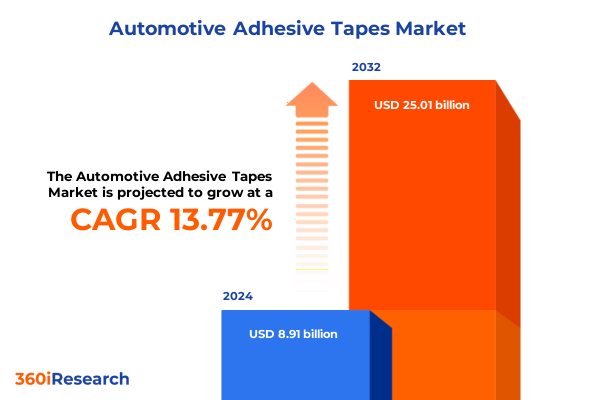

The Automotive Adhesive Tapes Market size was estimated at USD 7.45 billion in 2025 and expected to reach USD 7.89 billion in 2026, at a CAGR of 6.04% to reach USD 11.24 billion by 2032.

Understanding the Pivotal Role of Advanced Adhesive Tapes in Transforming Modern Automotive Manufacturing and Assembly Processes

The evolution of automotive assembly has elevated adhesive tapes from a secondary accessory to a primary enabler of innovation. By eliminating the need for mechanical fasteners, advanced adhesive tapes provide structural integrity while reducing vehicle weight and enhancing aesthetic appeal. This shift streamlines assembly processes, lowers capital investment in welding and fastening equipment, and drives efficiency gains on production lines. Recent advancements in backing materials and adhesive chemistries have unlocked new performance thresholds, including improved thermal stability, chemical resistance, and environmental sustainability, underscoring the strategic importance of these materials in modern automotive manufacturing

As the industry embraces electrification and rigorous emission standards, the demand for specialized adhesive solutions has surged. Electric vehicle manufacturers now rely on tapes engineered for high-voltage insulation, thermal management, and vibration damping in battery modules. Government incentives and zero-emission targets have accelerated electric vehicle production globally, with China accounting for nearly 60% of battery electric and plug-in hybrid vehicle output in 2023. Simultaneously, regulatory mandates and consumer preferences are driving lightweighting initiatives, with industry roadmaps aiming for double-digit percent reductions in vehicle mass by 2025. Together, these dynamics have positioned automotive adhesive tapes as critical components in the transition toward safer, lighter, and more sustainable mobility

Identifying the Critical Technological and Market Shifts Redefining Adhesive Tape Applications and Industry Dynamics Across Global Automotive Value Chains

Automotive assembly is undergoing transformative shifts as electric, hybrid, and autonomous platforms redefine vehicle architecture. In response, manufacturers are developing adhesive tapes with enhanced functional properties, such as ultra-thin form factors for compact battery enclosures and eco-friendly chemistries that meet stringent environmental regulations. These innovations support assembly efficiency and vehicle performance, marking a departure from traditional fastening methods toward more integrated bonding solutions. Concurrently, strategic investments in high-temperature-resistant tapes have addressed the unique demands of under-the-hood applications and high-voltage systems, catalyzing new product portfolios tailored to next-generation powertrains

Digitalization and advanced manufacturing practices are reshaping tape production and quality assurance. Industry 4.0 integration, exemplified by automated process controls, real-time defect detection, and predictive maintenance, has delivered substantial efficiency gains. One major adhesive producer reported a 34% reduction in equipment downtime and a 22% boost in throughput after implementing smart manufacturing platforms. This data-driven approach ensures consistent product quality, accelerates new product introductions, and optimizes resource utilization across global facilities

Sustainability has emerged as a core tenet of product development, driving the adoption of low-VOC and recyclable adhesive tapes. Leading manufacturers have introduced solvent-free, water-based acrylic systems and bio-based foam backings to reduce environmental impact across the product life cycle. Concurrently, flame-retardant and conductive specialty tapes have been engineered to meet evolving safety and electromagnetic shielding requirements. These dual imperatives-performance and sustainability-are converging to define the next wave of adhesive tape innovations

Looking ahead, the integration of sensor tapes for autonomous and connected vehicles is expected to expand the functional scope of adhesive solutions. Cameras, radar modules, and lidar sensors rely on robust mounting tapes that maintain precise alignment and withstand extreme thermal cycling. By embedding functional layers or conductive pathways, these tapes enable new vehicle technologies, underscoring the vital role of adhesives in the rapidly evolving automotive landscape

Assessing the Combined Effects of the 2025 U.S. Automotive Tariff Regime on Adhesive Tape Supply Chains, Cost Structures, and Industry Resilience

In April and May 2025, the U.S. implemented a 25% tariff on imported vehicles and automotive parts, disrupting established supply chains and escalating material costs for adhesive tape manufacturers and converters. Multiple trade associations, including automaker and aftermarket groups, petitioned the Treasury and Commerce Departments for transitional relief, citing the complexity and fragility of global automotive supply chains and the risk of production stoppages and higher consumer prices. This regulatory upheaval has forced industry actors to reassess sourcing strategies and inventory planning to mitigate exposure to sudden duty increases

Major automakers have reported significant earnings hits stemming from these tariffs. In Q2 2025, one leading manufacturer disclosed a $1.1 billion operating income loss attributed to tariff costs, with projections of up to $5 billion of annual profit erosion. Another global OEM warned of a $1.5 billion impact, highlighting the breadth of the challenge. While consumer prices have not yet fully reflected these costs, corporate earnings pressures signal that adhesive tape suppliers, absorbing higher raw material and conversion expenses, will eventually face margin compression or be compelled to pass costs through to end users

The tariff regime has also triggered broader supply chain realignments. With parts subject to 25% duties unless sourced under USMCA-compliant content thresholds, some adhesive producers are accelerating nearshoring initiatives and expanding domestic production footprints. Conversely, companies maintaining offshore supply bases are contending with longer lead times, elevated freight costs, and heightened regulatory scrutiny. This environment underscores the necessity of supply chain agility and underscores the strategic value of diversified manufacturing platforms

To navigate these headwinds, industry participants are exploring tariff mitigation strategies, including tariff classification audits, duty drawback programs, and trade preference certifications. Additionally, investments in U.S.-based manufacturing facilities-with multi-year capacity expansions slated in Michigan, Kansas, and Tennessee-aim to reduce import dependency and shield operations from abrupt policy shifts. These measures reflect a broader industry pivot toward resilient, localized supply chains as tariff volatility becomes a defining feature of the 2025 business landscape

Uncovering Core Market Segmentation and Product Differentiation Trends Shaping the Future of Automotive Adhesive Tape Solutions Across Diverse Categories

The product type landscape of automotive adhesive tapes encompasses diverse solutions tailored to specific assembly and performance needs. Double-sided tapes, segmented into permanent and removable variants, have become indispensable for emblem mounting and trim bonding, offering immediate fixture strength without the need for secondary fastening. Foam tapes, available in closed-cell and open-cell constructions, excel at sealing and vibration dampening, while single-sided permanent tapes ensure lasting adhesion on low-surface-energy substrates. Specialty tapes, ranging from conductive and flame-retardant to UV-resistant formulations, address critical functional demands, and transfer tapes provide ultra-low build-up solutions for intricate component bonding. These distinctions drive product development priorities as manufacturers optimize tapes for mechanical performance and environmental compliance

Adhesive chemistries further differentiate market offerings. Acrylic systems-delivered via solvent-based, solvent-free, and water-based formulations-balance high shear strength with environmental considerations. Rubber adhesives, harnessing both natural and synthetic variants, prioritize immediate tack and flexibility for applications requiring rapid handling. Silicone-based adhesives, available in high- and low-temperature grades, provide exceptional thermal stability and chemical resistance in under-the-hood environments. This segmentation informs material selection throughout vehicle platforms and influences converter tooling investments and end-use qualification processes

Application segmentation spans from sensitive electrical assemblies to aesthetic exterior trims and protective packaging workflows. In electrical systems, tapes facilitate EMI shielding and wire harness bundling. Exterior applications leverage tapes for emblem mounting, molding attachment, and trim bonding, achieving flush fits and design continuity. Interior tapes secure carpets, dashboards, and headliners, streamlining tool utilization and eliminating mechanical fixtures. Protective packaging tapes, crucial for pallet stabilization and surface protection during logistics, ensure component integrity. Each application segment presents unique adhesion, substrate compatibility, and performance criteria, driving targeted research and product testing protocols

The end-use spectrum divides into aftermarket and original equipment channels. Aftermarket demand for custom fabrication and replacement kits has surged with vehicle personalization trends, whereas original equipment programs emphasize just-in-sequence supply, rigorous qualification standards, and integrated design collaboration. Vehicle type segmentation also plays a pivotal role: commercial vehicles, passenger cars, and two-wheelers adhere to distinct regulatory and operational profiles, while electric vehicles necessitate specialized tapes for battery pack insulation and motor housing assembly. Sales channels-direct sales, national and regional distributors, and B2B and manufacturer online platforms-shape go-to-market strategies, influencing service models, lead times, and technical support frameworks. Recognizing these interlocking layers of segmentation is essential for aligning product roadmaps and channel investments with customer requirements

This comprehensive research report categorizes the Automotive Adhesive Tapes market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Tape Type

- Adhesive Type

- Adhesive Technology

- Application

- End Use

- Sales Channel

Exploring Regional Variations in Automotive Adhesive Tape Adoption Driven by Local Regulations, Manufacturing Hubs, and Evolving Mobility Trends

In the Americas, the convergence of federal incentives supporting electric vehicle production and a robust onshoring agenda has intensified domestic demand for specialized adhesive tapes. The Inflation Reduction Act’s tax credits and manufacturing stipulations have catalyzed facility expansions across the U.S., driving volume growth in battery assembly tapes and under-hood sealing solutions. Concurrently, tariffs on imported automotive parts have spurred investment in local production capacity, reinforcing North America’s position as a key market for high-performance and low-VOC adhesive technologies

Europe, Middle East & Africa exhibit a dual focus on sustainability and regulatory compliance. The European Union’s aggressive electric mobility targets-aiming for 30 million EVs by 2030-and national ICE vehicle phase-out mandates, such as the UK’s 2030 ban, have escalated demand for eco-friendly tapes that meet stringent REACH and low-VOC requirements. Automotive converters in the region are also prioritizing lightweight multi-material bonding and fire-retardant specialty tapes to align with Euro NCAP crash and safety standards, solidifying Europe’s role as a crucible for regulatory-driven innovation

Asia-Pacific continues to lead global production, with China alone accounting for roughly 60% of electric vehicle assembly in 2023. Well-established manufacturing ecosystems in Japan, South Korea, India, and Southeast Asia have fostered rapid adoption of advanced adhesive tapes, particularly for high-volume body-in-white bonding and battery module encapsulation. Regional OEM and converter partnerships are driving investments in state-of-the-art coatings and dispensing technologies, while cost-competitive supply chains maintain the region’s dominance. Ongoing government support for EV infrastructure and localization policies will further cement Asia-Pacific as the largest and most dynamic market for automotive adhesive tapes

This comprehensive research report examines key regions that drive the evolution of the Automotive Adhesive Tapes market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players’ Strategic Moves, Innovations, and Collaborations Driving Competitive Advantage in Automotive Adhesive Tapes

3M has expanded its South Korean production facility by 25%, prioritizing double-coated foam tapes that serve over one-third of regional automotive applications. This investment enhances capacity for high-performance bonding solutions aligned with the Asia-Pacific region’s EV growth trajectory

Tesa SE’s introduction of ultra-thin adhesive tapes in 2023 targeted lightweight battery modules, delivering a 20% reduction in thickness and an 18% improvement in thermal conduction. This innovation underscores the critical junction of weight savings and thermal management in electric vehicle design

Nitto Denko Corporation’s 2023 launch of heat-resistant tapes for high-voltage wire harnesses achieved a 32% durability gain under prolonged heat exposure, meeting fire safety directives and reinforcing the importance of specialized materials in next-generation powertrains

Avery Dennison’s 2024 rollout of solvent-free, 45% recycled material adhesive tapes for interior components has reduced VOC emissions by 28%, exemplifying the shift toward green product portfolios driven by both regulatory and customer sustainability mandates

Henkel’s integration of Industry 4.0 systems across its global facilities drove a 34% downtime reduction and a 22% throughput increase, showcasing the efficiencies unlocked by digital quality controls and predictive maintenance in tape manufacturing

Sika’s strategic focus on e-mobility has yielded advanced bonding and thermal management solutions embedded in battery enclosures and body structures, supported by partnerships with major OEMs and a growing portfolio of structural adhesives and conductive gap fillers

H.B. Fuller’s award-winning EV Protect 4006 tape, recognized for its ability to contain thermal runaway events within seconds, exemplifies breakthroughs in battery safety and thermal propagation control, positioning the company at the forefront of next-gen EV adhesive solutions

Arkema’s bio-based polyamide adhesives, such as Rilsan PA11 derived from castor beans, have captured a significant share of luxury EV battery casing applications by reducing product carbon footprints by 45% compared to petroleum-based alternatives

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Adhesive Tapes market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Advance Tapes International

- AIPL Tapes Industry LLC

- Amcor plc.

- American Biltrite Inc.

- Arkema SA

- ATP Adhesive Systems AG

- Avery Dennison Corporation

- BASF SE

- Compagnie de Saint-Gobain S.A.

- DIC Corporation

- ECHOtape

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Intertape Polymer Group Inc.

- L&L Products, Inc.

- Lintec Corporation

- Lohmann GmbH & Co. KG

- Nitto Denko Corporation

- ORAFOL Europe GmbH

- PPI Adhesive Products Ltd.

- Rogers Corporation

- Scapa Group Plc by Schweitzer-Mauduit International, Inc.

- Shurtape Technologies, LLC

- Sika AG

- Tesa SE

- The Chemours Company

- The Dow Chemical Company

- ThreeBond International, Inc.

- Triton Middle East LLC

- Volz Selbstklebetechnik GmbH

- Worthen Industries, Inc.

Delivering Practical Strategic Recommendations and Operational Best Practices to Enhance Growth, Resilience, and Sustainability in Automotive Adhesive Tape Operations

To mitigate tariff exposure and enhance supply chain resilience, industry leaders should accelerate onshoring initiatives and diversify supplier bases. Establishing or expanding manufacturing footprints in tariff-protected regions and leveraging trade preference programs will reduce duty burdens and secure uninterrupted supply of critical raw materials and finished tapes

Investing in high-performance and sustainable adhesive chemistries will differentiate product portfolios and align with tightening environmental regulations. Developing solvent-free, low-VOC systems and bio-based formulations that match or exceed traditional performance criteria will appeal to OEMs pursuing lightweight, green vehicle designs and sustainable manufacturing goals

Adopting digital manufacturing platforms and Industry 4.0 capabilities will optimize production efficiency and quality consistency. Integrating real-time monitoring, automated inspection, and predictive maintenance solutions across tape production lines will reduce waste and accelerate new product introductions while minimizing downtime

Forming strategic partnerships with OEMs and battery module suppliers to co-develop application-specific tapes will facilitate faster time-to-market and deeper technical collaboration. Joint validation programs and shared R&D investments will drive bespoke solutions for emerging vehicle architectures, including 800 V battery systems and next-generation sensor mounts

Expanding omnichannel sales models-combining direct sales, distributor networks, and online B2B platforms-will broaden market reach and enhance customer engagement. Streamlining e-commerce interfaces and digital technical support tools will empower converters and end users with self-service capabilities and rapid access to product data, further strengthening brand loyalty and service differentiation

Outlining the Robust Primary and Secondary Research Approach Providing Foundations for In-Depth Analysis and Accurate Insights in This Executive Summary

This analysis integrates comprehensive secondary research and primary stakeholder engagement to ensure robust insights. Secondary sources included industry reports, company press releases, regulatory filings, and trade association publications, which were systematically reviewed to identify market trends and technological advancements. Primary research encompassed structured interviews with adhesive tape manufacturers, automotive OEM technical specialists, and supply chain executives, facilitating validation of quantitative findings and enriching qualitative understanding.

Data triangulation was employed to reconcile disparate sources and enhance data reliability. Market segmentation and trend projections were cross-verified with public financial disclosures, government policy data, and real-world adoption case studies. Methodologies adhered to best practices in market research, including scope definition, data mapping, and iterative hypothesis testing. Technical assessments of adhesive chemistries and application performance incorporated peer-reviewed literature and expert practitioner feedback.

Throughout the research process, rigorous quality controls were maintained. Data integrity checks and consistency validations ensured accurate representation of market dynamics. Confidential survey instruments and non-disclosure frameworks protected stakeholder anonymity while enabling candid insights. This multidisciplinary approach underpins the credibility and actionability of the findings presented in this executive summary.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Adhesive Tapes market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Adhesive Tapes Market, by Tape Type

- Automotive Adhesive Tapes Market, by Adhesive Type

- Automotive Adhesive Tapes Market, by Adhesive Technology

- Automotive Adhesive Tapes Market, by Application

- Automotive Adhesive Tapes Market, by End Use

- Automotive Adhesive Tapes Market, by Sales Channel

- Automotive Adhesive Tapes Market, by Region

- Automotive Adhesive Tapes Market, by Group

- Automotive Adhesive Tapes Market, by Country

- United States Automotive Adhesive Tapes Market

- China Automotive Adhesive Tapes Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Synthesizing Key Takeaways from Comprehensive Analysis to Offer Clear Direction on Market Positioning and Strategic Priorities for Automotive Adhesive Tapes

The automotive adhesive tape market stands at a crossroads defined by electrification, sustainability, and shifting trade policies. Manufacturers that pivot to offer high-performance, eco-friendly tape solutions tailored for battery systems and lightweight structures will capture the most disruptive opportunities. At the same time, companies that proactively adapt supply chains to the prevailing tariff environment through onshoring and trade preference optimization will safeguard profitability and customer continuity. Strategic investments in Industry 4.0, product innovation, and channel expansion form the cornerstones of future success.

Looking forward, the intersection of advanced material technologies and digital manufacturing will redefine the competitive landscape. Market participants that forge deep technical partnerships with OEMs and material suppliers will accelerate solution co-creation and unlock new application frontiers, from autonomous sensor mounts to next-generation EV battery enclosures. Ultimately, the companies that achieve seamless integration of product performance, sustainability, and operational resilience will lead the industry and set the standard for adhesive tape applications in the evolving automotive sector

Connect Directly with Associate Director of Sales & Marketing for Exclusive Access to the Comprehensive Automotive Adhesive Tape Market Research Report

Ready to gain unparalleled insights into the automotive adhesive tape market? Contact Ketan Rohom, Associate Director of Sales & Marketing, to access the definitive research report and empower your strategic decisions with expert analysis and data-driven guidance

- How big is the Automotive Adhesive Tapes Market?

- What is the Automotive Adhesive Tapes Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?