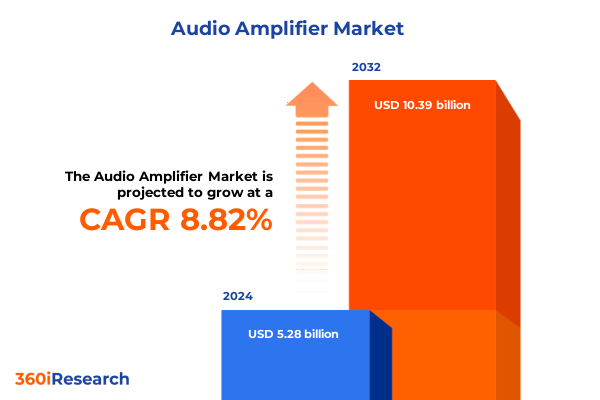

The Audio Amplifier Market size was estimated at USD 5.72 billion in 2025 and expected to reach USD 6.20 billion in 2026, at a CAGR of 8.90% to reach USD 10.39 billion by 2032.

Comprehensive Audio Amplifier Industry Landscape Highlighting Pivotal Drivers, Technological Advancements, and Value Propositions Driving Market Evolution Across Applications and End User Segments

The audio amplification landscape has undergone a profound transformation in recent years, driven by the convergence of technological breakthroughs and evolving consumer expectations. What was once a niche segment catering primarily to audiophiles and professional sound engineers has blossomed into a pivotal enabler of immersive experiences across automotive cabins, home entertainment systems, commercial venues, and industrial applications. This expansion has been fueled by a surge in demand for richer sound signatures, seamless connectivity, and compact form factors that integrate effortlessly into contemporary devices.

Fueled by advances in semiconductor materials and digital signal processing, today's amplifiers deliver greater energy efficiency, lower distortion, and enhanced thermal performance compared to legacy designs. Emerging transistor technologies, such as gallium nitride and silicon carbide, are pushing power densities to new heights, allowing designers to achieve superior audio fidelity while meeting stringent energy regulations. Concurrently, the proliferation of networked audio solutions-spanning Bluetooth, Wi-Fi, and proprietary protocols-has heightened the importance of robust amplification platforms capable of handling diverse streaming standards and multi-channel deployments.

Amidst this dynamic milieu, strategic stakeholders have had to reassess traditional value propositions. Integration of amplifier stages with digital signal processors has become commonplace, reducing component counts and simplifying board-level design cycles. Moreover, the emphasis on miniaturization has spurred demand for integrated amplifier modules that combine preamplification, power amplification, and protection circuits within a single package. These trends are reshuffling R&D roadmaps, with suppliers and OEMs alike prioritizing convergent designs that offer scalability across a spectrum of power outputs and form factors.

Looking ahead, the interplay between immersive audio formats, regulatory frameworks, and cross-industry collaborations will continue to shape the strategic imperative for innovation. By understanding the core technological drivers and end user dynamics that underpin today’s market, organizations can position themselves to capture emerging opportunities and mitigate potential disruptions.

Revolutionary Shifts in Audio Amplification Technologies and Consumer Expectations Redefining Industry Standards and Competitive Dynamics in Modern Electronics Across Professional and Consumer Markets

The audio amplifier domain is experiencing revolutionary shifts as convergent technologies redefine the boundaries of performance and versatility. Foremost among these is the ascendancy of digital amplifiers, which harness advanced algorithms to deliver high-repeatability performance while occupying a fraction of the PCB real estate required by analog amplifiers. Transitioning from Class AB to highly efficient Class D and increasingly popular Class H topologies, manufacturers are achieving remarkable gains in power conversion without compromising the warmth and clarity that discerning listeners demand.

In parallel, materials science breakthroughs-most notably in wide-bandgap semiconductors-are unleashing a new generation of amplifiers capable of operating at higher voltages and temperatures. Gallium nitride devices, for instance, are now being leveraged to produce compact modules that drive high-power speakers with minimal heat sinks, making them ideally suited for automotive and professional audio applications. Meanwhile, the revival of interest in hybrid amplifier architectures is giving rise to Class G models that adapt voltage rails dynamically to input signals, yielding a harmonious balance of efficiency and sonic purity.

Beyond hardware, the rise of smart ecosystems is reshaping user interactions with audio systems. Voice assistants, room calibration routines, and networked multi-room platforms require amplifiers to possess not only raw power but also sophisticated communication interfaces. As streaming services proliferate, the ability to process real-time metadata and apply adaptive equalization on the fly has become a core differentiator. This software-driven approach to sound tuning empowers manufacturers to roll out firmware-driven feature updates, extending product lifecycles and fostering deeper brand loyalty.

These transformative currents are collectively eroding conventional industry boundaries. Consumer electronics suppliers are forging alliances with automotive OEMs to integrate premium sound experiences into vehicles, while pro audio specialists are venturing into compact form factors tailored for home studios and live streaming setups. Such cross-pollination underscores the imperative for agile roadmaps that anticipate shifts in both technological paradigms and end user expectations.

In-depth Assessment of United States Tariff Implementations in 2025 and Their Multifaceted Impact on Supply Chains, Component Sourcing, and Pricing Strategies in Audio Amplification

The tariff landscape emerging in the United States in 2025 has introduced both challenges and strategic inflection points for audio amplifier stakeholders. New duties on imported semiconductor components, raw materials, and finished electronic modules have amplified input costs, prompting manufacturers to reevaluate sourcing strategies. Many suppliers have responded by diversifying their procurement footprints, cultivating relationships with alternative foundries and domestic fabricators to mitigate exposure to external levies.

In particular, restrictions on key materials such as specialized magnetic cores and certain wide-bandgap semiconductor wafers have led to extended lead times and spot shortages. This has heightened the importance of supply chain resilience, driving organizations to maintain buffer inventories and explore near-shoring partnerships in Mexico and Canada under revised free trade provision frameworks. While these measures have helped stabilize availability, they have also introduced additional logistics complexity and working capital demands.

On the pricing front, the pass-through of incremental duties has exerted pressure on amplifier ASPs, particularly in segments where product differentiation is minimal. To sustain margin integrity, several manufacturers have accelerated the adoption of modular designs that permit rapid reconfiguration of input stages based on component availability and tariff exposure. Concurrently, product roadmaps have been adjusted to emphasize higher-value features-such as integrated DSP functions or advanced thermal management-that justify premium positioning and partially offset cost escalations.

Looking forward, regulatory uncertainty remains a paramount concern. As stakeholders navigate an evolving tariff regime, proactive engagement with policy bodies and industry consortia will be crucial. By leveraging data-driven scenario planning and refining multi-sourcing strategies, organizations can turn tariff-induced volatility into a catalyst for supply chain modernization and innovation.

Critical Segmentation Insights Uncovering Diverse Technology, Product, End User, Distribution Channel, and Power Output Perspectives Fueling Strategic Decision-Making and Market Positioning Dynamics

The segmentation of the audio amplifier market reveals distinct patterns of innovation and end user preference, underscoring the need for tailored approaches across multiple dimensions. From a technology standpoint, the market spans classic analog topologies such as Class A and Class AB-cherished for their sonic warmth-through highly efficient digital and hybrid architectures including Class D, Class G, and Class H. Each topology brings a unique performance profile, inviting stakeholders to balance fidelity, efficiency, and cost according to the target application.

When examining product types, the landscape is divided between integrated amplifiers that merge preamplification and power stages in compact modules, standalone power amplifiers designed to drive high-wattage speaker arrays, and preamplifiers optimized for signal conditioning and low-noise gain. Integrated modules have gained traction in consumer electronics, where space constraints and simplified BOMs are paramount, whereas dedicated power amplifiers continue to dominate professional audio and industrial segments that require maximal output and rugged enclosure designs. Preamplifiers remain indispensable for high-fidelity systems and specialized processing chains where precise gain staging is critical.

End users further delineate market dynamics, with automotive manufacturers incorporating robust amplification platforms into next-generation in-cabin entertainment and active noise control systems, while commercial installers deploy scalable amplifier arrays for retail, hospitality, and corporate venues. Consumer electronics brands emphasize seamless integration with smart home ecosystems, pushing for compact form factors and wireless interfaces that appeal to convenience-oriented buyers. Industrial applications, from factory automation voice alerts to security communication systems, demand amplifiers with extended operating temperature ranges and enhanced reliability certifications.

Distribution channels also shape the buyer journey. Offline channels, led by direct sales to OEMs, traditional retail outlets, and specialized system integrators, remain essential for high-touch engagements and post-installation support. Meanwhile, online platforms are expanding their foothold by offering rapid product comparators, user reviews, and streamlined procurement portals. Lastly, power output segmentation-spanning high, medium, and low wattage classes-aligns offerings with the diverse needs of stadium-grade sound reinforcement, residential audio setups, and portable wearable speakers, ensuring that each solution resonates with its intended usage scenario.

This comprehensive research report categorizes the Audio Amplifier market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Power Output

- End User

- Distribution Channel

Comprehensive Regional Insights Highlighting Unique Market Dynamics, Growth Enablers, and Competitive Landscapes Across Americas, Europe Middle East & Africa, and Asia Pacific

Regional nuances play a decisive role in shaping audio amplifier strategies as market dynamics diverge across geographies. In the Americas, advanced research ecosystems and a strong presence of semiconductor foundries contribute to rapid technology adoption and iterative design improvements. Automotive OEMs headquartered in North America continue to invest heavily in premium in-cabin audio experiences, driving demand for high-end amplifiers that integrate noise cancellation and immersive sound DSP. Latin American markets, while price-sensitive, are exhibiting emerging interest in mid-tier audio solutions as broadband penetration and disposable incomes rise.

Over in Europe, Middle East, & Africa, stringent regulatory standards on electronic emissions and energy efficiency have accelerated the shift toward high-efficiency amplifier classes. Europe’s robust professional audio sector-spanning live events, broadcast studios, and corporate venues-relies on local manufacturers who emphasize compliance with harmonic distortion and audio latency benchmarks. In the Middle East, luxury hospitality developments are raising the bar on integrated soundscapes, while in parts of Africa, nascent infrastructure projects are creating fresh demand for industrial-grade amplification in public announcement and security systems.

The Asia-Pacific region has emerged as a global growth engine, fueled by mass production capabilities and a thriving consumer electronics ecosystem. East Asian markets are pioneering compact, ultra-efficient amplifiers that cater to wearables and portable speakers, while Southeast Asian manufacturers are capitalizing on cost advantages to serve global white-label demands. In South Asia, rapid urbanization and the expansion of automotive assembly facilities are translating into heightened interest in vehicle-integrated audio platforms. Simultaneously, a burgeoning pro audio scene in Australia and New Zealand underscores the region’s diverse spectrum of amplification needs.

These regional distinctions underscore the strategic imperative for stakeholders to craft differentiated value propositions that resonate with local regulations, cultural preferences, and infrastructure realities. By calibrating product roadmaps and go-to-market plans to these geographic insights, organizations can unlock targeted growth pockets and bolster their competitive foothold on a global stage.

This comprehensive research report examines key regions that drive the evolution of the Audio Amplifier market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Company Profiles and Competitive Analysis Illuminating Innovative Portfolios, Collaborative Ventures, and R&D Initiatives Shaping the Audio Amplifier Market Leadership Hierarchy

Leading companies within the audio amplifier arena are charting distinct strategic paths to solidify their market positions. Several notable players have invested in expanding their digital amplifier portfolios, introducing next-generation Class D solutions that leverage proprietary modulation techniques to minimize electromagnetic interference while maximizing power density. Concurrently, developers of high-voltage analog topologies have unveiled Class H devices that dynamically adjust rail voltages to improve efficiency under varying load conditions, catering to premium automotive and professional audio customers.

Partnerships and collaborative ventures are also reshaping the competitive landscape. Some semiconductor specialists have forged alliances with consumer electronics brands to co-develop integrated amplifier-DSP modules tailored for smart speakers and immersive home theater systems. Elsewhere, joint R&D initiatives between foundries and amplifier designers are expediting the qualification of gallium nitride and silicon carbide transistors for mass-market audio applications. These cooperative models are enabling a faster translation of emerging semiconductor breakthroughs into end products.

In addition, several prominent companies are enhancing their after-sales ecosystems by offering cloud-based performance monitoring and firmware update services. This shift toward service-oriented amplification platforms not only strengthens customer retention but also provides continuous revenue streams through feature subscriptions. Meanwhile, a subset of market leaders is doubling down on sustainability, optimizing amplifier architectures to reduce standby power and integrating recyclable packaging to align with global environmental commitments.

Amidst this competitive intensity, the ability to anticipate regulatory shifts, secure multi-channel distribution agreements, and scale manufacturing footprints will define the next chapter of market leadership. Companies that can harmonize their technological roadmaps with customer aspirations, while maintaining agility in partnerships and product design, are best positioned to capture emerging waves of audio amplification demand.

This comprehensive research report delivers an in-depth overview of the principal market players in the Audio Amplifier market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allen & Heath Ltd.

- AMETEK.Inc.

- Analog Devices, Inc.

- Anthem

- Bose Corporation

- Bryston Ltd.

- Cirrus Logic, Inc.

- Diodes Incorporated

- DIOO Microcircuits Co., Ltd.

- Harman International Industries, Incorporated by Samsung Electronics Co., Ltd.

- Infineon Technologies AG

- Integrated Silicon Solution Inc.

- Kenwood Corporation

- McIntosh Laboratory, Inc.

- Monolithic Power Systems, Inc.

- NAD Electronics International by Lenbrook Industries Limited

Actionable Strategic Recommendations Empowering Industry Leaders to Harness Emerging Technologies, Optimize Supply Chains, Navigate Regulatory Landscapes for Sustainable Growth, and Enhance Competitive Agility

To thrive in the evolving audio amplification ecosystem, industry leaders must adopt a proactive stance that aligns technical innovation with commercial agility. First, prioritizing research and development in wide-bandgap semiconductor integration will unlock power efficiency gains and form factor reductions, positioning products for next-generation applications in electric vehicles and compact consumer devices. By advancing modular amplifier architectures, organizations can introduce configurable platforms that adapt to varying power output requirements and regulatory environments, thereby accelerating time-to-market and reducing inventory complexity.

Concurrent with these technological investments, companies should fortify their supply chain resilience by embracing multi-sourcing strategies and near-shoring initiatives. Establishing regional fabrication partnerships under revised trade agreements will mitigate exposure to tariff fluctuations and logistical bottlenecks. In concert, leveraging data-driven demand forecasting can optimize buffer inventories, ensuring critical components remain accessible without inflating working capital unnecessarily.

From a go-to-market perspective, cultivating a balanced channel mix that emphasizes both digital platforms and direct engagements will prove vital. Deploying e-commerce portals enhanced with interactive product configurators and virtual demonstration tools can streamline procurement for OEM partners and end users alike. At the same time, reinforcing relationships with system integrators and specialized distributors will bolster support for complex installations, especially in commercial and industrial segments where hands-on expertise is paramount.

Finally, engaging in policy dialogues and industry consortia will enable leaders to anticipate regulatory shifts-from energy efficiency mandates to component import duties-and shape standards that favor innovation. By marrying these strategic recommendations with robust performance metrics and continuous stakeholder feedback, organizations can chart resilient paths to sustainable growth and maintain a competitive edge in the dynamic audio amplifier landscape.

Rigorous Research Methodology Overviewing Data Collection Approaches, Analytical Frameworks, and Validation Techniques Ensuring Accuracy and Reliability of Audio Amplifier Market Insights with Stakeholder Validation

Ensuring the robustness of the insights presented in this report, a comprehensive research methodology was employed that integrates both primary and secondary data collection techniques. Primary research involved in-depth interviews with design engineers, procurement specialists, and sound system integrators across key end user segments. These conversations provided firsthand perspectives on performance requirements, sourcing challenges, and product feature prioritization, allowing the study to capture current sentiment and practical considerations driving purchase decisions.

Complementing these qualitative findings, secondary research drew upon publicly available technical papers, regulatory filings, and industry standards documentation. Detailed reviews of patent submissions, white papers on wide-bandgap semiconductor adoption, and regulatory reports on audio equipment safety standards informed the analysis of technological trends and compliance frameworks. Additionally, historical data on component lead times and tariff announcements were analyzed to contextualize shifts in supply chain dynamics.

The analytical framework employed a thematic coding approach to synthesize interview transcripts and identify cross-cutting insights, which were then validated through stakeholder circles comprising senior audio architects and product managers. Triangulation techniques were applied to reconcile any discrepancies between primary observations and secondary sources, ensuring alignment and reliability. Furthermore, the study leveraged scenario modeling to explore potential regulatory and technological developments, offering a spectrum of strategic considerations rather than fixed forecasts.

Finally, the entire research process was overseen by an editorial committee with expertise in electronic systems and market intelligence. Rigorous quality control checks, including data consistency audits and peer reviews, guaranteed the accuracy and integrity of the final deliverables. This methodological rigor underpins the confidence that industry stakeholders can place in the actionable insights and strategic recommendations uncovered throughout the audio amplifier analysis.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Audio Amplifier market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Audio Amplifier Market, by Product Type

- Audio Amplifier Market, by Technology

- Audio Amplifier Market, by Power Output

- Audio Amplifier Market, by End User

- Audio Amplifier Market, by Distribution Channel

- Audio Amplifier Market, by Region

- Audio Amplifier Market, by Group

- Audio Amplifier Market, by Country

- United States Audio Amplifier Market

- China Audio Amplifier Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Culminating Insights Synthesizing Market Drivers, Trends, and Strategic Imperatives to Guide Stakeholders in Navigating the Future Landscape of Audio Amplification and Decision-Making Confidence

This executive summary has illuminated the critical factors influencing today’s audio amplifier market, from transformative technology shifts to the nuanced impacts of regional policies and trade dynamics. By synthesizing insights across topology preferences-ranging from high-fidelity analog designs to cutting-edge digital and hybrid classes-the analysis underscores the strategic importance of aligning product roadmaps with evolving efficiency mandates and user expectations.

The segmentation insights reveal that a one-size-fits-all approach is no longer viable. Stakeholders must tailor amplifier solutions to specific use cases, whether integrating compact modules into consumer electronics, deploying robust power units in professional audio installations, or customizing amplification chains for industrial environments. Geographic distinctions further dictate that offerings must be calibrated to local regulatory requirements and end user sophistication levels.

Moreover, the 2025 tariff developments in the United States have demonstrated that supply chain agility and multi-sourcing strategies are integral to mitigating cost headwinds and ensuring uninterrupted component flow. Organizations that have proactively diversified procurement channels and embraced near-shoring have been better positioned to maintain competitive margin structures.

Ultimately, the insights and recommendations presented herein equip industry leaders with the strategic foresight needed to navigate the complex audio amplifier landscape. By undergirding decisions with robust research and embracing adaptive innovation frameworks, stakeholders can confidently steer their organizations toward sustainable growth and enduring market relevance.

Engage Directly with Ketan Rohom for Personalized Guidance on Acquiring Comprehensive Audio Amplifier Market Research and Tailored Strategic Insights to Elevate Your Competitive Edge and Unlock Growth Opportunities

For organizations seeking tailored analysis and insights to strengthen their strategic positioning in the audio amplification space, engaging directly with Ketan Rohom offers an efficient pathway to deeper understanding and actionable data. With a wealth of experience guiding Sales and Marketing initiatives, Ketan can provide a custom consultation that aligns research deliverables with your specific business objectives. By discussing your goals, end user focus, and technological priorities, you can ensure that the final report delivers precisely the intelligence needed to support critical decisions. Reach out to schedule a personalized briefing and take the next step toward leveraging robust market research to drive growth, innovation, and competitive distinction within the audio amplifier industry.

- How big is the Audio Amplifier Market?

- What is the Audio Amplifier Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?