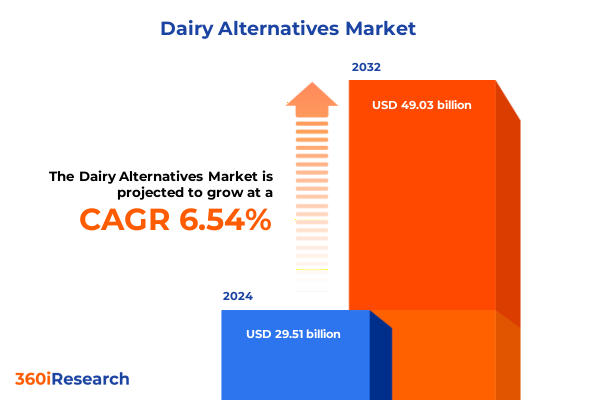

The Dairy Alternatives Market size was estimated at USD 31.47 billion in 2025 and expected to reach USD 33.53 billion in 2026, at a CAGR of 6.53% to reach USD 49.03 billion by 2032.

Exploring the Surge of Dairy-Free Innovations Driven by Health Consciousness Sustainability Imperatives and Evolving Consumer Preferences

The dairy alternatives category has witnessed a remarkable transformation as products once confined to niche markets have become a routine presence in consumer shopping baskets. Over the past several years, alternative milks, yogurts, cheeses, and spreads have moved beyond early adopters into mainstream retail shelves, driven by evolving consumer behaviors and a steady shift away from traditional dairy consumption. This normalization of dairy-free products is underscored by consistent year-over-year increases in both dollar and unit sales, particularly within milk and yogurt subcategories, where plant-based offerings have achieved use frequencies comparable to traditional dairy.

Consumer perceptions around health, sustainability, and dietary inclusivity continue to fuel interest in dairy alternatives. Heightened awareness of lactose intolerance and dairy allergies has led health-conscious individuals to explore nondairy options with nutritional profiles that meet or exceed conventional counterparts, such as pea-based milks offering comparable protein levels without cholesterol. Simultaneously, concerns about greenhouse gas emissions and water usage associated with livestock farming have elevated environmental considerations, encouraging a growing number of flexitarians and environmental advocates to incorporate plant-based alternatives into their diets.

Uncovering the Transformative Impact of Precision Fermentation Pea Milk and Other Technological Breakthroughs Reshaping the Dairy Alternatives Market

Precision fermentation and microbial-derived proteins are redefining dairy alternatives by delivering products that mimic the molecular structure of cow’s milk without relying on animal agriculture. Leading innovators have harnessed genetically engineered microbes to produce casein and whey analogues that offer the same functional and sensory attributes as conventional dairy, yet with a fraction of the environmental footprint. Companies pioneering these methods are attracting significant investment, signaling a shift from purely plant-derived formulations to hybrid and fermentation-based solutions.

Alongside microbial innovations, legume-based milks-particularly those derived from yellow split peas-are gaining traction as both sustainable and nutritious substitutes. Pea-based formulations deliver protein levels on par with dairy while requiring substantially less water and land, and with far lower carbon emissions. Despite some consumer hesitancy around taste, ongoing improvements in flavor profiling and branding are paving the way for broader acceptance in mainstream retail.

Innovation extends into packaging and personalized nutrition, with form factors from shelf-stable powders to on-the-go pouches capturing new consumption occasions. Recent retail insights reveal double-digit growth in plant-based protein liquids and powders, highlighting consumer enthusiasm for fortified and functional nondairy formats. In addition, digital platforms and direct-to-consumer channels have gained prominence as brands leverage data-driven marketing to engage health-driven segments, further accelerating the pace of product development and adoption.

Assessing the Far-Reaching Consequences of Recent Trade Policies and Tariffs on the Competitiveness of Dairy Alternative Products

The reinstatement and expansion of tariff measures on imported goods have introduced new cost pressures for manufacturers reliant on global supply chains. Proposed levies on imports from key trading partners, including a 25% tariff on certain goods from Canada and Mexico and a 10% duty on imports from China, have prompted proactive planning among industry stakeholders. These measures are poised to increase input costs, potentially leading to higher retail prices and margin compression across dairy alternative categories.

Ingredients such as soy and pea proteins, along with fractionated oils used in nondairy creams and spreads, have experienced layered duties under Section 301 provisions. While coconut oil and its fractions generally enter tariff-free, Chinese origin shipments are subject to an additional 7.5% duty, intensifying sourcing challenges for coconut-based ice creams and creams. As raw material costs climb, manufacturers face a delicate balance between preserving product affordability and maintaining sustainable supply chain practices.

In response, many companies are diversifying supplier portfolios and relocating production to regional facilities to mitigate trade-related disruptions. Strategic partnerships with domestic growers and the adoption of tariff engineering-such as reclassifying shipment origins-are increasingly common. Meanwhile, some brands are freezing prices or absorbing short-term cost increases to preserve consumer loyalty, leveraging private-label collaborations and streamlined operations to offset tariff impacts.

Decoding Multifaceted Dairy Alternatives Uncovering Hidden Opportunities in Product Categories Packaging Formats Distribution Channels and User Groups

The dairy alternatives category encompasses a diverse array of product segments that cater to varied consumer preferences and use occasions. Butter and spread alternatives range from analog margarines to plant-based butters and spreadable formulations that replicate the creaminess and functionality of dairy spreads, while cheese alternatives include hard, soft, and processed slice variants alongside spreadable formats designed for melting and snacking. Ice cream substitutes leverage almond, coconut, oat, and soy bases, each offering unique textural and flavor profiles to satisfy indulgent cravings without lactose. Milk alternatives represent one of the most mature segments, featuring formulations from almond, coconut, oat, pea, rice, and soy sources, all engineered to parallel the taste and nutritional value of cow’s milk. Complementing these, yogurt alternatives derived from almond, coconut, oat, and soy deliver probiotic benefits in both spoonable and drinkable formats.

Packaging and distribution further refine the market’s segmentation. Dairy alternatives are presented in a wide spectrum of containers-from glass bottles and aluminum cans to carton bricks and flexible pouches-addressing consumer demands for convenience, sustainability, and on-the-go consumption. Products are available in liquid, powdered, and shelf-stable formats, with a growing trend toward single-serve and functional powder blends that support personalized nutrition. Distribution channels span traditional offline retail, including convenience stores, specialty shops, and supermarkets and hypermarkets, as well as online brand platforms and major eCommerce portals, each offering distinct advantages in reach and consumer engagement. End-user applications range across household consumption, commercial foodservice, and industrial ingredient supply, underscoring the category’s versatility and the multiplicity of growth opportunities.

This comprehensive research report categorizes the Dairy Alternatives market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Category

- Packaging

- Form

- Distribution Channel

- End-User

Revealing Regional Dynamics Shaping the Future of Dairy Alternatives Across Americas Europe Middle East Africa and Asia Pacific Markets

In the Americas, the dairy alternatives market benefits from a well-established retail infrastructure and high consumer awareness, anchored by a strong flexitarian movement and significant penetration within natural and conventional channels. North American innovation hubs drive product development while collaborations between startups and large food manufacturers accelerate commercialization and scale. Retailers continue to expand shelf space for nondairy items, supported by marketing initiatives that emphasize health and sustainability benefits.

Europe, the Middle East, and Africa present a regulatory landscape that increasingly favors plant-based options, with sustainable food initiatives and carbon-neutral pledges pushing nondairy products into the policy spotlight. Western European markets prioritize organic and ethically sourced ingredients, and governance frameworks incentivize reduced reliance on livestock. In emerging EMEA regions, rising urbanization and purchasing power are catalyzing demand, even as distribution networks evolve to accommodate refrigerated and shelf-stable formats.

The Asia-Pacific region offers some of the most dynamic growth trajectories, propelled by high rates of lactose intolerance, rapidly expanding middle-class populations, and heightened environmental consciousness. China and India, in particular, are witnessing a proliferation of local and international brands, with innovation focused on regional flavors and fortified formulations to meet diverse nutritional needs. Investments in cold-chain logistics and eCommerce are unlocking new consumption occasions, while government support for alternative proteins fuels R&D and market entry.

This comprehensive research report examines key regions that drive the evolution of the Dairy Alternatives market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unveiling the Strategies Innovations and Resilience of Leading Global Players Disrupting the Dairy Alternatives Industry Landscape

Leading market participants are demonstrating resilience and strategic agility as they navigate evolving consumer and trade dynamics. Oatly, for example, reported a near-stable first-quarter 2025 revenue performance with modest volume growth and improved gross margins, reflecting its ability to optimize supply chain efficiency and drive premium positioning in key markets. The company’s emphasis on profitable growth and targeted capital investments has enhanced its path to financial sustainability.

Meanwhile, microbial-fermentation trailblazers have attracted significant venture capital to scale production of precision-fermented dairy proteins. These players are forging partnerships with major foodservice operators to validate product functionality, setting the stage for broader adoption in both retail and industrial applications. Their model reduces reliance on traditional agricultural inputs and aligns with corporate sustainability agendas.

Innovative consumer brands continue to expand flavor profiles and category extensions. Califia Farms’ recent launch of tropical-inspired, coconut-cream-based beverages underscores its commitment to product innovation and clean-label credentials, garnering widespread retailer support across the U.S. Such releases illustrate how established brands leverage R&D and marketing acumen to maintain relevance and capture incremental market share.

This comprehensive research report delivers an in-depth overview of the principal market players in the Dairy Alternatives market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adisoy Foods & Beverages Pvt. Ltd.

- Archer Daniels Midland Company

- Blue Diamond Growers

- Califia Farms, LLC

- Dabur India Ltd.

- Daiya Foods Inc. by Otsuka Pharmaceutical Co., Ltd.

- Danone S.A

- Drupe Foods India Pvt Ltd.

- DuPont de Nemours, Inc.

- Earth’s Own Food Company, Inc. by Agrifoods International Cooperative LTD

- Eden Foods, Inc.

- GT’s Living Foods LLC

- Kerry Group plc

- Milkadamia

- Nestlé Group

- Pacific Foods by Campbell Soup Company

- Planet Oat by HP Hood LL

- Purefoods by Rollins International Pvt. Ltd

- Sain Milks

- SunOpta, Inc.

- The Alternativive Company

- The Hain Celestial Group, Inc

- TheNotCompany, INC.

- Viollife by Upfield Group B.V.

Empowering Industry Leaders with Actionable Strategies to Navigate Disruptions and Capitalize on Emerging Trends in Dairy-Free Markets

Industry leaders should prioritize investment in precision fermentation capabilities and strategic partnerships to secure access to next-generation protein production methods. By collaborating with fermentation technology providers and academic institutions, brands can accelerate product development timelines and differentiate on both functionality and sustainability.

Diversifying ingredient sourcing and establishing regional manufacturing hubs will mitigate trade-related risks and reduce transportation emissions. Companies can leverage tariff-engineering techniques and long-term supplier agreements to stabilize input costs and shield margins from geopolitical volatility.

Expanding direct-to-consumer channels and enhancing eCommerce capabilities will deepen consumer engagement and capture actionable data on shopping behaviors. Tailored digital marketing strategies, leveraging social media and subscription models, can foster brand loyalty and enable personalized product offerings.

Finally, aligning product portfolios with emerging consumer demands-such as high-protein formulations, reduced-sugar options, and novel flavor experiences-will unlock incremental growth. Continuous consumer feedback loops and agile product development methodologies will ensure offerings remain relevant and competitive.

Detailing the Rigorous Research Framework and Methodological Approach Underpinning Robust Insights into Dairy Alternatives

This report is grounded in a rigorous research framework that integrates primary interviews with industry executives, formulators, and supply chain experts to capture diverse viewpoints and validate market hypotheses. Secondary research leveraged authoritative sources, including government databases, trade associations, and peer-reviewed publications, to contextualize historical trends and recent policy developments.

Quantitative analysis triangulated data from retail measurement firms, publicly available financial disclosures, and international trade statistics to map segment performance and tariff impacts. Qualitative insights were derived from thematic analysis of innovation pathways, regulatory shifts, and consumer sentiment studies, ensuring a holistic understanding of market dynamics.

A multi-stage validation process involved expert panel reviews and iterative feedback cycles to refine segmentation definitions and forecast scenarios. This methodology ensures that findings are robust, transparent, and actionable for decision-makers seeking to navigate the complexities of the dairy alternatives landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Dairy Alternatives market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Dairy Alternatives Market, by Product Category

- Dairy Alternatives Market, by Packaging

- Dairy Alternatives Market, by Form

- Dairy Alternatives Market, by Distribution Channel

- Dairy Alternatives Market, by End-User

- Dairy Alternatives Market, by Region

- Dairy Alternatives Market, by Group

- Dairy Alternatives Market, by Country

- United States Dairy Alternatives Market

- China Dairy Alternatives Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Synthesizing Key Discoveries and Industry Perspectives to Illuminate the Path Forward for Dairy Alternative Market Evolution

The convergence of technological innovations, evolving consumer mindsets, and geopolitical influences is charting a new course for the dairy alternatives sector. Precision fermentation and pea-based formulations are laying the groundwork for next-wave products that deliver authentic taste, functionality, and sustainability benefits. Simultaneously, the cumulative effects of tariffs and trade policies are reshaping supply chain strategies and accelerating regional production footprints.

Segmentation analysis reveals a mosaic of opportunities across traditional and emerging subcategories-from artisanal plant-based cheeses to fortified protein powders-underscoring the importance of portfolio diversification. Regional insights highlight distinct growth drivers and regulatory landscapes, with established Western markets prioritizing environmental credentials, while Asia-Pacific markets emphasize nutritional needs and convenience.

As leading companies demonstrate resilience through strategic agility and product innovation, industry stakeholders are equipped to navigate complex headwinds and unlock new avenues for growth. A coordinated approach that leverages partnerships, data-driven marketing, and flexible manufacturing will be critical to sustaining momentum and achieving long-term success in the dynamic dairy alternatives market.

Connect with Our Associate Director to Unlock Comprehensive Market Research and Secure Strategic Advantages in Dairy Alternative Sectors

To unlock unparalleled insights that will empower your organization to navigate the dynamic dairy alternatives landscape with confidence and precision, reach out today to Ketan Rohom, Associate Director, Sales & Marketing. Ketan’s expertise will guide you through the comprehensive research report, ensuring you have the strategic intelligence needed to capitalize on emerging opportunities and future-proof your product portfolio. Engage directly to discuss customized licensing options, enterprise subscriptions, or bespoke data deliverables. Take the next step toward informed decision-making and sustainable growth in the dairy alternatives sector by connecting with Ketan and acquiring the full market research report.

- How big is the Dairy Alternatives Market?

- What is the Dairy Alternatives Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?