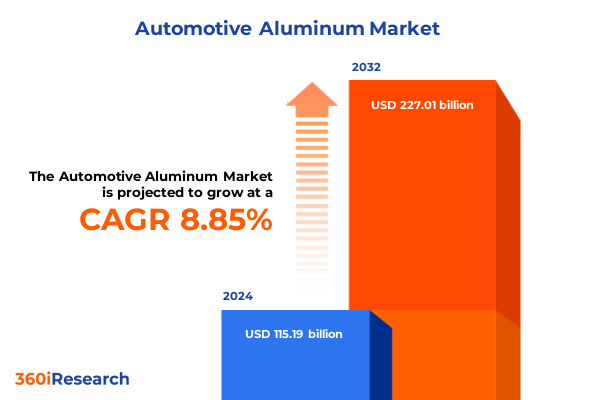

The Automotive Aluminum Market size was estimated at USD 125.31 billion in 2025 and expected to reach USD 136.32 billion in 2026, at a CAGR of 10.18% to reach USD 247.01 billion by 2032.

Revolutionizing Automotive Aluminum: Leveraging Cutting-Edge Manufacturing, Sustainability Initiatives, and Strategic Alliances to Lead the Future of Mobility

The automotive aluminum market has emerged as a cornerstone of modern vehicle design, fueled by the convergence of lightweight engineering principles and stringent emissions regulations. In recent years, automakers have accelerated their shift toward aluminum-intensive architectures to reduce vehicle mass, enhance fuel efficiency, and meet evolving safety standards without compromising structural integrity. As electric and hybrid powertrains become increasingly prevalent, the imperative to optimize weight-to-strength ratios has intensified, positioning aluminum as a critical enabler of next-generation mobility solutions. Moreover, advances in alloy development, high-pressure die casting, and additive manufacturing are unlocking unprecedented design flexibility, allowing manufacturers to achieve complex geometries that were previously unattainable with traditional steel stampings.

This summary distills the most impactful trends shaping the global automotive aluminum ecosystem, from transformative shifts in manufacturing processes to the far-reaching implications of evolving trade policies. By synthesizing insights across application segments, product types, vehicle categories, and geographic markets, it provides a cohesive narrative on the forces driving demand, competitive dynamics, and emerging opportunities. Stakeholders will gain clarity on how raw material sourcing, production efficiencies, and end-use requirements intersect to influence the trajectory of aluminum adoption in passenger cars, commercial vehicles, and electrified platforms.

Through a blend of qualitative expert perspectives and rigorous secondary research, this document equips decision-makers with the strategic intelligence needed to navigate a landscape defined by rapid technological innovation, regulatory complexity, and global supply chain reconfiguration. It serves as a roadmap for industry participants seeking to capitalize on the evolving automotive aluminum value chain and secure a competitive edge in an era of unprecedented change.

Navigating Technological Disruption, Sustainability Imperatives, and Geopolitical Influences Reshaping the Automotive Aluminum Value Chain

The automotive aluminum landscape is undergoing a fundamental transformation driven by a confluence of technological advances, environmental mandates, and shifting geopolitical dynamics. On the technological front, manufacturers are embracing advanced casting methods, such as high-pressure die casting and additive layer manufacturing, to achieve intricate component designs while reducing material waste. This transition is further accelerated by the integration of digital simulation tools and artificial intelligence, which enable real-time monitoring and optimization of alloy compositions, thermal profiles, and process parameters.

In parallel, sustainability imperatives are reshaping end-to-end supply chains. Automakers and suppliers are increasingly committing to recycled content targets and closed-loop recycling programs, thereby reducing the industry’s carbon footprint and fostering circular economy principles. Lifecycle assessment methodologies are being institutionalized to quantify environmental impacts, driving investment in low-carbon smelting processes and renewable energy integration within primary production and recycling facilities.

Furthermore, evolving trade policies and geopolitical considerations are redefining global sourcing strategies. Heightened scrutiny of critical material dependencies and the imposition of new tariffs have prompted tier-one suppliers to pursue regional diversification and vertical integration. These strategic pivots are complemented by bilateral and multilateral agreements aimed at stabilizing raw material flows and harmonizing quality standards. As a result, industry participants are recalibrating their capital allocation and risk management frameworks to ensure resilience against supply disruptions and regulatory volatility.

Assessing the Far-Reaching Consequences of Expanded United States Aluminum Tariffs on the Automotive Sector in the Wake of 2025 Policy Shifts

The U.S. government’s 2025 tariff measures have profoundly altered the economics of aluminum sourcing for the automotive sector. In February 2025, Proclamation 10895 increased the levy on aluminum articles and derivative products from 10 percent to 25 percent for all countries, effectively phasing out previous exemptions and tariff-rate quotas under Section 232 of the Trade Expansion Act of 1962. This action terminated existing product exclusion processes and General Approved Exclusions, creating a uniform duty structure aimed at bolstering domestic primary production. Subsequently, Proclamation 10896 further raised the ad valorem duty on steel and aluminum imports to 50 percent, effective June 4, 2025, while adjusting implementation parameters to align with the U.S.–UK Economic Prosperity Deal. These successive policy shifts have introduced unprecedented cost uncertainty for automakers reliant on imported aluminium components and accentuated the incentive to onshore or nearshore fabrication capabilities.

Automotive-specific analyses indicate that a 25 percent tariff on aluminum could increase the cost of a typical vehicle by approximately $1,500, exacerbating production expenses and compressing profit margins. Suppliers are facing the dual challenge of passing through higher raw material costs to OEMs while maintaining aftermarket price competitiveness in an already price-sensitive consumer market. The ripple effects extend to sub-tier suppliers, where elevated duties on derivative aluminum articles risk triggering financial distress among SMEs less able to absorb sudden expense increases.

Industry bodies and consultancies have warned of potential capacity bottlenecks and production delays. S&P Global Mobility projects that steel and aluminum tariffs could reduce North American vehicle output by up to 20,000 units per day under an extended disruption scenario. Furthermore, the average cost impact per vehicle could range from $400 to $500, with greater exposure for aluminum-intensive platforms such as high-end pickups and luxury sedans. Consequently, many OEMs are reevaluating supply contracts, accelerating investments in domestic rolling mills, and exploring alternative lightweight alloys to mitigate tariff-driven inflationary pressures.

Unveiling Actionable Segmentation Insights Illuminating How Application, Product Type, Vehicle Type, Manufacturing Process, and End Use Intersect in Automotive Aluminum

A nuanced segmentation framework reveals distinct performance dynamics across application areas. Within the body structure domain, inner panels, outer panels, and reinforcements each present unique metallurgical requirements, influencing alloy selection and forming techniques. In chassis framing, segments such as crossmembers and subframes demand high structural rigidity, driving advancements in extrusion and forging processes. Heat exchanger components-including condensers, intercoolers, and radiators-call for specialized alloy grades optimized for thermal conductivity and corrosion resistance. Powertrain segments like cylinder heads, engine blocks, and transmission housings rely on casting precision to meet stringent fatigue life specifications. Meanwhile, wheel assemblies differentiate between alloy wheels and forged wheels, where weight reduction and mechanical strength are balanced through tailored forging and finishing practices.

Product type segmentation underscores the importance of manufacturing methodology on component performance. Gravity die casting, high-pressure die casting, and low-pressure die casting each afford varying degrees of dimensional accuracy and throughput, influencing their application across different vehicle platforms. Extruded profiles, whether architectural or structural, deliver consistent cross-sectional properties essential for load-bearing structures. In forging, closed-die and open-die techniques enable high-integrity components for chassis and suspension systems. Rods, wires, and sheet plate materials further diversify the landscape, with cold-rolled and hot-rolled sheet plate offering differing formability and surface finish characteristics.

Vehicle type serves as an additional lens, with passenger cars, commercial vehicles, and electrified powertrains each exhibiting distinct aluminum intensity. Commercial vehicle segments, spanning buses to heavy-duty trucks, prioritize durability and weight optimization. Electric and hybrid variants-battery electric, hybrid electric, and plug-in hybrid vehicles-drive the adoption of aluminum-intensive battery housings and lightweight structural elements. Finally, end-use segmentation differentiates between aftermarket and OEM channels, reflecting divergent performance, certification, and pricing requirements.

This comprehensive research report categorizes the Automotive Aluminum market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Vehicle Type

- Manufacturing Process

- Application

- End Use

Decoding Regional Dynamics Across Americas, Europe Middle East Africa, and Asia Pacific to Uncover Growth Drivers and Challenges in Automotive Aluminum

Regional dynamics in the Americas are shaped by robust demand from North American vehicle manufacturers, where aluminum-intensive pickup trucks, SUVs, and performance sedans drive sustained consumption. Investment in domestic primary production and recycling infrastructure has been catalyzed by federal and state incentives aimed at reshoring critical supply chains. Meanwhile, remelt and secondary smelting capacity expansions seek to capitalize on the region’s substantial scrap availability, enhancing feedstock security for both OEMs and suppliers.

In Europe, the Middle East, and Africa, the transition toward electrified mobility is exerting upward pressure on aluminum utilization. Electric vehicle battery enclosures, structural battery housings, and heat management components are key growth vectors, supported by EU regulations on CO₂ emissions and circular economy directives. Technological collaboration between European automakers and regional aluminum mills is fostering innovative high-strength, low-weight alloys. At the same time, Middle Eastern producers are leveraging low-energy smelting routes and renewables integration to position themselves as competitive exporters to European markets.

Asia-Pacific represents the fastest-growing region, driven by surging vehicle production volumes in China, India, and Southeast Asia. China's vertically integrated aluminum industry benefits from significant hydropower capacity, yielding cost advantages in primary metal production. Concurrently, Japan and South Korea are leading in advanced casting and extrusion technologies, supplying high-precision components to global OEMs. In India, government policies incentivizing local manufacturing under the Make in India initiative are promoting capacity additions across the entire aluminum value chain, from ingot production to high-end automotive component fabrication.

This comprehensive research report examines key regions that drive the evolution of the Automotive Aluminum market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Strategic Initiatives of Leading Aluminum Producers and Automotive OEMs Driving Innovation, Capacity Expansion, and Supply Chain Integration

Key industry participants are strategically positioning themselves through capacity expansions, alloy innovation, and vertical integration. Alcoa has ramped its downstream rolling operations and is advancing initiatives in low-carbon alumina refining, collaborating with automotive OEMs to develop next-generation high-strength alloys tailored for electric vehicles. Novelis, as a leading producer of recycled aluminum sheet, continues to expand its remelt and casting facilities across North America and Europe, emphasizing closed-loop partnerships with OEMs to secure recycled feedstock and meet stringent sustainability targets. Kaiser Aluminum’s focus on extrusion and forging capabilities supports the growing demand for complex structural and chassis components, with recent capital investments aimed at augmenting billet production and enhancing operational flexibility.

Constellium has differentiated itself through the development of proprietary high-strength, ductile aluminum grades for crash management systems and battery enclosures, supported by joint R&D centers in Europe and the United States. On the automotive original equipment front, Ford Motor Company and General Motors are deepening strategic alliances with primary aluminum suppliers and investing in captive casting facilities to internalize key segments of their value chains. Meanwhile, Tesla’s pursuit of in-house casting press technology and its proprietary giga-casting approach exemplifies the industry’s gravitation toward large-scale, integrated manufacturing solutions. These initiatives underscore a broader trend of collaboration and co-investment between material suppliers and OEMs to accelerate time-to-market for lightweight, cost-efficient automotive components.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Aluminum market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alcoa Corporation

- Aluminum Corporation of China Limited (CHALCO)

- Arconic Inc.

- China Hongqiao Group Limited

- China Zhongwang Holdings Limited

- Constellium SE

- Hindalco Industries Limited

- Hindalco Industries Limited

- Kaiser Aluminum Corporation

- Norsk Hydro ASA

- Novelis Inc.

- Rio Tinto

- Rio Tinto plc

- UACJ Corporation

- UACJ Corporation

Formulating Strategic, Sustainability-Focused, and Collaborative Recommendations for Industry Leaders to Capitalize on Emerging Opportunities in Automotive Aluminum

Industry leaders should proactively pursue strategic partnerships with recycled aluminum suppliers and invest in circular economy frameworks to balance cost pressures with sustainability commitments. By integrating closed-loop recycling programs early in the product development cycle, manufacturers can secure high-quality feedstock while mitigating exposure to volatile primary metal prices. Additionally, deploying digital twins and advanced process controls across casting and extrusion lines will enhance yield, reduce scrap, and accelerate time-to-market for complex geometries.

Automakers are advised to diversify their supply chain footprints by establishing regional fabrication hubs in close proximity to key markets. This approach minimizes tariff exposure, shortens lead times, and supports responsiveness to shifting demand patterns. In parallel, supplier collaborations should focus on co-developing high-strength, multi-phase aluminum alloys that meet evolving safety and thermal performance standards for electrified powertrains. Joint pilot projects and co-funded innovation centers can serve as accelerators for these material innovations.

Companies should also strengthen their engagement with policymakers to shape pragmatic trade and environmental regulations. By contributing technical expertise and economic impact assessments, industry stakeholders can advocate for harmonized global standards, pragmatic duty relief mechanisms, and incentives that reward low-carbon production practices. Ultimately, adopting a holistic strategy that combines material innovation, digitalization, supply chain resilience, and policy engagement will be paramount for capturing long-term value in the automotive aluminum sector.

Outlining Rigorous Research Methodologies Integrating Primary Interviews, Secondary Data Analysis, and Expert Validation to Ensure Authoritative Market Insights

This research synthesized data from multiple primary and secondary sources to ensure comprehensive market coverage and analytical rigor. Primary insights were derived from in-depth interviews with executives at aluminum suppliers, component manufacturers, and automakers, complemented by consultations with industry analysts and policy experts. These qualitative exchanges provided nuanced perspectives on strategic priorities, technology roadmaps, and regional market dynamics.

Secondary data collection involved extensive review of trade publications, government tariff proclamations, technical patents, and company disclosures. Publicly available regulatory documents, including Proclamations 10895 and 10896, were analyzed to quantify policy shifts affecting aluminum tariffs. Proprietary databases were leveraged to track capacity expansions, merger and acquisition activity, and capital expenditure trends across the value chain.

To validate findings, the research team employed a triangulation framework, cross-referencing quantitative data points with expert feedback and real-world case studies. Statistical models were used to assess sensitivity to key variables such as tariff changes, alloy adoption rates, and regional production costs. Quality assurance protocols, including peer review and methodology audits, were implemented to maintain consistency and transparency throughout the study.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Aluminum market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Aluminum Market, by Product Type

- Automotive Aluminum Market, by Vehicle Type

- Automotive Aluminum Market, by Manufacturing Process

- Automotive Aluminum Market, by Application

- Automotive Aluminum Market, by End Use

- Automotive Aluminum Market, by Region

- Automotive Aluminum Market, by Group

- Automotive Aluminum Market, by Country

- United States Automotive Aluminum Market

- China Automotive Aluminum Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2862 ]

Summarizing Critical Findings and Strategic Imperatives to Navigate the Evolving Automotive Aluminum Landscape with Confidence and Foresight

In conclusion, the automotive aluminum market stands at a pivotal junction defined by rapid technological evolution, heightened sustainability obligations, and recalibrated trade policies. The integration of advanced manufacturing processes and the pursuit of lightweight, high-strength alloys are driving unprecedented design innovation across vehicle segments. However, the 2025 tariff adjustments in the United States have injected significant cost volatility, compelling stakeholders to explore domestic production enhancements and supply chain reconfiguration.

Segment-specific analysis has illuminated the critical interplay between application requirements and material form, underscoring the value of tailored alloy formulations for body structures, chassis components, heat management systems, powertrain parts, and wheel assemblies. Regional market insights reveal differentiated growth trajectories, with Americas focusing on reshoring initiatives, EMEA advancing electrification-driven demand, and Asia-Pacific capitalizing on volume-driven expansions aided by energy-efficient smelting.

Key players are responding through capacity investments, strategic alliances, and co-innovation models that bridge material science and automotive engineering. For industry participants, the path forward involves aligning sustainability targets with operational excellence, leveraging digital enablers for process optimization, and engaging collaboratively with policymakers to foster a stable trade environment. These strategic imperatives will define competitive advantage and determine success in an increasingly dynamic automotive aluminum ecosystem.

Engage with Ketan Rohom to Secure Comprehensive Automotive Aluminum Market Intelligence and Empower Informed Strategic Decision Making in 2025 and Beyond

If you are ready to gain a comprehensive understanding of the automotive aluminum landscape and translate these insights into actionable strategies, connect with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan can guide you through the full market research report, helping you access in-depth analysis, proprietary data, and expert perspectives that will equip your organization to make informed investment decisions and drive sustainable growth. Reach out today to secure your copy and position your business at the forefront of automotive aluminum innovation.

- How big is the Automotive Aluminum Market?

- What is the Automotive Aluminum Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?