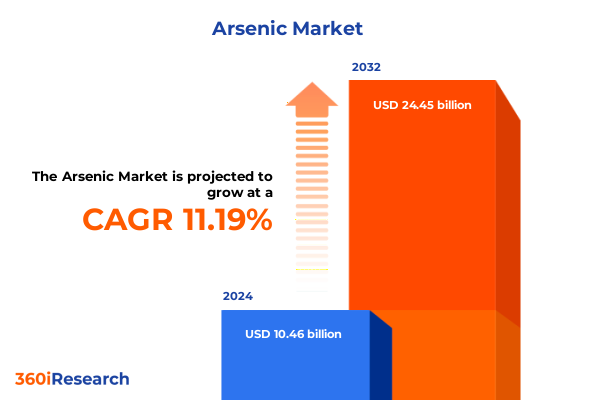

The Arsenic Market size was estimated at USD 11.62 billion in 2025 and expected to reach USD 12.92 billion in 2026, at a CAGR of 11.20% to reach USD 24.45 billion by 2032.

Unveiling the Multifaceted Role of Arsenic Across Industries From Agricultural and Electronic Uses to Environmental and Regulatory Considerations

Arsenic, a naturally occurring metalloid, occupies a unique position at the intersection of industrial utility and environmental concern. It predominantly emerges from mineral sources like arsenopyrite and as a by-product of smelting operations for metals such as copper, lead, and zinc, underscoring its extensive integration into global supply chains. Given its varied oxidation states, arsenic manifests in multiple compound forms, including pentoxide, trioxide, and trisulfide, each of which exhibits distinct chemical behaviors and industrial applications. As a testament to its versatility, arsenic forms find critical use cases ranging from semiconductor doping to agricultural inputs, highlighting the material’s far-reaching impact on modern manufacturing processes.

Reflecting on its environmental distribution, arsenic permeates soil, water, and biota, influencing ecological systems and posing public health considerations. Historical industrial practices, particularly coal-fired generation and obsolete smelting facilities, contributed significant arsenic trioxide emissions, leaving a legacy of localized contamination. In response, regulatory bodies have imposed stringent limits on arsenic residuals in water and soil, prompting the evolution of advanced remediation techniques and monitoring protocols. Consequently, stakeholders must navigate an intricate web of compliance requirements while seeking to harness the material’s technological benefits effectively.

Examining the Profound Technological, Environmental, and Regulatory Transformations Reshaping the Arsenic Market and Driving Strategic Realignment

The arsenic landscape has undergone transformative shifts driven by rapid technological innovation and evolving environmental imperatives. In the electronics sector, gallium arsenide and arsenic doping continue to be instrumental for achieving superior electron mobility in high-frequency applications, reinforcing the material’s indispensable role in next-generation semiconductors. This progress has stimulated investments in precision purification processes, optimizing the trioxide precursor into ultra-high-purity forms for critical doping operations consistently demanded by miniaturization trends.

Simultaneously, environmental stewardship has emerged as a primary catalyst for strategic realignment. Heightened awareness of arsenic’s toxicity has driven the phase-out of chromated copper arsenate in residential wood products and the substitution of legacy pesticides with less persistent formulations. These regulatory measures have compelled industry participants to innovate alternative wood preservation chemistries and to adopt robust lifecycle assessments for new arsenic-based compounds, ensuring both efficacy and environmental compatibility.

Moreover, the regulatory horizon continues to expand with fresh directives addressing permissible arsenic discharge limits and classification as a priority contaminant in water quality standards. These initiatives have sparked the deployment of next-generation adsorption and membrane technologies capable of selectively removing arsenic from effluents, thereby redefining compliance strategies. Consequently, businesses must realign their research, procurement, and production frameworks to stay ahead of tightening thresholds and to leverage emerging technological enablers.

Assessing the Comprehensive Effects of 2025 United States Tariff Regimes on Arsenic Supply Dynamics, Cost Structures, and Global Competitive Positioning

Since the onset of 2025, the United States has enacted a universal 10% tariff on virtually all imports, introducing a foundational cost uplift across raw materials and specialty chemicals, including arsenic compounds. This baseline duty, effective April 5, 2025, underscores a strategic pivot toward bolstering domestic production by altering the relative competitiveness of imported inputs. Further, reciprocal tariffs targeting specific trading partners have layered additional duties, with European Union imports facing a 20% rate and Japan encountering a 24% levy, compounding supply cost pressures for entities relying on international arsenic suppliers.

Building on this framework, Section 232 proclamations adjusted duty rates on designated chemical precursors to an additional 25% ad valorem beginning March 12, 2025, thereby intensifying the cumulative financial burden on imports of arsenic trioxide and related derivatives. These measures have disrupted established logistics models, as supply chains recalibrate to mitigate tariff exposure through nearshoring, dual-sourcing strategies, and increased inventory buffers. The aggregate effect underscores the importance of dynamic procurement planning to preserve operational continuity and cost competitiveness.

Industry associations have voiced concerns about the potential for elevated tariffs to erode the inherent advantage of U.S. chemical manufacturers. Stakeholders warn that inflated input costs could cascade into downstream sectors such as pharmaceuticals and electronic semiconductors, risking price escalations and constrained access to critical arsenic-based materials. In parallel, market participants continue to evaluate exemption petitions and advocate for phased implementation schedules to soften abrupt cost shocks. Consequently, decision-makers must vigilantly monitor tariff developments and engage in proactive policy dialogues to navigate this evolving trade landscape.

Illuminating Critical Market Insights Across Diverse Arsenic Segmentation Axes Spanning Form, Grade, Application, End Use Industry, and Distribution Channels

A nuanced understanding of the arsenic market emerges through multiple segmentation lenses that elucidate demand drivers and competitive nuances. By form, stakeholders differentiate between pentoxide, trioxide, and trisulfide variants, recognizing that each chemical state dictates unique manufacturing protocols and end-use suitability. This form-based perspective guides investment in specialized processing technologies capable of handling distinct reactivity and purification challenges inherent to each compound category.

Grade segmentation further refines market insights by distinguishing laboratory reagent grade, pharmaceutical grade, and technical grade arsenic compounds. Laboratory reagent grade applications prioritize analytical precision and purity benchmarks, whereas pharmaceutical grade materials necessitate stringent biocompatibility and regulatory clearance. In contrast, technical grade derivatives focus on cost-efficiency and performance parameters suited for broad industrial processes, including semiconductors and metal alloys.

Application-focused analysis captures the diversified utility of arsenic across agricultural pesticides, glass manufacturing, metal processing, and wood preservation, alongside electronic semiconductor uses such as PCB etching and semiconductor doping. This breadth underscores arsenic’s multifunctional nature, prompting differentiated supply chain strategies. Meanwhile, end-use industry segmentation spans agriculture, chemical production, electronics, metallurgy, pharmaceuticals, and wood treatment, highlighting cross-sector interdependencies. Finally, distribution channel segmentation, encompassing direct sales, global and regional distributors, and online platforms, reveals shifting procurement behaviors as buyers prioritize agility and traceability. Together, these segmentation dimensions offer a holistic lens for deciphering market structure and strategic entry points.

This comprehensive research report categorizes the Arsenic market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Grade

- Distribution Channel

- Application

Strategic Regional Perspectives on Arsenic Market Dynamics in the Americas Europe Middle East & Africa and Asia-Pacific to Enable Targeted Engagement

The Americas region continues to reflect a distinctive supply landscape shaped by the historic cessation of domestic arsenic production in the United States in 1985, compelling reliance on imports of arsenic trioxide and metal feedstocks. This structural dynamic has fostered robust distribution networks and spurred investments in domestic refining partnerships to secure uninterrupted access to primary arsenic inputs. Simultaneously, environmental oversight at federal and state levels has reinforced stringent standards for arsenic discharge and workplace exposure, driving operational refinement among processing facilities.

In Europe Middle East & Africa, regulatory harmonization under the European Union has led to the prohibition of chromated copper arsenate in residential wood treatments and rigorous classification of arsenic compounds as priority substances under the Water Framework Directive. These measures have accelerated the shift toward alternative preservation chemistries and incentivized R&D in eco-efficient remediation technologies. Meanwhile, market demand in Middle Eastern petrochemical hubs and African mining nations continues to leverage arsenic in niche industrial processes, underscoring the region’s dual role as both regulator and end-user.

Asia-Pacific stands out for sustained utilization of arsenic compounds in wood preservation and intensive agricultural applications, particularly in countries where chromated copper arsenate and organic arsenicals remain approved. At the same time, the region has emerged as a leading producer of semiconductor-grade arsenic feedstocks, driven by rapid expansion in electronics manufacturing. Investments in capacity augmentation and purity enhancement initiatives reflect a strategic prioritization of arsenic’s critical role in advanced technology supply chains.

This comprehensive research report examines key regions that drive the evolution of the Arsenic market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unveiling Competitive Strategies and Innovations Among Prominent Arsenic Market Participants Driving Value Creation and Technological Advancement

Leading companies in the arsenic compounds arena have distinguished themselves through strategic investments in advanced purification, sustainable manufacturing practices, and integrated distribution frameworks. American Elements, renowned for its diverse industrial and pharmaceutical arsenic offerings, has prioritized scale-up of high-purity trioxide production lines while embedding rigorous environmental controls across its facilities. Thermo Fisher Scientific, through its Alfa Aesar brand, leverages a global distribution network to ensure rapid delivery of laboratory-grade arsenic compounds, underscoring agility in serving research and niche semiconductor sectors.

Sumitomo Chemical and Merck KGaA exemplify vertically integrated models where upstream purification units feed into downstream specialty chemical divisions, optimizing value capture and quality assurance. These firms emphasize research collaborations to tailor arsenic derivatives for next-generation semiconductor doping and emerging medical formulations. Concurrently, GFS Chemicals and MP Biomedicals focus on trace-metal reagent purity, catering to analytical and biopharma markets with stringent regulatory demands. Such differentiated positioning highlights the interplay between technical expertise and market penetration strategies.

Smaller, agile players complement this competitive landscape by targeting regional distribution efficiencies and customized service offerings. Their proximity to end-users enables responsive product customization and technical support, reinforcing the importance of localized engagement. Collectively, these leading and niche participants illustrate a vibrant ecosystem where innovation, sustainability, and supply chain resilience define competitive advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the Arsenic market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ChemCon

- ChemWerth

- Chenzhou Chenxi Metals Co. Ltd.

- Donghai Dongfang Electronic Material

- Emcure Pharmaceuticals

- Furukawa Co., Ltd.

- Haichen Optoelectronic

- Hebei Chengxin

- Henan Guoxi Chemical

- Hengyang Waharsenic Technology Co., Ltd.

- Hunan Gold Group

- Hunan Jinye Industrial

- Jiangxi Copper Corporation

- Jiangxi Deyi Semiconductor Technology

- PPM Pure Metals GmbH

- Shandong Humon Smelting

- Umicore

- Xilan Chemicals Co. Ltd.

- Yunnan Tin Company Group

- Zhongtianli (Yangzhou Zhongtianli New Material)

Formulating Actionable Strategies to Empower Industry Leaders in Navigating Regulatory Complexities and Capturing Emerging Arsenic Market Opportunities

Industry leaders seeking to capitalize on emerging arsenic market opportunities should prioritize agile supply chain strategies that balance cost control with regulatory compliance. Establishing dual sourcing arrangements and cultivating partnerships with regional distributors can mitigate exposure to tariff-driven cost volatility and logistical disruptions. By proactively diversifying procurement channels, organizations can sustain operational continuity even amid shifting trade policies.

Equally critical is the integration of sustainable manufacturing practices. Leaders should invest in closed-loop purification systems and advanced effluent treatment technologies to exceed evolving environmental standards and to reinforce corporate responsibility commitments. This focus not only ensures compliance with tightening discharge limits but also positions companies advantageously with environmentally conscious stakeholders and end users.

Furthermore, innovation acceleration through collaborative R&D alliances can unlock novel arsenic-based applications, from next-generation semiconductor materials to targeted pharmaceutical therapies. By aligning with academic institutions and specialized technology providers, industry players can drive product differentiation while sharing risk and harnessing external expertise. Such an ecosystem-driven approach will be instrumental in navigating regulatory complexity and capturing high-value segments within the arsenic domain.

Deploying a Robust Multimethod Research Framework to Ensure Analytical Rigor, Data Integrity, and Objectivity in Arsenic Market Study

This analysis rested on a robust multimethod research framework designed to deliver comprehensive insights with high integrity and objectivity. Primary data collection included structured interviews with key stakeholders across the arsenic value chain, encompassing upstream producers, downstream manufacturers, and regulatory authorities. These qualitative engagements provided nuanced perspectives on supply chain dynamics, compliance challenges, and innovation trajectories.

Complementing qualitative findings, extensive secondary research was conducted through systematic review of peer-reviewed publications, government proclamations, industry association reports, and reputable open-source databases. Data triangulation across these resources ensured validation of critical trends and regulatory developments. In addition, segmentation analysis leveraged classification schemes based on form, grade, application, end use, and distribution channels to delineate market contours and identify strategic entry points. This methodological rigor underpins the reliability of the forward-looking insights presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Arsenic market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Arsenic Market, by Form

- Arsenic Market, by Grade

- Arsenic Market, by Distribution Channel

- Arsenic Market, by Application

- Arsenic Market, by Region

- Arsenic Market, by Group

- Arsenic Market, by Country

- United States Arsenic Market

- China Arsenic Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Consolidating Key Insights and Strategic Imperatives to Illuminate Future Pathways and Catalyze Sustainable Growth in the Arsenic Market

The arsenic market’s trajectory is shaped by the convergence of technological innovation, regulatory evolution, and geopolitical realignments. From the proliferation of high-purity semiconductor applications to the persistent environmental imperatives around toxicity management, stakeholders face a dynamic landscape requiring proactive adaptation and strategic foresight. By synthesizing core findings across segmentation, regional dynamics, and competitive positioning, this summary illuminates the multifaceted drivers defining arsenic’s role in industrial ecosystems.

Looking ahead, strategic imperatives will revolve around supply chain resilience, collaboration-driven innovation, and leadership in sustainable practices. Organizations that adeptly navigate tariff fluctuations, invest in next-generation purification and remediation technologies, and forge collaborative alliances will secure competitive differentiation. In doing so, they will not only address immediate market challenges but also catalyze sustainable growth pathways for the arsenic sector over the long term.

Engage with Ketan Rohom to Secure In-depth Arsenic Market Intelligence and Propel Your Business Forward with Actionable Research Insights

Engage directly with Ketan Rohom to secure unparalleled arsenic market intelligence that empowers strategic decision-making and fuels sustainable growth. This opportunity offers tailored insights into the most critical facets of the arsenic landscape, from form-specific supply chain dynamics to the subtleties of regulatory impact and regional differentiation. By partnering with this dedicated resource, organizations can access actionable recommendations grounded in rigorous analysis and real-world expertise. Take the next decisive step toward maximizing competitive advantage and operational resilience by obtaining the full market research report today

- How big is the Arsenic Market?

- What is the Arsenic Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?