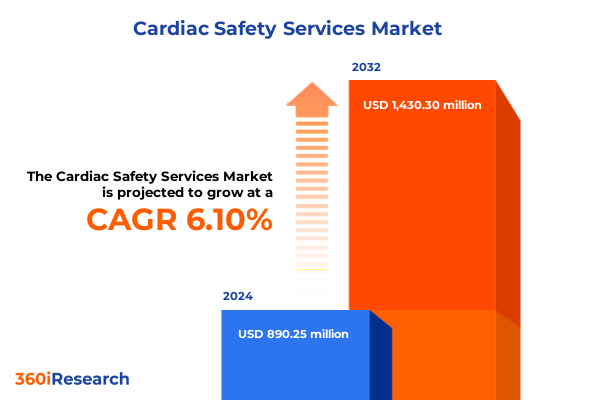

The Cardiac Safety Services Market size was estimated at USD 937.15 million in 2025 and expected to reach USD 992.03 million in 2026, at a CAGR of 6.22% to reach USD 1,430.30 million by 2032.

Unveiling the Strategic Importance of Comprehensive Cardiac Safety Protocols in Clinical Development to Safeguard Patients and Enhance Research Outcomes

Cardiac safety services play a pivotal role in modern clinical development, providing critical insights that shape the safety profile of novel therapeutics and medical devices. By leveraging advanced diagnostic modalities and standardized protocols, service providers ensure that cardiac events are consistently monitored, analyzed, and mitigated. As regulatory agencies intensify their scrutiny of cardiovascular risks, the integration of comprehensive cardiac safety assessments into early-stage pipelines has become indispensable for sponsors aiming to minimize late-stage failures and safeguard patient well-being.

In today’s competitive landscape, stakeholders recognize that proactive cardiac safety strategies not only reduce development timelines but also enhance the overall value proposition of investigational products. With therapeutic modalities evolving toward more complex biologics and combination therapies, the demand for sophisticated cardiac safety endpoints has surged. Consequently, clinical trial teams are increasingly partnering with specialized providers that offer end-to-end solutions-from continuous ECG monitoring to in-depth QT interval analysis-thereby aligning clinical objectives with stringent safety requirements and paving the way for successful regulatory submissions.

Moreover, the advent of wearable technologies and AI-driven analytics has introduced new dimensions to cardiac safety monitoring. Remote electrocardiogram capture and real-time data interpretation enable rapid detection of anomalies, empowering clinical teams to make informed decisions without compromising trial integrity. This convergence of technology and expertise underscores the necessity for a strategic approach that balances cutting-edge methodologies with regulatory compliance, setting the stage for a more resilient and patient-centered clinical research environment.

Exploring the Impact of Digital Health Innovations and Regulatory Harmonization on Cardiac Safety Assessments in Evolving Clinical Trial Ecosystems

Over the past decade, digital health innovations have reshaped the cardiac safety landscape, introducing seamless connectivity between patients and trial investigators. Wearable devices now facilitate continuous heart rate and rhythm monitoring outside of traditional clinic visits, while AI-enabled platforms synthesize complex datasets to predict cardiac events with unprecedented accuracy. These advances have not only accelerated data collection processes but also fostered more patient-centric trial designs, where real-time feedback and adaptive protocols improve both safety oversight and participant engagement.

Concurrently, efforts to harmonize regulatory frameworks across major regions have reduced inconsistencies in cardiac safety requirements. The adoption of unified guidelines, such as the latest iterations of ICH E14 and S7B, has streamlined end-point definitions and standardized threshold criteria for QT prolongation. This regulatory alignment alleviates the burden on sponsors conducting multi-regional studies, ensuring that cardiac safety data meet global standards and facilitating smoother regulatory reviews.

Together, these transformative shifts have converged to create a more agile and transparent ecosystem for cardiac safety assessments. By integrating digital tools and embracing harmonized regulations, clinical teams can navigate the complexities of cardiovascular risk evaluation more efficiently, ultimately accelerating development timelines while upholding the highest safety standards.

Assessing How the 2025 Tariff Adjustments in the United States Have Reshaped Cardiac Safety Supply Chains and Service Delivery Dynamics

In 2025, the introduction of revised US tariffs targeting a broad range of imported medical equipment and diagnostic instruments has had significant implications for cardiac safety service providers. As key components such as high-precision imaging devices and specialized Holter monitors became subject to higher import duties, the cost structure of comprehensive cardiac assessments experienced upward pressure. This shift prompted stakeholders to reassess procurement strategies and evaluate alternative sourcing options to maintain operational efficiency and budgetary discipline.

The ripple effects extended beyond pricing dynamics, as supply chain disruptions began to emerge. Extended lead times for critical equipment fueled concerns over trial delays and data integrity, compelling sponsors to prioritize domestic suppliers or establish strategic partnerships with low-tariff regions. Simultaneously, the increased cost burden intensified competition among service providers, with many passing through tariff-related expenses or absorbing a portion to retain clients. These market adaptations underscored the delicate balance between maintaining service quality and managing financial constraints in a changing trade environment.

To navigate this complex landscape, leading organizations adopted proactive mitigation measures. By diversifying supply chains, expanding local manufacturing alliances and optimizing inventory management, they enhanced resilience against tariff fluctuations. This multifaceted approach not only safeguarded trial continuity but also reinforced the strategic importance of supply chain agility in the era of evolving trade policies.

Uncovering Actionable Insights from Service Type Segmentation to End User Focus That Shape Strategic Decisions in Cardiac Safety Solutions

Segmenting the cardiac safety landscape by service type reveals distinct pathways for meeting trial requirements. Blood pressure measurement services provide foundational hemodynamic data critical for early safety signals, while cardiovascular imaging services offer in-depth structural and functional insights. ECG and Holter monitoring capture real-time electrical activity over extended periods, enabling robust arrhythmia detection, whereas thorough QT studies deliver gold-standard assessments of drug-induced changes in cardiac repolarization. Each service category demands specialized expertise and technical infrastructure, underscoring the value of tailored solutions that address specific trial objectives.

When examining the market through the lens of service delivery type, a clear divergence emerges between integrated services and standalone offerings. Integrated service providers deliver end-to-end solutions, combining data management, analytical reporting and regulatory support under a unified framework. In contrast, standalone services cater to targeted study components, allowing sponsors to outsource discrete tasks without the overhead of full-scale partnerships. This duality in service models affords flexibility for trial teams to optimize cost efficiency and operational alignment according to project complexity.

Application-based segmentation further distinguishes service requirements between drug and device development versus regulatory compliance initiatives. Early-phase pipelines prioritize cardiac safety evaluations to de-risk candidate profiles, whereas later-phase programs focus on generating documentation and evidence required for market approval. This differentiation drives demand for agile service providers capable of scaling expertise from exploratory assessments to comprehensive regulatory submissions.

Finally, understanding end-user segmentation illuminates the diverse needs of contract research organizations, pharmaceutical and biopharma companies, and academic or private research institutes. CROs often seek turnkey cardiac safety packages to support sponsor programs, while pharma and biopharma entities may integrate specialized services into broader development portfolios. Research institutes, leveraging academic expertise, frequently collaborate on methodological innovations, contributing to evolving best practices and technological advancements.

This comprehensive research report categorizes the Cardiac Safety Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Type

- Application

- End User

Highlighting Key Regional Variations in Regulatory Frameworks, Technological Adoption and Market Drivers Across the Americas, EMEA and Asia-Pacific

The Americas region exhibits a mature cardiac safety services ecosystem, underpinned by robust clinical infrastructure and high healthcare expenditure. The United States, in particular, maintains stringent regulatory oversight, with the FDA setting comprehensive guidelines for QT assessment and arrhythmia monitoring. This environment has fostered a competitive landscape of service providers offering advanced diagnostic modalities and integrated data solutions. Concurrently, markets in Canada and Latin America are enhancing their capabilities, driven by cross-border collaborations and investments in trial capacity, thereby reinforcing North America’s position as a primary hub for cardiac safety research.

Europe, the Middle East & Africa presents a multifaceted regulatory tapestry, with the European Medicines Agency orchestrating unified standards across member states while individual countries retain specific requirements. This regulatory duality has spurred service providers to develop adaptive frameworks that comply with both centralized and localized guidelines. In parallel, the region benefits from established clinical research networks in Western Europe and emerging centers in Eastern Europe, Turkey and the Gulf Cooperation Council states, which offer competitive cost structures and expanding access to diverse patient cohorts.

In the Asia-Pacific arena, the cardiac safety landscape is undergoing rapid transformation, fueled by significant economic growth and healthcare spending increases. National regulatory authorities are accelerating guideline updates to align with global best practices, creating opportunities for service providers to expand their footprint. Local manufacturing of diagnostic equipment is gaining traction, reducing dependency on imports and mitigating tariff impacts. Moreover, emerging markets in India, China and Southeast Asia are witnessing escalating demand for clinical trials, driven by large patient populations and government initiatives to foster innovation. These dynamics position Asia-Pacific as a pivotal growth region for cardiac safety services, balancing cost-effectiveness with expanding technical capabilities.

This comprehensive research report examines key regions that drive the evolution of the Cardiac Safety Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Competitive Strengths and Strategic Initiatives of Leading Service Providers Shaping the Future Landscape of Cardiac Safety Testing

Leading service providers have strategically positioned themselves at the forefront of cardiac safety by expanding their capabilities across both early-stage and late-phase trial services. Global contract research organizations such as IQVIA and Parexel leverage extensive operational networks and sophisticated data analytics platforms to offer integrated cardiac safety assessments. These firms continually invest in proprietary software tools and cloud-based data management systems to streamline study execution and enhance regulatory readiness.

Simultaneously, specialized laboratory and diagnostic providers including Labcorp’s clinical development division and Charles River Laboratories differentiate themselves through targeted expertise in electrophysiology and cardiovascular imaging. By augmenting their service portfolios with advanced Holter monitoring devices and virtual trial technologies, these companies address both traditional site-based trial demands and emerging decentralized research models. Additionally, full-service outfits like ICON and PPD have fortified their offerings through strategic acquisitions, gaining novel digital capabilities and broadening geographic coverage.

The competitive landscape is further shaped by partnerships between technology innovators and established service providers, fostering the development of AI-driven risk-prediction models and remote monitoring solutions. This trend toward consolidation and collaboration underscores a collective industry drive to deliver end-to-end cardiac safety solutions that balance methodological rigor with operational efficiency. As companies continue to align their strategic investments with evolving client demands, the sector is poised for continued evolution and enhanced value delivery.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cardiac Safety Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ACM Global Laboratories

- Advarra, Inc.

- Banook Group

- Biotrial

- Celerion

- Certara, Inc.

- Charles River Laboratories International, Inc.

- Circle Cardiovascular Imaging Inc.

- Clario

- Clyde Biosciences Limited

- Eurofins Scientific SE

- GE HealthCare Technologies Inc.

- ICON PLC

- IQVIA Holdings Inc.

- Koninklijke Philips N.V.

- Laboratory Corporation of America Holdings

- Medpace, Inc.

- MERIT CRO, Inc.

- Metrion Biosciences Limited

- Ncardia Services B.V.

- NEXEL Co., Ltd.

- Octagos Health, Inc.

- Parexel International Corporation

- PhysioStim SAS

- PPD, Inc. by Thermo Fisher Scientific Inc.

- Richmond Pharmacology Limited

- Shanghai Medicilon Inc.

- Worldwide Clinical Trials

Actionable Strategies to Leverage Technological Advances and Overcome Regulatory Hurdles and Tariff Impacts in Cardiac Safety Service Delivery

Industry leaders should prioritize the development and adoption of integrated digital platforms that consolidate multi-modal cardiac safety data, enabling real-time visualization and advanced analytics. By harnessing cloud-based solutions and AI-powered algorithms, organizations can accelerate anomaly detection and streamline reporting processes, thereby enhancing the responsiveness of safety oversight. Investments in interoperable systems will also facilitate smoother data exchange with regulatory agencies, supporting more efficient review pathways.

Proactive engagement with regulatory authorities is essential to navigate the complexities of harmonized cardiac safety guidelines. Clinical teams are advised to seek scientific advice meetings early in protocol design, ensuring alignment on key end-points such as QT interval thresholds and arrhythmia criteria. Building these collaborative relationships can mitigate approval risks and foster a transparent feedback loop that informs study adaptations, ultimately reducing the potential for costly protocol deviations.

To address the financial and operational challenges posed by evolving trade policies, organizations should diversify their supply chain strategies. Nearshoring select manufacturing processes and establishing alternative sourcing partnerships can insulate operations from tariff-driven cost fluctuations. Coupled with robust inventory management practices, these measures will fortify supply chain resilience and secure uninterrupted access to critical diagnostic equipment.

Finally, adopting patient-centric trial methodologies-including decentralized monitoring and wearable device integration-can heighten participant engagement and data quality. By designing protocols that accommodate remote assessments and digital endpoints, sponsors not only enhance safety data granularity but also broaden access to diverse patient populations, positioning their programs for both scientific rigor and regulatory success.

Outlining a Rigorous Research Methodology Integrating Primary Interviews, Secondary Data Analysis and Quality Control to Deliver Reliable Cardiac Safety Insights

This research employed a comprehensive methodology combining primary and secondary approaches to deliver robust insights into cardiac safety services. Primary data collection included in-depth interviews with clinical operations executives, regulatory experts and biomedical engineers, providing firsthand perspectives on current challenges and emerging opportunities. Secondary research encompassed an extensive review of publicly available regulatory guidelines, clinical trial registries and peer-reviewed literature, ensuring alignment with the latest industry developments.

Quantitative and qualitative data were gathered from diverse sources, including FDA and EMA publications, clinical trial outcome databases and corporate disclosures. By synthesizing these materials, the analysis distilled critical trends in service delivery models, technological adoption and regulatory harmonization. Throughout data gathering, particular attention was paid to the evolving tariff landscape in the United States and its implications for equipment procurement and service pricing.

To ensure methodological rigor, findings underwent multiple layers of validation. Data triangulation techniques reconciled interview insights with secondary research outcomes, while internal quality control procedures verified accuracy and consistency. Additionally, subject matter experts conducted peer reviews at key milestones, providing critical feedback that refined analytical frameworks. This structured approach underpins the credibility of the insights presented, offering decision-makers a reliable foundation for strategic planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cardiac Safety Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cardiac Safety Services Market, by Service Type

- Cardiac Safety Services Market, by Type

- Cardiac Safety Services Market, by Application

- Cardiac Safety Services Market, by End User

- Cardiac Safety Services Market, by Region

- Cardiac Safety Services Market, by Group

- Cardiac Safety Services Market, by Country

- United States Cardiac Safety Services Market

- China Cardiac Safety Services Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Summarizing Core Findings on Technological Trends Regulatory Developments and Competitive Dynamics Impacting the Future of Cardiac Safety Services

The cardiac safety services sector stands at a pivotal juncture, shaped by a confluence of digital innovation, regulatory alignment and evolving geopolitical dynamics. Transformative technologies such as AI-driven monitoring and decentralized trial workflows have redefined safety assessment paradigms, enabling more agile and patient-centric approaches. At the same time, the harmonization of global guidelines and the strategic response to new tariff regimes have underscored the importance of regulatory foresight and supply chain resilience.

Segmentation analysis highlights the diverse requirements across service types-from blood pressure monitoring to thorough QT evaluations-as well as the critical distinction between integrated and standalone service models. Regional insights reveal that while North America leads in advanced capabilities, EMEA and Asia-Pacific regions are rapidly expanding their technical infrastructure and regulatory frameworks. Competitive intelligence further illustrates how leading organizations are leveraging strategic partnerships and digital investments to deliver end-to-end solutions.

Actionable recommendations emphasize the need for industry leaders to invest in interoperable digital platforms, engage proactively with regulatory authorities, diversify supply chains and embrace patient-centric trial designs. By implementing these strategies, stakeholders can navigate complexity, mitigate risks and capitalize on the dynamic opportunities within the cardiac safety landscape.

Engage with Associate Director Ketan Rohom to Unlock In-Depth Cardiac Safety Research and Propel Your Organization’s Strategic Development Goals Today

For organizations seeking deeper insights into cardiac safety service trends and strategic recommendations, personalized support is available. Engage with Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch) to explore how this research can inform your decision-making and drive successful clinical outcomes.

Don’t miss the opportunity to leverage expert analysis and actionable guidance that will enhance your cardiac safety strategy and strengthen your regulatory submissions. Secure access to the full market research report and gain a competitive edge in cardiac safety services by connecting with Ketan Rohom.

- How big is the Cardiac Safety Services Market?

- What is the Cardiac Safety Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?