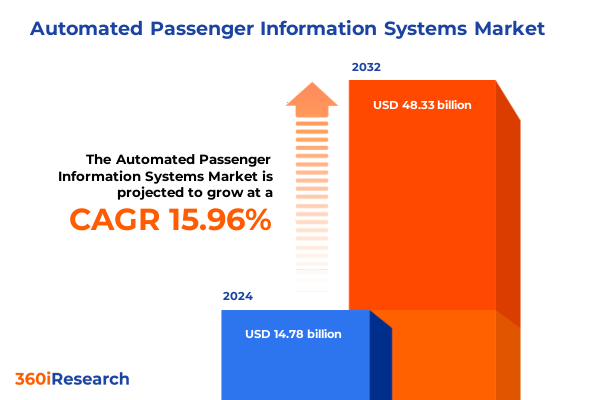

The Automated Passenger Information Systems Market size was estimated at USD 11.10 billion in 2025 and expected to reach USD 12.60 billion in 2026, at a CAGR of 14.32% to reach USD 28.33 billion by 2032.

Embracing the Dawn of Next-Generation Transit Information Solutions Shaping Seamless Journeys in Public Transportation Environments

Automated passenger information systems are rapidly evolving from basic timetable displays to sophisticated, integrated platforms that enrich the traveler experience through real-time updates, personalized alerts, and seamless multi-channel delivery. As public transportation networks expand and urban populations surge, the demand for actionable travel information has never been greater. Modern systems draw upon advanced data analytics and cloud computing to provide synchronized voice announcements, dynamic digital signage, and intuitive mobile interfaces.

Adoption of these integrated solutions not only enhances operational efficiency-by reducing dwell times and improving service reliability-but also strengthens passenger confidence in transit networks. With the convergence of Internet of Things (IoT) connectivity, artificial intelligence, and 5G-enabled communications, transit authorities can now proactively manage disruptions, optimize service planning, and deliver location-based context that directly addresses traveler needs. This intelligence-driven evolution marks a pivotal shift in how information is curated and delivered, setting the stage for transformative customer experiences and operational excellence throughout the transportation ecosystem.

Charting the Technological Evolution Driving Unprecedented Digital Transformation in Passenger Information Delivery Across Transportation Networks

The landscape of passenger information delivery is undergoing profound transformation as transit agencies shift from static, schedule-based displays to fully digitized, adaptive platforms. Advances in machine learning enable systems to predict service deviations, dynamically adjust content, and personalize notifications for millions of daily users. Concurrently, cloud-native architectures facilitate rapid deployment and scaling of applications, while edge computing ensures low-latency updates for onboard displays and station signage.

These technological drivers coincide with a growing emphasis on accessibility and inclusivity. Modern solutions incorporate multi-language support, text-to-speech conversion for visually impaired travelers, and intuitive graphical interfaces that transcend demographic boundaries. Furthermore, the proliferation of mobile applications and web-based portals has empowered passengers to engage with transit services directly, stimulating a shift toward user-centric design principles.

As ecosystems expand to integrate emerging mobility services-such as on-demand shuttles and micro-transit-automated passenger information platforms are evolving into orchestration hubs. By consolidating schedule data, traffic conditions, and real-time vehicle positioning, these systems deliver a unified journey management experience that adapts seamlessly to disruptions, capacity constraints, and passenger preferences. This era of hyper-connected transit intelligence is redefining the standards for reliability, transparency, and traveler satisfaction across urban and regional networks.

Analyzing the Far-Reaching Effects of Evolving United States Tariff Policies on Hardware and Software Supply Chains in 2025

In early June 2025, a landmark Presidential Proclamation under Section 232 of the Trade Expansion Act raised tariffs on steel and aluminum imports from 25 percent to 50 percent, excluding specific United Kingdom goods eligible under a trilateral prosperity agreement. This adjustment, effective June 4, 2025, directly influences manufacturing costs for hardware components such as communication device enclosures, displays, and structural control units that rely on steel or aluminum substrates.

Simultaneously, the U.S. Trade Representative finalized tariff increases under Section 301 for certain Chinese-origin products following a statutory four-year review. Effective January 1, 2025, duties on critical supply chain inputs-such as tungsten alloys used in high-resolution displays and silicon wafers integral to platform software processing-rose to as high as 50 percent, reinforcing the administration’s stance against intellectual property misappropriation and forced technology transfer practices.

Recognizing the potential disruption to domestic industries, the USTR extended exclusions for 164 previously reinstated product categories and 14 additional items related to solar manufacturing equipment through August 31, 2025. This three-month extension preserves tariff relief for select electronics and industrial components, though the narrow scope of exclusions underscores ongoing vulnerability for manufacturers dependent on Chinese supply chains.

Collectively, these policy actions are reshaping procurement strategies and supplier relationships within the automated passenger information ecosystem. Hardware vendors are evaluating alternative sourcing in North America, Europe, and Southeast Asia to offset increased import duties. Software integrators and service providers are adjusting project budgets to account for extended lead times and elevated material costs. As input prices fluctuate, stakeholders must adopt agile sourcing frameworks, hedge inventory exposures, and engage proactively with customs authorities to mitigate the cumulative impact of evolving trade measures.

Uncovering Strategic Insights from Component, System, User, Deployment, and Delivery Mode Segmentations Defining Automated Passenger Information Markets

Delving into market segmentation through the lens of component, system type, end user, deployment, and delivery mode offers a nuanced understanding of where opportunity and competition converge. The hardware segment, encompassing communication devices, control units, and displays, has witnessed intensified demand for ruggedized communication modules and high-definition digital screens, while the services landscape-spanning implementation, maintenance, and support-has grown more sophisticated with the integration of predictive analytics for proactive system upkeep.

Within software, the divergence between application solutions and platform frameworks is sharpening, as agencies prioritize modular, API-driven platforms that support custom passenger interfaces and third-party application integration. System type analysis highlights the rapid uptake of digital signage, dominated by LED and LCD technologies, alongside the expansion of kiosk-based interactions and mobile application ecosystems tailored for Android and iOS users. Onboard display innovations balance overhead and seatback form factors, delivering synchronized voice and visual announcements, while public address systems transition toward wireless architectures and cloud-enabled web platforms ensure cross-channel content consistency.

Adoption patterns within end-user categories vary significantly. Airlines and rail operators are channeling investments into advanced cabin and station-based information displays, optimized for passenger safety and real-time connection updates. Bus operators, segmented into private and public fleets, are modernizing fleet-wide systems to enhance route visibility. Port authorities, spanning river and seaport terminals, deploy versatile solutions to manage passenger flows from quay to terminal, and port-of-call scheduling.

Deployment configurations reflect operational priorities, with station-based systems engineered for high-traffic indoor and outdoor environments, onboard solutions tailored to bus, ferry, and train applications, and handheld interfaces leveraging smartphones and tablets to deliver on-demand journey information. Delivery mode analysis reveals a shift toward cloud-based software-as-a-service and platform-as-a-service offerings, complemented by strategic on-premise installations for enterprise-grade security and local data sovereignty.

This comprehensive research report categorizes the Automated Passenger Information Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- System Type

- Delivery Mode

- End Users

- Deployment

Distilling Regional Dynamics Influencing Automated Passenger Information Adoption and Growth Patterns Across the Americas, EMEA and Asia-Pacific Markets

A regional perspective underscores distinctive adoption dynamics across the Americas, EMEA, and Asia-Pacific. In North America, transit agencies emphasize compliance with stringent ADA accessibility mandates and capitalize on federal infrastructure funding to modernize legacy systems. Emerging investments in intelligent transport corridors between U.S. metros and Canadian border crossings reflect cross-border cooperation and shared technology standards.

Across Europe, the Middle East, and Africa, heterogeneous market conditions drive varied technology lifecycles. Western European networks lead in digital signage sophistication and eco-friendly display innovations, while Eastern European and Middle Eastern corridors focus on foundational deployments and rapid scalability. Africa’s expanding urban transit systems are increasingly integrating mobile-first information platforms to circumvent infrastructure gaps and accelerate passenger engagement.

In the Asia-Pacific region, rapid urbanization and government initiatives-such as smart city and digital railway programs-propel high-volume deployment of onboard displays, public address systems, and progressive web applications. Significant installations in major metropolitan areas, combined with an emphasis on contactless travel experiences and real-time mobile alerts, position the Asia-Pacific landscape as a bellwether for future global trends in passenger information technology.

This comprehensive research report examines key regions that drive the evolution of the Automated Passenger Information Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Showcasing Leading Industry Players Pioneering Innovation and Competitive Strategies Within the Automated Passenger Information Systems Ecosystem

Market leadership is shaped by a cohort of specialized technology providers, integrators, and established transit equipment manufacturers. Legacy engineering firms have expanded their portfolios to include intelligent passenger information modules, forging partnerships with cloud infrastructure vendors to deliver end-to-end managed services. Meanwhile, software innovators are cultivating open, microservices-based platforms that enable rapid customizations for local transit authorities and private operators.

Collaborative ventures between rolling stock manufacturers and system integrators have yielded turnkey solutions that bundle display hardware, control electronics, and application software under one service agreement. Key public transit operators and port authorities regularly engage with these strategic alliances to streamline procurement and accelerate system certifications. Concurrently, mobile-centric startups are disrupting traditional value chains with nimble Android and iOS applications, leveraging advanced geolocation and predictive analytics to preempt passenger needs and enhance journey planning capabilities.

Despite intense competition, the market exhibits consolidation trends, as leading players pursue targeted acquisitions to integrate analytics capabilities and IoT device management into their core offerings. Strategic investments in user experience design hubs and development centers reflect a growing focus on personalized passenger interactions, while cyber resilience initiatives ensure compliance with evolving data privacy regulations and safeguard mission-critical operational networks.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automated Passenger Information Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alstom SA

- Cubic Transportation Systems, Inc.

- Fujitsu Limited

- Hitachi, Ltd.

- Indra Sistemas, S.A.

- INIT Innovations in Transportation, Inc.

- Mitsubishi Electric Corporation

- Siemens AG

- Simpleway Europe a.s.

- Singapore Technologies Engineering Ltd.

- Teleste Corporation

- Televic Group NV

- Thales SA

- Wabtec Corporation

Practical Strategies and Forward-Looking Recommendations to Accelerate Market Leadership in Automated Passenger Information Systems

Industry leaders must prioritize the convergence of cloud-native platforms and edge compute to ensure real-time information delivery under varied network conditions. Structured pilot programs should evaluate emerging AI-driven predictive modules and assess their capacity to reduce system downtime and maintenance costs. At the same time, transit agencies and suppliers should co-develop standardized data schemas and application programming interfaces to foster interoperability across multi-vendor landscapes.

To mitigate tariff-driven supply chain risks, decision-makers should establish diversified sourcing protocols that incorporate dual- and multi-sourcing strategies, while exploring nearshoring opportunities in adjacent markets. Negotiating extended tariffs exclusions and leveraging free trade agreement provisions can also reduce cost volatility. Investment in digital twins for passenger information networks will enable scenario modeling, empowering stakeholders to optimize performance under shifting regulatory and demand conditions.

Moreover, embedding accessibility and inclusivity features at the design phase-such as multilingual interfaces and assistive audio services-will extend system usability to broader demographics while ensuring compliance with emerging global accessibility standards. Finally, cultivating public-private partnerships and cross-industry consortiums will facilitate shared investment in innovation pilots and create unified standards for secure data exchange and passenger privacy management.

Rigorous Research Framework and Methodological Approaches Underpinning the Integrity and Reliability of Automated Passenger Information Market Insights

This research employs a multi-faceted methodology combining primary interviews with transit agency executives, technology vendors, and end-user focus groups, with secondary analysis of industry white papers, regulatory filings, and public policy documents. Data triangulation ensures consistency across diverse information sources, while scenario testing and expert validation sessions refine key assumptions and strategic insights.

Quantitative modeling of supply chain dynamics integrates tariff schedules, procurement lead times, and cost indices to gauge the potential impact of policy shifts and regional deployment cycles. Qualitative assessments of user experience preferences draw upon structured surveys and in-field observations at pilot installations, ensuring that design recommendations align with passenger behavior and accessibility requirements.

To maintain methodological rigor, every data point is cross-verified against multiple reputable sources, and an advisory board of independent transport consultants provides oversight on research design and analytical frameworks. Ethical considerations and data privacy protocols guide the handling of sensitive stakeholder information, while continuous benchmarking against contemporary market developments preserves the currency and relevance of findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automated Passenger Information Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automated Passenger Information Systems Market, by Component

- Automated Passenger Information Systems Market, by System Type

- Automated Passenger Information Systems Market, by Delivery Mode

- Automated Passenger Information Systems Market, by End Users

- Automated Passenger Information Systems Market, by Deployment

- Automated Passenger Information Systems Market, by Region

- Automated Passenger Information Systems Market, by Group

- Automated Passenger Information Systems Market, by Country

- United States Automated Passenger Information Systems Market

- China Automated Passenger Information Systems Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 4134 ]

Synthesizing Key Findings and Strategic Imperatives to Navigate the Future of Automated Passenger Information Systems with Confidence

As transportation networks navigate the complexities of digital transformation, automated passenger information systems stand at the forefront of service innovation and operational optimization. The interplay of advanced analytics, dynamic displays, and multi-channel delivery modes has reshaped expectations for real-time journey visibility and passenger engagement. Regional policies and trade measures introduce both challenges and opportunities, demanding agile sourcing strategies and robust collaboration across the transit ecosystem.

Reflecting on segmentation insights, it is clear that component specialization, system type diversification, and end-user requirements drive tailored solution development. Market leaders that seamlessly integrate cloud-native platforms with edge compute capabilities will deliver superior performance and reliability. By embracing strategic recommendations-ranging from interoperability standards to inclusive design principles-stakeholders can navigate evolving tariff landscapes and capitalize on emerging smart mobility initiatives.

Moving forward, the convergence of AI and IoT will underpin the next generation of passenger information services, enabling proactive disruption management and hyper-personalized travel experiences. Allocating resources toward pilot innovations and forging public-private partnerships will be pivotal in capturing the full potential of this transformative technology landscape.

Take Decisive Steps Today by Collaborating with Ketan Rohom to Gain Exclusive Automated Passenger Information Market Intelligence and Drive Success

Elevate your strategic planning and secure a competitive edge by partnering with Ketan Rohom, Associate Director of Sales & Marketing, to explore the comprehensive automated passenger information market research report. Gain unparalleled insights into the latest technological advancements, tariff implications, regional dynamics, and growth strategies tailored for industry leaders. Through a personalized consultation, you will uncover critical data, tailored recommendations, and actionable intelligence designed to drive your organization’s decision-making and investment priorities.

By engaging directly with Ketan Rohom, you can discuss specific requirements, clarify market nuances, and obtain bespoke analysis that aligns with your business objectives. This exclusive opportunity ensures you receive an in-depth understanding of segment-specific drivers, regulatory influences, and emerging trends that will shape the future of passenger information systems. Take the next step toward informed decision-making and enhanced market positioning-connect with Ketan Rohom today to acquire your definitive resource on automated passenger information systems and fuel your path to success

- How big is the Automated Passenger Information Systems Market?

- What is the Automated Passenger Information Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?