market. Primary inputs were gathered through in-depth interviews with senior executives at gas producers, cylinder distributors, and equipment manufacturers, alongside consultations with industry experts and academic researchers. Secondary sources include peer-reviewed journals, technical white papers, regulatory filings, and trade association publications. Data triangulation has been employed to reconcile discrepancies between reported capacities, technology deployment, and anecdotal evidence, ensuring the reliability of qualitative insights. The methodology also features supply-chain mapping exercises, production cost modeling, and scenario analysis to assess the implications of trade policy shifts and technological adoption across key regions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Argon Gas market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Argon Gas Market, by Grade

- Argon Gas Market, by Purity Level

- Argon Gas Market, by Production Method

- Argon Gas Market, by Application

- Argon Gas Market, by Region

- Argon Gas Market, by Group

- Argon Gas Market, by Country

- United States Argon Gas Market

- China Argon Gas Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Concluding Insights Summarizing Critical Findings Strategic Implications and Next Phase Considerations for Stakeholders in the Argon Gas Market

In conclusion, argon gas remains indispensable across a spectrum of industries due to its inert properties and versatility. Technological advancements in separation and purification are unlocking new efficiency gains, while sustainability imperatives and tariff landscapes are reshaping capital investment decisions. Segmentation by grade, application, purity, and production method reveals targeted avenues for innovation and differentiation. Regionally tailored strategies, informed by divergent supply-chain structures and regulatory environments, will be critical for stakeholders aiming to capture growth. Ultimately, the ability to align operational flexibility with long-term resilience and environmental objectives will determine competitive success in the evolving argon gas market.

Take the Next Strategic Step by Connecting with Our Associate Director of Sales & Marketing to Secure the Comprehensive Argon Gas Market Research Report

We invite you to take the next strategic step in securing critical market intelligence on the argon gas industry by engaging directly with Ketan Rohom, Associate Director of Sales & Marketing. His expertise and detailed knowledge of the report’s findings will guide you through the tailored insights and actionable strategies assembled in this comprehensive study. Connect with Ketan Rohom to discuss how this research can support your company’s growth objectives, optimize your supply chain decisions, and fortify your competitive position in the dynamic argon gas market. Reach out today to arrange a personalized briefing and purchase the full market research report for deep, data-driven analysis.

- How big is the Argon Gas Market?

- What is the Argon Gas Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?