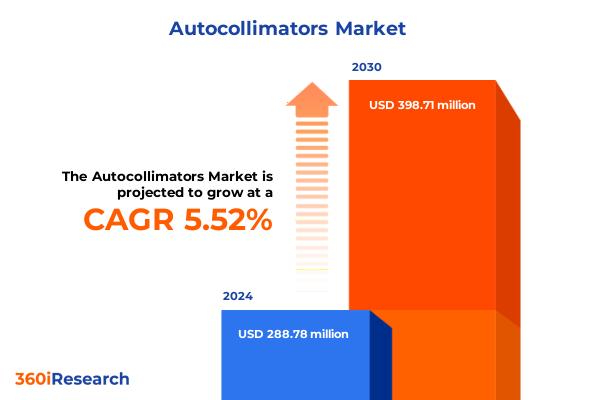

The Autocollimators Market size was estimated at USD 288.78 million in 2024 and expected to reach USD 304.31 million in 2025, at a CAGR of 5.52% to reach USD 398.71 million by 2030.

An authoritative overview of autocollimator technology and its pivotal role in precision alignment and metrology across modern industrial and optical applications

This executive summary introduces the contemporary landscape of autocollimator technologies, situating precision optical alignment instruments within the broader context of advanced manufacturing, optics, and quality assurance. Autocollimators serve as foundational tools for measuring angular displacement and ensuring alignment integrity across optical benches, machine tools, and calibrated fixtures. Over recent years, evolving requirements for higher throughput, tighter tolerances, and seamless integration with digital workflows have elevated the role of autocollimators from standalone measurement devices to essential components of automated metrology systems.

The introduction frames the reader’s perspective by clarifying where autocollimators fit within instrument portfolios, distinguishing the differing capabilities and operational envelopes that practitioners choose depending on whether they require electronic sensing for digital integration or visual systems for direct optical judgment. It also highlights how axis configuration, working distance, and accuracy range create practical constraints and opportunities for implementation. Finally, the introduction outlines why a strategic understanding of product differentiation, applications across industries, and distribution modalities is critical for procurement teams, test engineers, and product leaders seeking to align precision measurement tools with evolving production and inspection workflows.

How digitization, miniaturization, interoperability, and calibration modernization are fundamentally reshaping autocollimator selection and deployment across industries

Transformative shifts in the autocollimator landscape are now driven by intersecting technological, operational, and supply chain dynamics that are reshaping product expectations and procurement behavior. First, digitization and software-defined metrology have increased demand for electronic autocollimators that deliver data-ready outputs and integrate with manufacturing execution and quality management systems. In parallel, improvements in optical components, detector sensitivity, and miniaturization have raised the baseline performance available from both electronic and visual instruments, enabling use cases previously reserved for specialized labs.

Operationally, manufacturers and end users are redefining instrument selection criteria to favor solutions that reduce setup time, support dual-axis measurements without complex realignment, and maintain accuracy across a broader range of working distances. These shifts are accompanied by heightened attention to interoperability, with stakeholders seeking autocollimators that can communicate with alignment targets, laser trackers, and automated stages. Finally, the landscape is being influenced by workforce trends and regulatory expectations that push for repeatable, auditable measurement processes; as a result, calibration and standards workflows are undergoing modernization to preserve traceability while shortening calibration cycles.

Tariff-driven shifts in 2025 that are reshaping procurement, manufacturing footprints, and supply resilience for precision optical instruments in the United States

The cumulative effects of United States tariff actions in 2025 have introduced new layers of complexity for procurement and supply chain planning in precision optical instruments. Tariff adjustments have altered landed costs for imported optical components and finished instruments, prompting some buyers to reassess global sourcing strategies and to evaluate near-shore and domestic supply alternatives. As a consequence, procurement teams are increasingly balancing unit price considerations against lead times, technical support accessibility, and the long-term reliability of supply relationships.

Beyond immediate cost implications, tariffs have accelerated conversations about localized assembly and strategic inventory buffering for critical items such as precision optics, detector arrays, and calibrated reference targets. For technology providers, tariff-driven pressures have incentivized a re-evaluation of manufacturing footprints, with some firms shifting higher-value assembly or final calibration steps closer to major customer clusters to mitigate duties and improve responsiveness. Importantly, these shifts have also encouraged closer collaboration between technical teams and procurement functions to optimize total cost of ownership, incorporating recalibrated expectations for logistics, warranty support, and aftermarket services.

Comprehensive segmentation analysis connecting product types, axis configurations, working distances, and accuracy ranges to industry-specific applications and procurement channels

Discerning product and application segmentation reveals how instrument capabilities align with end-user demands and operational constraints. Based on product type, the landscape bifurcates into electronic instruments prized for their digital outputs and seamless integration into automated metrology lines, and visual instruments that continue to serve applications where direct optical interpretation or cost-conscious simplicity remains paramount. Meanwhile, axis configuration defines usability and procedure: single-axis devices often fit inline checks and simple alignment tasks, while dual-axis instruments significantly reduce setup complexity for applications requiring rapid orthogonal measurements.

Working distance profiles further delineate instrument suitability: short-range (<1 meter) instruments are often optimized for bench-top calibration and semiconductor or electronics assembly tasks, mid-range systems designed for the 1–3 meter envelope accommodate machine tool alignment and many manufacturing fixtures, and long-range (>3 meter) configurations enable on-site aerospace and large-structure alignment. Accuracy range is a decisive factor for adoption: sub-arcsecond capabilities are typically reserved for optics laboratories and high-precision semiconductor or aerospace optical assemblies, 1–10 arcsecond instruments address most industrial alignment and machine tool setup needs, and broader tolerance devices above 10 arcseconds serve general-purpose construction and manufacturing inspection tasks.

End-use industry segmentation shows clear application-driven purchasing patterns. Aerospace and semiconductor sectors demand the tightest tolerances and rigorous calibration protocols, driving preferences toward electronic, high-accuracy solutions and calibrated service partnerships. Automotive and manufacturing sectors prioritize throughput, ruggedness, and integration with production lines, often selecting mid-range accuracy devices that balance speed and precision. Construction and select field service applications emphasize portability and long working-distance capability for on-site alignment and verification. Application segmentation underscores the diversity of measurement tasks: alignment workflows span machine tool and spindle setup as well as optical component placement; calibration and standards work focuses on angle standard calibration and polygon/indexer verification; metrology and inspection tasks include flatness inspection and precise mirror or wedge angle measurement. Distribution channel segmentation shapes buyer experience and procurement cycles, with offline channels providing hands-on evaluation and immediate technical dialogue, and online channels-via manufacturer websites and e-commerce platforms-offering convenience, extended reach, and rapid quote-to-order paths for standardized instrument configurations.

This comprehensive research report categorizes the Autocollimators market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Axis Configuration

- Working Distance

- Accuracy Range

- Technology

- End-Use Industry

- Application

- Distribution Channel

Regional demand drivers and logistical realities shaping instrument selection and service expectations across the Americas, Europe Middle East & Africa, and Asia-Pacific territories

Regional dynamics reveal differentiated demand drivers and logistical considerations that influence instrument selection and vendor strategies. In the Americas, demand is strongly influenced by aerospace, automotive, and advanced manufacturing clusters that prioritize access to high-accuracy instruments, localized calibration services, and rapid field support. These regional expectations favor suppliers that can provide responsive technical assistance, onsite calibration, and service-level agreements that align with production continuity demands.

Europe, the Middle East & Africa exhibit a spectrum of adoption patterns: established European manufacturing and research institutions sustain demand for both high-precision laboratory-grade instruments and ruggedized industrial systems, while markets in the Middle East and Africa emphasize long-distance alignment capabilities and robust environmental tolerances for field deployment. Across this broad region, regulatory harmonization and rigorous quality standards heighten the importance of documented traceability and certified calibration pathways.

Asia-Pacific continues to be a major driver of volume and technological adoption, with significant activity in semiconductor, electronics manufacturing, and precision optics production. Rapid industrialization in several Asia-Pacific countries increases demand for mid-range accuracy instruments used in high-throughput manufacturing, while research centers and advanced optics firms continue to invest in sub-arcsecond systems. Vendor strategies in the region often emphasize local partnerships, regional calibration centers, and distribution networks that reduce lead times and support after-sales service.

This comprehensive research report examines key regions that drive the evolution of the Autocollimators market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

How product modularity, software integration, accredited calibration services, and hybrid distribution strategies determine competitive advantage among instrument providers

Key company-level insights emphasize strategic positioning, product breadth, and services that differentiate competitive performance in the autocollimator ecosystem. Leading product developers increasingly pair optical hardware with software ecosystems that enable data logging, automated rejection workflows, and integration with broader metrology suites. Firms that invest in modular instrument architectures gain flexibility to serve both specialty research clients seeking sub-arcsecond performance and industrial customers prioritizing ruggedness and throughput.

Service offerings and calibration networks are equally pivotal in differentiating providers. Companies that maintain accredited calibration facilities, clear traceability pathways, and mobile calibration services can significantly ease procurement friction for high-reliability sectors such as aerospace and semiconductor manufacturing. Furthermore, distribution strategies matter: organizations that blend direct sales and channel partnerships achieve broader market coverage, while those that develop ecommerce capabilities capture demand for standardized configurations and rapid replenishment. Finally, strategic partnerships with optical component suppliers, precision-stage manufacturers, and software integrators allow companies to deliver turnkey alignment and inspection solutions that reduce implementation risk for end users.

This comprehensive research report delivers an in-depth overview of the principal market players in the Autocollimators market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AMETEK, Inc.

- Armstrong Optical Ltd

- Brunson Instrument Company

- Chuo Precision Industrial Co., Ltd.

- Duma Optronics Ltd.

- Edmund Optics Inc.

- Edutek Instrumentation

- Elshaddai Engineering Equipments

- Hexagon AB

- HOFBAUER OPTIK MESS- UND PRUEFTECHNIK

- Holmarc Opto-Mechatronics Ltd.

- Katsura Opto Systems Co., Ltd.

- Lasersos Limited

- Logitech Ltd.

- Micro-Radian Instruments

- MÖLLER-WEDEL OPTICAL GMBH

- Newport Corporation by MKS Inc.

- NIKON CORPORATION

- OEG GmbH

- OptoSigma Corporation

- Plano Optics Private Limited

- PLX Inc. by Luxium Solutions

- Precision Optical Systems Singapore Pte Ltd.

- Prisms India Private Limited

- Standa Ltd.

- Subi Tek

- SURUGA SEIKI Co., Ltd. by MISUMI Group Inc.

- Tamilnadu Engineering Instruments

- TRIOPTICS GmbH by Jenoptik AG

- ZG Optique SA

Practical strategic moves for product design, calibration services, supply diversification, and software interoperability to strengthen competitiveness and reduce operational risk

Actionable recommendations for industry leaders emphasize concrete steps to capture value from evolving demand patterns and to strengthen supply resilience. First, invest in product architectures that facilitate both electronic data capture and straightforward visual operation, enabling a single platform to address laboratory-grade precision and factory-floor robustness. Such dual-capability designs reduce SKU proliferation and simplify sales and service processes.

Second, prioritize the development or expansion of accredited calibration services and regional service centers to shorten response times and preserve traceability for regulated sectors. Third, diversify supply chains for critical optical components and consider partial localization of final assembly or calibration to mitigate tariff exposure and reduce lead-time variability. Fourth, enhance software interoperability through open APIs and standard export formats so instruments can plug into quality and production systems without extensive custom engineering. Finally, align go-to-market strategies to offer a balanced channel mix: enable hands-on evaluation through offline channel partners while streamlining procurement for standardized configurations via online platforms and manufacturer portals to meet differing buyer preferences and procurement cycles.

A rigorous mixed-methods research approach combining expert interviews, technical literature review, and triangulation to validate instrument, application, and regional trends

The research methodology underpinning this analysis combines primary and secondary approaches to ensure a robust, triangulated understanding of product, application, and regional dynamics. Primary research involved structured interviews with technical leads, procurement managers, and metrology engineers to gather first-hand perspectives on instrument selection criteria, calibration needs, and deployment challenges. These insights were complemented by consultations with calibration service providers and third-party integrators to capture practical considerations around service levels and after-sales support.

Secondary research synthesized published technical literature on optical measurement techniques, product specifications from manufacturer materials, and regulatory guidelines for calibration and traceability. Data synthesis emphasized cross-validation, using multiple sources to confirm recurring themes such as the importance of digital outputs, the operational trade-offs between single- and dual-axis instruments, and the logistical implications of regional supply chains. Throughout, methodological rigor was maintained by documenting assumptions, preserving source provenance for technical claims, and applying qualitative weighting to reconcile differing expert viewpoints.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Autocollimators market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Autocollimators Market, by Product

- Autocollimators Market, by Axis Configuration

- Autocollimators Market, by Working Distance

- Autocollimators Market, by Accuracy Range

- Autocollimators Market, by Technology

- Autocollimators Market, by End-Use Industry

- Autocollimators Market, by Application

- Autocollimators Market, by Distribution Channel

- Autocollimators Market, by Region

- Autocollimators Market, by Group

- Autocollimators Market, by Country

- United States Autocollimators Market

- China Autocollimators Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 2067 ]

Concluding synthesis highlighting the convergence of technical innovation, service excellence, and supply resilience as the pathway to sustained success in precision alignment technologies

In conclusion, autocollimators remain a critical enabler of precision across optical, aerospace, semiconductor, and advanced manufacturing domains, yet the ecosystem is undergoing meaningful change. Digital integration, modular hardware design, and an emphasis on accredited calibration services are redefining buyer expectations, while tariff dynamics and regional logistics are prompting companies to reconfigure supply chains and service footprints. The most successful organizations will be those that align product flexibility with robust service networks and software interoperability to deliver measurable operational improvements for end users.

Strategic leaders should therefore prioritize investments that close the gap between laboratory-grade performance and factory-floor usability, while building the supply and service capabilities needed to protect uptime and preserve traceability. By doing so, they will be best positioned to support the nuanced requirements of aerospace and semiconductor clients, meet the throughput needs of automotive and industrial customers, and provide resilient long-distance solutions for construction and field applications. The path forward is one of balanced innovation-combining optical excellence with practical deployment realities to deliver sustained value to customers.

Engage the Associate Director of Sales and Marketing for a tailored report briefing and fast-track delivery options to convert research into actionable commercial plans

To obtain the full, in-depth market research report and tailored insights for your strategic planning, reach out to Ketan Rohom, Associate Director, Sales & Marketing, who can facilitate report access, custom data extracts, and a briefing tailored to your priorities. The report purchase process includes options for a standard report delivery, an extended briefing with slide-ready executive summaries, and bespoke add-ons such as custom segmentation analysis, competitive landscaping, and technical consultation sessions. Engage with Ketan to arrange a confidential walkthrough of the report findings, select the right deliverables for your team, and schedule a follow-up call to translate insights into implementation roadmaps.

Prompt engagement accelerates value capture: after a short discovery call to align scope, Ketan can coordinate an expedited delivery schedule, introduce subject-matter experts for technical Q&A, and provide guidance on licensing and internal distribution. Many purchasers benefit from combining the base report with a targeted workshop that converts high-level insights into operational steps for engineering, procurement, and R&D teams. If you prefer a tailored extract or a custom appendix focused on specific product types, axis configurations, working distances, or accuracy ranges, Ketan will coordinate internal resources to deliver those additions with confidentiality and speed.

Act now to secure a briefing slot and confirm any customization requirements so your leadership receives a precise, actionable package aligned with procurement timelines and product development cycles. Ketan will also share recommended next steps for integrating the report findings into vendor selection, supplier negotiations, and cross-functional readiness assessments. Please indicate preferred timing for an initial call and the primary objectives you want the report to address, and Ketan will follow up to finalize arrangements and confirm delivery milestones.

- How big is the Autocollimators Market?

- What is the Autocollimators Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?