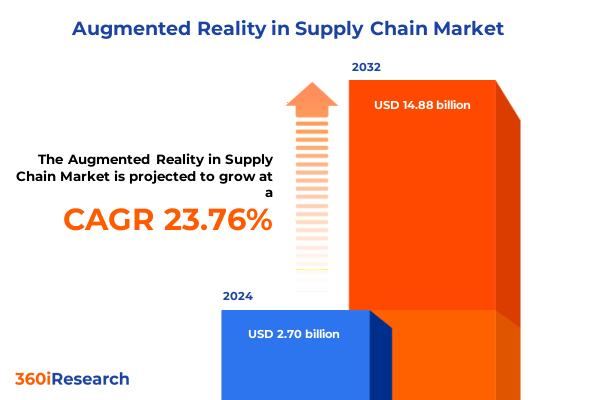

The Augmented Reality in Supply Chain Market size was estimated at USD 3.35 billion in 2025 and expected to reach USD 4.06 billion in 2026, at a CAGR of 23.72% to reach USD 14.88 billion by 2032.

Exploring the role of augmented reality technologies in redefining efficiency accuracy and connectivity across modern supply chain operations

The increasing complexity of modern supply chains demands innovative solutions that bridge the physical and digital worlds. Augmented reality (AR) presents a powerful technology capable of overlaying digital information onto real-world environments, guiding frontline workers with contextual instructions that enhance efficiency. By integrating visual cues directly into the user’s field of view, AR can dramatically streamline workflows such as order picking, equipment maintenance, and inventory management, reducing reliance on paper-based processes and handheld devices. Transitioning to an AR-enabled ecosystem empowers organizations to reduce errors, accelerate training, and improve overall operational agility.

As global pressures mount-from labor shortages to fluctuating demand-business leaders are seeking resilient strategies that can adapt in real time. AR solutions, ranging from handheld tablets to smart glasses and head-mounted displays, can be deployed across diverse settings, enabling rapid scaling and iterative optimization. Furthermore, the convergence of AR with advanced analytics and connectivity platforms facilitates continuous monitoring and performance feedback, ensuring that supply chains evolve alongside changing market conditions. Understanding these foundational capabilities lays the groundwork for leveraging AR as a catalyst for transformative improvements in supply chain performance and responsiveness.

Identifying the technological operational and strategic turning points that are driving augmented reality adoption and transforming supply chain landscapes

The AR supply chain landscape is experiencing rapid evolution as emerging technologies and shifting business priorities converge. Artificial intelligence and machine learning are now driving smarter AR applications, enabling systems to recognize complex environments, identify defects on the fly, and provide predictive recommendations to operators. These AI-driven capabilities not only streamline quality inspection and troubleshooting but also adapt to user behavior over time, delivering increasingly intuitive guidance. Real-time digital twins complement this trend by offering virtual replicas of warehouses or production lines, allowing stakeholders to simulate layout changes or process modifications before physical implementation.

Moreover, the proliferation of connected AR devices fosters enhanced collaboration across distributed teams. Remote experts can see an on-site worker’s view through networked glasses and annotate live video feeds, effectively extending technical knowledge beyond geographic boundaries. As 5G and edge computing infrastructures mature, AR experiences will become more seamless, with ultra-low latency and high-fidelity visuals supporting complex tasks in every supply chain node. These developments mark a clear inflection point where AR transitions from pilot projects to mission-critical deployments, reshaping how organizations plan, operate, and optimize their end-to-end logistics processes.

Assessing the financial operational and strategic implications of the latest United States tariff initiatives on augmented reality supply chain solutions

Recent United States tariff initiatives are creating multi-layered effects on the cost and availability of AR components essential for supply chain deployments. Under Section 301, duties on Chinese‐origin wafers, polysilicon, and semiconductor components will rise to fifty percent in early 2025, increasing the base cost of displays, sensors, and processing units that power head‐mounted displays and smart glasses. These surcharges, designed to bolster domestic manufacturing resilience, have driven suppliers to reassess sourcing strategies and consider nearshoring options to mitigate exposure.

Meanwhile, the implementation of twenty-five percent tariffs on imported steel and aluminum affects the production of ruggedized AR housings, projector frames, and mounting hardware utilized in fixed and portable AR installations. As a result, equipment providers face higher raw material costs, which are likely to be passed through to end-users unless strategic cost offsets are identified. These combined measures have accelerated the pursuit of alternative materials and design optimizations, while prompting discussions on the total cost of ownership for long-term AR investments. The net impact underscores the importance of proactive tariff management, component diversification, and supplier collaboration to preserve project economics in a rapidly evolving trade environment.

Uncovering the nuanced component application and end user segmentation dynamics that shape augmented reality deployment strategies within supply chains

Component, application, and end-user perspectives reveal critical drivers for AR solution customization within supply chains. On the component front, hardware segments-ranging from smart glass form factors to projector systems-demand careful selection based on durability, battery life, and field-of-view constraints, while software choices must align with tracking accuracy requirements dictated by marker-based or markerless environments. Services integration further influences project outcomes, with consultancy and system integration ensuring seamless alignment to existing warehouse management or asset tracking platforms and ongoing support services maintaining system uptime.

Application segmentation highlights the distinct needs of logistics and shipping versus maintenance and repair workflows. Route optimization and fleet management benefit from AR’s real-time overlay of navigational data on mobile devices, while field inspection teams rely on head-mounted displays to capture diagnostic visuals without compromising hands-free operation. Training and simulation scenarios employ tailored content development tools to replicate safety procedures or assembly tasks, and order picking solutions leverage inventory tracking capabilities to guide operators through complex warehouse layouts. End-user industries such as automotive manufacturing require AR-enabled quality inspection for precise tolerance validation, whereas healthcare environments utilize surgery assistance overlays for enhanced procedural accuracy. These segmentation insights emphasize the importance of aligning AR solution design to industry-specific functional requirements, ensuring that technology investments translate into measurable performance gains.

This comprehensive research report categorizes the Augmented Reality in Supply Chain market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Application

- End User

Exploring regional adoption maturity and growth drivers across Americas Europe Middle East Africa and Asia Pacific augmented reality supply chain landscapes

The Americas region leads in advanced AR adoption across supply chain operations, driven by strong enterprise IT ecosystems and early investments in smart warehousing initiatives. High-volume logistics hubs in North America leverage AR to optimize order fulfillment processes, while Latin American manufacturers are exploring integration use cases to improve traceability in complex distribution networks. This adoption is bolstered by an expanding AR software ecosystem and a mature telecommunications infrastructure that supports cloud-based content management and real-time data synchronization.

In Europe, Middle East & Africa, the focus of AR implementations often centers on high-precision maintenance and repair workflows. Leading logistics providers are piloting vision-picking smart glasses in fulfillment centers to reduce error rates and enhance labor productivity, capitalizing on regional strengths in industrial automation. Emphasis on sustainability and circular supply chains has accelerated the integration of AR for asset lifecycle management, enabling stakeholders to visualize product provenance and maintenance histories through intuitive overlays.

Asia-Pacific exhibits a rapid uptick in AR deployments propelled by extensive manufacturing operations and aggressive digital transformation mandates. Warehouse automation across the region increasingly incorporates AR-guided picking in conjunction with autonomous mobile robots, while end-to-end supply chain platforms use AR to facilitate real-time inventory audits. Investments in 5G networks and edge computing further accelerate scalable AR rollouts, positioning Asia-Pacific as a hotbed for next-generation smart logistics solutions.

This comprehensive research report examines key regions that drive the evolution of the Augmented Reality in Supply Chain market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining the strategic positioning innovation partnerships and competitive strengths of leading augmented reality vendors shaping supply chain efficiencies

Leading AR vendors and integrators occupy strategic positions based on their hardware performance, software capabilities, and ecosystem partnerships. A key case study comes from a global logistics enterprise that achieved a twenty-five percent improvement in picking efficiency by deploying smart glasses powered by a specialized vision-picking platform. This success underscores the value of robust software integration and specialized hardware ergonomics in real operational settings.

In the hardware domain, some technology providers are pivoting toward software and services, focusing on SDKs and development frameworks to extend partner-driven applications. This approach allows organizations to select from a diverse range of head-mounted displays, handheld devices, and projector units without being locked into proprietary ecosystems. Complementary partnerships between logistics companies and AR headset manufacturers have emerged, driving collaborative pilot programs that validate use cases and establish best practices.

Additionally, software providers specializing in tracking algorithms, content-authoring tools, and cloud-based analytics continue to refine their platforms to support evolving supply chain needs. These vendors emphasize modular architectures that integrate seamlessly with warehouse management and asset-tracking systems, ensuring end-to-end visibility and performance monitoring. As the AR landscape matures, strategic alliances and open platform strategies will remain central to vendor competitiveness and adoption acceleration.

This comprehensive research report delivers an in-depth overview of the principal market players in the Augmented Reality in Supply Chain market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Apple Inc

- Augmedics

- BMW AG

- CareAR

- DHL Supply Chain

- Google LLC

- GreyOrange Pte Ltd

- Honeywell International Inc

- IKEA

- KLA Corporation

- Lenovo Group Ltd

- Locus Robotics

- Magic Leap Inc

- Meta Platforms Inc

- Microsoft Corporation

- Niantic Inc

- Oculavis GmbH

- PTC Inc

- Qualcomm Technologies Inc

- RealWear Inc

- Samsung SDS Co Ltd

- Scandit AG

- Snap Inc

- Upskill

- Vuzix Corporation

- Walmart Inc

- XPO Logistics

- Zebra Technologies Corporation

Delivering strategic operational and tactical guidance to industry leaders for successful integration scaling and value capture with augmented reality solutions

Organizations should begin by conducting cross-functional workshops to identify high-value AR use cases, prioritizing scenarios where error reduction and training acceleration yield immediate returns. By establishing a structured proof-of-concept framework, leaders can validate performance metrics such as picking accuracy, repair cycle time, and workforce productivity before initiating full-scale rollouts.

Next, collaboration with technology partners is essential. Engaging hardware suppliers, software developers, and systems integrators early in the process ensures that solution architectures align with existing IT infrastructures and operational constraints. Negotiating pilot-stage agreements with flexible terms enables iterative refinement without excessive capital outlay. As pilots demonstrate success, organizations should scale deployments incrementally, leveraging modular service agreements to maintain ongoing support and training resources.

Finally, leaders must foster organizational readiness by upskilling the workforce. Tailored training programs that blend hands-on AR experiences with traditional learning modalities will drive user adoption and confidence. Establishing a governance framework for performance monitoring and continuous improvement ensures that AR initiatives evolve in response to operational feedback and emerging needs. This strategic combination of use-case prioritization partner collaboration and workforce enablement lays the foundation for sustainable value capture from augmented reality investments.

Detailing the qualitative and quantitative research data triangulation and validation methods that underpin this augmented reality supply chain analysis

This analysis integrates a mix of qualitative and quantitative research methodologies to provide robust insights. Secondary research involved reviewing government trade filings, industry journals, and publicly available tariffs notices to ensure an accurate portrayal of the regulatory environment. Data triangulation was performed by cross-referencing multiple open sources on AR deployments and supply chain technology trends.

Primary research included structured interviews with industry executives, technology heads, and frontline operations managers across logistics, manufacturing, and retail sectors. These expert consultations offered firsthand perspectives on deployment challenges, performance metrics, and integration strategies. Finally, validation workshops were conducted to test preliminary findings against real-world pilot program outcomes, ensuring practical relevance and reliability of our conclusions.

Combining these research streams enabled a comprehensive understanding of component economics, application scenarios, and regional variations, underpinned by a transparent methodology that stakeholders can confidently apply to strategic planning and investment decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Augmented Reality in Supply Chain market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Augmented Reality in Supply Chain Market, by Component

- Augmented Reality in Supply Chain Market, by Application

- Augmented Reality in Supply Chain Market, by End User

- Augmented Reality in Supply Chain Market, by Region

- Augmented Reality in Supply Chain Market, by Group

- Augmented Reality in Supply Chain Market, by Country

- United States Augmented Reality in Supply Chain Market

- China Augmented Reality in Supply Chain Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 3816 ]

Summarizing the strategic technological operational and economic imperatives for embracing augmented reality to future proof supply chain performance

Augmented reality is rapidly transitioning from experimental pilot projects to strategic enablers of supply chain transformation. By overlaying digital intelligence onto physical workflows, organizations can achieve significant gains in accuracy, speed, and flexibility across picking, maintenance, training, and logistics operations. The evolving integration of AI and digital twins further amplifies AR’s impact, enabling predictive insights and proactive decision-making that drive resilience in volatile market conditions.

Despite the headwinds posed by evolving tariff landscapes and material cost fluctuations, the strategic deployment of AR solutions offers a clear pathway to operational efficiency and competitive differentiation. Organizations that adopt a phased implementation approach, coupled with robust governance and performance tracking, are best positioned to capture sustained value. Ultimately, AR’s convergence with robotics, IoT, and next-generation networking will redefine supply chain boundaries, creating more connected, intelligent, and adaptive ecosystems prepared for the challenges of tomorrow.

Initiate your purchase consultation with Ketan Rohom Associate Director Sales Marketing today to secure augmented reality supply chain market insights

Are you ready to elevate your strategic planning and unlock the full potential of augmented reality within your supply chain operations? Engage with Ketan Rohom, Associate Director Sales & Marketing, to explore tailored market insights that address your organization’s unique challenges and growth objectives. Our expert-led consultation will provide you with a clear roadmap to leverage AR technologies, from selecting the most effective hardware and software platforms to optimizing integration strategies and mitigating cost impacts related to evolving trade policies. By securing this focused dialogue, you will gain exclusive access to comprehensive analyses, actionable recommendations, and depth of industry expertise that empower decisive investment and implementation.

Don't miss the opportunity to transform your supply chain performance and drive sustained competitive advantage. Initiate your purchase consultation with Ketan Rohom Associate Director Sales Marketing today to secure augmented reality supply chain market insights

- How big is the Augmented Reality in Supply Chain Market?

- What is the Augmented Reality in Supply Chain Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?