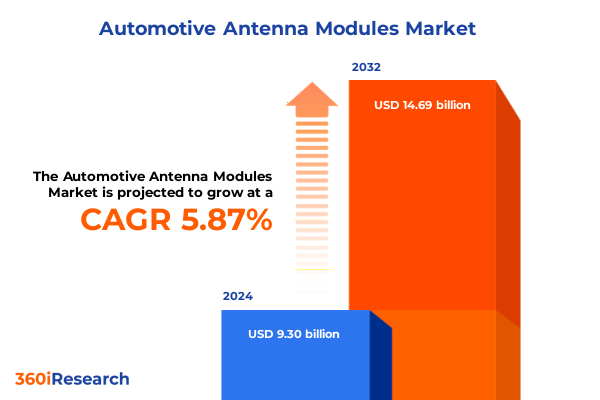

The Automotive Antenna Modules Market size was estimated at USD 9.77 billion in 2025 and expected to reach USD 10.26 billion in 2026, at a CAGR of 6.00% to reach USD 14.69 billion by 2032.

Setting the Stage for a Transformative Decade in Automotive Antenna Modules Underpinned by Connectivity, Integration, and Unprecedented Technological Evolution

The automotive antenna module market stands at the cusp of a profound transformation driven by exponential advancements in vehicular connectivity and an ever-growing array of in-vehicle services. As modern vehicles evolve into rolling data centers, antennas have moved beyond simple reception of satellite and radio signals to become critical enablers of telematics, infotainment, safety, and autonomous functionalities. This convergence of connectivity demands, regulatory mandates for vehicle-to-everything communication, and consumer expectations for seamless digital experiences underscores the antenna module’s strategic importance for automotive OEMs and tiered suppliers alike.

Moreover, this rapidly shifting environment is characterized by an acceleration of technological integration, where multi-band, multifunction modules are increasingly commonplace. Antenna designers must reconcile performance parameters for GPS positioning, cellular 5G, Wi-Fi, Bluetooth, and C-V2X within increasingly compact, lightweight form factors. In addition, the flight toward electric powertrains and autonomous driving platforms imposes new packaging, electromagnetic compatibility, and thermal management considerations. As a result, industry participants who anticipate these dynamics and embrace collaborative innovation stand to secure a lasting competitive advantage in a market defined by continuous evolution.

Transformative Technological Shifts Redefining the Automotive Antenna Module Landscape with 5G, C-V2X, and Autonomous Mobility Demands

The continuous deployment of 5G networks represents one of the most consequential shifts reshaping the antenna module landscape, enabling higher bandwidth, lower latency communication and supporting advanced safety applications like real-time collision avoidance. Concurrently, the maturation of cellular vehicle-to-everything (C-V2X) technologies is fostering a new paradigm in traffic management, infrastructure-to-vehicle data exchange, and fleet coordination. These developments require antenna systems to deliver consistent, high-fidelity signal performance across diverse frequency bands, stimulating rapid innovation in antenna architecture and advanced materials.

In parallel, the surge in demand for autonomous driving capabilities is driving weight reduction and integration imperatives. Antenna modules are now engineered to seamlessly marry radar, lidar, and camera systems with telecommunication antennas, embracing multifunctionality to streamline vehicle design and improve aerodynamics. Furthermore, the broader shift toward electrification has spawned localized high-voltage noise environments, necessitating robust electromagnetic shielding and filtering within antenna assemblies. Ultimately, the interplay of connectivity, autonomy, and electrification represents a pivotal convergence that is redefining product roadmaps and strategic investments for antenna module suppliers around the globe.

Assessing the Strategic Consequences of the 2025 US Tariff Impositions on Automotive Antenna Module Supply Chains and Cost Efficiency Trajectories

In 2025, the United States government enacted a series of tariffs targeting imported automotive components, with specific levies imposed on antenna modules originating from select overseas manufacturers. These duties, applied at escalated rates, have reverberated through global supply chains, compelling OEMs and tier-one suppliers to reassess sourcing strategies and recalibrate cost structures. As tariffs inflate landed costs, manufacturers have begun to explore domestic production alternatives, consider near-shoring critical subassemblies, and evaluate inventory buffers to maintain stable supply and mitigate margin erosion.

However, while tariffs introduce supply chain complexity and cost pressures, they also accelerate strategic realignment among industry players. Some module suppliers have pursued joint ventures with U.S. fabricators to establish local assembly plants, thereby circumventing punitive duties and shortening delivery lead times. Meanwhile, others are leveraging design-to-cost methodologies to optimize bill of materials and enhance modularity, reducing dependence on tariff-affected imports. Despite initial headwinds, these adaptive responses underscore the market’s resilience and its capacity to transform trade barriers into catalysts for supply chain diversification and local investment.

Unlocking Actionable Insights from Form Factor, Application, Vehicle Type, Functionality, and Sales Channel Segment Dynamics Driving Module Innovations

Insights drawn from form factor segmentation underscore distinct performance and packaging trade-offs. Embedded antenna modules excel in sleek, low-profile integration within vehicle rooftops and pillars, while patch antennas offer targeted beam shaping ideal for high-precision GPS and satellite radio reception. Rod antennas deliver durable omnidirectional coverage suited to heavy-duty commercial applications, and shark fin architectures have emerged as a design favorite on passenger vehicles, combining aerodynamic efficiency with multifunctional radio, GPS, and cellular connectivity.

Application segmentation reveals navigation and radio functions as foundational use cases, with GPS-based positioning forming the bedrock of advanced driver assistance systems. AM/FM and satellite radio continue to enhance in-vehicle entertainment, even as telematics platforms leverage cellular and Wi-Fi connectivity for over-the-air updates, remote diagnostics, and usage-based insurance models. Wireless communication segmentation further illuminates the rising significance of Bluetooth for short-range connectivity, cellular for broadband telephony and data streaming, and Wi-Fi for hotspot functionality and high-speed downloading.

When viewed through a vehicle-type lens, commercial platforms operate in heavy and light categories, each demanding ruggedized modules capable of withstanding harsh environmental conditions, whereas passenger cars in hatchback, sedan, and SUV configurations prioritize sleek form factors and styled shark fin antennas. Functionality segmentation contrasts multi-function modules that consolidate GPS, radio, and cellular tasks against single-function antennas optimized for specialized tasks. From a sales channel standpoint, OEM partnerships drive integrated designs and long-term roadmaps, while aftermarket channels address retrofit demands, performance upgrades, and replacement cycles with flexible form factor options.

This comprehensive research report categorizes the Automotive Antenna Modules market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form Factor

- Functionality

- Application

- Vehicle

- Sales Channel

Navigating Regional Market Contrasts Across Americas, EMEA, and Asia-Pacific Illustrating Diverse Adoption Patterns and Growth Enablers for Antenna Solutions

Regional dynamics shape distinct growth trajectories across the Americas. North America sustains robust adoption of connected services underpinned by widespread 5G coverage and stringent safety regulations mandating advanced telematics. Mexico’s assembly plants, serving domestic and export markets, rely on cost-optimized modules, while the United States emerges as a key hub for tier-one supplier innovation and tariff response strategies.

Europe, the Middle East, and Africa present a mosaic of contrasting adoption patterns. Western Europe champions high-end multi-band antennas driven by premium OEM demand and comprehensive C-ITS pilot programs, whereas Eastern European markets exhibit gradual uptake aligned with economic modernization and government incentives. In the Middle East, rapid fleet upgrades in logistics and passenger transport have spurred investment in telematics, and Africa’s nascent connectivity infrastructure underscores opportunities for cost-effective aftermarket solutions.

Asia-Pacific leads global deployment, with China’s automotive electrification roadmap fueling domestic module manufacturing and local content requirements. Japan and South Korea remain innovation hotspots, advancing millimeter-wave 5G and C-V2X testing, and India’s emerging passenger vehicle market shows accelerated growth in telematics retrofit applications. Across all regions, infrastructure readiness, regulatory frameworks, and vehicle parc composition critically influence antenna module configuration and supplier strategies.

This comprehensive research report examines key regions that drive the evolution of the Automotive Antenna Modules market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Players Shaping the Competitive Contours of the Automotive Antenna Module Industry through Innovation, Partnerships, and Strategic Alliances

Leading players in the automotive antenna module arena deploy a blend of organic R&D and strategic collaborations to secure market share. Tier-one multinational suppliers have strengthened portfolios through acquisition of specialized antenna design firms, enabling in-house development of multi-element and software-defined modules. Partnerships between technology startups and established OEM suppliers have fostered rapid prototyping of millimeter-wave and adaptive beamforming solutions, addressing the needs of next-generation autonomous platforms.

Investment in patent portfolios underscores the competitive drive to protect innovations in compact integration, noise immunity, and multi-technology coexistence. Meanwhile, alliances with chipset and semiconductor companies have accelerated the co-development of antenna-RFIC modules that minimize signal loss and reduce system complexity. Several leading enterprises have embraced co-located R&D facilities adjacent to major automotive clusters, leveraging proximity to OEM partners for iterative design feedback and joint validation cycles.

Competitive differentiation also emerges through service offerings, as certain suppliers extend lifecycle management and predictive maintenance capabilities via integrated diagnostic sensors. These added-value services reinforce supplier relationships, ensure consistent performance across diverse operating conditions, and provide actionable data back to OEMs and fleet operators. Collectively, these strategic initiatives delineate the competitive contours of the market and highlight the paths by which new entrants might achieve parity with established incumbents.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Antenna Modules market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alps Alpine Co., Ltd.

- Amphenol Corporation

- Aptiv PLC

- Atmel Corporation

- Brose Fahrzeugteile GmbH & Co. KG

- Continental AG

- DENSO Corporation

- Harman International Industries, Inc.

- Murata Manufacturing Co., Ltd.

- Panasonic Corporation

- Robert Bosch GmbH

- Yazaki Corporation

Delivering Actionable Roadmaps for Industry Stakeholders to Capitalize on Connectivity Trends, Mitigate Trade Headwinds, and Drive Sustainable Module Adoption

Industry participants should prioritize diversification of their supply chains to mitigate trade disruptions and accelerate responsiveness to regulatory changes. By cultivating dual-sourced relationships and evaluating near-shore manufacturing options, suppliers can achieve greater control over critical components and adapt more swiftly to tariff revisions.

In parallel, investment in modular, software-defined antenna architectures will enable scalable updates and customization, reducing time to market for new protocols and frequency bands. Collaborating with network operators and chipset vendors can optimize integration with 5G, C-V2X, and future communications standards, ensuring modules remain at the technological forefront.

Furthermore, engaging in cross-industry consortiums and standardization bodies will help shape interoperable frameworks, drive consistency in performance benchmarks, and facilitate smoother certification processes. Suppliers are also advised to develop comprehensive warranty and predictive maintenance offerings, leveraging embedded sensors and data analytics to extend product lifecycles and strengthen customer loyalty.

Finally, OEMs and tier-one companies should align roadmaps with regional infrastructure initiatives, leveraging government incentives for smart transportation systems and electric mobility. By proactively mapping regulatory landscapes and engaging in pilot programs, stakeholders can position their antenna module solutions as integral components of future mobility ecosystems.

Detailing a Robust Research Methodology Integrating Primary Interviews, Secondary Analysis, and Rigorous Validation to Ensure Comprehensive Market Examination

This study synthesizes insights from a multi-step research methodology designed to deliver a comprehensive examination of the automotive antenna module market. Primary research comprised in-depth interviews with OEM engineers, tier-one buyer executives, technology architects, and aftermarket distributors to validate key technological trends, procurement criteria, and adoption barriers.

Secondary research included a careful review of industry journals, patent filings, regulatory frameworks, and trade association reports to establish a foundational understanding of historical developments and emerging standards. Company press releases and financial disclosures were analyzed to pinpoint strategic initiatives, investment patterns, and partnership announcements within the antenna module ecosystem.

Further, the research team conducted a detailed segmentation analysis, classifying market dynamics across form factor, application, vehicle type, functionality, and sales channel dimensions. A robust triangulation process cross-checked findings from diverse sources to ensure data integrity. Finally, stakeholder workshops and expert panels provided iterative validation of preliminary insights, refining the final recommendations and regional assessments contained within this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Antenna Modules market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Antenna Modules Market, by Form Factor

- Automotive Antenna Modules Market, by Functionality

- Automotive Antenna Modules Market, by Application

- Automotive Antenna Modules Market, by Vehicle

- Automotive Antenna Modules Market, by Sales Channel

- Automotive Antenna Modules Market, by Region

- Automotive Antenna Modules Market, by Group

- Automotive Antenna Modules Market, by Country

- United States Automotive Antenna Modules Market

- China Automotive Antenna Modules Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Concluding Reflections on the Market Evolution, Key Drivers, and Strategic Imperatives for Automotive Antenna Modules in an Era of Accelerated Connectivity

The automotive antenna module market is rapidly evolving under the influence of enhanced connectivity, autonomous mobility, and electrification trends. As vehicles become more reliant on multifaceted communication systems, antenna modules must reconcile competing performance, packaging, and cost requirements. Meanwhile, tariff-driven supply chain realignment underscores the importance of diversified sourcing and domestic manufacturing capabilities.

Segmentation insights reveal tailored opportunities across form factor and application categories, indicating that OEMs and suppliers should embrace modular design philosophies to address both standardized and niche requirements. Regionally, market maturity varies widely, with Asia-Pacific driving volume through electrification initiatives, Europe championing safety and telematics pilots, and the Americas focusing on 5G deployments and regulatory compliance. Key players continue to differentiate through integrated solutions, strategic partnerships, and data-driven service models.

Given these converging forces, industry decision-makers should emphasize agile product roadmaps, collaborative innovation, and proactive regulatory engagement to capture the full potential of future mobility ecosystems. By aligning technology investments with evolving market demands and mitigating geopolitical and trade risks, stakeholders can secure a leadership position in a landscape defined by continuous transformation.

Take the Next Step toward Informed Decision-Making by Engaging with Our Associate Director for In-Depth Market Insights and Customized Intelligence Solutions

Ready to gain a competitive edge and harness detailed market intelligence tailored to your strategic objectives? Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to explore the comprehensive automotive antenna module market research report. You will receive a personalized consultation to align the report's insights with your organization’s priorities and to clarify any questions you may have about segmentation analysis, regional outlooks, or competitive benchmarking.

Our team will guide you through the report’s structure, highlight the key findings most relevant to your business challenges, and outline how you can leverage actionable recommendations to optimize product development, supply chain resilience, and market positioning. Schedule a one-on-one discussion today to secure early access to proprietary data, benefit from exclusive executive summaries, and customize additional research add-ons that meet your unique requirements. Take this opportunity to collaborate with an experienced market research professional committed to delivering the clarity and depth you need for informed decision-making and sustainable growth in the automotive antenna module landscape. Contact Ketan Rohom now to initiate your tailored engagement and drive your strategic roadmap forward.

- How big is the Automotive Antenna Modules Market?

- What is the Automotive Antenna Modules Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?