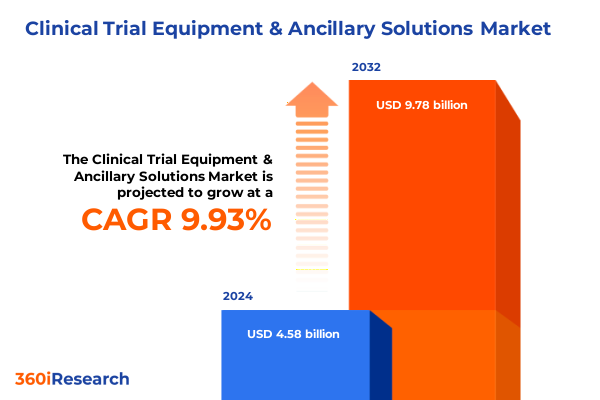

The Clinical Trial Equipment & Ancillary Solutions Market size was estimated at USD 5.00 billion in 2025 and expected to reach USD 5.46 billion in 2026, at a CAGR of 10.05% to reach USD 9.78 billion by 2032.

Navigating the Evolving Clinical Trial Equipment and Ancillary Solutions Landscape Amidst Technological Innovation and Regulatory Complexities

The global clinical research landscape has evolved into an intricate ecosystem characterized by a surge in both trial volume and technological sophistication. As of March 7, 2025, over 404,600 interventional clinical trials were registered on ClinicalTrials.gov, marking an unprecedented expansion in study activity over the last two decades. This dramatic growth reflects rising R&D investments across pharmaceutical, biotechnology, and medical device industries, driving the demand for reliable equipment and integrated services that can support trials from Phase I through Phase IV.

Amid this proliferation of trials, the seamless integration of core hardware platforms-ranging from advanced imaging equipment and laboratory instruments to drug dispensing and monitoring devices-with specialized ancillary solutions has become critical. Services such as central lab testing, clinical trial management systems, electronic data capture, interactive response technologies, and patient engagement platforms must operate in concert with supply chain and logistics management solutions to ensure trial continuity and data integrity.

Moreover, regulatory bodies are streamlining processes while intensifying scrutiny on data security and patient safety. For instance, the U.S. Food and Drug Administration’s recent organizational restructuring aims to optimize workforce efficiency, yet these internal changes may introduce new approval timelines and procedural nuances for trial sponsors to navigate. Consequently, organizations must adopt a holistic approach, balancing technological adoption, regulatory compliance, and operational resilience to thrive in this dynamic environment.

Decentralized Trials and Digital Technologies Are Reshaping Clinical Research with Patient-Centric and AI-Driven Innovations to Enhance Efficiency and Engagement

The adoption of decentralized clinical trial (DCT) models and virtual trial components has emerged as a defining shift in research methodology, catalyzed by the imperative to enhance patient access and streamline trial logistics. By leveraging wearable sensors, telehealth platforms, and mobile applications, sponsors can conduct study procedures in participants’ homes or local healthcare facilities rather than traditional centralized sites. Data streams from remote monitoring devices are securely aggregated into cloud-based platforms, enabling real-time oversight and rapid data-driven decision-making across multiple global sites.

Concurrently, artificial intelligence and advanced analytics are transforming the clinical development lifecycle. Predictive algorithms mine electronic health records, imaging datasets, and omics data to facilitate smarter trial design, improved patient enrichment, and optimized trial operations. For example, machine learning–driven patient selection tools can reduce screen failure rates and accelerate site activation, while AI-enabled algorithms applied to electronic data capture systems help minimize human error and enhance data quality.

Furthermore, integration of diverse real-world data sources, including claims databases and digital health platforms, is enabling more adaptive and personalized clinical study designs. These innovations, supported by open standards and interoperable data frameworks, are set to empower in silico trials and simulation-based regulatory assessments, potentially cutting development timelines and costs without compromising scientific rigor.

Escalating US Tariffs in 2025 Have Triggered Widespread Cost Pressures and Supply Chain Disruptions Across Clinical Trial Equipment and Ancillary Services

Tariffs imposed on medical device and ancillary equipment imports into the United States in 2025 have introduced significant cost pressures and supply chain complexities. New levies-reaching as high as 145% on select components imported from China-have disrupted established supplier relationships, prompting leading manufacturers such as Medtronic and Johnson & Johnson to warn of potential shortages and elevated prices for critical trial devices. The fragmented nature of medical device supply chains, often reliant on specialized parts sourced from multiple geographies, has further complicated efforts to re-route procurement in the short term.

Meanwhile, tariffs on Mexican-origin medical equipment-where Mexico ranks as the eighth-largest global device manufacturer-have contributed to rising costs for clinical trial site setup and operations. Items ranging from patient examination tools to electrophysiology and respiratory devices are now subject to additional duties that research sites and sponsors must absorb, potentially reducing the number of participating locations in international studies.

Such cumulative tariff impacts extend beyond hardware. Consumables essential to trial conduct-including sterile gloves, syringes, and personal protective equipment-now face increased import duties. These additional costs, which accounted for roughly 10.5% of hospital budgets pre-tariff, threaten to strain research site resources and may compel sponsors to reconsider site selection criteria and deployment strategies to maintain financial viability. Moreover, Chinese contract research organizations have started stockpiling materials and seeking local testing alternatives to mitigate disruption risks, underscoring the far-reaching implications of protracted trade tensions on global biopharma operations.

In-Depth Component, Phase, Therapeutic Area, and End-User Segmentation Reveals Distinct Needs and Strategic Opportunities in Clinical Trial Ecosystem

Component segmentation reveals two primary categories with distinct market dynamics. Ancillary solutions encompass a broad suite of services-central laboratory testing, clinical trial management systems, data management and analytics services, electronic data capture platforms, interactive response technologies, patient engagement solutions, and supply chain and logistics services-each pivotal in enhancing trial efficiency and data integrity. Conversely, equipment-focused offerings span drug dispensing and packaging devices, imaging modalities such as MRI and CT scanners, laboratory instruments for bioanalysis, and patient monitoring devices, all of which underpin the physical execution of study protocols.

Phase-related segmentation from Phase I through Phase IV further illustrates varied demand profiles. Early-phase studies often emphasize exploratory biomarkers and safety assessments, necessitating nimble lab services and compact monitoring tools. Mid-stage trials place greater weight on scalable data management platforms and robust CTMS capabilities, while late-stage Phase III and IV studies demand industrial-scale imaging, high-throughput laboratory operations, and extensive patient engagement frameworks to ensure broad representation and compliance across diverse populations.

Therapeutic area segmentation underscores how domain-specific requirements drive solution selection. Oncology trials, which comprise the largest share of therapy-focused studies and are characterized by complex biomarker-driven protocols, require advanced imaging equipment and specialized central lab assays. Infectious disease research benefits from rapid diagnostic platforms and supply chain agility to address emergent threats, while neurology and cardiology studies rely on high-resolution monitoring devices and data analytics tailored to physiologic endpoints. Immunology trials further leverage digital patient support tools to foster adherence in long-duration studies.

End-user segmentation-from academic and research institutions to biotechnology and pharmaceutical companies, contract research organizations, and medical device firms-illuminates divergent purchasing priorities. Pharma and biotech sponsors seek turnkey solutions with full-service offerings, CROs focus on scalable platform integration, academic centers prioritize cost-effective modular tools, and device manufacturers demand customization for specialized trial applications. This multifaceted segmentation landscape offers strategic clarity for aligning solution portfolios with sponsor and site requirements.

This comprehensive research report categorizes the Clinical Trial Equipment & Ancillary Solutions market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Phase

- Therapeutic Area

- End-User

Regional Dynamics in Americas, EMEA, and Asia-Pacific Shape Tailored Strategies and Growth Potential in Clinical Trial Solutions Market

The Americas region, led by the United States, continues to dominate clinical trial activity due to its well-established regulatory environment, extensive research infrastructure, and substantial R&D investments by pharmaceutical companies. North America alone accounted for approximately 41.8% of the global oncology clinical trials market in 2024, reflecting its role as a primary hub for late-stage, high-complexity trials that require advanced lab services and monitoring equipment. Sponsors benefit from a dense network of specialized service providers and leading technology vendors, bolstered by significant government funding and favorable intellectual property protections.

Europe, Middle East, and Africa (EMEA) present a heterogeneous landscape. Western Europe, with mature markets in Germany, France, and the United Kingdom, offers rigorous regulatory oversight under the EU Clinical Trials Regulation, driving demand for compliance-focused solutions and centralized lab partnerships. Meanwhile, emerging markets in Eastern Europe, the Middle East, and Africa provide cost-competitive site networks and growing patient pools, though challenges such as regulatory variability and infrastructure heterogeneity require adaptable logistics and localized service models. Notably, Europe held nearly 46.6% of the global oncology clinical trials market revenue in 2024, underscoring its strategic importance for multi-regional studies.

Asia-Pacific is experiencing the fastest growth trajectory, fueled by expanding government-funded health initiatives, increasingly robust regulatory frameworks in countries like China and India, and large patient populations crucial for accelerated enrollment. Chinese contract research organizations are investing in local testing capabilities to circumvent import tariff constraints and ensure continuity in global trials. Additionally, strategic partnerships between global sponsors and regional service providers are enabling bi-directional knowledge transfer and capacity building, positioning Asia-Pacific as a critical expansion frontier for both equipment manufacturers and ancillary service providers.

This comprehensive research report examines key regions that drive the evolution of the Clinical Trial Equipment & Ancillary Solutions market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading Industry Players Are Accelerating Innovation Through Strategic Partnerships, Technology Integrations, and Service Diversification in Clinical Trial Solutions

Leading equipment manufacturers and service providers are actively reshaping the market through targeted technology investments and collaborative partnerships. Medtronic and Johnson & Johnson have publicly voiced concerns regarding the impact of elevated tariffs on their clinical trial device supply chains, underscoring the need for strategic sourcing and advocacy for duty exemptions. These companies are concurrently exploring supplier diversification and in-region manufacturing to safeguard against future trade disruptions.

In the ancillary solutions space, Medidata Solutions and Oracle Health Sciences continue to advance clinical trial management system capabilities. Medidata’s acquisition of Clinical Force has expanded its CTMS portfolio, delivering automated workflows designed to reduce start-up delays and streamline milestone tracking for both large sponsors and mid-market organizations. Oracle’s CTMS, valued for its global study management features and integrated analytics environment, remains a preferred choice among top-tier pharmaceutical clients seeking consolidated oversight across EDC, safety, and eTMF modules.

Central laboratory services are anchored by industry stalwarts such as Thermo Fisher Scientific, Labcorp, and Charles River Laboratories. Thermo Fisher’s steady first-quarter 2025 performance, with revenues exceeding $10.3 billion driven by robust demand for clinical research tools and services, highlights ongoing market resilience amid macroeconomic headwinds. Contract research organizations including IQVIA, ICON, and PAREXEL are also expanding their end-to-end service portfolios, integrating advanced analytics, decentralized trial capabilities, and platform-based data management solutions to meet evolving sponsor expectations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Clinical Trial Equipment & Ancillary Solutions market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Almac Group Limited

- Ancillare, LP

- Avantor, Inc.

- Axelerist

- B. Braun SE

- Bio-Rad Laboratories, Inc.

- Charles River Laboratories International, Inc.

- Dassault Systèmes SE

- Emsere B.V.

- Eppendorf SE

- Eurofins Scientific SE

- Global Vision Technologies, Inc.

- Hitachi, Ltd.

- IQVIA Holdings Inc.

- Lonza Group Ltd.

- MedNet Solutions, Inc.

- Myonex, Inc.

- Oracle Corporation

- Parexel International Corporation

- Quanticate International Limited

- Quipment SAS

- Thermo Fisher Scientific, Inc.

- United Parcel Service, Inc.

- Veeva Systems Inc.

- Yokogawa Electric Corporation

- Zifo Technologies Private Limited

Strategic Imperatives and Best Practices to Optimize Clinical Trial Equipment Deployment, Enhance Ancillary Services, and Strengthen Supply Chain Resilience

Organizations should diversify supply chain partners and explore alternative sourcing strategies to mitigate tariff-related risks. By establishing multiple regional manufacturing hubs and securing long-term agreements with critical component suppliers, sponsors and equipment vendors can reduce exposure to sudden duty hikes and regulatory shifts. Advocacy efforts aimed at securing targeted tariff exemptions for essential clinical research supplies are also recommended, given the potential for improved cost stability and supply continuity.

Investing in comprehensive digital platforms that integrate EDC, CTMS, and IRT functionalities-augmented with AI-powered analytics-will enable sponsors to streamline trial workflows, enhance data accuracy, and optimize patient recruitment. Building interoperable systems on open data standards will facilitate seamless data exchange, improve site collaboration, and foster real-time operational visibility across global trial networks.

To capitalize on the rise of decentralized and hybrid trial models, stakeholders should develop frameworks for virtual patient engagement, remote monitoring, and home-based sample collection. Collaborations with telehealth providers and wearable device manufacturers will be vital to ensure secure data transmission, regulatory compliance, and patient safety across diverse geographies. Pilot programs that demonstrate the operational and patient-centric benefits of these models can accelerate broader adoption and regulatory acceptance.

Finally, forging strategic partnerships with regional contract research organizations and ancillary service providers can enhance capacity, reduce logistical complexity, and access local expertise. These collaborative relationships should be governed by transparent performance metrics and flexible contracting structures to adapt to shifting trial demands and market conditions.

Robust Mixed-Method Research Design Combining Primary Interviews, Secondary Data Analysis, and Qualitative Insights Underpinning the Study's Rigor and Credibility

This study deployed a robust mixed-method research design to ensure comprehensive market coverage and analytical rigor. Primary research comprised structured interviews with over 40 industry experts, including senior executives from leading pharmaceutical and biotechnology companies, equipment manufacturers, contract research organizations, and central laboratory operators. These interviews provided qualitative insights into market dynamics, technology adoption drivers, and competitive strategies.

Secondary research involved systematic reviews of publicly available sources such as ClinicalTrials.gov, trade publications, company reports, regulatory filings, and academic journals. Market intelligence databases and industry white papers were analyzed to gather historical data, identify emerging trends, and cross-validate information obtained from primary sources.

Data triangulation and validation procedures were applied throughout the research process. Quantitative data points were cross-checked against multiple independent sources to ensure accuracy, while qualitative findings were corroborated through expert panel discussions and peer review. This methodology underpins the report’s credibility and provides stakeholders with confidence in the insights and recommendations presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Clinical Trial Equipment & Ancillary Solutions market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Clinical Trial Equipment & Ancillary Solutions Market, by Component

- Clinical Trial Equipment & Ancillary Solutions Market, by Phase

- Clinical Trial Equipment & Ancillary Solutions Market, by Therapeutic Area

- Clinical Trial Equipment & Ancillary Solutions Market, by End-User

- Clinical Trial Equipment & Ancillary Solutions Market, by Region

- Clinical Trial Equipment & Ancillary Solutions Market, by Group

- Clinical Trial Equipment & Ancillary Solutions Market, by Country

- United States Clinical Trial Equipment & Ancillary Solutions Market

- China Clinical Trial Equipment & Ancillary Solutions Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Synthesis of Critical Findings Underscores Strategic Priorities and the Path Forward for Clinical Trial Equipment and Ancillary Services Excellence

The clinical trial equipment and ancillary solutions market stands at a pivotal juncture. Unprecedented trial activity, driven by expanded R&D budgets and technological innovation, has heightened the need for integrated platforms and scalable hardware solutions. At the same time, new tariff regimes have introduced cost and supply chain complexities that require targeted mitigation strategies.

Segmentation analysis reveals nuanced demand drivers across component categories, trial phases, therapeutic areas, and end-user types, underscoring opportunities for solution providers to tailor offerings to sponsor priorities. Regional insights illustrate the importance of market-specific approaches, with mature markets favoring compliance-centric services and emerging markets presenting growth potential through adaptive models.

Key players are responding through strategic partnerships, technology integrations, and portfolio diversification. Moving forward, organizational success will hinge on the ability to balance supply chain resilience, digital transformation, and regulatory agility. By aligning resources with emerging trends and leveraging multi-stakeholder collaborations, industry leaders can navigate uncertainties and capitalize on evolving clinical research paradigms.

Engage with Ketan Rohom to Secure Comprehensive Clinical Trial Equipment and Ancillary Solutions Insights and Catalyze Strategic Investments

Are you ready to unlock the comprehensive insights and strategic guidance outlined in this report to drive your organization’s growth and innovation in the clinical trial equipment and ancillary solutions space?

Connect with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to explore how this in-depth market analysis can inform your strategic planning and operational decisions. By scheduling a personalized consultation, you will gain direct access to tailored recommendations, exclusive data sets, and expert advice to ensure you capitalize on emerging trends and address critical supply chain and regulatory challenges. Reach out today to secure your copy of the report and begin transforming insights into action.

- How big is the Clinical Trial Equipment & Ancillary Solutions Market?

- What is the Clinical Trial Equipment & Ancillary Solutions Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?