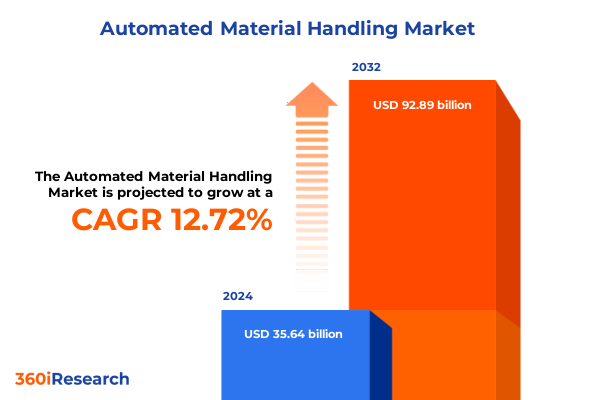

The Automated Material Handling Market size was estimated at USD 40.14 billion in 2025 and expected to reach USD 44.38 billion in 2026, at a CAGR of 12.73% to reach USD 92.89 billion by 2032.

Unveiling the Compelling Dynamics and Emerging Innovations Driving Unprecedented Future Growth in Automated Material Handling Technologies Across Diverse Industries

In the current era of heightened operational complexity and rapid technological advancement, automated material handling has emerged as a cornerstone of efficient supply chain execution. Organizations across diverse sectors are embracing digital transformation initiatives as they pursue higher levels of productivity, safety, and cost efficiency. The convergence of robotics, software intelligence, and advanced control devices is enabling unprecedented levels of automation, offering firms the ability to respond to demand fluctuations with agility and precision. As labor shortages continue to challenge traditional manual processes, these integrated solutions provide not only a pathway to sustained growth but also a strategic buffer against economic and geopolitical uncertainties that can disrupt global logistics networks.

Throughout the introduction of this report, readers will find a comprehensive overview of the critical forces shaping the automated material handling landscape. From the influence of e-commerce expansion to the imperative of sustainability, each factor is examined in relation to its impact on technology adoption. This section sets the stage for deeper analysis by highlighting the interplay between innovation drivers and operational constraints, illustrating how companies can harness automation to achieve competitive differentiation and long-term resilience.

Exploring Transformative Shifts Redefining Automation Landscapes with Digitalization Connectivity and Operational Resilience in Material Handling

The automated material handling sector is undergoing transformative shifts driven by the integration of digital connectivity, artificial intelligence, and modular system architectures. These transitions are redefining traditional intralogistics by enabling seamless communication between equipment, software platforms, and overarching enterprise resource planning systems. As a result, organizations are shifting away from siloed, standalone installations and toward cohesive ecosystems that leverage real-time data to optimize throughput and minimize downtime. Predictive maintenance, powered by IoT sensors and machine-learning algorithms, is emerging as a game-changer, reducing unplanned outages and extending the lifecycle of high-value assets.

Moreover, the evolution of collaborative robotics and autonomous mobile robots is breaking down barriers to entry for smaller operations, making advanced automation accessible beyond large distribution centers. These agile systems can navigate dynamic environments, adapt to changing layout requirements, and collaborate safely with human operators. Taken together, the drive toward networked, intelligent, and scalable automation platforms is reshaping how organizations design workflows, allocate resources, and anticipate future capacity needs.

Analyzing the Consequential Influence of Evolving United States Tariffs in 2025 on Supply Chains Manufacturing Costs and Equipment Acquisition

Recent developments in United States tariff policy have introduced significant variables into procurement strategies and supply chain cost structures for material handling equipment. The extension of Section 301 tariffs on certain imports has elevated the landed cost for equipment components originating from key manufacturing hubs, prompting many stakeholders to reassess sourcing portfolios. Simultaneously, the continuation of Section 232 measures on steel and aluminum has led manufacturers to absorb higher input expenses, which are in turn reflected in the pricing of conveyors, storage structures, and steel-framed robotic gantries.

These tariff-related dynamics are steering many organizations toward nearshoring initiatives, incentivizing them to partner with domestic suppliers or consolidate orders to take advantage of volume discounts that offset incremental duty costs. In parallel, service providers are expanding local repair and maintenance networks to mitigate the risk of cross-border delays. Ultimately, the combined effect of these fiscal measures is fostering a gradual reconfiguration of supplier ecosystems, influencing decision-makers to diversify sourcing strategies and prioritize total cost of ownership considerations in their capital expenditure assessments.

Illuminating Key Segmentation Insights Based on Equipment Types End Use Industries Component Software Integration and Installation Methodologies

A nuanced segmentation analysis reveals how specific equipment and industry requirements are shaping adoption patterns. Within equipment categories, automated guided vehicles have accelerated uptake in scenarios where flexibility and lane-agnostic mobility are paramount, particularly through unit load vehicles that seamlessly transport standardized pallets. In high-density storage environments, mini load and shuttle automated storage and retrieval systems are preferred for their ability to maximize vertical space and reduce pick-to-light errors. Concurrently, traditional conveyor systems continue to underpin high-speed sortation applications, with belt conveyors dominating light-weight material flow and roller conveyors favored for pallet transfers. Industrial robots, including articulated and SCARA variants, are increasingly integrated with vision systems to handle tasks ranging from precision assembly to case packing, while robotic palletizers expand capacity for both conventional and irregular load profiles.

End use industries demonstrate distinct automation trajectories. The automotive sector’s assembly plants leverage robotic gantries for repetitive tasks, whereas parts manufacturing facilities are exploring cobot collaborations to enhance flexibility. E-commerce distribution centers prioritize dynamic sortation systems to meet variable order profiles, while brick and mortar retailers deploy conveyor networks for back-office replenishment. In the food and beverage arena, beverage processors seek hygienic conveying solutions, and packaged food producers integrate control software for traceability. Across healthcare and pharmaceuticals, hospital pharmacies are adopting ASRS for secure inventory management, while manufacturing sites embrace robotic equipment to ensure sterile conditions. Installation strategies vary, with new greenfield deployments favoring end-to-end turnkey solutions and retrofit projects focusing on modular upgrades that minimize disruption.

This comprehensive research report categorizes the Automated Material Handling market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Equipment Type

- End Use Industry

- Component

- Installation Type

Revealing Distinct Regional Insights Highlighting Strategic Growth Patterns and Market Dynamics Across Americas EMEA and Asia Pacific Markets

Regional dynamics underscore differentiated growth drivers and adoption barriers. In the Americas, the United States remains the largest adopter of automated systems, propelled by ongoing e-commerce expansion, reshoring efforts, and investment incentives that support advanced manufacturing. Canadian operations are following suit, albeit at a measured pace, focusing on retrofit installations to modernize existing facilities. Meanwhile, Latin American distributors are exploring partnerships with global vendors to bridge technology gaps and keep pace with regional logistics growth.

In Europe, Middle East, and Africa, western European markets lead in implementing energy-efficient palletizing and sortation systems, driven by stringent environmental regulations and sustainability mandates. The United Kingdom’s distribution hubs are at the forefront of adopting digital twin technologies for layout planning, while Middle Eastern logistics parks emphasize large-scale ASRS deployments to support import-export throughput. African markets are still nascent but show growing interest in low-cost conveyor solutions and basic robotics for assembly applications. Across Asia-Pacific, China and Japan dominate through domestic manufacturing of conveyor and robotic equipment, whereas India is emerging as a high-potential market for retrofit solutions, accelerated by government programs promoting smart factories.

This comprehensive research report examines key regions that drive the evolution of the Automated Material Handling market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Competitive Intelligence and Strategic Profiles of Leading Global Players Driving Innovation Partnerships and Market Expansion

The competitive landscape features a blend of longstanding automation specialists and emerging technology firms. Major players have differentiated by integrating cloud-based control software with advanced analytics, creating unified platforms that deliver end-to-end visibility. Leaders in this space have also forged strategic alliances with system integrators to expand local service footprints, ensuring rapid deployment and ongoing maintenance support. In parallel, robotics manufacturers are extending their offerings through open-source software ecosystems, enabling third-party developers to create specialty modules for niche applications.

Recent collaborations between equipment vendors and logistics service providers signal a shift toward solution-as-a-service models, where end users can access automation capabilities through subscription-based contracts. This approach reduces upfront capital requirements and aligns technology upgrades with evolving operational goals. Smaller entrants are focusing on software innovations such as AI-powered path planning and vision-guided picking, aiming to carve out positions in specific verticals. Collectively, these competitive dynamics are fostering an environment of rapid innovation, with providers striving to deliver increasingly modular, scalable, and interoperable automation solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automated Material Handling market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Addverb Technologies Pvt. Ltd.

- Bastian Solutions, LLC

- BEUMER Group GmbH & Co. KG

- Daifuku Co., Ltd.

- Eisenmann SE

- Fives Group

- Grenzebach Maschinenbau GmbH

- Hanel GmbH & Co. KG

- Honeywell International Inc.

- Intelligrated, Inc.

- JBT Corporation

- Kardex AG

- Knapp AG

- Lödige Industries GmbH

- Mecalux, S.A.

- Murata Machinery, Ltd.

- SSI Schaefer AG

- Swisslog Holding AG (KUKA AG)

- System Logistics S.p.A.

- TGW Logistics Group GmbH

- Toyota Industries Corporation

- Vanderlande Industries B.V.

- Viastore Systems GmbH

- Witron Logistik + Informatik GmbH

Providing Strategic Actionable Recommendations for Industry Leaders to Navigate Technological Disruption Market Volatility and Evolving Regulatory Landscapes

Industry leaders seeking to maintain a competitive edge should prioritize investments in modular, scalable automation platforms that can evolve alongside shifting customer demands. By adopting digital twin simulations, organizations can validate system layouts virtually, reducing commissioning timelines and mitigating integration risks. Deploying flexible robots and autonomous mobile robotics within collaborative frameworks fosters workforce augmentation rather than replacement, enhancing throughput without compromising worker safety.

To navigate ongoing tariff volatility, stakeholders should implement comprehensive supplier risk assessments and explore near-sourcing arrangements that minimize exposure to duty fluctuations. Emphasizing interoperable software architectures will enable seamless integration of legacy equipment with newer technologies, safeguarding prior investments while facilitating incremental modernization. Furthermore, executives should capitalize on emerging government incentives for advanced manufacturing and sustainability initiatives, aligning automation deployments with broader corporate social responsibility objectives. Lastly, ongoing training programs that blend technical skills with digital literacy will empower workforces to operate sophisticated systems effectively and drive continuous improvement.

Outlining a Rigorous Research Methodology Combining Primary Interviews Secondary Analysis Data Triangulation and Expert Validation Processes

This report’s findings are built upon a rigorous research methodology designed to ensure accuracy, relevance, and practical applicability. Primary data was gathered through in-depth interviews with original equipment manufacturers, technology integrators, and end users across key industries, yielding first-hand perspectives on evolving deployment strategies and performance benchmarks. Secondary research incorporated comprehensive reviews of industry trade journals, patent filings, regulatory filings, and corporate disclosures, establishing a robust contextual framework for market developments.

Data triangulation techniques were applied to reconcile insights from diverse sources, while quantitative analyses leveraged anonymized shipment and order volume datasets to validate adoption patterns. The research team conducted multiple rounds of expert validation, engaging with advisory panels to refine interpretations and ensure alignment with real-world operational conditions. Rigorous quality checks, including cross-referencing with publicly reported case studies, guarantee that the conclusions and recommendations articulated in this report are both credible and actionable for decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automated Material Handling market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automated Material Handling Market, by Equipment Type

- Automated Material Handling Market, by End Use Industry

- Automated Material Handling Market, by Component

- Automated Material Handling Market, by Installation Type

- Automated Material Handling Market, by Region

- Automated Material Handling Market, by Group

- Automated Material Handling Market, by Country

- United States Automated Material Handling Market

- China Automated Material Handling Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 3180 ]

Concluding Perspectives Synthesizing Core Insights and Strategic Imperatives for Stakeholders Embracing the Future of Automated Material Handling

In summary, the automated material handling sector stands at the cusp of a new era defined by intelligent connectivity, flexible automation, and strategic supply chain realignment. Technological advancements-ranging from collaborative robotics to AI-driven maintenance-are converging with economic and regulatory forces, notably tariff dynamics, to reshape procurement, deployment, and operational paradigms. Segmentation analysis highlights how equipment types, industry verticals, and component preferences are driving tailored adoption strategies, while regional insights reveal distinct growth trajectories across the Americas, EMEA, and Asia-Pacific.

As competitive pressures intensify, leading companies are pursuing partnerships and innovation models that deliver turnkey solutions with minimal integration risk. The actionable recommendations presented herein offer a roadmap for navigating ongoing market volatility, optimizing total cost of ownership, and fostering sustainable value creation. By aligning automation strategies with organizational objectives and external drivers, stakeholders can capitalize on the transformative potential of material handling technologies and chart a path toward long-term operational excellence.

Engage with Associate Director Sales Marketing to Access Comprehensive Market Research and Empower Data Driven Decision Making

For decision-makers seeking in-depth intelligence on automated material handling technologies, engaging directly with Ketan Rohom, Associate Director of Sales & Marketing, provides an unmatched opportunity to secure the comprehensive market research report tailored to strategic objectives and operational requirements. Whether aiming to optimize capital allocations, evaluate emerging suppliers, or strengthen supply chain resilience, this report will equip organizations with the actionable insights and data-driven analyses essential to outperform competitors. Connect with Ketan Rohom to arrange a personalized demonstration of the report’s key findings, explore custom data deliverables, and discuss volume licensing options, ensuring full alignment with your organization’s growth ambitions and technology deployment roadmap. By leveraging this specialized offering, stakeholders can confidently navigate market complexities, accelerate innovation adoption, and drive sustainable value creation across their material handling operations.

- How big is the Automated Material Handling Market?

- What is the Automated Material Handling Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?