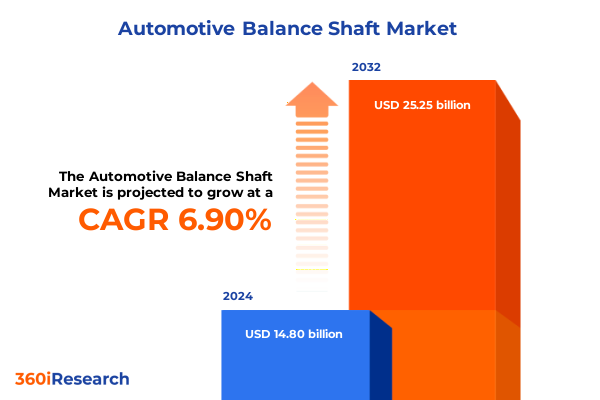

The Automotive Balance Shaft Market size was estimated at USD 15.81 billion in 2025 and expected to reach USD 16.88 billion in 2026, at a CAGR of 6.92% to reach USD 25.25 billion by 2032.

Exploring the Critical Role of Balance Shafts in Modern Engines and the Forces Shaping Future Developments Across Vehicle Powertrains

Engines that rely on inline and V-configurations often encounter inherent secondary vibrations that compromise comfort, efficiency, and longevity. Balance shafts serve as a critical countermeasure, meticulously engineered to counteract oscillatory forces and elevate the acoustic and mechanical performance of powertrains. Over the past decades, as consumer expectations for refinement have soared and regulatory bodies have tightened permissible noise and vibration levels, the integration of balance shafts has shifted from optional enhancement to standard inclusion in a growing array of internal combustion and hybrid engines.

Simultaneously, the global push toward powertrain downsizing and turbocharging has intensified the complexity of vibration profiles, underscoring the indispensable role of balance shafts in modern engine layouts. In response, engineers have refined design geometries, optimized configurations, and experimented with advanced materials to reconcile stringent noise, vibration, and harshness (NVH) objectives with escalating fuel economy mandates. As the industry pivots toward more electrified architectures, the legacy of balance shafts continues to influence hybrid integration strategies, underlining their sustained significance in a transitional period for propulsion technologies. This introduction sets the stage for an in-depth exploration of trends, pressures, and strategic imperatives reshaping the balance shaft market landscape.

Unveiling Transformative Shifts in Vehicle Powertrain Landscapes Driven by Electrification, Emission Norms, and Advanced NVH Solutions for Industry Evolution

The automotive landscape is undergoing a profound metamorphosis propelled by stringent emissions regulations, rapid electrification, and evolving consumer expectations for refinement. Recent milestones in global emissions standards have compelled OEMs to adopt smaller displacement engines paired with turbochargers-a combination that delivers power density yet exacerbates vibration challenges. Consequently, balance shaft configurations have evolved from simple single-axis layouts to dual-axis and multi-plane systems capable of addressing complex vibration harmonics inherent in downsized engines.

Moreover, the proliferation of hybrid powertrains has introduced novel dynamic forces as electric motors and internal combustion units operate in tandem. This synergy has prompted innovative balance shaft designs that accommodate intermittent firing patterns and transient torque loads. In parallel, advancements in computational modeling and additive manufacturing have accelerated prototyping cycles, enabling engineers to iterate geometric profiles and material combinations with unprecedented speed. As a result, the market has witnessed a shift toward lightweight, high-precision components that align with stringent NVH targets while preserving durability. These transformative shifts illustrate how technological progress and environmental mandates are converging to redefine balance shaft solutions for next-generation vehicles.

Assessing the Cumulative Impacts of 2025 United States Tariff Actions on Balance Shaft Supply Chains, Cost Structures, and Global Sourcing Strategies

In 2025, cumulative tariff actions enacted by the United States have significantly influenced the global balance shaft supply chain and cost structures. Steel imports remain subject to a 25% tariff, increasing raw material expenses for manufacturers who rely on imported coils and plates to forge shells and counterweights. Additionally, antidumping duties on certain imported cast‐iron components have further elevated costs for suppliers sourcing from select Asian markets. These measures have reverberated through contract negotiations, prompting supplier diversification and localized production strategies to mitigate margin pressures.

As a consequence, OEMs and Tier 1 suppliers have accelerated nearshoring initiatives to secure more predictable lead times and alleviate exposure to transpacific tariffs. Yet, transitioning manufacturing footprints entails substantial capital investment and operational recalibration. Meanwhile, supply chain teams have intensified collaboration with logistics providers to optimize shipping routes, exploit bonded warehousing, and implement tariff engineering practices. Collectively, these efforts aim to preserve cost competitiveness without compromising quality or delivery performance. Ultimately, the 2025 tariff landscape has galvanized industry stakeholders to reevaluate sourcing paradigms and reinforce resilience against trade‐policy volatility.

Deriving Key Insights from End Use, Configuration, Application, Material, and Distribution Segmentation to Navigate Market Complexities Effectively

A nuanced examination of end-use segmentation reveals distinct trajectories across commercial vehicles, off-road equipment, and passenger cars. Heavy commercial and light commercial vehicle platforms demonstrate a high propensity for advanced multi-plane balance shafts to deliver robust NVH control in diesel powertrains. Conversely, agricultural and construction equipment prioritize durability under severe duty cycles, often favoring single-axis designs with reinforced housings. Meanwhile, passenger cars balance refinement with cost efficiency, typically integrating dual-axis shafts to harmonize ride comfort and manufacturing complexity.

Considering configuration, dual-axis systems command preference in premium segments for their superior vibration attenuation, while single-axis offerings maintain relevance in cost-sensitive applications. Multi-plane solutions are gaining traction in high-performance engines that demand precise counterbalancing across multiple frequency bands. In application channels, original equipment manufacturers continue to anchor volume demand, supported by stringent quality and validation requirements. However, the aftermarket sector exhibits growing momentum as vehicle parc expansion drives replacement part consumption. Material choices further differentiate offerings, with cast iron favored for its damping properties and cost advantages, whereas forged steel is leveraged for lightweight strength in high-speed applications. Distribution dynamics have also evolved; established aftermarket retailers and independent distributors remain pivotal, yet e-commerce platforms are steadily reshaping procurement behaviors, particularly among small workshops and fleet operators.

This comprehensive research report categorizes the Automotive Balance Shaft market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Balance Shaft Configuration

- Material

- End Use

- Application

- Distribution Channel

Analyzing Regional Market Dynamics across the Americas, EMEA, and Asia-Pacific to Identify Growth Drivers, Challenges, and Investment Hotspots for Balance Shafts

Regional dynamics across the Americas, Europe/Middle East/Africa, and Asia-Pacific underscore divergent growth drivers and strategic imperatives for balance shaft stakeholders. In the Americas, legacy OEM hubs in North America are intensifying investments in light-duty hybrid programs, prompting demand for balance shafts optimized for stop-start powertrains and mild-hybrid integration. Latin American markets, while smaller in absolute scale, present opportunities for aftermarket distribution growth as vehicle parc ages and replacement cycles accelerate.

EMEA is characterized by rigorous Euro VI emission regulations and a strong pivot toward electrified commercial fleets. European OEMs are forging partnerships with component specialists to co-develop multi-plane systems aimed at meeting city-bus NVH standards and enhancing urban drivability. In the Asia-Pacific region, robust passenger car production centers in China, India, and Southeast Asia drive substantial OEM demand, while agricultural mechanization in South Asia sustains off-road balance shaft consumption. Simultaneously, rising labor costs and logistical complexities in China have encouraged regionalization of supply chains into Vietnam and Thailand. Collectively, these factors highlight the importance of tailoring product portfolios and distribution networks to each region’s unique regulatory landscape, end-market maturity, and infrastructure dynamics.

This comprehensive research report examines key regions that drive the evolution of the Automotive Balance Shaft market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Strategic Profiles and Positioning of Leading Suppliers to Understand Innovation Paths Shaping the Balance Shaft Landscape

The competitive landscape for balance shaft solutions is anchored by a mix of global component specialists and emerging technology innovators. Legacy engineering houses have leveraged decades of NVH expertise to refine countershaft geometries and enhance metallurgical properties through proprietary heat-treatment processes. Simultaneously, advanced manufacturing firms are pioneering additive manufacturing techniques and high-precision machining to produce complex multi-plane assemblies with tighter tolerances. Joint ventures between OEMs and Tier 1 suppliers are also on the rise, aimed at co-developing platform-specific balance shafts that accelerate validation cycles and secure engineering exclusivity.

Moreover, financial strategies such as strategic acquisitions have enabled companies to broaden material capabilities and expand regional footprints. Some players have introduced digital monitoring solutions, embedding sensors within balance shaft housings to capture in-service vibration data for predictive maintenance. These initiatives reflect a broader shift toward value-added services and holistic engine balancing packages that differentiate suppliers beyond unit pricing. As market entrants vie for share, the emphasis on collaborative R&D, intellectual property, and aftersales support continues to intensify, underscoring how strategic positioning and technological leadership are shaping competitive advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Balance Shaft market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ACPT Inc.

- American Axle & Manufacturing Inc.

- Bailey Morris

- Engine Power Components, Inc.

- GKN PLC

- Hirschvogel Group

- HYUNDAI WIA Corp

- JTEKT Corporation

- Linamar Corporation

- MAT Foundry Group Ltd.

- Meritor by Cummins Inc

- Mohit Engineers Pvt. Ltd

- Musashi Seimitsu Industry Co., Ltd.

- Nexteer Automotive Corporation

- Ningbo Jingda Hardware Manufacture Co., Ltd.

- NTN Corporation

- Otics Corporation

- Sansera Engineering Limited

- Shanghai GKN HUAYU Driveline Systems Co., Ltd.

- TFO Corporation

- The Timken Company

- Trelleborg AB

- Wanxiang America Corporation

- Xuchang Yuangdong Drive Shaft Co., Ltd.

- Yamada Manufacturing Co. Ltd.

Formulating Practical Strategies for Industry Leaders to Enhance Supply Chain Resilience and Foster Technological Advancement in the Balance Shaft Sector

Stakeholders seeking to fortify their position in the balance shaft domain should prioritize supply chain diversification to buffer against tariff fluctuations and geopolitical risks. By cultivating relationships across multiple geographies and integrating dual-sourcing strategies for key steel and cast components, companies can mitigate disruptions and negotiate favorable terms. Concurrently, investing in advanced materials research and forging partnerships with metallurgy specialists will be critical for achieving the dual objectives of weight reduction and enhanced fatigue life.

Furthermore, industry leaders must deepen collaborations with OEMs to co-innovate balance shaft configurations tailored to emerging powertrain architectures, including full-hybrid and mild-hybrid systems. Embracing digital engineering tools-such as high-fidelity simulation platforms and generative design workflows-can expedite iteration cycles and compress time-to-market. Lastly, expanding distribution footprints through strategic alliances with e-commerce platforms and value-added service providers will unlock aftermarket growth and enhance customer engagement. By pursuing these targeted strategies, decision-makers can ensure agility, drive innovation, and secure sustainable growth in a rapidly evolving market.

Detailing the Rigorous Research Methodology Employed to Ensure Data Integrity, Analytical Rigor, and Comprehensive Coverage of the Balance Shaft Market

This analysis is founded on a rigorous multi-source research methodology designed to deliver reliable insights into the balance shaft sector. Primary data was gathered through in-depth interviews with senior engineers, procurement specialists, and strategic planners at OEMs and Tier 1 suppliers, ensuring firsthand perspectives on technical challenges and market priorities. In parallel, secondary research encompassed review of industry whitepapers, regulatory filings, and patent databases to validate trends and identify emerging innovations.

The research further applied quantitative analysis to supply chain flow data, import/export records, and material pricing indices to assess cost dynamics. In addition, a Delphi method was leveraged to achieve consensus among subject-matter experts on the implications of tariff developments and technological shifts. Throughout the process, data triangulation techniques were employed to cross-verify findings from multiple sources, ensuring analytical rigor and minimizing bias. This structured approach to data collection and validation underpins the credibility and comprehensiveness of the insights presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Balance Shaft market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Balance Shaft Market, by Balance Shaft Configuration

- Automotive Balance Shaft Market, by Material

- Automotive Balance Shaft Market, by End Use

- Automotive Balance Shaft Market, by Application

- Automotive Balance Shaft Market, by Distribution Channel

- Automotive Balance Shaft Market, by Region

- Automotive Balance Shaft Market, by Group

- Automotive Balance Shaft Market, by Country

- United States Automotive Balance Shaft Market

- China Automotive Balance Shaft Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Drawing Conclusive Perspectives on Market Drivers, Technological Trends, and Strategic Priorities to Guide Stakeholder Decisions in the Balance Shaft Domain

Drawing together analyses of powertrain electrification, NVH optimization, and trade-policy shifts underscores a dynamic environment where balance shaft technologies continue to play a pivotal role. The persistent drive for engine refinement and the nuanced impacts of tariffs have catalyzed supply chain innovation and accelerated the adoption of advanced manufacturing techniques. Simultaneously, regional nuances-from stringent EMEA emission standards to Asia-Pacific production hubs-highlight the importance of tailored strategies that align product configurations and distribution models with local demand drivers.

Ultimately, stakeholders equipped with a holistic understanding of end-use, configuration, application, material, and regional dynamics will be best positioned to navigate market complexities. By integrating these multifaceted insights into strategic planning, decision-makers can optimize product portfolios, anticipate regulatory headwinds, and capitalize on emerging opportunities. The trajectory of the balance shaft market, while influenced by broader powertrain transformations, remains dependent on the ability of industry players to innovate, collaborate, and adapt.

Engage with Ketan Rohom to Access the In-depth Automotive Balance Shaft Market Research Report That Empowers Strategic Planning and Drives Business Growth

Are you seeking to elevate your strategic initiatives with unparalleled market intelligence on automotive balance shafts? Connect with Ketan Rohom, Associate Director, Sales & Marketing, to secure comprehensive insights tailored to your business imperatives and unlock a competitive edge today

- How big is the Automotive Balance Shaft Market?

- What is the Automotive Balance Shaft Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?