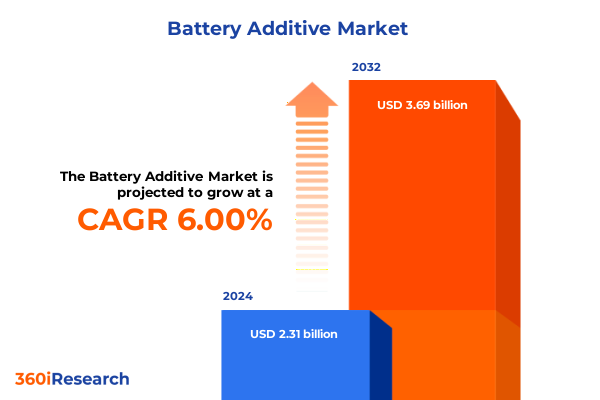

The Battery Additive Market size was estimated at USD 2.44 billion in 2025 and expected to reach USD 2.58 billion in 2026, at a CAGR of 6.05% to reach USD 3.69 billion by 2032.

Uncovering the Strategic Imperatives of Advanced Battery Additives amid Accelerating Electrification and Sustainable Energy Priorities

In an era defined by rapid electrification and intensifying sustainability objectives, battery additives have emerged as pivotal enablers of performance optimization and longevity. The convergence of stringent environmental regulations, ambitious carbon reduction targets, and surging demand for electric mobility has elevated additives from niche enhancements to strategic imperatives. Moreover, the escalating complexity of energy storage systems across automotive, industrial, and consumer sectors demands tailored formulations that can deliver precise conductivity enhancements, cycle life improvements, and robust thermal management.

Against this backdrop, stakeholders across the value chain are navigating a landscape where material innovation, regulatory compliance, and cost pressures intersect. Suppliers are under mounting impetus to introduce novel chemistries that not only bolster energy density but also mitigate safety risks and extend service life. Simultaneously, integrators and OEMs are seeking additives that align with circular economy principles, enabling easier recyclability and lower environmental impact. This dual pursuit of high performance and sustainability is reshaping collaboration models, accelerating partnerships between chemical innovators, battery manufacturers, and end-users.

This executive summary provides a structured overview of the transformative trends, regulatory considerations, and tactical segmentation insights that will define competitive advantage in the battery additive sector. By examining key shifts in industry dynamics, tariff-driven supply chain realignments, and regional growth patterns, decision-makers can better position their organizations to capitalize on emerging opportunities and navigate potential headwinds.

Exploring the Pivotal Technological and Market Shifts Reshaping Advanced Additive Applications in Next-Generation Battery Systems

Over the past decade, the battery additive landscape has undergone profound shifts driven by breakthroughs in material science and evolving end-market requirements. Innovations in lithium-ion chemistries, including the rise of lithium iron phosphate (LFP) and nickel-based cathodes, have redefined performance benchmarks and necessitated specialized conductive and stabilizing additives. Concurrently, the proliferation of energy storage systems for grid balancing and renewable integration has introduced a new demand vector, compelling formulators to optimize their products for long-duration cycling, high-temperature resilience, and cost-effective scalability.

Technological advances are intersecting with shifting regulatory environments, where safety standards are tightening and volatile organic compound (VOC) emissions are under closer scrutiny. This confluence is catalyzing the development of additives that simultaneously enhance thermal stability and mitigate outgassing. Furthermore, as battery recycling infrastructure expands, additive chemistries are being redesigned to facilitate material recovery and reduce the energy intensity of downstream processing.

These transformative shifts are also influencing business models, as formulators partner more deeply with OEMs to co-develop proprietary solutions, and as industry consortia drive precompetitive research on next-generation materials. In tandem, the maturation of digital twin technologies and advanced simulation tools is accelerating additive design cycles, enabling rapid prototyping and precise performance prediction. Together, these dynamics are charting a path toward higher-efficiency, safer, and more sustainable battery systems.

Analyzing the Multi-Faceted Effects of U.S. Trade Tariffs on Battery Additives Supply Chains Costs and Strategic Sourcing Decisions

The cumulative impact of U.S. tariffs on battery cells and critical materials is reshaping supply chains and cost structures, creating both challenges and strategic pivot points for market participants. Recent ‘‘reciprocal’’ tariffs have driven a substantial cost surge for imported battery cells, particularly those sourced from China, which accounted for 70 percent of U.S. imports in the prior year. The effective tariff rate on Chinese battery cells has risen to nearly 65 percent, adding an estimated $8 billion in incremental costs to U.S. carmakers and pack manufacturers in 2024 alone.

Beyond fully assembled cells, targeted duties on key precursor materials are exerting further pressure. Nickel sulfate, a feedstock absent from domestic production, is now subject to 20 percent duties on imports from the EU and 10 percent on supplies from Australia. Synthetic graphite, which underpins anode performance and accounted for 74 percent of U.S. imports from China, faces a 54 percent tariff, significantly elevating raw material expenses for cell producers. While certain materials such as lithium carbonate, lithium hydroxide, and cobalt sulfate have been exempted under the new framework, the selective coverage underscores the strategic aim to spur domestic upstream capacity while protecting nascent recycling ventures.

In response, industry players are recalibrating sourcing strategies. Some are accelerating investments in North American and Australian mine-to-material projects to secure tariff-free supplies. Others are retrenching to alternative suppliers in Southeast Asia or forging joint ventures to localize critical precursor production. At the same time, the elevated cost environment has prompted preemptive customer stockpiling and expedited long-term offtake agreements, as evidenced by global producers reporting increased working-capital allocations to raw material inventory ahead of tariff escalations. Collectively, these dynamics are redefining competitive positioning and investment priorities across the battery additive ecosystem.

Delving into Comprehensive Segmentation Insights to Illuminate Diverse Battery Additive Opportunities Across Types Applications and Benefits

Insight into the market’s segmentation reveals nuanced opportunities for formulators and suppliers, driven by battery type, application domain, performance objectives, and physical form. In terms of battery type, demand dynamics vary significantly between traditional lead-acid solutions and advanced lithium-ion systems, the latter further subdivided by LCO, LFP, NCA, and NMC chemistries. Each chemotype presents distinct additive requirements: for example, LFP applications often prioritize thermal stability and cycle life enhancement, while NCA and NMC formulations lean into conductivity and safety additive technologies.

Application-driven segmentation further delineates the market landscape. Automotive-grade batteries necessitate high-performance additives that deliver rapid charge acceptance and enhanced cycle endurance under variable operating conditions. Consumer electronics, encompassing laptops, smartphones, tablets, and wearables, call for compact formulations with excellent energy density and minimal thermal runaway risks. In energy storage, commercial, residential, and utility installations demand additives that balance cost effectiveness with long-duration cycling capability and low maintenance. Meanwhile, industrial segments such as military, telecom, and UPS emphasize resilience under extreme temperature fluctuations and reliability in mission-critical operations.

Beyond functional and application criteria, performance benefit segmentation highlights the strategic value of conductivity enhancement, cycle life improvement, safety additive solutions, and advanced thermal management. Finally, the choice between liquid and powder forms influences handling, dispersion uniformity, and integration into slurry processes. Recognition of these four segmentation dimensions enables market participants to tailor their R&D and go-to-market strategies with precision, aligning product portfolios to targeted opportunities.

This comprehensive research report categorizes the Battery Additive market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Battery Type

- Performance Benefit

- Form

- Application

Revealing Critical Regional Dynamics Influencing Battery Additives Adoption and Innovation Across the Americas EMEA and Asia-Pacific Markets

Regional dynamics exert a profound influence on both demand patterns and supply chain configurations in the battery additive sector. In the Americas, the convergence of expanding electric vehicle initiatives and regulatory incentives under recent federal and state-level policies has bolstered uptake of high-performance additives that support fast-charging networks and extended range capabilities. Concurrently, domestic investment programs are fueling upstream material processing, creating synergies for localized additive production and reducing import reliance.

Within the Europe, Middle East & Africa landscape, aggressive CO₂ reduction mandates and ambitious renewable integration targets have spurred growth in grid-scale storage projects. As a result, additives that enhance cycle stability and thermal resilience are in high demand for commercial and utility-scale systems. Moreover, emerging electrification efforts in the Middle East are driving early-stage opportunities, while the African market continues to prioritize cost-effective, scalable solutions adaptable to off-grid deployments.

Asia-Pacific remains the world’s largest manufacturing hub for both battery cells and additive chemistries, fueled by established supply chains in China, Japan, and South Korea. Rapid expansion of electric vehicle production and support for next-generation technologies, including solid-state batteries, is creating a vibrant ecosystem for novel additive innovations. At the same time, regional trade policies and evolving environmental regulations are prompting manufacturers to optimize additive formulations for lower environmental footprint and enhanced recyclability.

This comprehensive research report examines key regions that drive the evolution of the Battery Additive market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Companies Driving Innovation Competitive Differentiation and Strategic Collaborations within the Global Battery Additives Landscape

The competitive landscape of battery additive suppliers is characterized by a mix of diversified chemical conglomerates, specialized mid-tier innovators, and agile startups. Established players leverage integrated portfolios, cross-sector R&D expertise, and global manufacturing networks to deliver comprehensive additive solutions at scale. Their capabilities in advanced material synthesis, regulatory compliance frameworks, and global distribution channels enable them to serve both large OEMs and energy storage integrators.

In parallel, specialized niche companies focus intensively on performance-driven formulations for high-value applications. These innovators often partner with academic institutions and research consortia to co-develop proprietary additives that address emerging challenges, such as high-voltage stability and safety under extreme conditions. Their agility allows rapid customization and iterative testing, meeting the precise requirements of next-generation chemistries and small-batch production volumes.

Across the board, successful participants are forging strategic collaborations with battery producers, end-users, and recycling firms to close the innovation loop. Joint ventures aimed at circular-economy integration are gaining prominence, with additive developers co-investing in recycling technologies and upcycling initiatives. Such partnerships not only reinforce supply chain resilience but also enhance brand positioning in an increasingly sustainability-focused market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Battery Additive market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- ALTANA AG

- Arkema S.A.

- Ascend Performance Materials, LLC

- BASF SE

- Borregaard ASA

- BYD Company Ltd.

- Cabot Corporation

- HOPAX Corporation

- Imerys S.A.

- LG Energy Solution, Ltd.

- Orion Engineered Carbons S.A.

- PENOX S.A.

- SGL Carbon SE

- The Hammond Group, Inc.

Defining Actionable Strategic Recommendations to Steer Industry Leaders Toward Sustainable Growth Differentiation and Supply Chain Resilience

To thrive amidst intensifying competition and shifting market dynamics, industry leaders must adopt strategic imperatives that balance innovation acceleration with operational resilience. First, directing R&D investments toward additive chemistries optimized for emerging solid-state and high-nickel battery systems will position organizations at the forefront of next-generation growth. Collaborative research models that leverage digital design tools and rapid prototyping can significantly reduce time-to-market for breakthrough formulations.

Second, diversifying supply chains through partnerships and localized production hubs will mitigate tariff exposures and logistical disruptions. Establishing joint ventures in key regions, particularly North America and Southeast Asia, can secure access to critical precursor materials while aligning with regional incentive frameworks. Complementing this, robust risk management practices, including strategic inventory buffers and long-term offtake agreements, will safeguard continuity and cost stability.

Third, integrating circular-economy approaches into product development and commercialization strategies will enhance sustainability credentials and comply with tightening end-of-life regulations. Investing in recycling-ready additive formulations and collaborating with reclamation partners can drive resource efficiency and reduce environmental impact. Finally, fostering cross-functional alliances that unite R&D, regulatory affairs, and marketing teams will ensure cohesive execution and accelerate adoption of novel additive solutions.

Outlining a Rigorous Multi-Stage Research Methodology Integrating Primary Interviews Secondary Analysis and Expert Validation for Unbiased Insights

This research report is grounded in a rigorous, multi-stage methodology designed to deliver unbiased, actionable market insights. The process began with comprehensive secondary research, encompassing peer-reviewed journals, industry whitepapers, and public filings to map the technological landscape and regulatory frameworks. Trade association data and customs records were analyzed to uncover historical trade flows and tariff impacts, providing context for contemporary supply chain dynamics.

Next, extensive primary research was conducted through structured interviews with key stakeholders across the additive value chain, including R&D scientists, procurement executives, and end-use OEM representatives. These conversations yielded first-hand perspectives on performance requirements, adoption barriers, and emerging application areas. In parallel, a series of expert panel workshops validated preliminary findings and refined the segmentation logic, ensuring alignment with real-world operational imperatives.

Finally, qualitative insights were integrated with quantitative analyses to triangulate trends, identify strategic inflection points, and develop scenario-based evaluations of regulatory and market variables. This iterative validation process ensures that the report’s conclusions and recommendations are both empirically substantiated and highly relevant to decision-makers seeking to capitalize on the evolving battery additive ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Battery Additive market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Battery Additive Market, by Battery Type

- Battery Additive Market, by Performance Benefit

- Battery Additive Market, by Form

- Battery Additive Market, by Application

- Battery Additive Market, by Region

- Battery Additive Market, by Group

- Battery Additive Market, by Country

- United States Battery Additive Market

- China Battery Additive Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Synthesizing Key Insights to Highlight the Strategic Imperatives and Innovation Pathways Shaping the Future of Battery Additive Technologies

The battery additive sector stands at a critical juncture where performance optimization, regulatory dynamics, and sustainability imperatives converge. As electrification surges and energy storage applications diversify, additive formulations will be instrumental in unlocking new performance thresholds and enabling next-generation chemistries. Meanwhile, tariff-driven supply chain realignments and regional policy shifts underscore the necessity of strategic sourcing and localized partnerships.

Segmentation insights reveal that success will hinge on aligning product portfolios with distinct battery types, application domains, performance benefits, and form factors. Regional nuances further emphasize the importance of adaptive strategies that address specific market drivers in the Americas, EMEA, and Asia-Pacific. At the corporate level, collaboration between established chemical leaders and specialized innovators is vital to co-develop resilient, sustainable solutions.

By embracing recommended actions-targeted R&D, diversified supply chain strategies, and circular-economy integration-industry participants can navigate evolving headwinds and capture high-growth opportunities. This synthesis of market drivers and strategic imperatives provides a clear roadmap for organizations to optimize their additive offerings, strengthen competitive positioning, and contribute to the broader transition toward clean energy and electrified mobility.

Engage with Ketan Rohom to Access In-Depth Battery Additives Market Intelligence and Empower Your Strategic Decisions with Expert Guidance

If you are ready to gain an unparalleled competitive edge in the rapidly evolving battery additive market, connect today with Ketan Rohom, Associate Director of Sales & Marketing. Ketan’s expert guidance and comprehensive market intelligence will empower you to navigate complex supply chain challenges, capitalize on emerging trends, and fine-tune your strategic investments in advanced additive technologies. Engaging directly will unlock tailored insights, ensuring your organization is equipped with the actionable knowledge needed to accelerate product innovation, augment performance benefits, and secure resilient partnerships. Reach out to Ketan Rohom to schedule a bespoke briefing, obtain exclusive access to the full report, and transform your decision-making process with deep-dive analyses and forecast-proof strategies

- How big is the Battery Additive Market?

- What is the Battery Additive Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?