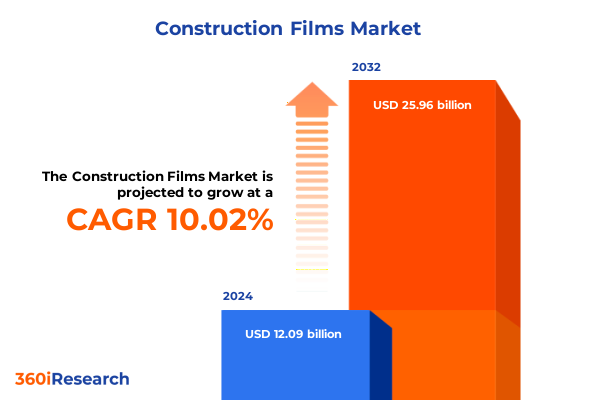

The Construction Films Market size was estimated at USD 13.16 billion in 2025 and expected to reach USD 14.33 billion in 2026, at a CAGR of 10.19% to reach USD 25.96 billion by 2032.

Pioneering the Integration of High-Performance Films in Modern Construction to Elevate Durability, Sustainability, and Aesthetic Appeal

The dynamic convergence of construction demands and material innovations has thrust film technologies into the spotlight, establishing them as vital enablers of enhanced building performance. In recent years, the construction sector’s push for structures that not only endure harsh environmental conditions but also adhere to evolving sustainability mandates has prompted stakeholders to explore film solutions that offer superior water resistance, UV protection, and energy efficiency. This introductory section frames the critical role that engineered films now play in roofing, waterproofing, and interior finishing applications, setting the context for a deep dive into their transformative potential.

Against a backdrop of tightening building codes and an increased emphasis on life-cycle performance, this analysis unpacks how advanced polymer chemistries and multilayer composite structures are revolutionizing traditional approaches. By tracing the intersection of market drivers-such as heightened regulatory scrutiny, the growing importance of green certifications, and the demand for lightweight yet durable materials-this introduction lays the foundation for understanding why film-based solutions have become integral to modern construction strategies. Readers will emerge with a clear appreciation of the macroeconomic and environmental factors propelling this market forward.

Unveiling the Transformative Forces Reshaping the Construction Films Market with Technology, Regulations, and Sustainability Trends

The construction films industry is in the midst of a profound metamorphosis driven by a confluence of technological breakthroughs, evolving regulations, and shifting consumer priorities. Digital fabrication techniques now facilitate precise film customization for specialized roofing membranes and interior wraps, while smart film coatings embedded with sensors are emerging to provide real-time monitoring of moisture ingress. Concurrently, regulatory bodies worldwide have tightened energy codes, incentivizing the adoption of films with higher solar reflectance and lower thermal transmission. Together, these forces are accelerating an industry-wide pivot toward film solutions that promise both performance enhancement and compliance with the green building movement.

Moreover, as circular economy principles gain traction, manufacturers are reengineering core polymer formulations to include recycled content and to enable post-application recycling. This transition underscores a broader commitment to reducing environmental footprints and aligns with landmark initiatives, such as the EU’s Green Deal and new US federal sustainability guidelines. In combination, advanced manufacturing, regulatory evolution, and intensified sustainability imperatives are redrawing the competitive landscape, presenting both opportunities and challenges for incumbents and new entrants alike.

Analyzing How 2025 Tariff Policies Are Reshaping Supply Chains, Cost Structures, and Competitive Dynamics within the US Construction Films Sector

In 2025, the imposition of tariffs on imported resin feedstocks has introduced a new paradigm for cost management and supply chain structuring within the United States construction films segment. Materials such as polyethylene, polypropylene, and PVC have all experienced upward pressure on landed costs, compelling manufacturers and distributors to reassess sourcing strategies. Many stakeholders have responded by forging partnerships with domestic resin producers to secure more stable pricing and by exploring regional polymer compounding facilities to reduce lead times and inventory risks.

These adjustments have triggered a ripple effect throughout the value chain. Construction film producers are implementing process optimizations and lean production techniques to mitigate margin compression, while downstream contractors are evaluating the cost-benefit tradeoffs of stocked versus just-in-time inventory models. At the same time, cross-border suppliers have pursued tariff engineering measures-such as alternative resin blends or on-shore conversion-to maintain market presence. Collectively, these responses have reshaped competitive dynamics, with nimble players who diversify their material base and optimize operational efficiency emerging as clear frontrunners in the new tariff-influenced landscape.

Discovering Critical Insights into Product, Application, End User, Thickness, and Distribution Channel Segments Driving Construction Films Innovation

A nuanced understanding of product variants, performance requirements, and distribution pathways is essential for navigating the construction films terrain. Product Type segmentation encompasses polyethylene films in high-density, low-density, and linear low-density forms; polypropylene offerings in biaxially oriented and cast formats; and PVC iterations in flexible and rigid gauges. Each substrate delivers distinct mechanical properties and processing characteristics, enabling tailored solutions for diverse site conditions and performance specifications. Application segmentation further delineates interior decoration films for floor and wall coverings, specialized roofing membranes including solar roofing and underlayment, and waterproofing solutions such as basement sheets and roof membranes. This layered view of product and application highlights how substrate innovations dovetail with project-specific demands.

End User distinctions among commercial facilities-ranging from office environments to retail spaces-industrial settings including manufacturing plants and distribution warehouses, and residential projects in both new builds and renovation contexts, illuminate the deployment patterns that drive demand concentration. Thickness classifications from below 50 microns to over 100 microns dictate film flexibility and installation techniques, while Distribution Channel segmentation-spanning direct sales, distributor networks, and online platforms-reveals the evolving pathways through which stakeholders procure materials. Synthesizing these multiple segment dimensions exposes high-value intersections, such as the rise of premium, high-micron films in industrial roofing applications distributed directly via digital platforms.

This comprehensive research report categorizes the Construction Films market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Thickness

- Application

- End User

- Distribution Channel

Uncovering Regional Dynamics in the Construction Films Industry Across Americas, Europe Middle East Africa, and Asia-Pacific Markets

Regional dynamics play a pivotal role in shaping strategic priorities and market trajectories for construction films stakeholders. In the Americas, robust infrastructure investment and a focus on resilient housing stock have spurred demand for high-performance waterproofing and ultraviolet-resistant roofing films. Policy incentives aimed at enhancing storm protection in coastal zones have also elevated interest in advanced laminated composites that combine weatherproofing with simplified installation.

Across Europe, the Middle East, and Africa, disparate building codes and climate conditions create a tapestry of requirements, from energy-efficient films that meet stringent EU energy performance standards to cost-effective waterproofing in emerging markets. Sustainability targets and circularity mandates in Europe drive innovation in recycled PET-based films, while colder climates in parts of the Middle East and North Africa emphasize thermal insulation properties. Market growth in sub-Saharan Africa remains nascent but promising, with infrastructure programs catalyzing initial adoption of protective film technologies.

In the Asia-Pacific region, rapid urbanization and large-scale construction booms in China, India, and Southeast Asia generate significant volume opportunities for general-purpose polyethylene and polypropylene films. Meanwhile, advanced economies such as Japan and South Korea are pioneering smart film applications and integrating digital tracking features to optimize building lifecycle monitoring. These regional distinctions underscore the importance of localized strategies that align product portfolios and go-to-market models to specific climate, regulatory, and economic contexts.

This comprehensive research report examines key regions that drive the evolution of the Construction Films market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Corporations and Innovative Players Shaping Competition and Collaboration within the Construction Films Market Spectrum

Competition in the construction films space is characterized by a blend of global polymer conglomerates, specialized film manufacturers, and agile niche innovators. Major resin producers leverage integrated upstream capabilities to secure reliable feedstock, enabling them to offer competitively priced high-volumes. In parallel, leading film converters invest heavily in R&D to introduce proprietary co-extrusion techniques and surface treatments that enhance adhesion, fire resistance, and longevity. Strategic alliances between resin suppliers and converters have become more common, accelerating innovation cycles and broadening application portfolios.

Smaller specialized entities differentiate through bespoke service offerings, rapid prototype development, and on-demand digital ordering systems. These agile operators often collaborate with end users to customize film properties according to unique project specifications, fostering deeper client relationships and premium pricing models. Additionally, mergers and acquisitions have intensified, as established players seek to augment regional footprints or acquire novel technologies. Ultimately, the competitive landscape rewards those who can blend scale, technical expertise, and customer intimacy into cohesive value propositions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Construction Films market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Berry Global, Inc.

- Climax Synthetics Pvt. Ltd.

- Compagnie de Saint-Gobain S.A.

- DuPont de Nemours, Inc.

- Eastman Chemical Company

- Inteplast Group of Companies

- Mitsubishi Chemical Corporation

- Mondi Group

- Plastika Kritis S.A.

- Polyplex Corporation Limited

- Raven Industries, Inc.

- RKW SE

- SKC Co., Ltd.

- Supreme Industries Limited

- Toray Industries, Inc.

Strategic Action Plans for Industry Leaders to Enhance Profitability, Strengthen Supply Chains, and Drive Innovation in Construction Films

To thrive in a market shaped by shifting input costs, heightened sustainability expectations, and technological disruption, industry leaders must adopt a multifaceted strategic agenda. Embracing advanced polymer blends and multilayer co-extrusion processes can unlock new performance tiers for roofing and waterproofing membranes, while simultaneously mitigating dependency on any single resin type. Complementing these product investments with digital supply-chain visibility tools will enhance responsiveness to tariff fluctuations and raw material availability, thereby minimizing overstock and transport inefficiencies.

Leadership teams should also prioritize partnerships that accelerate circularity, such as collaborations with recycling specialists to incorporate post-consumer resin streams without compromising mechanical integrity. On the commercial front, expanding direct digital channels and integrating predictive analytics can refine demand forecasting and tailor customer engagement. Finally, upskilling installation partners through virtual training and certification programs will ensure proper deployment, preserving the film’s designed performance characteristics and reinforcing brand reputation in an increasingly competitive marketplace.

Employing Rigorous Mixed-Method Approaches and Primary Secondary Data to Ensure Quality and Reliability in Construction Films Research

This analysis employs a mixed-method research framework to balance depth of insight with empirical rigor. Primary data collection involved structured interviews with C-suite executives, R&D directors, and procurement specialists across the film manufacturing and construction sectors, capturing firsthand perspectives on material performance priorities and market barriers. Supplementary surveys provided quantitative validation of adoption rates, satisfaction levels, and emerging application interest. To contextualize these findings, secondary research drew upon industry journals, trade association databases, and regulatory filings, ensuring alignment with the latest building codes and sustainability mandates.

Data triangulation and iterative expert reviews maintained methodological integrity throughout the research process. Each segment definition underwent cross-validation against real-world procurement workflows, and regional analyses were calibrated with macroeconomic indicators and construction activity reports. Quality control checkpoints evaluated consistency and coherence, resulting in a comprehensive database that underpins the report’s strategic recommendations and segment deep dives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Construction Films market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Construction Films Market, by Product Type

- Construction Films Market, by Thickness

- Construction Films Market, by Application

- Construction Films Market, by End User

- Construction Films Market, by Distribution Channel

- Construction Films Market, by Region

- Construction Films Market, by Group

- Construction Films Market, by Country

- United States Construction Films Market

- China Construction Films Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2385 ]

Synthesizing Core Findings to Provide a Clear Path Forward for Stakeholders in the Construction Films Ecosystem

Synthesis of the report’s core findings reveals a market at the crossroads of innovation, regulation, and cost sensitivity. Technological advancements in film formulations and digital fabrication are unlocking new application frontiers, while sustainability imperatives are elevating the importance of closed-loop material strategies. Tariff-driven supply chain realignments have introduced both challenges and competitive opportunities, rewarding enterprises that pivot swiftly and invest in agile sourcing models.

For stakeholders throughout the ecosystem-from resin producers and film converters to distributors and end-use contractors-the path forward centers on integrated approaches that blend technical excellence with operational resilience. By leveraging the segmentation and regional insights presented here, decision makers can pinpoint high-growth niches and optimize their product portfolios. Fueled by this holistic understanding, industry participants are poised to navigate market complexities and capitalize on the transformative potential of construction film technologies.

Engage with Ketan Rohom for Exclusive Insights and Secure Your Comprehensive Construction Films Market Research Report Today

To unlock the full depth of analysis, data tables, and actionable insights contained in this comprehensive construction films market report, reach out directly to Ketan Rohom. As Associate Director of Sales & Marketing, Ketan brings an in-depth understanding of industry needs and can guide you to the most relevant package that aligns with your strategic objectives. Engaging with Ketan ensures you receive personalized support, rapid access to supplementary data, and expert clarification on methodologies or segment breakouts.

Secure your strategic advantage today by partnering with an experienced research advisor who can help tailor the report to your business priorities. Contacting Ketan Rohom will enable you to explore additional add-on services, such as custom regional deep-dives or executive briefings, to further refine your decision-making process. Take the next step toward informed growth in the construction films arena by connecting with Ketan and obtaining your definitive market intelligence resource.

- How big is the Construction Films Market?

- What is the Construction Films Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?