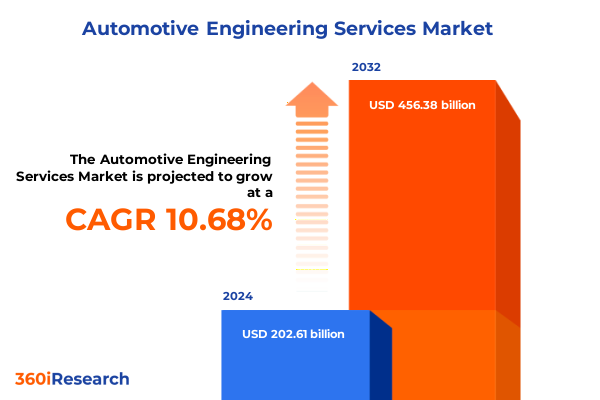

The Automotive Engineering Services Market size was estimated at USD 224.73 billion in 2025 and expected to reach USD 243.48 billion in 2026, at a CAGR of 10.65% to reach USD 456.38 billion by 2032.

Embracing Technological Convergence to Drive Innovation and Seamless Integration in Automotive Engineering Services Across the Value Chain

In recent years, automotive engineering services have become critical to supporting the industry’s shift towards software-defined vehicles, electrification, and connectivity. According to Tata Technologies, software-defined vehicles are experiencing rapid growth of approximately 25–30%, underscoring the need for integrated engineering solutions that combine hardware, software, and systems integration. Additionally, as vehicles become increasingly digital, the demand for advanced engineering support in electronics, embedded software, and system validation has soared, prompting providers to expand capabilities in AI-driven simulation and predictive maintenance solutions.

This executive summary presents a comprehensive analysis of the global automotive engineering services market, exploring major shifts in technology, regulatory impacts, and strategic segmentation. The report examines the cumulative effects of new United States tariffs in 2025 on supply chains and sourcing strategies, delves into key market segments defined by service type, vehicle category, application, technology, and end use, and highlights regional dynamics across the Americas, EMEA, and Asia-Pacific. Strategic profiles of leading companies and actionable recommendations are provided to guide decision-makers in navigating the evolving landscape and capitalizing on emerging opportunities.

Capturing the Core Drivers Reshaping Automotive Engineering Services Through Electrification Connectivity Autonomy and Digitalization Trends

The automotive engineering services landscape is being reshaped by transformative forces driven by electrification and autonomy. As electric vehicles gain market share, engineering providers are dedicating significant resources to battery management systems, power electronics, and charging infrastructure design. Insights from CES 2025 emphasize not only the proliferation of new electric vehicle models but also the integration of Level 3 automated driving systems, heralding a future where vehicles can operate independently in controlled environments. Simultaneously, advanced driver assistance systems and autonomous capabilities are maturing through sensor fusion, LiDAR system design, and machine learning algorithms, demanding sophisticated validation and testing protocols that span simulation to physical prototypes.

Connectivity is underpinning the next wave of innovation as vehicles evolve into nodes within the Internet of Vehicles. By 2025, widespread 5G adoption will enable ultra-low-latency communication, facilitating real-time data exchange for vehicle-to-everything applications that enhance safety and traffic optimization. Furthermore, sustainable manufacturing practices are increasingly integral, with leading OEMs and suppliers committing to carbon-neutral production and resource reuse, reflecting both regulatory pressures and consumer demand for greener mobility solutions. These shifts are driving growth in services such as digital twin development, lightweight materials engineering, and lifecycle carbon assessments.

Concurrently, workforce transformation and AI adoption are accelerating the demand for specialized skill sets. Governments and industry bodies are investing in retraining initiatives to equip engineers with expertise in battery technology, high-voltage systems, and software-defined architectures, as evidenced by a $23.6 million U.S. Department of Energy investment in battery workforce programs. At the same time, major manufacturers like General Motors are embedding artificial intelligence into design and production workflows, enhancing predictive maintenance, consumer personalization, and operational efficiency across global manufacturing facilities.

Analyzing the Cumulative Impact of 2025 United States Automotive Tariffs on Supply Chains Production Costs and Strategic Sourcing Decisions

The introduction of 25% tariffs on imported vehicles and key automotive components by the United States in early 2025 has had significant ripple effects across global supply chains and manufacturing strategies. Under a presidential proclamation effective April 2, passenger vehicles and light trucks face new duties, followed by levies on engines, transmissions, and electronic systems from May 3, disrupting established sourcing models and prompting rapid adjustments in logistics and procurement. Although parts compliant with the United States-Mexico-Canada Agreement enjoy temporary relief, uncertainty remains as non-compliant components will eventually attract full tariffs, creating complexities for multinational tier-one and tier-two suppliers.

Cumulatively, these tariffs are projected to elevate production costs by thousands of dollars per vehicle, particularly impacting manufacturers that rely on cross-border component flows. According to Dentons, the imposition of a 25% duty on components crossing the U.S.-Canada border multiple times before final assembly would force either substantial price increases or strategic relocation of production facilities, with potential job losses on both sides of the border. Moreover, S&P Global Mobility analysis indicates that a sustained 25% tariff could slow North American vehicle output by up to 20,000 units per day within a week of implementation, highlighting the need for agile supply chain reconfiguration and nearshoring initiatives.

Unveiling Strategic Segmentation Insights for Automotive Engineering Services Spanning Service Types Vehicle Categories Applications Technologies and End Use

The segmentation of the automotive engineering services market reveals critical pathways for targeted investments. In the realm of service type, design services encompass 3D rendering, CAD modeling, and CAE, supporting concept development and virtual product validation, while electronics engineering covers ECU design, embedded software development-spanning firmware and real-time operating systems-and PCB design, reflecting the shift towards complex electronic architectures. Prototyping services range from rapid additive processes to virtual prototyping, accelerating iterative development cycles, whereas simulation services leverage computational fluid dynamics and multi-body dynamics, including flexible and rigid body dynamics, to optimize performance before physical testing. Structural analysis is driven by fatigue testing, stress analysis, and topology optimization, and testing services deliver safety and reliability verification through crash, durability, and environmental testing protocols.

Further differentiation arises across vehicle types, with commercial, passenger, hybrid, and electric vehicle engineering demands. Battery electric and plug-in hybrid segments are fostering specialized battery pack integration, thermal management, and powertrain integration services. Application-based segmentation highlights distinct needs in body engineering-encompassing aerodynamic, sheet metal, and structural design-chassis systems for brakes, steering, and suspension, and electrical and electronics solutions focused on connectivity and infotainment. Interior engineering addresses ergonomic, HVAC, and seating system development, while powertrain divisions concentrate on engine design, transmission systems, and powertrain integration for both conventional and electrified drivetrains.

Technology-based segmentation underscores the prominence of ADAS and autonomous solutions and the rise of connectivity offerings such as telematics, vehicle-to-infrastructure, and vehicle-to-vehicle communication. Electrification services involve battery management, charging infrastructure, and power electronics expertise, and IoT integration spans cloud platform connections and sensor network implementation. Finally, end-use segmentation (aftermarket and OEM) delineates long-term service contracts, retrofit solutions, and original development programs, emphasizing the full lifecycle engagement of engineering providers in both new vehicle programs and post-production support.

This comprehensive research report categorizes the Automotive Engineering Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Vehicle Type

- Application

- Technology

- End Use

Exploring Regional Dynamics Shaping Automotive Engineering Services Across the Americas Europe Middle East Africa and Asia Pacific Markets

Regional dynamics are shaping divergent demands and strategic priorities within the automotive engineering services market. In the Americas, the United States leads with significant investments in electric and autonomous vehicle programs, driven by federal incentives, aggressive state emissions regulations, and growth in ride-sharing fleets. Engineering providers in North America are expanding local design and testing centers to mitigate tariff impacts and improve responsiveness to OEMs, while Latin America presents opportunities for light-vehicle and agricultural machinery services, underpinned by emerging government support for sustainable mobility.

Europe, Middle East, and Africa (EMEA) are characterized by stringent emissions targets and advanced safety regulations, catalyzing demand for lightweight materials innovation, digital twin solutions, and extensive ADAS validation. German and UK-based suppliers maintain strong influence in e-mobility and powertrain testing, while Middle Eastern markets are investing in diversification, autonomous public transit pilot projects, and localized production hubs. Across Africa, nascent electrification initiatives and infrastructure challenges create niches for retrofit and hybridization engineering engagements.

Asia-Pacific remains the largest production and export base, with China and India driving electrification scaling through national EV mandates and localized battery manufacturing. Service providers are leveraging regional R&D centers to support OEMs in high-volume platforms and to adapt global technologies to local requirements. Rapid urbanization and smart city developments in Southeast Asia further stimulate demand for connected mobility solutions and integrated traffic management engineering.

This comprehensive research report examines key regions that drive the evolution of the Automotive Engineering Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Key Automotive Engineering Service Providers Driving Innovation Through Strategic Expertise Collaborations and Advanced Technological Solutions

Leading players in the automotive engineering services domain are forging capabilities to address the industry’s evolving complexity. Tata Technologies has intensified its focus on software-defined vehicles and electronics integration, aligning R&D investments with the sector’s 25–30% annual growth rate in SDV development, and establishing dedicated software centers to support in-car digital innovation. General Motors has integrated AI and machine learning into production and maintenance processes at its Factory Zero plant, driving predictive analytics, real-time quality control, and personalized feature deployment to heighten operational efficiency and consumer satisfaction.

Bosch continues to expand its electrification ecosystem by investing $1.9 billion in a California facility for silicon carbide chip production, bolstered by up to $225 million in U.S. government subsidies, to secure over 40% of domestic SiC device capacity and support next-generation EV power electronics. Meanwhile, AVL strengthens its presence in North America through partnerships like its MOU with Jabil, combining advanced simulation, testing, and manufacturing expertise to accelerate complex powertrain and ADAS development for leading OEMs. Capgemini Engineering, formed through the Altran acquisition, leverages a global network of over 250,000 professionals to deliver end-to-end R&D and digital transformation services, positioning itself as a Leader in the ACES mobility space with robust capabilities across software, systems integration, and advanced validation infrastructures.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Engineering Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AVL List GmbH

- Bertrandt AG

- Continental AG

- EDAG Group

- EPAM Systems

- ESG Elektroniksystem- und Logistik-GmbH

- FEV Group GmbH

- HARMAN International

- HCL Technologies Ltd.

- Horiba, Ltd.

- IAV Automotive Engineering

- Magna International

- Onward Technologies Ltd.

- P3 Group GmbH

- Ricardo

- Robert Bosch GmbH

- Semcon

- Tata Consultancy Services (TCS)

- Tata Elxsi

- Tech Mahindra Limited

- Valmet Automotive

- Wipro Limited

Actionable Recommendations for Automotive Engineering Leaders to Navigate Disruption Leverage Emerging Technologies and Strengthen Competitive Agility

Automotive engineering service providers and OEMs must accelerate digital transformation by embedding software-centric architectures and modular platforms into their core development processes. By prioritizing open-standard computing systems and over-the-air update capabilities, organizations can future-proof vehicles and reduce time to market for new features. Furthermore, fostering collaborative partnerships with semiconductor and cloud solution providers will enhance control over critical supply chains and mitigate tariff-driven cost pressures.

To navigate geopolitical uncertainties and trade disruptions, industry leaders should diversify sourcing by nearshoring critical component production and establishing agile regional hubs. Engaging in joint investments for localized engineering talent development will improve responsiveness to evolving regulatory environments and customer expectations. Additionally, implementing robust workforce upskilling programs focused on battery technology, software engineering, and digital validation methods will ensure the availability of specialized skills needed for next-generation mobility projects.

A balanced focus on sustainability and profitability is essential; integrating lifecycle assessment tools and circular economy principles into early design stages will align product roadmaps with emerging emissions regulations and consumer demand for eco-friendly solutions. Finally, adopting a portfolio approach that spans end-to-end engineering-from concept through aftermarket support-enables service providers to capture value across the vehicle lifecycle while strengthening long-term client relationships.

Detailing a Comprehensive Research Methodology Integrating Primary and Secondary Insights to Deliver Reliable Analysis and Actionable Market Intelligence

This analysis synthesizes insights from extensive secondary research, including industry publications, financial disclosures, policy announcements, and news reports, combined with primary engagements comprising interviews with key stakeholders across OEMs, tier-one suppliers, and engineering service firms. Data triangulation methods were employed to validate trends and forecast scenarios through cross-referencing multiple sources.

Quantitative assessments leveraged tariff schedules, production outputs, and investment figures to model cost impacts and supply chain shifts, while qualitative evaluations examined strategic initiatives, partnership developments, and technology roadmaps. Regional dynamics were contextualized through policy frameworks and market intelligence analyses, ensuring a comprehensive perspective that addresses both global and localized considerations.

Throughout the research process, rigorous quality controls-such as peer reviews and expert validation panels-ensured accuracy, relevance, and actionable applicability of findings. The methodology’s structured approach provides decision-makers with transparent criteria for interpreting results and implementing strategic initiatives in the rapidly evolving automotive engineering services domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Engineering Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Engineering Services Market, by Service Type

- Automotive Engineering Services Market, by Vehicle Type

- Automotive Engineering Services Market, by Application

- Automotive Engineering Services Market, by Technology

- Automotive Engineering Services Market, by End Use

- Automotive Engineering Services Market, by Region

- Automotive Engineering Services Market, by Group

- Automotive Engineering Services Market, by Country

- United States Automotive Engineering Services Market

- China Automotive Engineering Services Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3657 ]

Summarizing Critical Insights and Strategic Imperatives to Illuminate Future Opportunities in the Automotive Engineering Services Ecosystem

The convergence of software-defined vehicle architectures, electrification imperatives, and advanced connectivity solutions is redefining the automotive engineering services landscape. Providers that integrate multidisciplinary expertise-from embedded software development to systems simulation and validation-will secure competitive advantage. The 2025 U.S. tariff regime underscores the necessity of supply chain resilience and diversified regional footprints to mitigate cost and production risks.

Strategic segmentation insights highlight the importance of targeted investments in high-growth areas such as battery systems, ADAS, and digital twin technologies, while regional analysis reveals distinct growth drivers across markets. Leading companies exemplify successful adaptation through focused R&D investments, cross-industry partnerships, and workforce transformation initiatives. By adopting the actionable recommendations outlined, industry participants can navigate complexity, capitalize on emerging trends, and establish sustainable paths for innovation and value creation.

Looking ahead, the interplay between regulatory frameworks, technological breakthroughs, and evolving consumer preferences will continuously reshape service demands. Organizations that remain agile, invest in future-proof capabilities, and foster collaborative ecosystems will be best positioned to thrive in the dynamic automotive engineering services sector.

Empowering Strategic Decisions with Expert Guidance Reach Out to Ketan Rohom to Access the Comprehensive Automotive Engineering Services Market Research Report

To gain direct access to the comprehensive insights, detailed analysis, and strategic guidance within the full market research report, reach out to Ketan Rohom, Associate Director of Sales & Marketing. His expertise and in-depth understanding of automotive engineering services will ensure your organization secures the data and recommendations necessary to guide high-impact decisions. Contact him today to acquire the full report and empower your teams with actionable intelligence that drives growth, competitive differentiation, and long-term success.

- How big is the Automotive Engineering Services Market?

- What is the Automotive Engineering Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?