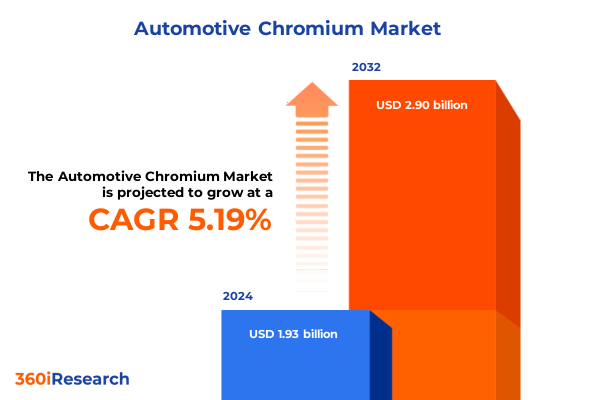

The Automotive Chromium Market size was estimated at USD 2.03 billion in 2025 and expected to reach USD 2.14 billion in 2026, at a CAGR of 5.63% to reach USD 2.99 billion by 2032.

Automotive Chromium Finishing Emerges at Crucial Intersection of Aesthetic Enhancement Performance Optimization and Regulatory Evolution in Surface Treatment Technologies

The automotive industry’s relentless pursuit of both performance and style has propelled chromium finishing into a position of strategic importance within surface treatment portfolios. Characterized by its distinctive lustrous appearance and exceptional corrosion resistance, chromium plating enhances the durability and visual appeal of bumpers, door handles, grills, and wheel rims across passenger cars and commercial vehicles. As consumer expectations evolve, vehicle manufacturers and tier suppliers are under pressure to deliver finishes that not only meet stringent quality standards but also adhere to an increasingly complex global regulatory landscape. Furthermore, the convergence of technological advances in process chemistry and automation has amplified the role of chromium finishing as a differentiator in competitive markets.

In recent years, environmental and health regulations have driven significant transformation in plating methodologies. The shift from hexavalent chromium, long valued for its hardness and adhesion properties, toward trivalent chromium alternatives reflects growing commitments to sustainability and worker safety. This transition is underpinned by robust investments in research and development aimed at optimizing trivalent bath formulations for enhanced corrosion resistance and color consistency. Consequently, manufacturers are adopting greener processes that both comply with global standards and fulfill consumer demand for eco-conscious products. Moreover, the emergence of adjunct finishing media such as electroless nickel and innovative thin-film coatings broadens the spectrum of aesthetic options available to automakers while reinforcing the shift toward holistic sustainability initiatives.

Revolutionary Shifts in Automotive Chromium Applications Drive Environmental Compliance Innovation and Industry Process Automation Transformation

The landscape of automotive chromium finishing is undergoing a profound metamorphosis as industry stakeholders embrace both environmental imperatives and process innovations. At the forefront, the migration from hexavalent to trivalent chromium plating has accelerated in response to stringent regulatory mandates and the proven advantage of reduced toxic emissions. Trivalent chromium solutions now represent a growing share of production, offering comparable corrosion protection with lower compliance burdens. Manufacturers are leveraging advanced bath chemistries to fine-tune deposit characteristics and achieve uniform coatings across complex geometries, including trim and structural components.

Beyond chemical reformulation, the integration of automation and artificial intelligence into plating lines is redefining operational efficiency and quality control. Real-time process monitoring and predictive analytics enable rapid identification of deviations, minimizing waste and enhancing consistency. Parallel developments in digitalization allow for closed-loop recycling of rinse waters and bath constituents, bolstering zero-liquid discharge objectives and cost containment. These technological breakthroughs, coupled with strategic collaborations between equipment suppliers, chemical formulators, and end users, are laying the foundation for the next generation of high-performance, environmentally responsible chromium finishing solutions.

Longstanding Tariff Measures in 2025 Reshape Sourcing Cost Structures and Strategic Supply Chain Decisions Across the U.S. Automotive Chromium Ecosystem

In early 2025, escalated U.S. tariff measures targeting imported chromium compounds and plating chemicals have reverberated throughout the automotive surface treatment ecosystem. Elevated duties ranging from 7.5 to 25 percent on critical feedstocks have inflated input costs for OEMs and tier-one suppliers, compelling a reassessment of sourcing strategies. In response, many players have accelerated localization initiatives, forging alliances with domestic chemical producers to secure stable supply chains and shield margins from policy-induced volatility.

Simultaneously, the tariff environment has catalyzed broader discussions around reshoring plating operations and incentivizing onshore capacity expansion. Companies are investing in process optimization to drive down consumption rates of raw materials while exploring alternative chemistries that reduce tariff exposure. Government and industry associations have convened to consider incentives that undergird the development of domestic electroplating infrastructure. Amid these structural shifts, strategic agility has become paramount, as automotive finishers navigate evolving cost structures and reposition themselves for long-term competitiveness in a policy-driven marketplace.

Holistic Insights Into Automotive Chromium Market Segmentation Revealing Core Drivers Across Product Forms Applications Vehicle Types End Uses Processes and Plating Types

The automotive chromium market exhibits a multifaceted segmentation landscape that underlines the diversity of technical requirements and end-user applications. On the basis of product form, traditional hexavalent processes coexist with an expanding portfolio of trivalent chemistries, each offering distinct trade-offs in terms of toxicity, performance, and regulatory compliance. When considering application scope, decorative enhancements such as bumpers, door handles, grills, and wheel rims showcase the role of chromium finishing in elevating both aesthetics and functional longevity across vehicle exteriors. Within the vehicle category, passenger cars-from hatchbacks and sedans to SUVs-command substantial volumes, whereas commercial vehicles, encompassing buses and trucks, demand coatings engineered for heightened abrasion and environmental resilience.

From an end-use perspective, the aftermarket segment thrives on customization and replacement parts, with chrome-plated accessories reflecting consumer-driven personalization trends, while the original equipment manufacturer domain prioritizes assembly integration and components that meet exacting production tolerances. Process-wise, electroless plating techniques, including composite plating and nickel phosphorus variants, deliver uniform thickness on complex parts, whereas traditional electroplating approaches such as barrel and rack plating remain prevalent for high-volume production. Finally, the sector distinguishes between decorative and functional plating types, wherein decorative finishes focus on visual appeal and functional coatings emphasize corrosion protection, wear resistance, and long-term durability.

This comprehensive research report categorizes the Automotive Chromium market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Form

- Vehicle Type

- Process

- Type

- Application

- End Use

Regional Dynamics in Global Automotive Chromium Adoption Highlight Emerging Growth Patterns Across Americas Europe Middle East Africa and Asia-Pacific Markets

Regional dynamics play a pivotal role in shaping the automotive chromium finishing market, as manufacturers align capabilities with localized regulatory frameworks and supply chain infrastructures. In the Americas, heightened tariff measures and incentive programs have spurred investments in domestic electroplating operations, driving partnerships between chemical suppliers and vehicle producers to minimize import dependencies and ensure regulatory alignment. North American markets also demonstrate robust aftermarket activity, fueled by consumer demand for personalized chrome-plated accessories across passenger and commercial vehicles.

Meanwhile, Europe, the Middle East, and Africa (EMEA) display a complementary pattern, with the European Union’s REACH regulations and local air toxics standards precipitating accelerated transitions to trivalent chromium technologies and closed-loop treatment systems. Manufacturers in this region are at the forefront of sustainable process development, leveraging energy-efficient equipment and advanced chemical recovery solutions. Further east, the Asia-Pacific region commands a dominant share of global chromium chemical production, underpinned by extensive plating capacity in China, Japan, and South Korea. Here, rapidly expanding automotive assembly has driven adoption of both decorative and functional coatings, while local industry clusters benefit from vertically integrated supply chains and economies of scale.

This comprehensive research report examines key regions that drive the evolution of the Automotive Chromium market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading Surface Treatment Providers Forge Strategic Alliances Innovations and Technology Investments to Define the Competitive Landscape of Automotive Chromium Finishing

The competitive landscape of automotive chromium finishing is anchored by several leading technology providers, each advancing specialized chemistries and integrated process solutions. At the forefront, MKS Instruments solidified its presence through the acquisition of Atotech, extending its portfolio into process chemicals and leveraging Atotech’s expertise in decorative and functional electroplating to enhance global service offerings. Element Solutions, through its MacDermid Enthone division, continues to drive innovation in trivalent chromium bath formulations and corrosion-resistant conversions, enabling automakers to meet stringent durability and environmental standards. European specialists such as Coventya and SurTec invest heavily in additive development and digital monitoring systems to optimize bath life and minimize waste, while collaborations with OEMs facilitate the rapid qualification of sustainable plating processes.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Chromium market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allied Finishing, Inc

- Arlington Plating Company

- Atotech

- Borough Ltd.

- Bunty LLC

- Chem Processing Inc

- Collini Dienstleistungs GmbH

- COVENTYA Group

- Douglas Metal Finishing Limited.

- Eakas Corporation

- Galva Decoparts Pvt. Ltd

- Kakihara Industries Co.,Ltd.

- MacDermid, Inc.

- MKS Instruments, Inc

- Ogawa Asia Company Limited.

- Plamingo Ltd.

- PPG INDUSTRIES, INC.

- Precision Plating Company Inc.

- Taiyo Manufacturing Co.,Ltd.

- U.S. Chrome Corporation

- Valley Chrome Plating INC.

Actionable Strategic Initiatives for Automotive Industry Leaders to Navigate Regulatory Pressures Supply Chain Volatility and Drive Sustainable Chromium Finishing Practices

Industry leaders should prioritize the full-scale adoption of trivalent chromium technologies to ensure compliance with evolving environmental regulations and to reduce hazardous waste generation. Concurrently, investments in digital process controls and artificial intelligence–enabled monitoring will yield significant efficiency gains, minimizing rework and chemical consumption. By diversifying raw material sourcing and forging partnerships with domestic suppliers, organizations can mitigate the impact of tariff volatility and strengthen supply chain resilience. It is equally critical to establish closed-loop recovery systems for rinse water and effluents, thereby supporting zero-liquid discharge objectives and lowering operational costs. Lastly, fostering cross-sector collaboration with equipment manufacturers, coating formulators, and regulatory bodies will accelerate the development of next-generation surface treatment solutions and maintain competitive advantage.

Rigorous Multimethod Research Framework Combining Primary Expert Interviews Secondary Data Analysis and Validation Protocols to Ensure Credibility of Findings

This study is underpinned by a rigorous research methodology that integrates both primary and secondary sources to validate market insights. Secondary research encompassed an exhaustive review of industry publications, regulatory frameworks, public corporate disclosures, and trade association reports to establish foundational knowledge of chromium finishing technologies and market dynamics. Primary research involved in-depth interviews with key stakeholders, including process engineers, procurement executives, and regulatory specialists at leading automotive OEMs and component suppliers. Insights garnered from these discussions were corroborated through cross-reference with quantitative data to ensure accuracy and reliability.

To ensure the integrity of findings, data points underwent a multi-tier validation process that included triangulation across diverse information sources and peer-review by subject matter experts. The research approach also incorporated iterative feedback loops with industry practitioners to refine segmentation frameworks and to capture emerging trends in process innovation, supply chain strategy, and regional adoption patterns.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Chromium market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Chromium Market, by Product Form

- Automotive Chromium Market, by Vehicle Type

- Automotive Chromium Market, by Process

- Automotive Chromium Market, by Type

- Automotive Chromium Market, by Application

- Automotive Chromium Market, by End Use

- Automotive Chromium Market, by Region

- Automotive Chromium Market, by Group

- Automotive Chromium Market, by Country

- United States Automotive Chromium Market

- China Automotive Chromium Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Concluding Reflections on the Pivotal Role of Sustainable Chromium Finishing Innovations in Shaping the Future of Automotive Surface Treatment Performance and Compliance

As the automotive industry continues to evolve under the dual imperatives of aesthetic differentiation and regulatory compliance, chromium finishing stands at a pivotal crossroads. The momentum toward trivalent chromium solutions underscores a broader shift to sustainable manufacturing practices, while advancements in automation and closed-loop systems reflect the sector’s commitment to operational excellence. Concurrently, strategic adjustments spurred by tariff regimes and regional regulatory landscapes highlight the importance of supply chain agility in maintaining cost competitiveness.

Ultimately, the future of automotive chromium finishing will be defined by the industry’s ability to harmonize performance, sustainability, and innovation. Organizations that embrace emerging chemistries, digital technologies, and collaborative partnerships will be best positioned to deliver high-quality surface treatments that meet the exacting demands of modern vehicles and environmentally conscious consumers.

Engage with Our Associate Director to Access In-Depth Market Insights and Tailored Solutions for Automotive Chromium Finishing Through Our Comprehensive Research Report

To explore the comprehensive insights and tailored strategic guidance presented in this report, reach out to Ketan Rohom, our Associate Director of Sales & Marketing, for personalized support. He can assist you with detailed inquiries about market drivers, innovative processes, and regional dynamics. Secure access to the in-depth Automotive Chromium Finishing market research report and empower your organization with data-driven decision making and actionable intelligence to stay ahead in this rapidly evolving sector.

- How big is the Automotive Chromium Market?

- What is the Automotive Chromium Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?