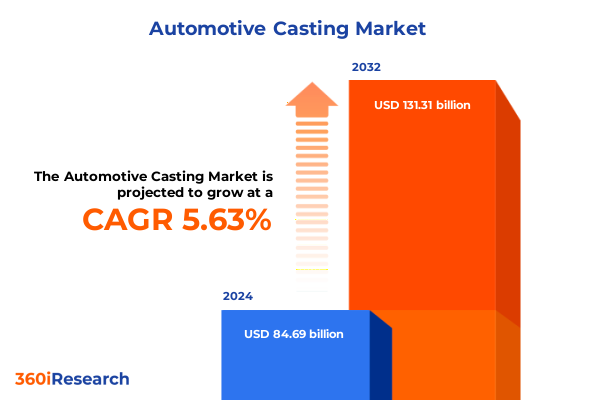

The Automotive Casting Market size was estimated at USD 89.43 billion in 2025 and expected to reach USD 94.43 billion in 2026, at a CAGR of 5.64% to reach USD 131.31 billion by 2032.

Understanding How Automotive Casting Underpins Vehicle Manufacturing Amid Shifting Technology, Sustainability Pursuits and Global Supply Transformations

The automotive casting industry stands at the crossroads of tradition and transformation, providing essential components that underpin vehicle safety, performance, and efficiency. Foundational casting methods deliver critical elements across body structures, powertrain assemblies, and chassis architectures, shaping the durability and functionality of modern automobiles. In recent years, casting operations have evolved from purely cost-focused mass production toward highly specialized processes that accommodate tightening weight targets, emission regulations, and the demands of electric and hybrid drivetrains.

This revival of casting importance is driven by an increasing emphasis on material innovation, as lightweight alloys and complex geometries enable automakers to meet stringent fuel economy and electrification objectives. Simultaneously, digitalization and Industry 4.0 integration are redefining how foundries monitor quality, optimize resource use, and accelerate time-to-market. As global supply chains adapt to geopolitical shifts and tariff pressures, casting suppliers are challenged to maintain agility, secure raw material access, and uphold quality standards across diverse regional environments.

Moreover, rising sustainability commitments are reshaping every step of the value chain, prompting foundries to adopt closed-loop recycling, lower-temperature processes, and energy-efficient furnaces. In response, industry participants are forging partnerships and pursuing targeted investments that align casting expertise with lightweighting, electrification, and digital manufacturing agendas. This report delivers a comprehensive view of how casting innovations intersect with broader mobility trends, providing stakeholders with critical insights to navigate a dynamic market landscape.

Capitalizing on Electrification, Lightweight Materials and Digital Innovation Reshaping Automotive Casting Processes and Industry Value Chains

The casting landscape is undergoing seismic shifts driven by electrification, regulatory frameworks, and customer demand for lighter, greener vehicles. As automakers accelerate the transition to battery electric architectures, cast components such as structural battery housings, electric motor housings, and heat-sink elements have emerged as strategic enablers of performance and safety. Consequently, foundries are investing in advanced aluminum and magnesium alloys, forging processes that yield thinner walls without compromising mechanical integrity.

In parallel, digital transformation initiatives are optimizing casting yields through predictive analytics, real-time process control, and automated defect detection. This convergence of digital and physical domains has paved the way for adaptive filling simulations, sensor-driven gating adjustments, and machine-learning models that reduce scrap rates and energy consumption. Furthermore, sustainability metrics have become central performance indicators, motivating the adoption of regenerative heating systems, waste heat recovery, and closed-loop material recycling.

In addition, global trade dynamics and shifting tariff landscapes are compelling suppliers to reconfigure production footprints, forge near-market partnerships, and diversify raw material sourcing. Taken together, these transformative forces are not only enhancing process efficiency but also redefining the competitive contours of the casting sector. As a result, the industry is witnessing the emergence of novel business models, co-development initiatives between foundries and OEMs, and cross-industry technology transfers that will shape future value chains.

Evaluating the Layered Burden of 2025 United States Tariffs on Vehicle Parts, Materials and the Automotive Casting Supply Chain

Throughout 2025, the United States has imposed a 25 percent tariff on imported passenger vehicles and light trucks, effective April 2, which has reverberated across casting supply chains as original components and raw materials encounter higher import costs. Shortly thereafter, on May 3, an additional 25 percent duty was applied to key auto components, encompassing engine blocks, transmission housings, and powertrain assemblies. These layered levies have immediately increased landed costs for cast parts sourced outside the United States, leading manufacturers to reassess procurement strategies and inventory buffers.

Furthermore, under Section 232 provisions, a blanket 25 percent tariff on select imported steel and aluminum from all origins, including engine block substrates and cylinder head billets, has compounded the overall duty burden. In cases involving materials from China, these rates can stack, resulting in an effective tariff of up to 50 percent on cast materials. While parts compliant with the United States-Mexico-Canada Agreement benefit from provisional exemptions, any non-USMCA content exceeding prescribed thresholds is subject to retroactive duties, further complicating cost calculations and supply chain compliance.

Consequently, foundries reliant on cross-border sourcing are evaluating near-shoring alternatives and investing in domestic melting capacity to mitigate volatility. Across the board, the higher import costs have prompted production shifts into U.S.-based facilities, spurred new alliances with regional melting partners, and intensified efforts to increase recycled content. At the same time, tier-one suppliers are negotiating tariff offsets and pursuing government engagement to secure refund mechanisms, seeking up to 15 percent reimbursement of duties in 2025 through administrative processes. Collectively, these cumulative tariff pressures are reshaping casting networks and accelerating strategic realignments in materials sourcing and manufacturing footprints.

Unlocking Detailed Automotive Casting Market Segmentation by Component, Material, Process and Application Reveals Targeted Growth Pathways

Detailed analysis by component type reveals distinct performance drivers and investment priorities across body, chassis, engine, and transmission cast segments. Within the body components segment, structural parts such as cross-members and pillars command stringent dimensional tolerances, while trim parts focus on aesthetic integrity. Chassis components, encompassing steering knuckles and suspension brackets, must balance fatigue resistance with weight targets. Engine sections break down into cylinder blocks and cylinder heads, each demanding specific mold design expertise to manage intricate cooling passages and bolster thermal efficiency. Transmission assemblies center on gearbox housings and torque converters, where material selection directly impacts fatigue performance and acoustic behavior.

Beyond component distinctions, material type represents a pivotal segmentation axis, with aluminum alloys dominating applications where weight reduction and corrosion resistance are critical. Cast iron remains indispensable for high-load engine blocks and heavy-duty chassis brackets, offering proven durability under extreme conditions. In parallel, magnesium is gaining traction for select electric motor housings and structural applications, valued for its exceptional strength-to-weight ratio despite elevated processing complexities.

Casting processes further diversify market dynamics, with die casting-through both cold-chamber and hot-chamber techniques-enabling high-volume production of thin-walled precision parts. Gravity die casting serves medium-volume applications, while investment casting addresses intricate geometries and tight surface finishes. Sand casting continues to serve large, custom components with lower tooling costs, albeit at slower cycle times. Each process introduces unique cost, quality, and scale considerations that inform strategic factory allocations and capacity planning.

Application segmentation underscores divergent cast part demand between commercial and passenger vehicle sectors. Heavy and light commercial vehicles drive robust volumes of high-strength cast iron chassis and transmission parts, whereas passenger cars, including hatchbacks, sedans, and SUVs, prioritize aluminum and magnesium components for fuel economy and ride dynamics. Taken together, these layers of segmentation provide actionable roadmaps for targeted product development and investment optimization.

This comprehensive research report categorizes the Automotive Casting market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component Type

- Material Type

- Casting Process

- Application

Mapping Regional Nuances in Automotive Casting Demand, Supply Chain Resilience and Strategic Opportunities Across Global Zones

Regional dynamics in automotive casting are influenced by localized regulatory imperatives, supply chain maturity, and customer demand profiles across the Americas, Europe–Middle East & Africa, and Asia-Pacific markets. In the Americas, established foundries benefit from close proximity to major assembly plants in Mexico, Canada, and the United States, but they must navigate evolving US tariff policies and shifting USMCA provisions. The region’s strong emphasis on reshoring and near-shoring is driving investments in domestic melting and finishing capabilities, particularly for aluminum and cast iron engine components.

Meanwhile, Europe, the Middle East & Africa present a diverse regulatory environment shaped by stringent emissions standards, carbon border adjustment mechanisms, and regional trade agreements. EU foundries leverage mature process technologies and high recycled content mandates to maintain cost competitiveness, all while accommodating rising demand for electric vehicle battery housings and powertrain enclosures. In the Middle East, nascent casting operations benefit from low-cost energy, although logistics and material supply constraints pose challenges for expansion into heavy-duty powertrain segments.

Across Asia-Pacific, high-volume production centers in China, India, Japan, and South Korea continue to dominate global casting exports. These hubs combine scale efficiencies with rapid process automation rollouts, though tier-one suppliers are increasingly seeking higher-valued, low-volume niches to offset margin pressures. Rapid growth in electric vehicle adoption is catalyzing local die casting capacities for complex motor housings and structural battery modules. Collectively, these regional insights shed light on how casting players must tailor their operational models, innovation roadmaps, and partnership strategies to distinct market imperatives and regulatory frameworks.

This comprehensive research report examines key regions that drive the evolution of the Automotive Casting market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Automotive Casting Innovators and Strategic Partnerships Driving Technological Advancements and Market Competitiveness

Leading casting companies are pursuing differentiated strategies to capture growth and extend technological leadership. Firms with global reach have executed targeted acquisitions to integrate advanced melting assets and digital process controls into their portfolios. Others have formed joint ventures with OEMs to co-develop proprietary alloy formulations that enhance electric motor performance or reduce part weight by double-digit percentages. Strategic investments in additive manufacturing for tooling and pattern creation are reducing lead times and enabling more complex geometries.

In addition, several foundries have partnered with software providers to deploy real-time quality monitoring systems and closed-loop control of gating and cooling channels. These initiatives have yielded measurable improvements in scrap reduction and cycle-time optimization. At the same time, collaboration with universities and research institutes is driving breakthroughs in low-temperature processing and novel alloy chemistries, which promise to further lower energy consumption and carbon footprints.

Partnerships with mobility start-ups and battery suppliers are also on the rise, reflecting an industry shift toward integrated e-propulsion casting solutions. Foundries that traditionally focused on iron and steel are retrofitting furnaces and upgrading sand systems to handle aluminum and magnesium, broadening their served market. Across the board, these leading companies are balancing expansion of global capacity with disciplined capital allocation, ensuring investments align with long-term electrification and lightweighting trajectories rather than short-term volume gains.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Casting market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bedford Machine & Tool Inc.

- Cast Products, Inc.

- Casteks Metal Science Co.,Ltd.

- Dynacast International Inc. by Form Technologies, Inc.

- Endurance Technologies Limited

- Georg Fischer Ltd.

- Gibbs Die-casting Group

- Impro Precision Industries Limited

- Kinetic Die Casting Company, Inc.

- Kopf Holding GmbH

- Lakeside Casting Solutions, LLC

- Minda Corporation Limited

- Mino Industry USA, Inc.

- Ningbo Parison Die Casting Co., Ltd.

- Ningbo Yinzhou Ke Ming Machinery Manufacturing Co., Ltd.

- Production Castings, Inc.

- Regensburger Druckgusswerk Wolf GmbH

- Rockman Industries Limited

- Ryobi Limited

- Sandhar

- Sipra Engineers Pvt. Ltd.

- Sunbeam Lightweighting Solutions Pvt. Ltd.

Implementing Future-Focused Strategies in Automotive Casting: Supply Chain Diversification, Digital Integration and Tariff Mitigation Tactics

Industry leaders should prioritize supply chain resilience through geographic diversification and strategic reshoring to mitigate ongoing tariff and logistics uncertainties. By expanding domestic melting and finishing capacities, manufacturers can reduce dependence on cross-border shipments and improve responsiveness to regional demand fluctuations. Simultaneously, adopting digital twins for casting processes will allow proactive identification of yield deviations and enable dynamic adjustments that preserve quality at scale.

In parallel, executives must accelerate material innovation by collaborating with alloy specialists to develop high-performance aluminum and magnesium grades optimized for electric vehicle applications. Early investment in low-temperature melting technologies and improved recyclability will position foundries to meet stricter environmental regulations and corporate sustainability goals. Furthermore, implementing advanced analytics that integrate production data, cost models, and tariff impact scenarios will empower leaders to evaluate scenario-based decisions in real time.

Finally, forging cross-sector partnerships-spanning raw material suppliers, software vendors, and research institutions-will be key to achieving process breakthroughs and unlocking new business models. By driving co-development of value-added cast solutions and service offerings, industry players can differentiate on speed, customization, and total cost of ownership rather than competing solely on unit economics.

Outlining a Rigorous Research Framework Combining Primary Interviews, Secondary Data Analysis and Triangulation for Comprehensive Market Insights

This research employs a rigorous, multi-stage methodology that blends primary and secondary data to ensure comprehensive coverage and high accuracy. Primary insights were obtained through in-depth interviews with casting plant managers, OEM engineering leads, and materials specialists across key regions. In addition, a structured survey was conducted among tier-one component suppliers to capture current process adoption rates, capacity constraints, and strategic priorities.

Secondary analysis drew upon published customs data, trade intelligence platforms, and proprietary databases tracking import duties and material flows. Company annual reports, sustainability disclosures, and patent filings were systematically reviewed to map innovation trends and technology investments. The study further integrates input from an expert advisory board, comprised of metallurgists, process engineers, and trade policy analysts, whose peer review validated key assumptions and triangulated findings.

Quantitative forecasting leverages bottom-up capacity models and top-down triangulation of macroeconomic and vehicle production indicators. Segmentation analysis across component types, material classes, process variants, and vehicle applications was performed to highlight granular demand drivers. These insights were synthesized into scenario frameworks to evaluate tariff and technology adoption impacts. Overall, this methodology delivers robust, evidence-based insights tailored to strategic decision making in the automotive casting domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Casting market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Casting Market, by Component Type

- Automotive Casting Market, by Material Type

- Automotive Casting Market, by Casting Process

- Automotive Casting Market, by Application

- Automotive Casting Market, by Region

- Automotive Casting Market, by Group

- Automotive Casting Market, by Country

- United States Automotive Casting Market

- China Automotive Casting Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Summarizing Pivotal Takeaways on Automotive Casting Industry Trajectories, Tariff Impacts and Strategic Imperatives for Sustained Competitiveness

In summary, the automotive casting industry is navigating a period of profound transformation driven by electrification mandates, lightweight material imperatives, and evolving trade policies. Advanced alloys, digital process controls, and sustainability initiatives are propelling casting from a cost center to a strategic innovation enabler. At the same time, the imposition of layered tariffs in 2025 has reshaped supply chain configurations, compelling foundries to pursue near-shoring, tariff offset mechanisms, and increased recycled content.

The segmentation analysis underscores the nuanced dynamics across body, chassis, engine, and transmission cast parts, each requiring tailored material, process, and quality frameworks. Regional insights reveal distinct opportunities and constraints within the Americas, Europe–Middle East & Africa, and Asia-Pacific, informing location-specific capacity and partnership strategies. Moreover, leading casting companies are differentiating through targeted M&A, technology co-development, and digital transformation to secure long-term competitiveness.

Ultimately, successful adaptation will hinge on decisive investments in domestic capabilities, alloy innovation, and integrated process analytics. By aligning strategic roadmaps with emerging regulatory and market trends, stakeholders can capture value across the entire casting ecosystem and drive resilient growth in a rapidly evolving mobility landscape.

Contact Associate Director Ketan Rohom to Gain Exclusive Access to Actionable Automotive Casting Intelligence and Secure Your Market Analysis Report

Accelerate your strategic decision making by engaging directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. With a deep understanding of casting process innovations, materials trends, and tariff influences, Ketan can tailor the report’s insights to your unique business challenges and opportunities. Reach out to explore customized data sets, benchmark analyses of leading casting operations, and future scenarios that align with your organizational priorities. Secure access to a robust, action-oriented market intelligence package that equips you to optimize material selection, refine process investments, and mitigate regulatory costs. Connect with Ketan today to ensure your team has the expert guidance and comprehensive analysis necessary to navigate the evolving automotive casting landscape and maintain competitive advantage.

- How big is the Automotive Casting Market?

- What is the Automotive Casting Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?