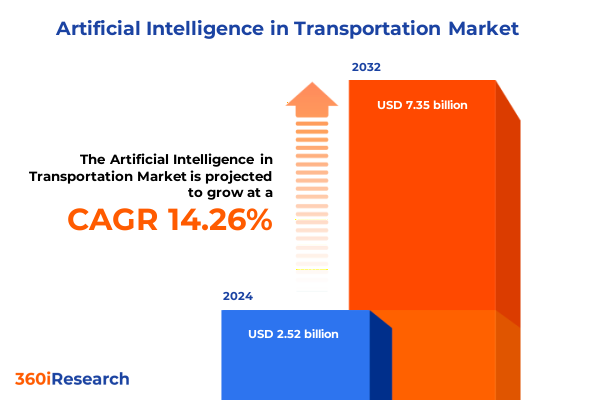

The Artificial Intelligence in Transportation Market size was estimated at USD 2.88 billion in 2025 and expected to reach USD 3.29 billion in 2026, at a CAGR of 14.28% to reach USD 7.35 billion by 2032.

Charting the Course for Intelligent Transit Solutions Through a Comprehensive Overview of Artificial Intelligence Applications in Modern Transportation

Artificial intelligence has rapidly transitioned from a speculative concept into a foundational pillar of modern transportation ecosystems. In recent years, breakthroughs in algorithms, computing power, and sensor technologies have enabled vehicles, infrastructure, and logistics operations to process vast amounts of data in real time. This convergence of technological progress and industry demand has set the stage for a fundamental reimagining of how people and goods move across cities, regions, and continents.

The scope of AI applications spans the full mobility spectrum, encompassing everything from autonomous driving to advanced traffic management. By harnessing machine learning, computer vision, and predictive analytics, stakeholders can unlock new efficiencies, enhance safety, and deliver personalized mobility experiences. This report begins by establishing the context for these advancements, outlining the interplay between emerging AI capabilities and the pressing needs of transportation networks worldwide. Through this lens, readers will gain a clear understanding of the forces driving innovation-and the strategic considerations necessary to capitalize on these developments.

Unraveling the Paradigm-Altering Innovations Shaping Transportation Through Next-Generation Artificial Intelligence Capabilities and Strategic Breakthroughs

The transportation industry is undergoing a seismic shift driven by AI-powered transformation that extends far beyond incremental improvements. Autonomous vehicle platforms that once seemed futuristic are now executing complex maneuvers on public roads, while advanced driver assistance systems have become standard safety equipment in millions of vehicles. Meanwhile, fleet managers leverage predictive maintenance solutions to minimize downtime and optimize asset utilization, marking a departure from reactive repair models.

Moreover, AI is redefining how cities orchestrate traffic flows. Intelligent signal control and congestion prediction tools integrate data from connected infrastructure, enabling dynamic route adjustments that alleviate bottlenecks. Edge computing architectures and 5G connectivity further accelerate this transformation by reducing latency and facilitating decentralized decision making. As a result, transportation stakeholders face new opportunities to drive operational excellence and sustainable growth. This section delves into these paradigm-altering innovations, illustrating how they coalesce to form a resilient, highly automated, and adaptive transit landscape.

Examining the Ripple Effects of 2025 United States Tariff Adjustments on the Integration and Advancement of AI-Driven Transportation Technologies

Beginning in early 2021 and extending through mid-2025, the United States enacted a series of tariff adjustments targeting critical components used in AI-enabled transportation systems. These measures, aimed at reshoring semiconductor production and bolstering domestic manufacturing, have introduced significant cost pressures for industry participants. Sensor modules, advanced computing chips, and networking equipment have all seen elevated import duties, compelling suppliers and integrators to reassess their procurement strategies.

Consequently, companies have accelerated efforts to diversify their supply chains and invest in regional manufacturing partnerships. While these shifts have yielded localized innovation hubs and shortened delivery lead times, they have also led to transitional challenges such as capacity constraints and higher unit costs. In addition, the evolving regulatory framework has spurred collaboration between policymakers and industry consortia to mitigate unintended disruptions. Through careful analysis of tariff impacts on component availability, production costs, and strategic sourcing decisions, this section illuminates the cumulative effects shaping AI adoption in transportation through 2025.

Illuminating Critical Market Segments by Application, Technology, Component, Mode, Deployment, and End User to Reveal Strategic AI in Transportation Opportunities

Analyzing the AI in transportation landscape requires a nuanced view of how diverse applications drive value across the mobility ecosystem. In terms of application area, the advent of Level 4 and Level 5 autonomous vehicles is transforming passenger travel, while driver assistance advances such as adaptive cruise control, automated emergency braking, blind spot detection, and lane keep assist are enhancing safety in conventional fleets. Parallel to this, fleet operators rely on asset tracking, driver monitoring, and route optimization to boost productivity, even as predictive maintenance frameworks built on condition monitoring and fault diagnosis minimize unplanned downtime. Traffic management systems further benefit from congestion prediction, intersection management, and traffic signal control to orchestrate urban mobility at scale.

From a technology perspective, computer vision tools that encompass image recognition, object detection, and video analytics serve as the eyes of connected systems. Deep learning methodologies including convolutional neural networks, generative adversarial networks, and recurrent neural networks provide the analytical backbone for interpreting complex data streams. In addition, machine learning techniques such as reinforcement learning, supervised learning, and unsupervised learning optimize decision-making processes. Natural language processing capabilities-from chatbots to speech recognition and voice assistants-are streamlining user interactions and enabling seamless human-machine collaboration.

Component segmentation reveals a trifecta of hardware, services, and software as the key enablers of innovation. Connectivity modules, processors, and sensors form the hardware foundation, while consulting, integration, and support services ensure successful deployment. Software solutions-spanning algorithms, middleware, and platforms-drive intelligence and interoperability. Deployment models range from public and private cloud environments to hybrid architectures and on-premises installations, offering varying degrees of scalability and control. Finally, end users extend from logistics and ride-hailing companies to city authorities, road operators, commercial and passenger vehicle manufacturers, and the individuals and tourists who depend on reliable, intelligent mobility every day.

This comprehensive research report categorizes the Artificial Intelligence in Transportation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Component

- Mode

- Application Area

- Deployment

- End User

Highlighting Regional Dynamics Across the Americas, Europe Middle East Africa, and Asia-Pacific to Understand Distinct Drivers Influencing AI in Transportation Markets

Regional dynamics exert a profound influence on how AI in transportation evolves across global markets. In the Americas, the United States serves as a hub for research and commercialization, supported by robust funding in autonomous vehicle pilots and public-private partnerships aimed at smart city implementations. Canada’s focus on regulatory harmonization and data privacy frameworks complements investments in connected rail and logistics corridors, while Latin American nations explore AI-driven solutions to tackle longstanding infrastructure challenges and accelerate cost-efficient urban mobility.

Across Europe, Middle East, and Africa, regulatory leadership emanating from the European Union has driven stringent safety standards for automated driving and incentivized multimodal integration. Public sector initiatives in the Middle East are adopting aerial drones and intelligent traffic management to support rapidly growing urban centers. In Africa, pilot programs in key metropolitan areas demonstrate the potential of AI to leapfrog traditional infrastructure constraints, leveraging mobile-first technologies for ride-hailing and freight tracking.

The Asia-Pacific region witnesses a diverse set of strategies, from China’s large-scale deployment of AI-equipped buses and electric vehicle fleets to Japan’s pioneering applications in rail automation and predictive maintenance. India’s policy drive for green corridors and intelligent highways is catalyzing local partnerships, while Australia and Southeast Asian markets adopt smart signal control and telematics solutions to address congestion and safety concerns. The result is a mosaic of regional priorities, each shaping the trajectory of AI innovation in transportation.

This comprehensive research report examines key regions that drive the evolution of the Artificial Intelligence in Transportation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Pacesetters and Disruptive Innovators Cultivating Competitive Advantage through AI-Enhanced Transportation Technologies

Innovation in AI-driven transportation is concentrated among established technology leaders and agile startups alike. Leading these efforts are companies that combine deep domain expertise with scalable intelligence platforms. Major automotive OEMs have forged alliances with chipset designers and software developers to integrate on-board AI processors and advanced perception suites. Technology giants, recognized for their strength in cloud infrastructure and machine learning frameworks, have launched end-to-end solutions targeting traffic optimization and fleet analytics.

Concurrently, emerging players are carving out niche positions by focusing on specialized applications such as long-haul autonomy, drone-based inspection, and cognitive maintenance services. These innovators leverage modular architectures and open ecosystems to accelerate proof-of-concept deployments and attract strategic investments. Furthermore, cross-industry collaborations between telecom providers, infrastructure operators, and systems integrators are creating holistic mobility solutions that align with evolving regulatory requirements and sustainability goals. By profiling these organizations and their distinctive value propositions, this section sheds light on the competitive dynamics that will shape the next wave of AI adoption across transportation sectors.

This comprehensive research report delivers an in-depth overview of the principal market players in the Artificial Intelligence in Transportation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aptiv PLC

- Aurora Innovation, Inc.

- Baidu, Inc.

- Gatik AI, Inc.

- Mobileye N.V.

- NVIDIA Corporation

- Robert Bosch GmbH

- Tesla, Inc.

- Uber Technologies, Inc.

- Valeo S.A.

- Waymo LLC

Empowering Senior Executives with Tactical Frameworks and Best Practices to Accelerate AI Adoption and Cement Market Leadership in Transportation

To harness the full potential of AI, industry leaders must prioritize strategic investments that align with both immediate operational needs and long-term transformation objectives. Executive teams should begin by establishing modular AI architectures that enable seamless integration of new algorithms and sensor inputs, thereby reducing time to deployment and enhancing adaptability. Simultaneously, forging partnerships across the supply chain-with component vendors, software developers, and systems integrators-builds resilience against tariff-related cost fluctuations and strengthens collaborative innovation networks.

In addition, organizations should cultivate in-house AI competencies by investing in talent development programs and targeted workshops. This human-capital focus ensures that teams can interpret advanced analytics outputs, manage model training cycles, and implement robust data governance practices. Prioritizing pilot projects in controlled environments helps validate use cases, mitigate risks, and build internal momentum. Finally, leaders must stay attuned to evolving regulatory landscapes and sustainability mandates, integrating compliance check points and ethical AI principles into their roadmaps. By following these recommendations, companies can accelerate responsible AI adoption and secure a leadership position in the emerging transportation ecosystem.

Detailing Rigorous Research Frameworks, Data Source Integration, and Analytical Protocols Ensuring Robust Insights into AI Applications in Transportation

This research synthesizes insights from a multi-faceted methodology designed to deliver comprehensive and actionable findings. Primary interviews were conducted with C-level executives, technology architects, and policy makers across key global markets to capture firsthand perspectives on adoption barriers and strategic priorities. These qualitative inputs were complemented by rigorous secondary research, encompassing academic publications, industry whitepapers, and patent filings to map technological trajectories and competitive landscapes.

Data triangulation techniques were applied to validate trends by cross-referencing information from proprietary databases, trade publications, and publicly announced developments. Quantitative analysis included evaluation of shipment volumes, adoption rates of AI modules, and integration timelines for autonomous platforms, enabling the identification of recurring patterns and correlation insights. The methodological framework also incorporated expert panels to review preliminary findings, ensuring objectivity and depth. By adhering to these robust research protocols, the study provides a defensible foundation for stakeholders seeking to navigate the complexities of AI-driven transportation innovation.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Artificial Intelligence in Transportation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Artificial Intelligence in Transportation Market, by Technology

- Artificial Intelligence in Transportation Market, by Component

- Artificial Intelligence in Transportation Market, by Mode

- Artificial Intelligence in Transportation Market, by Application Area

- Artificial Intelligence in Transportation Market, by Deployment

- Artificial Intelligence in Transportation Market, by End User

- Artificial Intelligence in Transportation Market, by Region

- Artificial Intelligence in Transportation Market, by Group

- Artificial Intelligence in Transportation Market, by Country

- United States Artificial Intelligence in Transportation Market

- China Artificial Intelligence in Transportation Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3816 ]

Synthesizing Core Findings into Strategic Imperatives that Solidify the Role of Artificial Intelligence as a Catalyst for Transportation Industry Transformation

This study unites foundational concepts, market drivers, and strategic imperatives to illustrate how AI is reshaping transportation across every dimension. From the proliferation of Level 4 and Level 5 autonomous vehicles to the mainstreaming of predictive maintenance and intelligent traffic management, AI emerges as the catalyst for safer, more efficient, and sustainable mobility networks. The analysis of tariff impacts underscores the importance of adaptive supply chain strategies and policy engagement, while segmentation insights reveal where targeted innovation can unlock the greatest value.

Regional perspectives demonstrate that no one-size-fits-all approach exists; rather, success depends on aligning technological capabilities with local regulatory frameworks and infrastructure maturity levels. Company profiles highlight the competitive intensity and collaboration dynamics that will define the next phase of growth. Ultimately, the evidence emphasizes that organizations capable of integrating advanced analytics, modular architectures, and ethical considerations into cohesive strategies will secure a lasting competitive edge. The path forward demands proactive leadership, multidisciplinary collaboration, and unwavering commitment to continuous innovation.

Engage with Ketan Rohom to Acquire Tailored Market Intelligence and Personalized Guidance for Capitalizing on AI Innovations in Transportation

I invite you to connect directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to explore how this in-depth market intelligence can be tailored to your organization’s unique priorities. By engaging in a one-on-one consultation, you will gain clarity on the most pressing AI trends, receive customized guidance on how to navigate evolving regulatory landscapes, and uncover strategic partnership opportunities. This collaboration ensures that your next steps are informed by rigorous analysis and a deep understanding of the transportation industry’s technology adoption curves. Reach out today to secure a competitive edge, streamline your innovation roadmap, and accelerate your journey toward smarter, AI-enabled mobility solutions.

- How big is the Artificial Intelligence in Transportation Market?

- What is the Artificial Intelligence in Transportation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?