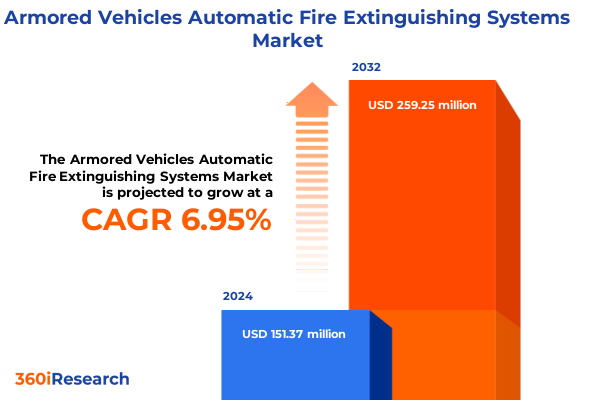

The Armored Vehicles Automatic Fire Extinguishing Systems Market size was estimated at USD 161.22 million in 2025 and expected to reach USD 175.45 million in 2026, at a CAGR of 7.02% to reach USD 259.25 million by 2032.

Setting the Stage for Next-Generation Armored Vehicle Fire Suppression: An In-Depth Exploration of Market Dynamics and Strategic Imperatives

In today’s high-stakes defense environment, ensuring the integrity and survivability of armored vehicles in the face of onboard fire incidents has become an imperative for manufacturers, military planners, and procurement professionals alike. Armored platforms ranging from personnel carriers to main battle tanks carry critical munitions, crew, and civilians into volatile theaters where fire outbreaks pose a severe risk to mission success and human safety. Against this backdrop, automatic fire extinguishing systems have evolved from optional add-ons to mandatory safeguards, driven by intensifying battlefield threats, elevated protection standards, and an expanding range of fire suppression technologies. Moreover, recent enhancements in sensor accuracy, agent dispersal mechanisms, and integration with vehicle electronics have elevated expectations for reliability and response speed. This introduction lays the groundwork for a thorough examination of the market’s undercurrents, key influencers, and strategic inflection points.

Building on this foundation, the subsequent sections traverse transformative shifts in technology and regulation, analyze the cumulative impact of United States tariffs instituted in 2025, and unveil critical segmentation and regional insights. Leading players and their competitive maneuvers receive spotlight attention, culminating in actionable recommendations for stakeholders seeking to optimize safety, performance, and cost-effectiveness. The report’s research methodology is then detailed, underscoring rigorous data validation and expert consultation, before drawing concise conclusions that highlight strategic pathways forward. This executive summary equips decision-makers with a coherent narrative of market dynamics and prescriptive findings to inform procurement, design, and investment strategies in armored vehicle fire protection.

Navigating the Paradigm Shifts in Armored Vehicle Fire Suppression: Emerging Technologies, Regulatory Evolution, and Stakeholder Influences

The landscape of armored vehicle fire extinguishing systems is undergoing a profound metamorphosis propelled by converging technological breakthroughs, evolving regulatory mandates, and shifting defense spending priorities. Advances in water mist nozzles now enable microdroplet formation that rapidly reduces heat and displaces oxygen, while novel gas agents such as Novec 1230 deliver environmental benefits without compromising extinguishing performance. In tandem, digital sensors and embedded diagnostics provide real-time system health monitoring, predictive maintenance alerts, and secure integration with vehicle command networks. Consequently, what once was a purely reactive safety feature has transformed into a proactive mission assurance capability.

Equally consequential are regulatory and compliance shifts influencing global procurement. Heightened emphasis on sustainable chemicals has led to phase-outs of older halon agents, driving system redesigns to align with environmental protocols. Simultaneously, interoperability standards under NATO STANAG and other alliance frameworks now mandate common electrical interfaces and mounting schematics, streamlining logistics for joint operations. Furthermore, innovation ecosystems are increasingly collaborative, with defense OEMs partnering with materials scientists and electronics firms to co-develop modular suppression units. As a result, stakeholders must navigate a complex web of technical, environmental, and alliance imperatives, all while managing cost pressures and accelerating field deployment timelines.

Assessing the Far-Reaching Consequences of 2025 United States Tariffs on Armored Vehicle Fire Suppression Ecosystem and Supply Chain Dynamics

In 2025, the imposition of new United States tariffs targeted at key components and raw materials used in fire suppression systems has reverberated across the global supply chain, compelling manufacturers to reassess sourcing strategies and cost structures. Steel cylinders, precision nozzles, and specialized polymers have all seen duty hikes that elevated landed costs and pressured margins for both original equipment manufacturers and retrofit service providers. Consequently, some suppliers have migrated final assembly operations back to North American facilities or diversified to partner plants in tariff-exempt zones to mitigate these added expenses. At the same time, local content thresholds imposed in defense procurement contracts have become more stringent, spurring investment in domestic tooling and supplier qualification processes.

Moreover, these tariffs have accelerated consolidation among smaller component makers, as they seek economies of scale to absorb duty impacts. Larger multinational fire suppression firms have leveraged offsetting investments in automation and digital engineering to maintain competitive pricing, redirecting savings into research on alternative agents and lightweight cylinder alloys. Additionally, end users such as armed forces and security contractors have adjusted procurement plans, either by extending system upgrade cycles or by negotiating volume-based agreements to spread tariff costs over longer contract terms. This dynamic environment underscores the importance of agile supply chain planning and close collaboration between regulatory, procurement, and engineering teams to sustain operational readiness without compromising financial objectives.

Unveiling Crucial Segmentation Insights by System Type, Vehicle Class, Application Mode, and Sales Channel to Drive Strategic Market Decisions

A nuanced understanding of key market segments illuminates where value creation and differentiation opportunities lie across the system type, vehicle class, application mode, and distribution channels. Within the system type category, foam systems have attracted attention for their rapid blanket formation capabilities, particularly Aqueous Film Forming Foam that balances flammability control with environmental toxicity reductions, while Protein Foam variants maintain proven effectiveness against high-temperature hydrocarbon fires. Gas-based systems remain critical where water is impractical, with CO2 offering a cost-effective solution, FM-200 preserving legacy platform compatibility, and NOVEC 1230 delivering superior safety profiles for crewed vehicles. In scenarios demanding minimal equipment mass, powder agents-both ABC Powder for multi-class fire suppression and BC Powder optimized for liquid and gas fires-continue to hold ground, even as the water mist segment gains traction for its minimal collateral damage on electronics.

Vehicle class segmentation further refines priorities, with armored personnel carriers often favoring lightweight, modular configurations for rapid deployment, whereas infantry fighting vehicles call for integrated designs that align with onboard power systems. Main battle tanks, carrying sensitive munitions and operating in extreme environments, demand redundancy and agent potency, influencing system redundancy designs. Application modes span original equipment installations that capitalize on integrated design efficiency and aftermarket retrofit programs that extend the service life of legacy fleets. Sales channel dynamics reveal that while direct sales foster deeper OEM partnerships and customization, distributor networks offer agility for rapid replacement parts, and online platforms are emerging as a convenient avenue for standard retrofit kits, particularly among smaller defense contractors.

This comprehensive research report categorizes the Armored Vehicles Automatic Fire Extinguishing Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- System Type

- Application

- Vehicle Type

- Sales Channel

Decoding Regional Dynamics in Armored Vehicle Fire Suppression across Americas, Europe Middle East Africa, and Asia-Pacific to Inform Expansion Priorities

Distinct regional dynamics shape both demand drivers and competitive positioning in the armored vehicle fire extinguishing systems arena. In the Americas, a strong emphasis on domestic defense spending coupled with Section 232 and Buy American provisions has catalyzed local manufacturing investments and supplier accreditations. This environment rewards firms capable of rapidly achieving US-based production certifications and supporting high-tempo field operations across North and South America. Meanwhile, the Europe, Middle East and Africa region reflects a mosaic of regulatory frameworks, where environmental restrictions in the EU prioritize low-global-warming potential agents, while Middle Eastern nations focus on high-intensity vehicle survivability for armored patrolling. African militaries, often partnering with international donors and peacekeeping coalitions, emphasize cost-effective aftermarket solutions and rapid retrofit capabilities to modernize aging fleets.

Asia-Pacific presents another layer of complexity. Major defense powers such as India, South Korea and Japan are upgrading indigenous vehicle programs and require alignment with local content policies and offset obligations. Southeast Asian nations, balancing budget constraints and diverse terrain requirements, frequently pursue versatile platforms that can integrate modular fire suppression units. Furthermore, regional tensions have prompted accelerated procurement cycles, underscoring the need for suppliers to maintain agile production schedules and robust logistics networks. Across all territories, regional insight highlights that success hinges on a supplier’s ability to blend compliance acumen with operational readiness support.

This comprehensive research report examines key regions that drive the evolution of the Armored Vehicles Automatic Fire Extinguishing Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlighting Leading Manufacturers and Innovative Solution Providers Shaping the Armored Vehicle Fire Suppression Market with Strategic Collaborations

A competitive cohort of specialized and diversified firms leads the charge in armored vehicle fire suppression, each leveraging unique strengths to secure defense contracts and aftermarket partnerships. Firetrace International has distinguished itself through proprietary linear detection tubing and integrated nozzles that enable early fire detection and swift agent discharge, appealing to operators seeking minimal maintenance overhead. Fike Corporation differentiates with advanced pressure-regulated cylinders and custom-engineered control panels tailored for extreme climatic conditions, reinforcing its reputation among tank OEMs. Survitec Group, known for its maritime life-safety systems, has extended its product portfolio into vehicle fire protection, capitalizing on its deep expertise in robust, shock-resistant enclosures and global service footprint.

Johnson Controls, through its Fenwal heritage, commands attention with its broad agent portfolio and scalable electronics integrations, supporting both new builds and extensive life-cycle support agreements. Kidde (a division of Carrier Global) continues to innovate in foam performance and digital interface modules, reinforcing alliances with leading defense primes. In addition, emerging players are forging strategic collaborations with sensor technology firms and materials suppliers to develop next-generation formulations and lightweight composites. Across this landscape, contracting authorities increasingly favor suppliers offering end-to-end support-from design and validation to field training and performance monitoring-underscoring the shift from transactional sales to service-driven engagements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Armored Vehicles Automatic Fire Extinguishing Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accuro Brandschutzanlagen GmbH

- Amerex Corporation

- Angus Fire Ltd.

- Defense Services Group LLC

- Dynamit Nobel Defence GmbH

- ExploSpot Systems Pvt. Ltd.

- Fike Corporation

- FIRE ARMOUR PVT. LTD.

- Fire Protection Technologies Pty. Ltd.

- Fire Rid

- Fire Safe Technologies LLP

- Fire Suppression Systems Ltd.

- Fireaway Inc.

- Firetrace International, Inc.

- Gielle Group

- Halma plc

- INKAS Armored Vehicle Manufacturing

- Johnson Controls Inc.

- Krauss-Maffei Wegmann GmbH & Co.

- LEHAVOT LIMITED

- Lenco Industries, Inc.

- Lockheed Martin Corporation

- Marotta Controls, Inc.

- Morita Holding Corporation

- Oberon Fire Systems Co., Ltd.

- Oshkosh Defense, LLC

- Protecfire GmbH

- Reacton Fire Suppression Limited

- RTX Corporation

- RTX Corporation

- Spectrex Inc.

- Titan Legal Services, Inc.

Driving Operational Excellence and Competitive Advantage with Targeted Strategies for Enhanced Safety, Efficiency, and Market Leadership in Fire Suppression

Industry leaders can enhance resilience and market positioning by implementing a series of targeted strategies that align technology advancement with operational demands. First, prioritizing investment in next-generation agent research-particularly water mist and low-global-warming gas blends-can yield competitive differentiation while preempting regulatory constraints on halon-replacement chemicals. Furthermore, deploying predictive analytics platforms to monitor system health and forecast maintenance needs will reduce downtime and strengthen mission readiness.

In parallel, creating strategic joint ventures with regional manufacturing partners can address local content requirements and accelerate qualification under defense procurement regulations. By establishing centers of excellence for rapid prototyping and testing, organizations can bring customized solutions to market more swiftly. Elaborating aftermarket service models that bundle training, remote diagnostics, and performance audits will deepen customer relationships and generate recurring revenue streams. Additionally, embracing digital sales channels for standard retrofit kits enables reach into smaller defense contractors and emerging military markets, fostering organic growth. Lastly, cultivating cross-industry collaborations-from materials science innovators to electronics integrators-will amplify capabilities and support the evolution of modular, scalable fire suppression architectures designed for the next generation of armored vehicles.

Employing Rigorous Mixed-Method Research Approaches to Validate Findings and Ensure Robust Insights in Armored Vehicle Fire Suppression Analysis

The findings and recommendations presented herein derive from a rigorous mixed-method research framework designed to ensure validity, reliability, and comprehensive sector coverage. Primary research activities included in-depth interviews with defense procurement officers, OEM engineers, and system integrators across multiple continents, providing firsthand insights into performance requirements, sourcing challenges, and future priorities. Complementing these qualitative inputs, a series of structured surveys captured supplier perspectives on technology development roadmaps, regulatory impacts, and distribution channel effectiveness.

Secondary research encompassed a systematic review of regulatory documents, military standards, patent filings, and company technical briefs to validate agent properties, system architectures, and regional procurement mandates. Data triangulation was achieved by cross-referencing government announcements on defense budgets, international trade duty schedules, and published alliance interoperability guidelines. Additionally, select case studies of retrofit programs and new platform deployments were examined to assess real-world efficacy, adoption timelines, and lifecycle support models. This methodological approach ensured that each insight reflects both strategic context and operational realities, providing stakeholders with a robust foundation for decision making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Armored Vehicles Automatic Fire Extinguishing Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Armored Vehicles Automatic Fire Extinguishing Systems Market, by System Type

- Armored Vehicles Automatic Fire Extinguishing Systems Market, by Application

- Armored Vehicles Automatic Fire Extinguishing Systems Market, by Vehicle Type

- Armored Vehicles Automatic Fire Extinguishing Systems Market, by Sales Channel

- Armored Vehicles Automatic Fire Extinguishing Systems Market, by Region

- Armored Vehicles Automatic Fire Extinguishing Systems Market, by Group

- Armored Vehicles Automatic Fire Extinguishing Systems Market, by Country

- United States Armored Vehicles Automatic Fire Extinguishing Systems Market

- China Armored Vehicles Automatic Fire Extinguishing Systems Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Summarizing Critical Takeaways and Strategic Implications for Unlocking Resilience and Competitive Edge in Armored Vehicle Fire Suppression Operations

Through this comprehensive exploration, several critical themes emerge as intrinsic to success in the armored vehicle fire suppression domain. Technological innovation-spanning advanced agent chemistries, sensor integration, and modular system designs-remains the primary driver of differentiation. Equally, evolving regulatory frameworks and environmental mandates shape both product development trajectories and supply chain configurations, demanding proactive compliance strategies. The 2025 United States tariffs further underscore the strategic importance of agile sourcing, local manufacturing partnerships, and flexible procurement contracts to shield stakeholders from cost volatility.

Segmentation and regional analyses highlight that nuanced understanding of system types, vehicle classes, application models, and distribution channels enables precision targeting of resources and capabilities. Meanwhile, leading companies have demonstrated that service-oriented contracts, digital sales innovations, and collaborative R&D can reinforce market leadership. Ultimately, the path forward for defense OEMs, system integrators, and procurement agencies lies in harmonizing these elements-investing in next-generation fire suppression technologies while optimizing global supply networks and strengthening aftermarket engagement models. By doing so, organizations can elevate vehicle survivability, bolster crew safety, and secure operational readiness in complex mission environments.

Take the Next Step Today and Contact Ketan Rohom to Unlock Tailored Insights and Strategies from Armored Vehicle Fire Extinguishing Systems Research

To explore the full depth of armored vehicle fire extinguishing systems and secure your competitive advantage, reach out directly to Associate Director, Sales & Marketing Ketan Rohom. With a deep understanding of defense procurement cycles and technical specifications, Ketan can guide you through the comprehensive report, help identify the sections most relevant to your strategic goals, and arrange a tailored package to support your evaluation, planning, or procurement initiatives. Whether you require detailed insights into system type innovations, tariff impacts, regional dynamics, or supplier benchmarks, Ketan’s expertise ensures you receive the precise information and analysis needed to drive informed decisions. Connect today to unlock actionable intelligence and advance your organization’s fire safety and operational readiness in armored platforms.

- How big is the Armored Vehicles Automatic Fire Extinguishing Systems Market?

- What is the Armored Vehicles Automatic Fire Extinguishing Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?