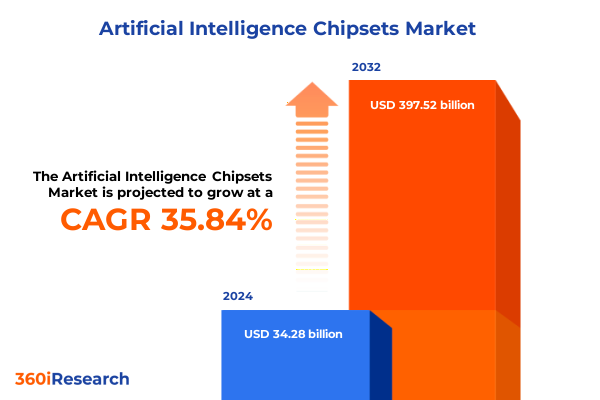

The Artificial Intelligence Chipsets Market size was estimated at USD 46.19 billion in 2025 and expected to reach USD 62.26 billion in 2026, at a CAGR of 35.99% to reach USD 397.52 billion by 2032.

Evolution of Artificial Intelligence Chipsets Heralding a New Era of High-Performance, Energy-Efficient and Scalable Computing Solutions

The rapid evolution of artificial intelligence chipsets represents one of the most consequential technological transformations of the digital age. What began as specialized hardware for narrow AI tasks has morphed into a broad ecosystem of high-performance, energy-efficient processors powering everything from massive data centers to edge devices. This progression has been driven by an insatiable demand for greater computational power alongside stringent requirements for lower power consumption and real-time processing capabilities.

Today’s AI chipsets integrate a variety of architectures-ranging from traditional CPUs and GPUs to dedicated NPUs, TPUs, and vision-focused VPUs-each optimized for distinct workloads. Innovations in packaging, high-bandwidth memory, and advanced lithography are key enablers of this diversification, enabling unprecedented levels of parallel processing and memory throughput on increasingly compact dies. As organizations across industries strive to harness the potential of generative AI, computer vision, and natural language understanding, the role of these specialized processors continues to expand.

The introduction of cloud-native and on-premises deployment options has further accelerated AI adoption, offering scalable, flexible solutions tailored to enterprise requirements. This dynamic landscape underscores the importance of strategic investment in both hardware and software optimizations, as firms seek to balance performance, cost, and time-to-market. In the following sections, we delve into the transformative shifts shaping this ecosystem, the impact of trade policies, and the critical insights that will guide stakeholders through the complexities of the AI chipset market.

Unprecedented Technological and Market Shifts Transforming the Artificial Intelligence Chipset Landscape and Redefining Competitive Dynamics

The landscape of AI hardware has undergone seismic shifts in recent quarters, propelled by the explosive growth of generative AI workloads. Leading chipmaker NVIDIA has ascended to the pinnacle of market value, becoming the most valuable publicly traded company, a testament to the strategic importance of its GPUs in powering cutting-edge AI applications. Simultaneously, an increasing number of specialized processors such as NPUs and TPUs are being integrated into next-generation systems, underscoring a trend toward heterogeneous architectures tailored to diverse AI workloads.

Parallel to this, memory technologies pivotal to AI performance are scaling new heights. South Korea’s SK Hynix reported record quarterly operating profits driven by surging demand for high-bandwidth memory chips used in generative AI accelerators. These HBM modules are critical for minimizing data bottlenecks and sustaining the throughput requirements of large language models and computer vision systems.

Moreover, cost structures in AI training and inference are being reshaped by hardware economics. Analysts from Epoch AI and Stanford University have observed that AI accelerator chips and server components can account for roughly half of training and experimentation expenditures, spotlighting the critical role that chip design and manufacturing play in controlling the overall cost of AI development. As a result, chip designers are innovating on packaging, power management, and workload-specific optimizations to deliver greater efficiency and drive down total cost of ownership.

Collectively, these trends illustrate a paradigm shift toward modular, workload-aware hardware platforms that seamlessly integrate CPUs, GPUs, NPUs, and advanced memory solutions. The convergence of these technologies is setting the stage for the next wave of AI-driven innovation across industries.

Assessing the Cumulative Impact of 2025 United States Semiconductor Tariffs on Global Supply Chains, Innovation and Industry Competitiveness

In 2025, the United States significantly intensified its tariff regime on semiconductor imports, initiating with a 25 percent levy that was declared by the administration in February and set to escalate further throughout the year. This policy is designed to incentivize domestic production under the auspices of the CHIPS Act, yet it introduces new challenges for established global supply chains that have evolved to distribute manufacturing across multiple regions.

According to an analysis by the Information Technology and Innovation Foundation, sustaining a blanket 25 percent tariff on semiconductor imports over a decade could reduce U.S. GDP growth by 0.76 percent by the tenth year, translating into an aggregate loss of approximately $1.4 trillion in economic output. This impact would be felt most acutely in sectors heavily reliant on semiconductors, such as automotive manufacturing and AI-driven services, where component costs could surge and consumer prices could correspondingly rise.

Industry groups have raised alarms over the potential disruption of capital-intensive domestic manufacturing projects, warning that levies on semiconductor manufacturing equipment and materials could inflate the cost of new fabs and threaten project viability. Moreover, by extending tariffs to electronics containing foreign-made chips-ranging from smartphones to laptops-the policy risks broadening the cost impact to the end-user market and dampening demand across multiple technology sectors.

Looking ahead, uncertainties around the scope and duration of these tariffs continue to create strategic ambiguity for both domestic and international stakeholders. Companies must weigh the benefits of reshoring production against the potential for higher capital expenditures, operational delays, and realignment of procurement strategies. As the tariff landscape remains in flux, agility and proactive supply chain management will be essential for navigating the evolving trade environment.

Key Insights into Artificial Intelligence Chipset Market Dynamics and Value Creation through Multi-Dimensional Segmentation Analysis

A nuanced segmentation of the AI chipset market reveals the diverse requirements and strategic imperatives that drive demand. When examining chipset types, the landscape spans from general-purpose GPUs and CPUs to domain-specific ASICs, along with field-programmable FPGAs and next-generation Neural Processing Units, Tensor Processing Units, and Vision Processing Units. Each category fulfills distinct roles, ranging from massive parallel computations for training large language models to low-latency inference at the edge.

Architectural distinctions further differentiate analog approaches, which excel in low-power or mixed-signal scenarios, from fully digital designs optimized for programmability and precision. Meanwhile, deployment modalities split between cloud-based solutions-delivering scalability and rapid scaling of compute resources-and on-premises deployments that prioritize data sovereignty, customization, and latency control for mission-critical applications.

Applications of AI chipsets demonstrate equally varied requirements. In autonomous vehicles and robotics, real-time perception and decision-making drive demand for high-throughput vision processing and inference units. In natural language processing and deep learning research, data center-grade GPUs and TPUs remain indispensable for model training at scale. Predictive analytics applications across finance and healthcare leverage a blend of CPUs and NPUs to execute complex algorithms with energy efficiency. This segmentation underscores the importance of aligning chipset selection with workload characteristics, operational constraints, and total cost of ownership considerations.

This comprehensive research report categorizes the Artificial Intelligence Chipsets market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Chipset Type

- Architecture

- Deployment Type

- Application

Regional Perspectives on the Artificial Intelligence Chipset Ecosystem Highlighting Distinct Growth Drivers and Market Opportunities Worldwide

The Americas region continues to lead in AI chipset innovation, underpinned by significant R&D investments, robust venture capital funding, and the presence of major fabless and foundry players. Tech hubs in Silicon Valley and Austin host a concentration of design houses and OEMs collaborating on cutting-edge processors, while end-user demand from hyperscale data centers sustains an ecosystem of innovation and scale.

In Europe, Middle East, and Africa, a mosaic of national initiatives has emerged, focusing on strategic autonomy and digital sovereignty. Consortiums across the EU are investing in pilot production facilities and fostering cross-border collaborations between universities and industry. Governments in the Gulf Cooperation Council are similarly deploying AI-enabled smart city projects and leveraging regional data centers to drive digital services growth.

The Asia-Pacific region boasts the most diverse manufacturing landscape, anchored by leading foundries in Taiwan, South Korea, and increasingly mainland China. Local champions are rapidly advancing in specialized domains such as high-bandwidth memory and advanced packaging. Simultaneously, robust domestic demand from telecommunications, consumer electronics, and automotive sectors creates a self-reinforcing cycle of innovation and capacity expansion.

This comprehensive research report examines key regions that drive the evolution of the Artificial Intelligence Chipsets market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Positioning and Competitive Strengths of Leading Global Players Shaping the Future of Artificial Intelligence Chipset Innovation

NVIDIA has solidified its market leadership through a combination of architectural innovation and ecosystem partnerships, delivering GPUs that dominate data center and cloud AI deployments. Its strategic alignment with hyperscale cloud providers ensures a steady cadence of design wins and volume shipments, while its software stack continues to expand the addressable market for AI applications.

AMD competes by integrating AI-optimized accelerators into its latest CPU architectures and forging alliances to co-design AI inference engines, positioning itself as a flexible alternative for enterprises seeking heterogeneous compute platforms. Its open approach to collaboration with software vendors is augmenting its presence in emerging AI workloads.

TSMC, as the world’s leading pure-play foundry, underpins much of the advanced AI chipset ecosystem. Its pioneering work in process nodes and advanced packaging technologies enables tier-one chip designers to push performance and power-efficiency boundaries, even as geopolitical tensions and evolving tariff regimes introduce new operational considerations.

SK Hynix has leveraged its HBM3 memory leadership to become a critical partner for AI accelerator producers, scaling production to meet unprecedented demand and investing in R&D for next-generation memory solutions. Its ability to diversify product offerings across DRAM and HBM segments enhances its resilience amid cyclical market fluctuations.

Complementary players such as Broadcom and Intel are pursuing differentiated strategies; Broadcom focuses on custom ASIC designs for cloud infrastructure, while Intel is ramping up its foundry services and integrating AI units into its CPU platforms. Their efforts contribute to the diversification and robustness of the AI chipset supply chain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Artificial Intelligence Chipsets market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced Micro Devices, Inc.

- Alibaba Group Holding Limited

- Arm Limited

- Cambricon Technologies Corporation

- Cambricon Technologies Corporation Limited

- Cerebras Systems, Inc.

- Fujitsu Limited

- Google LLC

- Graphcore Ltd.

- Hailo Technologies Ltd.

- Huawei Technologies Co., Ltd.

- Intel Corporation

- MediaTek Inc.

- Micron Technology, Inc.

- Microsoft Corporation

- Mythic, Inc.

- NVIDIA Corporation

- Qualcomm Incorporated

- Samsung Electronics Co., Ltd.

- Texas Instruments Incorporated

- Xilinx, Inc.

Actionable Strategic Recommendations for Industry Leaders to Navigate Disruption and Capitalize on Emerging Opportunities in AI Chipset Development

Industry leaders should prioritize co-development partnerships between chip designers and end-user application developers to ensure feature sets align with evolving AI workloads. Collaborative consortia can mitigate risk and accelerate validation cycles, enabling faster time to market for domain-specific accelerators.

Investing in modular architecture frameworks will allow firms to support a spectrum of use cases-from high-throughput training clusters to energy-efficient edge inference-without incurring prohibitive redesign costs. Embracing open standards and frameworks can further reduce barriers to integration, promoting wider ecosystem adoption.

Given the volatility in tariff and trade policies, organizations must cultivate agile supply chain strategies that include multi-sourcing agreements and buffer inventory at critical nodes. Proactive engagement with policymakers and industry associations will aid in shaping balanced regulations that support both domestic competitiveness and global collaboration.

On the product roadmaps, integrating advanced packaging technologies such as chiplets and 3D stacking can unlock performance gains while mitigating the risks associated with node scaling. Concurrently, investing in power management innovations will be critical to maintaining performance-per-watt leadership as AI workloads diversify.

Finally, companies should enhance data-driven decision-making by deploying sophisticated market intelligence platforms that track emerging technology trends, competitive moves, and regulatory changes in real time. This continuous feedback loop will inform strategic pivots and investment priorities, ensuring resilience and sustained growth in the AI chipset market.

Comprehensive Research Methodology Underpinning Rigorous Market Analysis and Ensuring Reliability of Insights into AI Chipset Trends

This research employed a multi-faceted methodology combining primary interviews with senior executives, product architects, and procurement leaders across the AI hardware ecosystem. Secondary data sources included published financial reports, regulatory filings, and credible industry news outlets. Quantitative data were validated against multiple independent databases to ensure accuracy and consistency.

A rigorous triangulation process was applied to reconcile insights from primary interviews with secondary research findings. The study mapped supply chain complexities through direct engagement with key foundries, raw material suppliers, and equipment manufacturers, supplemented by third-party logistics data. Regional dynamics were analyzed by overlaying economic indicators, technology infrastructure metrics, and public policy frameworks.

Segmentation analysis was driven by a detailed taxonomy encompassing chipset type, architecture, deployment models, and application domains. Each segment was evaluated for technology maturity, competitive intensity, and growth drivers. Regional assessments incorporated macroeconomic trends, regulatory environments, and capital expenditure patterns from leading industry players.

Competitive profiling utilized a combination of market capitalization metrics, patent filings analysis, and partnership announcements to gauge the strategic position of key companies. Scenario planning workshops with subject matter experts informed the evaluation of tariff impacts and potential policy shifts. The methodology is designed to deliver robust, impartial insights to support strategic decision-making in the AI chipset domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Artificial Intelligence Chipsets market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Artificial Intelligence Chipsets Market, by Chipset Type

- Artificial Intelligence Chipsets Market, by Architecture

- Artificial Intelligence Chipsets Market, by Deployment Type

- Artificial Intelligence Chipsets Market, by Application

- Artificial Intelligence Chipsets Market, by Region

- Artificial Intelligence Chipsets Market, by Group

- Artificial Intelligence Chipsets Market, by Country

- United States Artificial Intelligence Chipsets Market

- China Artificial Intelligence Chipsets Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Conclusion Synthesizing Key Findings on Market Dynamics, Technological Advances and Strategic Imperatives in the AI Chipset Industry

This executive summary has distilled the critical developments shaping the artificial intelligence chipset market, encompassing technological innovations, tariff-driven complexities, and granular segmentation dynamics. The interplay between heterogeneous architectures and evolving deployment models underscores the need for adaptable hardware strategies.

Trade policies in 2025 have introduced new considerations for supply chain resilience, with escalating tariffs amplifying the cost structures of both upstream manufacturers and downstream integrators. Navigating these headwinds requires a balanced approach that aligns domestic production incentives with the realities of global sourcing.

Regional heterogeneity presents both challenges and opportunities. While North America leads in R&D and capital deployment, EMEA’s focus on digital sovereignty and APAC’s manufacturing prowess collectively portray a multi-polar ecosystem. Companies that can orchestrate cross-regional partnerships and leverage localized strengths will be best positioned to capture value.

Leading players-ranging from GPU giants to memory specialists and foundries-continue to push performance and efficiency thresholds. Their strategic initiatives, from co-development alliances to advanced packaging investments, reflect the competitive imperative to address the escalating demands of AI workloads.

Ultimately, success in the AI chipset market will hinge on the ability to integrate technological agility with strategic foresight. Stakeholders who can anticipate market shifts, optimize their portfolios across segments and regions, and manage policy-related risks will drive the next wave of AI-driven transformation.

Take the Next Step Toward Unrivaled AI Chipset Market Intelligence with an Exclusive Report From Associate Director Ketan Rohom

Unlock unparalleled insights into the competitive dynamics and emerging trends of the artificial intelligence chipset market by exploring our comprehensive report led by Ketan Rohom, Associate Director of Sales & Marketing. This exclusive research offers granular analysis of technological shifts, tariff implications, segmentation drivers, and regional growth patterns to inform strategic decision making at the highest level.

Engage directly with Ketan Rohom to tailor this market intelligence to your organization’s objectives, ensuring you leverage the most recent and actionable data. By adopting these insights, you will be poised to anticipate market disruptions, optimize your product roadmaps, and identify new avenues for innovation and collaboration.

Don’t miss the opportunity to gain a decisive advantage in this rapidly evolving ecosystem. Contact Ketan Rohom today to secure your copy of the full report and embark on a journey toward transformative growth in the AI chipset domain.

- How big is the Artificial Intelligence Chipsets Market?

- What is the Artificial Intelligence Chipsets Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?