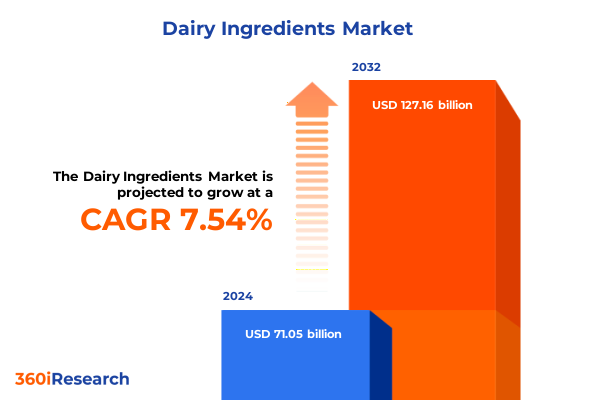

The Dairy Ingredients Market size was estimated at USD 76.05 billion in 2025 and expected to reach USD 81.55 billion in 2026, at a CAGR of 7.61% to reach USD 127.16 billion by 2032.

Overview of evolving dairy ingredient industry dynamics shaping innovation processes and strategic decisions in a rapidly changing global landscape

The dairy ingredients market has undergone a profound evolution driven by shifting consumer preferences, supply chain complexities, and an intensified focus on innovation. Consumers are increasingly seeking products that offer clean labels, nutritional benefits, and functional advantages; this demand has prompted manufacturers to expand their portfolios and invest in research and development at an unprecedented pace. At the same time, global supply dynamics and trade policies have introduced new layers of complexity into sourcing and distribution, requiring stakeholders to adopt more agile operational models.

Against this backdrop, industry participants are navigating a landscape where emerging technologies, sustainability imperatives, and evolving regulatory frameworks intersect. The pursuit of enhanced traceability, reduced carbon footprints, and improved product performance has accelerated the adoption of advanced processing methods and digital solutions. As a result, dairy ingredient producers must balance cost optimization with value creation, ensuring that they not only meet current market needs but also anticipate future trends.

In the pages that follow, the executive summary synthesizes the most critical insights that define today’s dairy ingredients sector. Each section explores a distinct dimension-ranging from transformative shifts in technology and consumer demand to the impact of tariff adjustments, segmentation nuances, regional dynamics, competitive strategies, and actionable recommendations. Together, these findings provide a strategic blueprint for decision-makers seeking to thrive in a rapidly changing environment.

Key disruptive forces redefining dairy ingredient value chains through technological innovation sustainability imperatives and consumer-driven personalization

Innovation and transformation have become inseparable pillars of the dairy ingredients industry, as technological breakthroughs and consumer-driven imperatives relentlessly reshape the value chain. From automated churning and advanced evaporation systems to precision spray drying and freeze-drying techniques, processing technology is unlocking new performance attributes-enabling higher solubility, enhanced stability, and tailored nutritional profiles. This wave of technological progress is complemented by the integration of Industry 4.0 solutions, where data analytics, Internet of Things sensors, and real-time monitoring optimize yields, reduce energy consumption, and strengthen supply chain resilience.

Concurrently, sustainability has moved from a peripheral concern to a core strategic priority. The drive to decarbonize operations, source responsibly, and minimize water usage is influencing facility design, ingredient sourcing policies, and packaging choices. As stakeholders embrace circular economy principles, biodegradable pouches and recyclable cans are emerging alongside initiatives to valorize by-products such as whey permeate and casein whey streams. These sustainability measures not only address environmental objectives but also resonate with consumers who demand ethical sourcing and responsible production.

In addition, personalization and health-oriented nutrition are elevating the role of dairy ingredients in targeted applications such as sports nutrition, clinical formulations, and infant products. Leveraging advances in analytical chemistry and genomics, manufacturers are exploring bioactive peptides and fortified matrices that deliver specific health benefits-from gut health to muscle recovery. Through these transformative shifts, the industry is redefining its competitive landscape and forging new pathways toward value creation and consumer engagement.

Analysis of the cumulative financial operational and supply chain effects of recent 2025 United States tariff adjustments on dairy ingredient trade

Recent adjustments to United States tariffs in early 2025 have exerted a cumulative effect on the economics and logistics of dairy ingredient trade, with ripple effects across sourcing strategies and pricing structures. These tariff modifications, which include incremental duties on select whey protein concentrates and milk powder imports, have essentially increased landed costs for companies reliant on foreign suppliers. As a result, many manufacturers have reevaluated their global procurement footprints, seeking to mitigate margin pressure through local partnerships or by negotiating longer-term agreements that offer greater cost stability.

The implications extend beyond straightforward cost increments. Higher import duties have intensified volatility in spot markets, prompting repeated contract renegotiations and encouraging a shift toward domestic capacity expansion. In response, several leading players have accelerated investments in local processing facilities, aiming to secure raw material streams and insulate production from future tariff fluctuations. Simultaneously, certain exporters have pursued market diversification, redirecting volumes toward regions unaffected by these levies to sustain revenue growth.

Moreover, the tariff landscape has underscored the strategic importance of supply chain agility and risk management. Companies are increasingly deploying scenario planning tools to model potential policy shifts, while bolstering inventory buffers at key distribution hubs. This emphasis on resilience is reshaping procurement infrastructures, laying the groundwork for more flexible, cost-efficient networks that can adapt swiftly to evolving trade environments.

Strategic segmentation analysis revealing nuanced performance drivers across product type form packaging application end-user and sales channel dimensions

A granular view of segmentation reveals critical performance drivers that underpin competitive advantage across the dairy ingredients spectrum. Within product portfolios, the spectrum spans Butter Powder, Casein & Caseinates, Lactose & Derivatives, Milk Powder, and Whey Protein, each presenting distinct margin profiles and functional attributes. Milk Powder itself bifurcates into Fat Fortified Powder, Skimmed Powder, and Whole Powder, offering varied nutritional compositions that cater to applications from bakery to infant formula. Equally nuanced, Whey Protein subdivides into Concentrate, Hydrolysate, and Isolate, each variant commanding differing price points and technological requirements tied to protein purity and bioavailability.

Form factors further influence market dynamics, with Liquid offerings addressing immediate-use scenarios and Powder forms dominating long-term storage and transportation. Processing technology choices-whether Churning for butterfat separation, Evaporation for lactoserum concentration, Freeze Drying to preserve heat-sensitive compounds, or Spray Drying for cost-effective bulk drying-are pivotal in dictating product quality, yield, and operational expenditure. Packaging typologies such as Bottles, Cans, Pouches, and Sachets play a crucial role in value preservation and consumer convenience, with Bottles available in Glass and PET to balance aesthetics, weight, and barrier properties.

Application sectors including Bakery, Confectionery, Dairy Products, Infant Formula, and Sports & Clinical Nutrition drive demand heterogeneity, compelling manufacturers to tailor ingredient functionalities and regulatory compliance pathways. End-User categories differentiate between Commercial bulk requirements and Household consumption patterns, while Sales Channels span Offline outlets-Convenience Stores, Specialty Stores, Supermarkets & Hypermarkets-and Online platforms that cater to digital-savvy consumers seeking niche offerings. Recognizing these segmentation layers is essential for companies aiming to optimize portfolio allocation, align production capabilities, and capture growth in targeted segments.

This comprehensive research report categorizes the Dairy Ingredients market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- Processing Technology

- Packaging Type

- Application

- End-User

- Sales Channel

Comparative regional performance evaluation highlighting growth trajectories market maturity and regulatory influences across Americas Europe Middle East Africa and Asia Pacific territories

Regional dynamics exert a profound influence on dairy ingredient trends, reflecting diverse consumption patterns, regulatory landscapes, and production capacities. In the Americas, mature markets exhibit stable per capita consumption underpinned by well-established supply chains and robust processing infrastructure. Here, product innovation tends to focus on value-added formulations and clean-label credentials, with end-users favoring high-protein and functional solutions that address wellness and convenience.

Across Europe, the Middle East & Africa, regulatory frameworks around quality standards and health claims shape ingredient adoption. Growth corridors in the Middle East and Africa are fueled by urbanization and rising disposable incomes, while Europe remains a hub for premium specialty ingredients and sustainability-driven initiatives. Companies operating in this region navigate complex import regulations and labeling requirements, balancing cost pressures with demand for traceable, ethically sourced products.

In Asia-Pacific, rapid urban growth and expanding middle-class demographics drive the strongest uptick in dairy ingredient demand. Markets such as China and India are witnessing surging interest in infant nutrition, whey-based formulations, and localized product variants designed to align with regional taste profiles. Additionally, government incentives for domestic manufacturing and joint ventures are stimulating capacity expansion, positioning Asia-Pacific as a critical arena for long-term industry growth and investment.

This comprehensive research report examines key regions that drive the evolution of the Dairy Ingredients market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive landscape overview spotlighting leading dairy ingredient manufacturers strategic collaborations portfolio expansions and sustainability commitments

A review of key industry players underscores a landscape defined by strategic alliances, portfolio diversification, and sustainability commitments. Leading multinational organizations leverage integrated value chains to optimize raw material sourcing, invest in cutting-edge processing facilities, and consolidate their positions through targeted mergers and acquisitions. These companies emphasize R&D collaboration with academic institutions and startups to advance functional ingredient development, harnessing bioactive peptides, fortified proteins, and clean-label formulations to meet evolving end-user needs.

Mid-tier producers differentiate themselves by specializing in niche segments such as organic milk powders or plant-dairy hybrid ingredients, carving out pockets of high-margin growth. They often engage in strategic partnerships with co-manufacturers and co-packers to expand geographical reach without heavy capital investments. In parallel, agile regional players capitalize on localized expertise, tailoring product specifications and packaging formats to address distinct market requirements, from infant formula regulations in Asia to halal certifications in the Middle East.

Across the board, leading companies are embedding sustainability into their corporate strategies, setting ambitious targets for greenhouse gas emissions, water stewardship, and waste reduction. These commitments are increasingly woven into supplier codes of conduct, traceability platforms, and consumer-facing transparency initiatives. Such efforts not only resonate with environmentally conscious customers but also anticipate stricter regulatory regimes and foster long-term resilience.

This comprehensive research report delivers an in-depth overview of the principal market players in the Dairy Ingredients market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ajinomoto Co., Inc.

- Amco Proteins

- Archer-Daniels-Midland Company

- Arla Foods Ingredients Group P/S

- Batory Foods

- Cargill, Incorporated

- Cayuga Milk Ingredients

- Dairy Farmers of America Inc.

- Dairy Ingredients Inc.

- Danone S.A.

- Epi Ingredients

- Euroserum

- Fonterra Co-operative Group Limited

- Glanbia PLC

- Gujarat Cooperative Milk Marketing Federation Ltd.

- Hoogwegt Groep B.V.

- ICL Food Specialties

- Ingredia SA

- International Food Products Corporation

- Kansas Dairy Ingredients

- Kerry Group PLC

- Koninklijke DSM N.V.

- Lactalis Ingredients

- Lacto Japan Co., Ltd.

- LAND O’LAKES, INC.

- Olam Group

- Ornua Co-operative Limited

- Pacific Dairy Ingredients

- Prolactal GmbH

- Saputo Inc.

- Valio Group

Targeted strategic recommendations for dairy ingredient industry leaders to enhance operational agility sustainability credentials and innovation pipelines

Industry leaders should prioritize investments in advanced processing technologies to enhance product quality and operational efficiency. Upgrading churning, evaporation, and drying systems can yield significant energy savings and improve batch consistency, laying the foundation for scalable innovation. Concurrently, establishing flexible modular facilities allows for rapid adaptation to emerging product trends, whether in specialized infant nutrition or performance-driven sports formulations.

Moreover, companies must strengthen end-to-end supply chain visibility through digital platforms that integrate supplier performance data, real-time logistics tracking, and predictive analytics. This holistic approach to risk management will enable stakeholders to mitigate disruptions related to tariff fluctuations, raw material shortages, or regulatory changes. To capitalize on consumer demand for sustainability, industry participants should adopt circular economy practices by valorizing by-products, optimizing water usage, and transitioning to eco-friendly packaging substrates.

Finally, forging strategic partnerships with technology providers, academic research centers, and channel specialists can accelerate market entry and diversify product pipelines. Collaborative innovation models-combining R&D expertise, market insights, and distribution networks-will be instrumental in capturing high-growth applications in clinical nutrition, plant-dairy hybrids, and personalized wellness solutions. By aligning these strategic imperatives, companies can position themselves for robust growth, strengthened market differentiation, and enduring value creation.

Robust multi-dimensional research framework detailing primary interviews secondary sources data triangulation and analytical validation techniques

This analysis is anchored in a rigorous research framework combining both primary and secondary data sources. Primary research involved in-depth interviews with senior executives, R&D leaders, supply chain experts, and regulatory authorities from across the dairy ingredients ecosystem, ensuring insights are grounded in practitioner perspectives. Secondary research encompassed extensive review of industry publications, trade association reports, regulatory filings, and credible news outlets to capture the latest developments and contextualize emerging trends.

Quantitative data was validated through a triangulation process, wherein multiple sources-including customs records, corporate financial statements, and market intelligence databases-were cross-referenced to ensure accuracy and consistency. Advanced analytical techniques, such as scenario modeling and sensitivity analysis, were employed to assess the impact of tariff shifts and supply chain disruptions under varied conditions. Qualitative insights were further refined through expert workshops, peer reviews, and stakeholder feedback sessions.

The segmentation framework was meticulously applied across product types, forms, processing technologies, packaging variants, applications, end-user categories, and sales channels, enabling a comprehensive and nuanced understanding of market dynamics. This multi-dimensional approach ensures that the findings reflect both macro-level industry forces and micro-level performance drivers, supporting decision-makers in crafting tailored strategies.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Dairy Ingredients market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Dairy Ingredients Market, by Product Type

- Dairy Ingredients Market, by Form

- Dairy Ingredients Market, by Processing Technology

- Dairy Ingredients Market, by Packaging Type

- Dairy Ingredients Market, by Application

- Dairy Ingredients Market, by End-User

- Dairy Ingredients Market, by Sales Channel

- Dairy Ingredients Market, by Region

- Dairy Ingredients Market, by Group

- Dairy Ingredients Market, by Country

- United States Dairy Ingredients Market

- China Dairy Ingredients Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1908 ]

Consolidated summary emphasizing strategic imperatives for sustained growth innovation and resilience in the global dairy ingredients industry

The dairy ingredients industry stands at a pivotal juncture where innovation, sustainability, and strategic agility converge to define future success. Transformative technological advances are reshaping production efficiencies and product functionalities, while evolving consumer preferences demand cleaner labels, personalized nutrition, and ethical sourcing. Concurrently, the ripple effects of 2025 tariff adjustments underscore the necessity for resilient supply chains and nimble procurement strategies.

Segmentation analysis illuminates the critical role of fine-grained portfolio management across product types, form factors, processing methods, and application domains. Regional insights highlight divergent growth trajectories: stable consumption in the Americas, regulatory complexity in Europe, the Middle East & Africa, and dynamic expansion in Asia-Pacific. Competitive benchmarking reveals that leading companies are differentiating through strategic collaborations, R&D investments, and sustainability commitments, setting a high bar for market entry.

To thrive amid these conditions, industry leaders must embrace a holistic roadmap that integrates technological upgrades, end-to-end digitalization, sustainability imperatives, and collaborative innovation. By aligning organizational capabilities with these imperatives, stakeholders can unlock new growth opportunities, mitigate emerging risks, and secure long-term value creation in the global dairy ingredients market.

Empower your strategic decision making with direct access to comprehensive dairy ingredients market intelligence

To explore these insights in depth and to forge a path toward sustained competitive advantage in the dynamic dairy ingredients industry, engage directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. By securing the full market research report, you will gain privileged access to comprehensive data, proprietary analysis, and expert perspectives tailored to your strategic priorities. This partnership will enable your organization to identify untapped opportunities, anticipate market shifts, and implement actionable tactics that drive revenue growth and operational excellence. Reach out today to schedule a personalized briefing and to invest in the intelligence that will inform your next critical business decisions.

- How big is the Dairy Ingredients Market?

- What is the Dairy Ingredients Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?