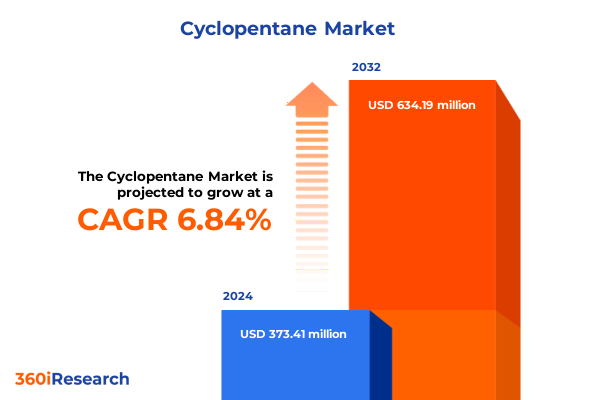

The Cyclopentane Market size was estimated at USD 398.46 million in 2025 and expected to reach USD 425.36 million in 2026, at a CAGR of 6.86% to reach USD 634.19 million by 2032.

Unveiling the Multifaceted Role of Cyclopentane Across Emerging Applications and Sustainability Drivers in the Modern Chemical Landscape

Cyclopentane has emerged as a pivotal hydrocarbon with versatile applications across insulation, refrigeration, solvents, and specialty machining fluids. In recent years, its role has expanded beyond a simple chemical intermediate to a strategic enabler of energy-efficient processes and environmentally conscious formulations. Driven by global efforts to phase down high-global-warming-potential blowing agents, cyclopentane’s favorable thermodynamic profile and negligible ozone-depletion potential have propelled its adoption in polyurethane foam manufacturing. Concurrently, demand from cleaning and solvent markets has grown as formulators seek low-toxicity alternatives that balance performance with regulatory compliance.

Market dynamics are also shaped by evolving purity expectations, with sectors such as precision cooling and electronics requiring ultra-high-purity grades to safeguard component integrity. Meanwhile, advancements in bio-based production routes are gaining traction as sustainability commitments intensify across chemical supply chains. This introduction outlines the multifaceted drivers propelling cyclopentane’s ascent, setting the stage for an in-depth exploration of transformative shifts, tariff impacts, segmentation insights, regional nuances, and strategic imperatives.

Tracing the Paradigm-Shifting Innovations Transforming Cyclopentane Production, Supply Chain Resilience, and Application Dynamics Worldwide

Over the past decade, cyclopentane production and utilization have undergone transformative shifts driven by innovations in process intensification and renewable feedstocks. Enhanced catalytic hydrogenation and selective dehydrogenation processes have reduced energy footprints, enabling manufacturers to increase throughput while slashing carbon emissions per unit of output. In parallel, the integration of membrane separation techniques and advanced distillation configurations has elevated product purity, catering to sectors where sub-ppm contaminants can compromise thermal management or electronic performance.

Equally significant is the rise of bio-based cyclopentane routes leveraging lignocellulosic biomass and waste glycerol streams. These sustainable pathways not only diversify raw material supply but also resonate with corporate net-zero commitments. On the application front, cyclopentane has transcended its traditional use as a blowing agent. In cleaning formulations, modified grades deliver robust solvency with lower VOC profiles, while in refrigeration replacements, cyclopentane blends optimize energy efficiency and system longevity. Together, these advancements underscore a landscape in flux, where technology and sustainability coalesce to redefine cyclopentane’s market trajectory.

Analyzing the Ripple Effects of United States 2025 Tariff Policies on the Cyclopentane Supply Chain and Market Equilibrium

In 2025, the United States government instituted new tariff measures targeting cyclopentane imports, reshaping cost structures and supply chain strategies. These duties, calibrated to protect domestic producers and incentivize onshore capacity expansions, have elevated landed costs for key synthetic grades sourced from major exporters. As a result, purchasers have reevaluated procurement geographies and accelerated relationship development with local manufacturers to mitigate duty impacts and reduce lead-time variability.

The tariff regime’s cumulative effect extends beyond pricing. By tightening the flow of cost-effective imports, it has driven investment in modular production technologies within North America, fostering a more resilient and agile supply base. Nevertheless, the increased cost burdens have been partially passed through to end-users, influencing foam insulation and refrigeration equipment pricing. Buyers in cost-sensitive markets are now exploring alternative feedstocks and near-term hedging strategies to smooth procurement cycles, illustrating a dynamic equilibrium between protective trade measures and market responsiveness.

Unraveling Critical Market Trends Across Purity Levels, Source Variants, Applications, End-Use Segments, and Distribution Channels

Across purity benchmarks, three tiers define quality thresholds: mid-range grades between 95 and 98 percent maintain broad adoption in general-purpose foam applications, whereas sub-95 percent material serves less critical cleaning or solvent uses, and ultra-high-purity above 99 percent commands premium positioning in precision cooling and electronics manufacturing. In tandem, source differentiation between bio-based production and petrochemical synthesis is sharpening as sustainability pledges and green procurement policies shape supplier evaluations. Companies integrating renewable feedstocks gain favor among stakeholders seeking lifecycle emissions reductions.

Cyclopentane’s functional diversity spans its role as a blowing agent delivering superior cell structures and thermal performance in insulation foams, to its deployment as a cleaning agent where solvency and low residue are paramount. As a refrigerant replacement, blends incorporating cyclopentane optimize energy cycles and environmental compliance, while its solvent properties support adhesives and specialty formulations. End-use segmentation reveals nuanced demand patterns, with automotive sectors embedding cyclopentane in exterior foam gaskets and interior acoustic insulation, while the construction industry leverages its thermal efficiency for building envelopes. In consumer electronics and appliances, cyclopentane underpins foam insulation in air conditioners and refrigerators to meet stringent energy standards. Meanwhile, packaging applications utilize flexible films and rigid containers blown with cyclopentane to achieve lightweight, high-barrier performance.

Distribution pathways bifurcate between online procurement channels, which offer rapid fulfillment and smaller lot sizes, and traditional offline routes. Within offline networks, direct sales arrangements secure large-volume contracts, whereas distributor partnerships expand geographic reach and service support. This segmentation matrix underscores how market participants tailor product offerings and commercial models to meet diverging requirements across end-use verticals, regulatory landscapes, and sustainability mandates.

This comprehensive research report categorizes the Cyclopentane market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Purity

- Source

- Formulation

- Application

- End Use Industry

- Distribution Channel

Exploring Regional Growth Trajectories, Market Nuances, and Strategic Drivers Shaping Cyclopentane Demand Across Key Global Markets

Americas continue to anchor global cyclopentane consumption, propelled by robust construction activity and stringent energy conservation codes in residential and commercial insulation. North American manufacturers are advancing closed-loop recovery systems and investing in greenfield capacity to capitalize on tariff-driven localization and nearshoring trends. Latin America’s growing foam insulation and packaging sectors present incremental growth pockets, supported by rising industrialization and government incentives for energy efficiency.

In Europe, Middle East & Africa, regulatory imperatives such as the F-gas regulation and Euro 7 emission standards accelerate the transition to low-global-warming-potential blowing agents, reinforcing cyclopentane adoption in automotive and refrigeration end uses. European producers are refining catalytic processes to enhance product yields while optimizing compliance with REACH and other regional environmental directives. The Middle East leverages its petrochemical infrastructure to expand synthetic cyclopentane output, while African markets are in nascent stages of foam insulation penetration.

Asia-Pacific exhibits the fastest demand escalation, driven by rapid urbanization, expanding consumer electronics manufacturing, and government mandates for energy-efficient building materials. China and India lead capacity expansions, targeting both domestic consumption and export markets. Regional players emphasize cost optimization and supply chain integration, with strategic alliances forming between upstream feedstock suppliers and specialized cyclopentane producers. These dynamics underscore diverse growth trajectories and strategic priorities across global markets.

This comprehensive research report examines key regions that drive the evolution of the Cyclopentane market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry-Leading Entities Steering Technological Advancements and Competitive Strategies in the Cyclopentane Sector

Leading chemical corporations have intensified investments to secure technological leadership in cyclopentane production and downstream applications. Large integrated producers focus on process intensification, forging partnerships with catalyst innovators to reduce hydrogen consumption and streamline distillation sequences. Meanwhile, specialty chemical manufacturers differentiate through grade customization and value-added services such as performance testing and regulatory support, catering to high-growth segments like electronics and refrigeration.

Emerging entrants leverage agile manufacturing platforms and digital technologies to disrupt entrenched supply chains. By deploying real-time analytics, advanced quality monitoring, and predictive maintenance, these agile players achieve superior asset utilization and rapid responsiveness to shifting demand patterns. Collaborative research agreements between feedstock suppliers and cyclopentane producers are expanding the scope of bio-based offerings, while joint ventures across regions aim to unlock new distribution networks and co-development opportunities.

Collectively, the competitive landscape is evolving toward a hybrid model where scale advantages converge with niche expertise. Companies that combine robust production infrastructure with sustainability credentials and market-specific technical support are poised to capture disproportionate share in premium end uses, reinforcing the centrality of strategic partnerships and continuous innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cyclopentane market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A-Gas International Limited

- Chevron Phillips Chemical Company LLC

- Cosutin Industrial Co., Limited

- Del Amo Chemical Company Inc.

- Gihi Chemicals Co., Limited

- Haihang Industry Co., Ltd.

- Haldia Petrochemicals Limited

- Haltermann Carless Group GmbH

- Ineos Group Holdings S.A.

- LG Chem Ltd.

- Liaoning Yufeng Chemical Co., Ltd.

- Maruzen Petrochemical Co., Ltd.

- Merck KGaA

- National Analytical Corporation

- Otto Chemie Pvt. Ltd.

- Pure Chem Co., Ltd.

- Santa Cruz Biotechnology, Inc.

- SceneWay Petroleum Chemical Co., Ltd.

- SINOPETROCHEM

- Sinteco S.r.l.

- Solstice Advanced Materials US, Inc.

- Thermo Fisher Scientific Inc.

- Tokyo Chemical Industry Co., Ltd.

- Trecora Resources

- Vizag Chemical International

- Yeochun NCC Co., Ltd.

Charting Strategic Roadmaps for Industry Stakeholders to Capitalize on Emerging Cyclopentane Market Opportunities Worldwide

To navigate the evolving cyclopentane landscape, industry stakeholders should prioritize diversified sourcing strategies that balance synthetic and bio-based supply streams. Strengthening partnerships with renewable feedstock providers and investing in process retrofits can hedge against tariff volatility and raw material price swings. In parallel, aligning product portfolios with evolving regulatory frameworks-particularly in energy efficiency and environmental compliance-will unlock new growth vectors in automotive, construction, and appliance applications.

Operational resilience can be elevated by adopting digital supply chain platforms that integrate demand forecasting with real-time logistics tracking. This capability not only mitigates lead-time disruptions but also enhances visibility across multi-tier networks. Companies should also pursue collaborative product development initiatives with end users to co-create high-performance formulations, securing early adoption and reinforcing customer loyalty. Finally, embedding sustainability objectives into capital planning-such as investments in green hydrogen for catalytic synthesis or closed-loop solvent recovery-will strengthen brand reputation and satisfy ESG mandates, driving long-term competitiveness.

Detailing the Rigorous Research Framework, Data Collection Protocols, and Analytical Approaches Underpinning the Cyclopentane Market Study

This study employs a rigorous mixed-methods framework to deliver robust market insights. Primary research comprises in-depth interviews with executives from leading cyclopentane producers, foam manufacturers, appliance OEMs, and industry associations, ensuring direct access to strategic perspectives and operational realities. Secondary research integrates data from regulatory filings, patent analyses, and trade association reports to contextualize industry trends and competitive dynamics.

Quantitative data triangulation leverages import-export databases, customs records, and proprietary pricing intelligence to validate volume movements and cost structures across key geographies. Advanced statistical models underpin the segmentation analysis, correlating purity tiers, source types, and application usage with macroeconomic indicators and energy efficiency adoption rates. Scenario planning techniques evaluate the impact of policy shifts, including 2025 tariff implementations and environmental mandates, generating alternative outlooks without explicit market sizing.

Throughout, quality assurance protocols ensure consistency and accuracy, with multiple layers of editorial review and expert panel validation. This methodological rigor underpins the credibility of conclusions and recommendations, equipping stakeholders with actionable intelligence rooted in empirical evidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cyclopentane market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cyclopentane Market, by Purity

- Cyclopentane Market, by Source

- Cyclopentane Market, by Formulation

- Cyclopentane Market, by Application

- Cyclopentane Market, by End Use Industry

- Cyclopentane Market, by Distribution Channel

- Cyclopentane Market, by Region

- Cyclopentane Market, by Group

- Cyclopentane Market, by Country

- United States Cyclopentane Market

- China Cyclopentane Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Concluding Insights Highlighting Future Outlook and Strategic Imperatives for Cyclopentane Industry Evolution and Resilience

As the cyclopentane market matures, its strategic importance in enabling low-global-warming-potential applications and energy-efficient solutions will only intensify. Technological advancements in production and the emergence of bio-based feedstocks herald new growth pathways, while regulatory developments and tariff policies continue to reshape competitive dynamics. Industry participants must remain agile, balancing scale-driven efficiencies with targeted innovation to meet evolving purity demands, sustainability goals, and application requirements.

Looking ahead, collaboration across the value chain-from feedstock suppliers and producers to end-users and regulatory bodies-will be critical to unlocking cyclopentane’s full potential. By forging integrated partnerships, deploying advanced analytics, and embedding environmental stewardship into core strategies, stakeholders can navigate market complexities and secure resilient growth. In doing so, cyclopentane will reinforce its role as a cornerstone of sustainable chemical solutions and energy conservation initiatives globally.

Engage with Ketan Rohom to Secure Comprehensive Cyclopentane Market Intelligence and Catalyze Your Strategic Growth Decisions with Expert Guidance

Securing this comprehensive market intelligence will empower your strategic initiatives and operational planning. To access the full in-depth analysis, proprietary data sets, and scenario-based projections, reach out directly to Ketan Rohom. As Associate Director, Sales & Marketing, he can furnish customized insights, facilitate access to premium research modules, and guide you through tailored consulting services. Engaging with his expertise will ensure your organization harnesses the full potential of cyclopentane market dynamics, optimizes supply chains, and stays abreast of regulatory shifts. Connect today to transform data into actionable strategies and advance your competitive edge.

- How big is the Cyclopentane Market?

- What is the Cyclopentane Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?